“Just a little bit more.” -John D. Rockefeller, founder of the Standard Oil Company and one of the richest men ever, when asked about how much money it takes to make one happy.

On the heels of about a 25% gain for the S&P 500 last year, stocks are up about 10% already in 2024. The logical question is, how much is too much? Well, like Rockefeller said long ago, maybe just a little bit more could be in store for the bulls.

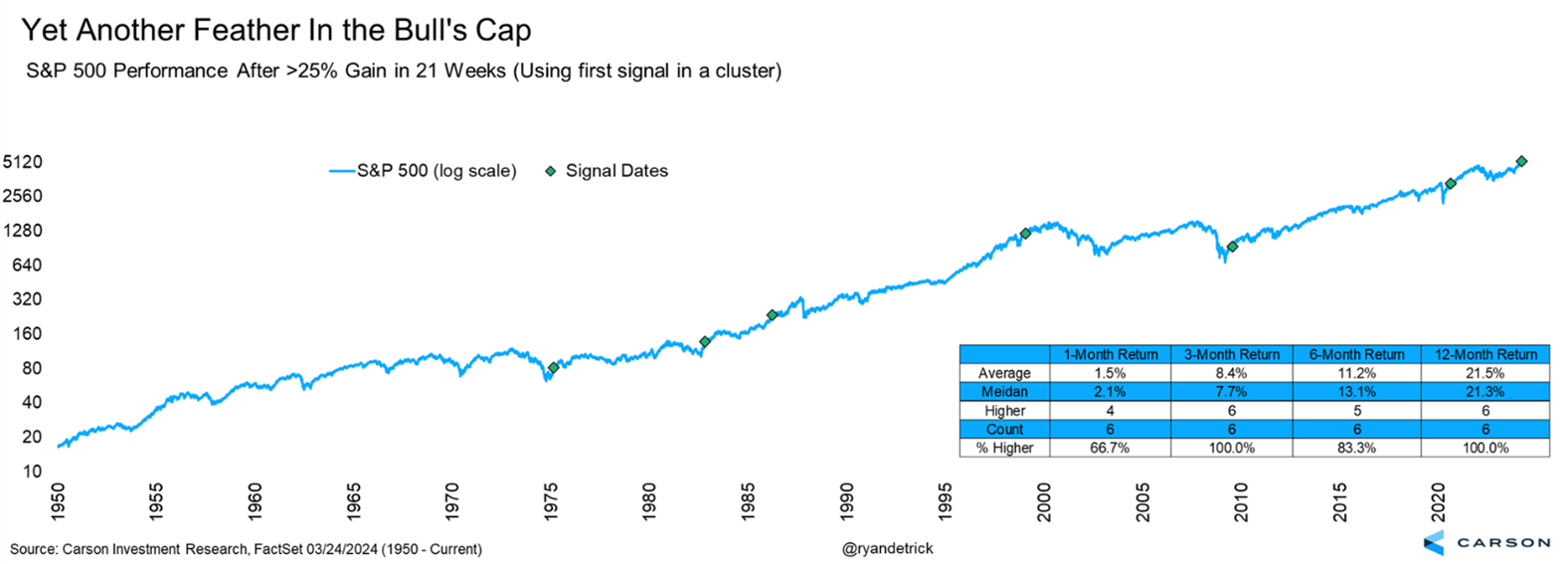

For starters, the S&P 500 is up 17 of the past 21 weeks and up 27% over that timeframe. Never in history has that happened before, so we hope you’ve enjoyed this incredible run—it might not happen again for a very long time. The good news? More gains could be coming. We found six other times stocks gained at least 25% in 21 weeks and sure enough, stocks were higher a year later each time with an average return of more than 21%.

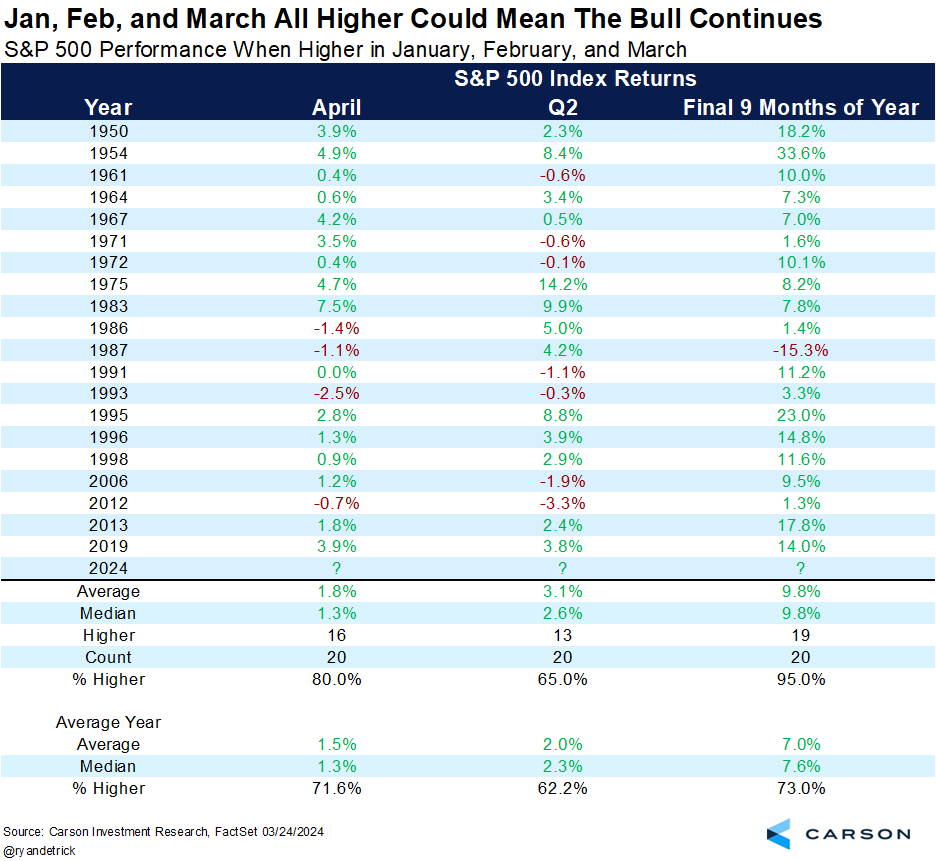

Stocks are about to gain each of the first three months of the year and we found that the rest of the year (so final nine months) were higher an incredible 19 out of 20 times after previous instances! Adding to the fun, April and Q2 tended to do even better as well.

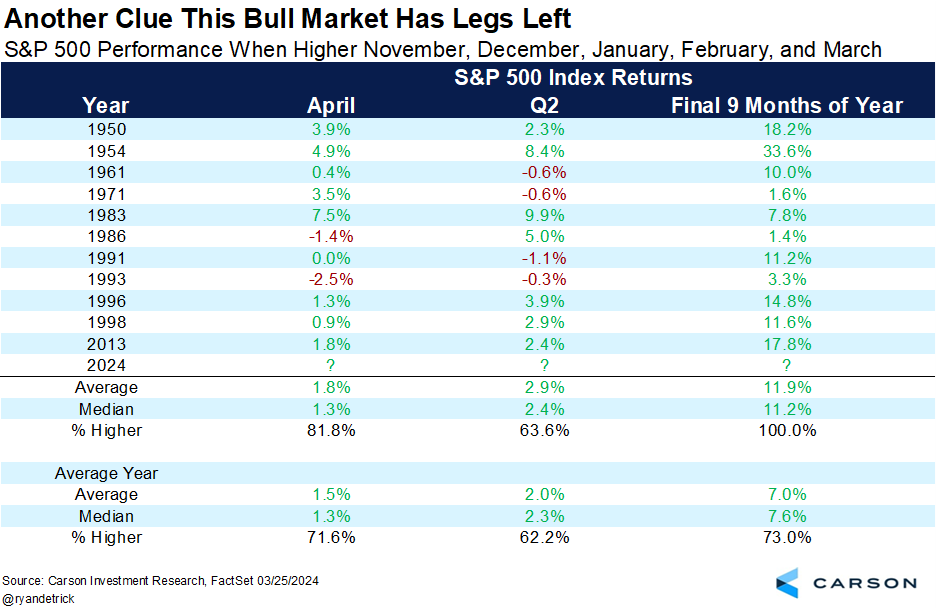

Let’s not forget stocks soared in November and December as well, so they are up five months in a row heading into the usually bullish month of April. Sure enough, stocks tended to do better in April and Q2 after such long win streaks. Lastly, the rest of the year (so the final nine months) have never been lower when there has been at least a five-month win streak heading into April. 💪

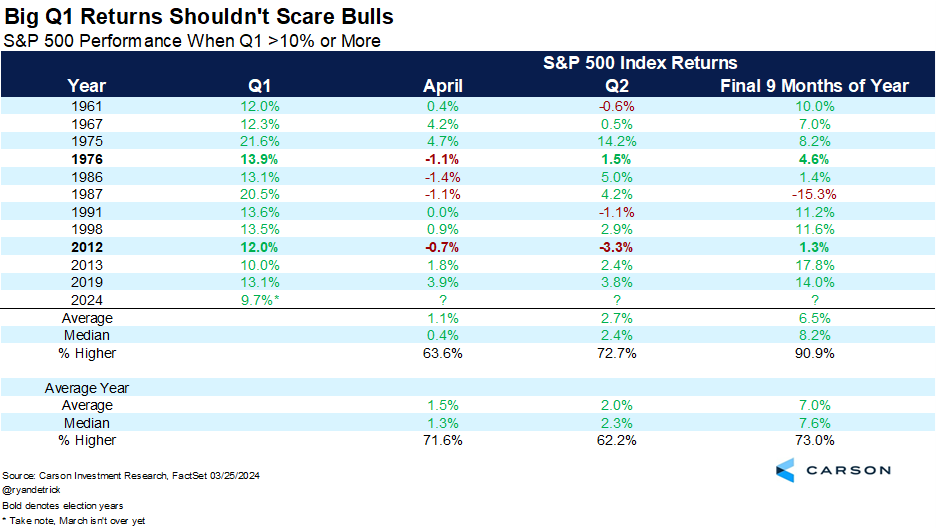

What about when Q1 gained 10% or more? Take note, 2024 isn’t there yet, but it is close with a couple of days to go. April and Q2 aren’t anything extra special, but the rest of the year was higher 10 out of 11 times, with only 1987 lower. 1987 was also up a record 20.5%, so that is a little different than the ballpark 10% in 2024. The average took a big hit those final nine months due to 1987, but the median was a rather solid 8.2%.

Looking more closely at the above, what got my attention was only 1976 and 2012 were election years and the returns the rest of those years were only 4.6% and 1.3%, respectively. 🤔

Lastly, we’ve seen very broad-based participation in this rally. Many large institutional research shops continue to (incorrectly, in my opinion) claim that only a few stocks are going higher and pulling the market along. I believe this isn’t true and really, never was.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

We’ve been pushing back against this narrative for a year now. I specifically remember in May of 2023 being on TV and the other guest said something to the tune of, ‘…only seven stocks are going up, the overall market will crack the rest of this year due to this.’ On air I quickly noted how various advance/decline lines were making new highs and it simply wasn’t true. We apparently disagreed then and we disagree now. 🤷♂️

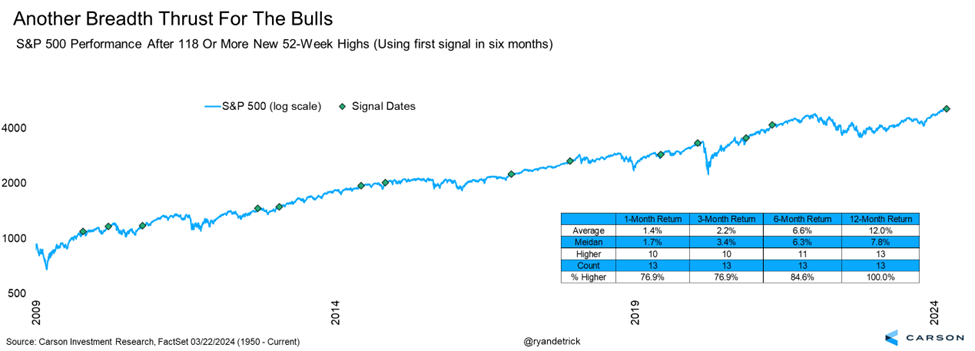

Looking at last week, on Thursday we saw a huge surge in S&P 500 stocks hitting new 52-week highs. In fact, 118 hit a new high, the most in three years! I found 13 other times we saw an initial surge in new highs like that and wouldn’t you know, the S&P 500 has been higher a year out 13 of 13 times (not very unlucky if you ask me) for an average return of 12.0%. 🔥

That’s enough for now. We’ve been overweight equities since December 2022 and we’ve also been in the camp the economy would avoid a recession that whole time. We remain there and many of these studies do little to change my optimistic outlook.

Many people are on Spring Break this week and next, so if you are taking some time off, have fun! ☀⛱🍹🥂

For more content by Ryan Detrick, Chief Market Strategist click here.

02171359-0324-A