Wednesday, December 13th, was important for two reasons:

- The Federal Reserve (Fed) acknowledged that inflation is easing quite rapidly, and they plan to respond with rate cuts.

- The November producer price index (PPI) indicated that core inflation is back at the Fed’s target.

Let’s start with the Fed meeting.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

A Data Dependent Fed Bows to the Data

The Fed kept policy interest rates unchanged in the 5.25-5.0% range, but the big story really was that they officially acknowledged that inflation is easing. Their updated “summary of economic projections” saw their estimates of core inflation for 2023 revised down from 3.7% to 3.2%. The 2024 estimate was pulled down from 2.6% to 2.4%.

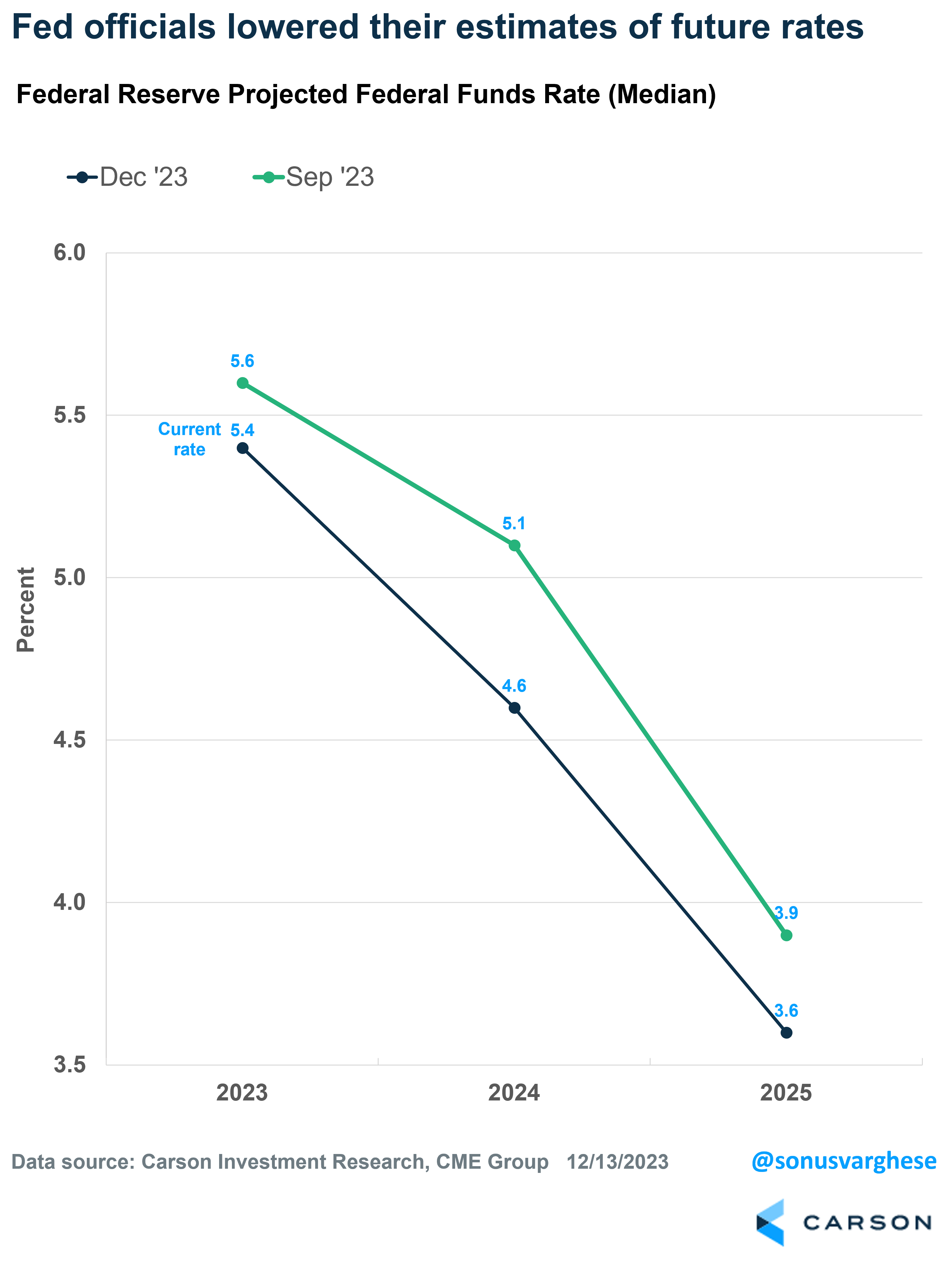

If you think inflation is going to be softer than you initially expected, what would you do? Well, if you’re a Fed official, you’d pull down your estimates for future interest rates, and that’s exactly what they did. They actually did a couple of things, both of which were quite dovish:

- They removed the extra rate hike for 2023 that they’d originally penciled in. In other words, they don’t think rates are going any higher.

- They moved the 2024 rate estimate from 5.1% to 4.6%. The current rate is 5.4%, and the updated estimate implies they’ll cut rates by around 0.8%-points (about three 0.25%-point cuts) in 2023.

Markets were off to the races after the Fed released their statement and projections – with bond yields falling, and equity markets rallying. Notably, Fed Chair Powell didn’t look to rain on the party in his press conference. Instead, he more or less reiterated the dovish outlook, noting that there has been progress on inflation, including in the categories they focus on. He once again emphasized that the risk of not doing enough to curb inflation was now balanced with the risk of holding rates too high for too long (and potentially breaking the economy in the process).

Inflation Is Back at the Fed’s Target

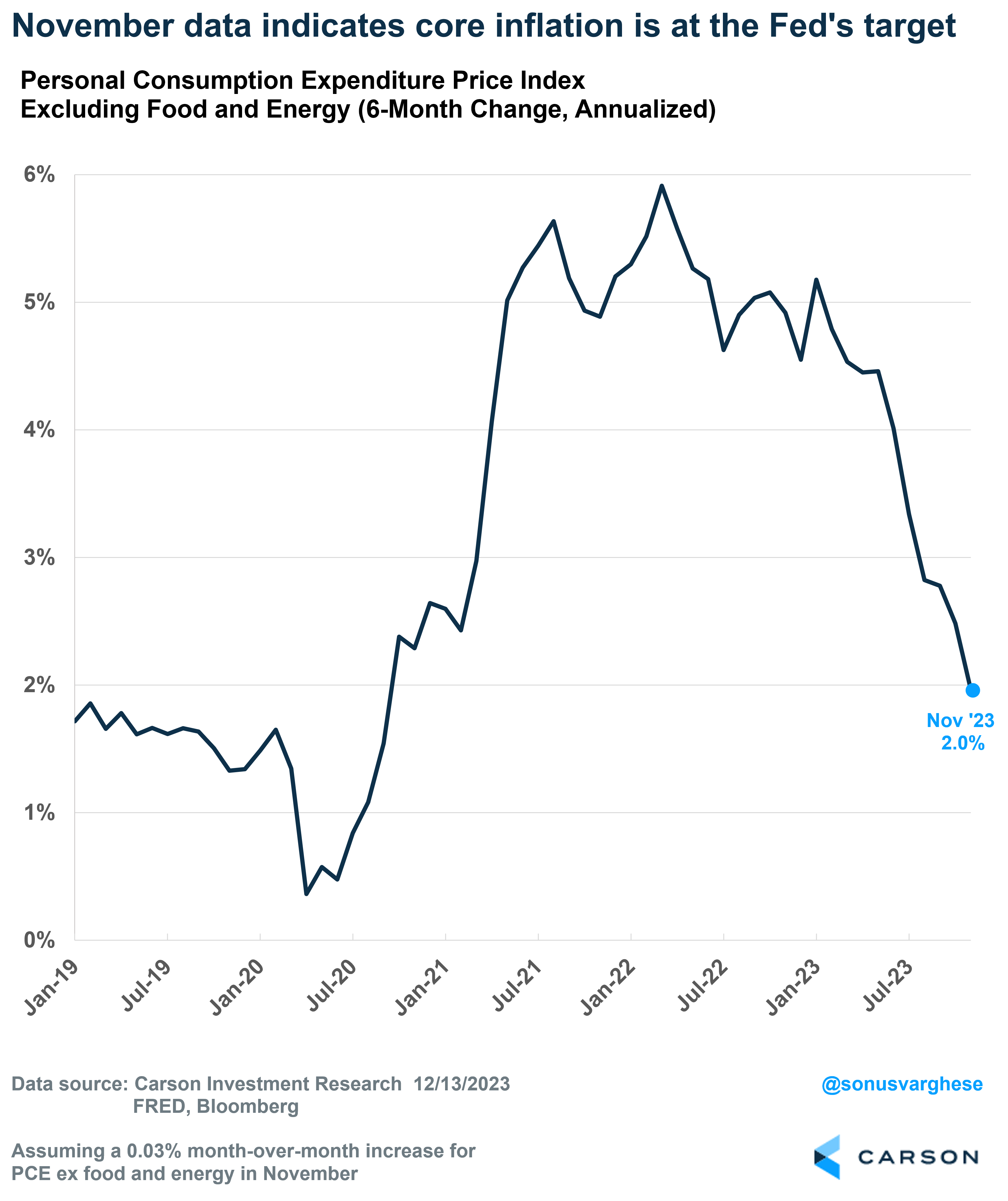

PPI data for November came in softer than expected, especially core PPI, which excludes the volatile food and energy components. The Fed’s preferred inflation metric is the personal consumption expenditures price index (PCE) and that takes several inputs from the PPI data, including for categories like health insurance and airfares.

Core PCE typically runs lower than its counterpart, the core consumer price index (CPI). That’s even more so now because 40% of core CPI is comprised of rents, versus 17% in core PCE, and the official rental data is running at an annual inflation rate of 6% now. Note that this is really outdated compared to what’s happening in rental markets right now, with private market indices like Apartment List showing rents falling compared to last year.

The good news is that the November CPI and PPI data indicate that core PCE was flat month over month in November. That means core inflation, using the Fed’s preferred metric, is running at an annual rate of 2.1% over the last three months, and 2% over the last six months.

In other words, the inflation problem appears to be over, at least for now. Even looking ahead, it’s likely that used car prices continue to fall and lagged data for rents catch up to reality, keeping downward pressure on core inflation.

Which means we expect the Fed is going to cut interest rates, as their own projections suggest. And it could come sooner rather than later.

A Big Day for Markets, and a Potentially Big Boost for the Economy

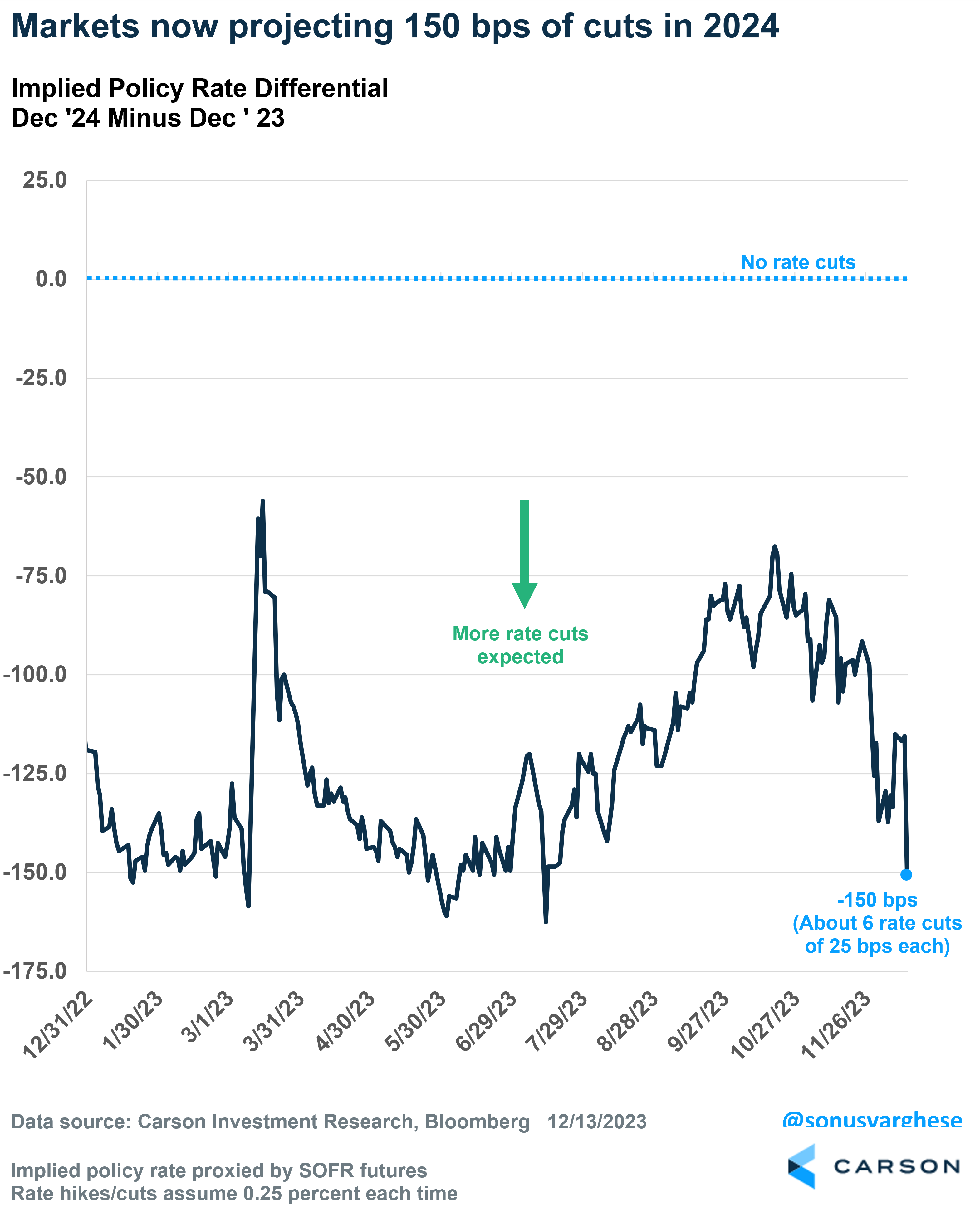

No surprise that markets liked everything that happened on Wednesday, including the prospect of a rate cut as early March (which investors estimate with a probability of almost 80%). Treasury yields headed even lower after Powell’s comments, with 1-year yields falling 0.22%-points to 4.91% and 2-year yields falling 0.3%-points to 4.43%. This was because markets are now estimating about 1.16%-points of cuts in 2024, more than Fed officials’ estimate of 0.80%-points.

Equities rallied on the back of lower interest rates, with the S&P 500 Index rising 1.4% on Wednesday and leaving it less than 2% off its all-time high. Rate-sensitive sectors like utilities and real estate, outperformed. Even small cap stocks, which have been weighed down by higher rates, saw huge gains, with the Russell 2000 Index rising 3.5%.

Lower interest rates also have potentially significant, and positive, effects on the economy. For one thing, it’ll immediately be reflected in mortgage rates. 30-year mortgage rates are now estimated to be close to 6.8%, down from around 8% in mid-October.

Lower mortgage rates could unlock activity in the housing market, especially in the existing homes market, where activity has ground to a near halt amid high rates. Additional sales of homes can lead to more consumer spending, including household appliances, furnishings, and other household goods. Lower rates could also boost auto sales, as loans for used and new vehicles become more affordable. Those are just a couple of direct, near-term boosts for the economy. In the medium term, a better outlook for inflation and interest rates could also results in a pickup in business investment.

In summary, the inflation tide has subsided quite decisively and that means a Fed pivot to interest rate cuts is on the horizon, which we expect to be very positive for markets and the economy. That’s very good news. Ryan and I talked about the continued strength of the economy and the recent market rally that started in late October on our latest episode of Facts vs Feelings. Take a listen below:

For more of Sonu’s thoughts click here.

2024821-1223-A