There is never a dull moment in financial markets, which can be both the attraction to and distraction of our industry. The start to 2025 is, of course, no exception. A strong economic backdrop and calm start to the year has given way to headline risk and even more over-analysis of economic data, Fed speak, and earnings guidance. The remedy to this is to focus on your long-term investing goals, recognize that the stock market does have regular drawdowns, and maybe even take a deep breath and realize we’ve experienced nearly the same percentage drawdown (as of this writing) from all-time highs that we endured just last summer. One way to cut through the short-term noise and keep a level head is to examine the valuation picture. Valuations change at what may seem like a glacial pace relative to daily news and fluctuations, but an occasional glance can help keep portfolios grounded amidst uncertainty.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

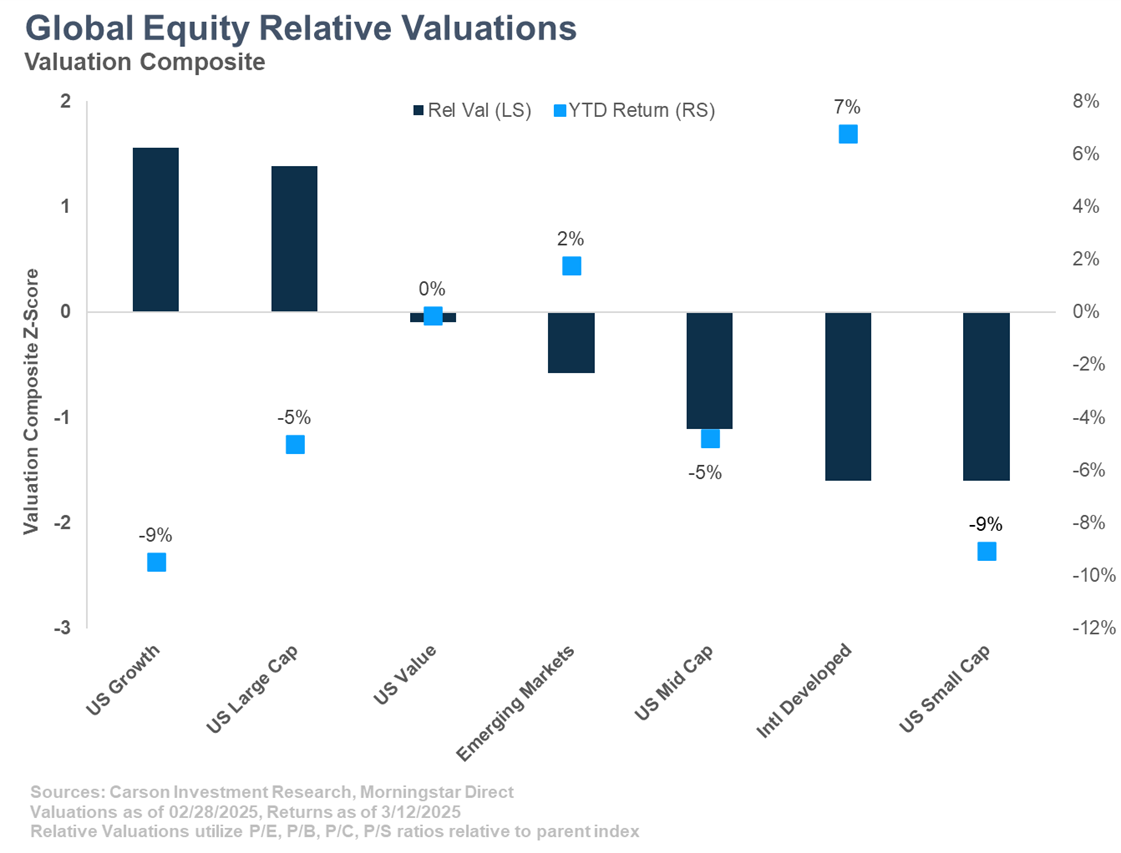

The overall picture today is largely the same as we highlighted a few months ago in our 2025 Outlook (page 24). Growth stocks, now a large part of the US large cap market index, remain the most expensive on a relative basis, with domestic small and mid-cap stocks flanking developed international markets as the less valuation-rich places to invest. As we continually point out, these differences are not a timing mechanism and can last for years or even decades, but there is an interesting dichotomy when safety is sought. As investors have tried (and tried) to dissect what may be happening with international negotiations and the domestic economy, the most expensive areas of the market have been hit hardest.

The reasons for this are vast and extend well beyond valuations (the US dollar reversal is a significant component, for example), but there is one element explicitly tied to valuations. As market participants rethink and recalibrate future growth prospects for companies downward, those companies with the highest growth expectations (and in this case highest relative valuations) have seen their prices adjust most quickly. This makes intuitive sense: if a company is expected to grow at a blistering pace but investors are considering lower overall demand, repricing that company to the new expectations or at least tempering those expectations is entirely warranted.

This has occurred in domestic equity sectors as well, as those richly priced technology and tech-adjacent sectors have corrected this year. Many other sectors have held up relatively well or even posted modest positive returns so far this year. The interesting observation about this sector mix is that it is not completely defensive sectors that we would expect to do well in a correction, but also cyclical sectors tied to economic growth. Perhaps these sectors’ valuation cushion (amongst other reasons) has been enough so far to prevent major repricing.

Day-to-day market volatility is nothing new but also tends to be quickly forgotten when everything is smooth sailing. But the big picture is always important—and we want to keep taking you back there while at the same time arming advisors and clients with all the information they need to sift through the daily noise and handle the tough client questions and situations. Valuations—as boring as they may be!—are an important part of the mosaic of information we utilize to allocate portfolios long term and hopefully can be an equally grounding factor when times get a little tough.

For more content by Grant Engelbart, VP, Investment Strategist click here.

7739511-0325-A