“When the facts change, I change my mind – what do you do, sir?” -John Maynard Keynes

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

One of the main reasons we were overweight equities at the start of this year was because virtually no one else was, as we explained in mid-December in Is Anyone Bullish?. Sure, there were a few bulls, but if you were bullish for the majority of this year you were crushed on social media, as it was obvious to everyone that a new bear market and recession were around the corner. Always remember what Joe Granville told us many years ago, “If it is obvious, it is obviously wrong.”

Then a funny thing happened. The economy surprised to the upside and stocks had one of their best starts to a year ever, with the Nasdaq having its best first six months ever.

Now wouldn’t you know it, we see many of those same bears changing their tune?

Mike Wilson over at Morgan Stanley is known for being one of the most bearish of the bears. He does great work and was quite right last year, but things haven’t worked so well this year, as at the start of the year he was looking for S&P 500 to go to 3,000. It’s currently around 4,400. Then two weeks ago he was saying we were in a 2019-like rally. He even apologized for being wrong on July 24 and upped his target to 3,900 this year. This by itself caught my attention that maybe it was time for some potential stock weakness when the biggest bear out there was changing his tune.

Carl Icahn is another big name who has been extremely bearish this year and is also changing his tune. In a letter to his investors sent earlier this month, he admitted he wagered too much against the stock market advance and will now focus less on hedging stocks and more on sticking to his activist strategy. “Our returns have been overwhelmed by our overly bearish view of the market,” Icahn said. “Going forward, we intend to stick to our knitting and focus on our activist strategy.”

So that’s two bears changing their views, but what about other signs?

Goldman Sachs hedge fund clients showed the cumulative dollar amount of short covering by hedge funds in June and July combined at the largest over a two-month period since 2016. It isn’t so cool (or prudent) to be bearish anymore is it? Here’s what the Wall Street Journal had to say.

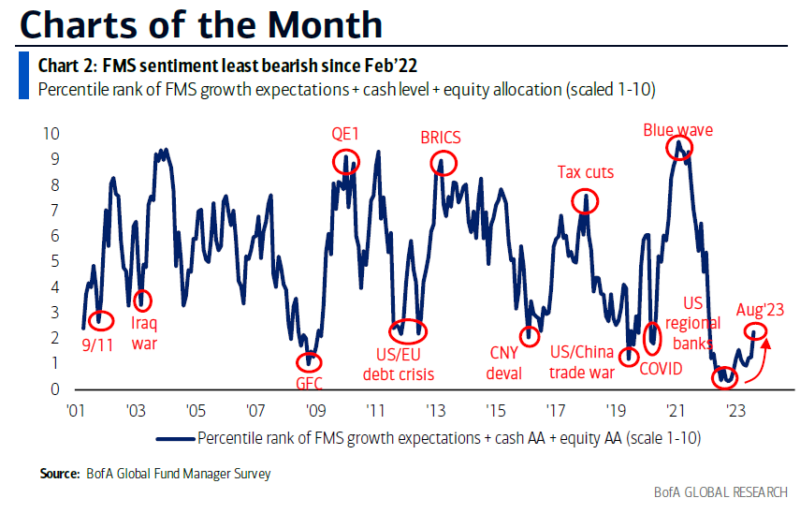

One of my favorite monthly surveys is Bank of America’s Global Fund Manager Survey. This survey looks at real managers that manage hundreds of billions of dollars. The recent survey showed that sentiment was the least bearish since February 2022. Of course, one look at the below and it is clear that there are less bears than before, but by no means is this near what we’d call over-the-top optimism.

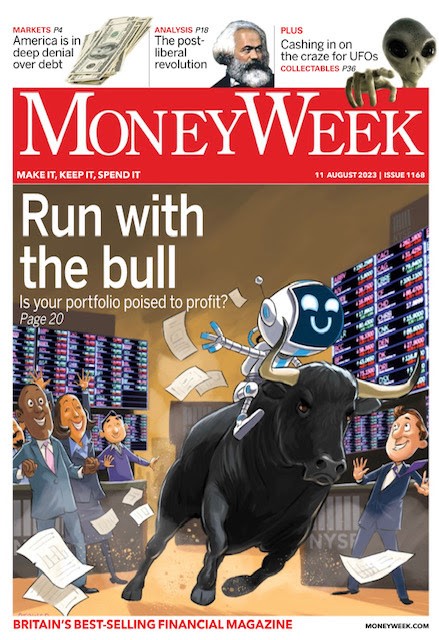

Another sign sentiment has shifted significantly is we are seeing bulls on magazine covers now. This recent MoneyWeek cover sure has a much different feel to it than we were seeing late last year. (But I must say I got a kick out of E.T. in the upper right-hand corner)

Speaking of last year, here’s a good reminder of what we were bombard with constantly. As horrible as a “100% chance” of a recession sounds, take note stocks formed a major bear market lows a few days before.

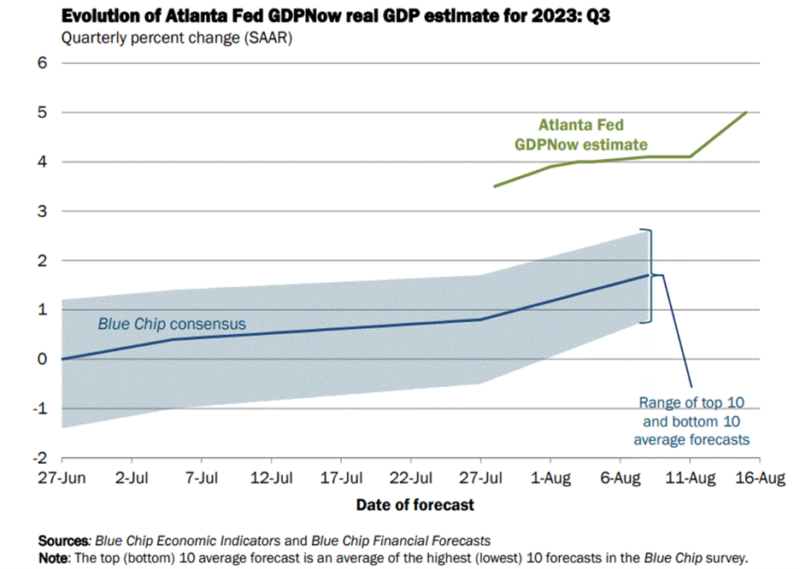

The economy continues to surprise nearly everyone to the upside and the Atlanta Fed is now expecting third-quarter GDP to come in at an incredible 5.8%! Take note the median expectation was for 0% at the start of the quarter, meaning half of all those economists surveyed expected negative growth! Well, that sure isn’t going to happen now. Reminds me of the old joke about why God created economists … to make weathermen look good!

One thing that has clearly worked this year and last year has been seasonality. We’ve been all over this, pointing out how bear markets tended to end in October, especially in midterm years, with the first half of pre-election years extremely bullish. That’s all played out exactly like history would have suggested, yet so many blatantly chose to ignore history.

Which brings us to now. Go read the quote from Keynes at the beginning one more time if you want. Some of the clues that had us bullish have been shifting, plain and simple. Let’s be clear, I don’t expect stocks to see a significant correction here, but some more modest weakness or consolidation would be perfectly normal. In fact, it’d be abnormal not to happen if you ask me.

Today we have some ‘johnny come lately’ bulls right as we entered a weak period historically. I discussed some of this two weeks ago in Stocks Don’t Like August, Now What? and I even joined Michael Santoli on CNBC on August 1st to discuss the increased likelihood of some volatility and weakness in August.

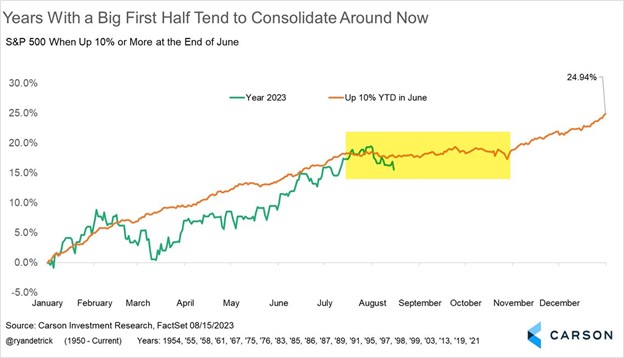

Here’s a chart I shared on Twitter (sorry, I’m not calling it X yet) that was quite popular. It showed that looking at prior years that were up at least 10% by the middle of the year tended to see some seasonal weakness right around here. Again, not a shock if you follow history. The good news is once you could get past that, the rest of the year tended to be strong with new highs happening later in the year. This is how we see 2023 potentially playing out as well, with potential new highs in the S&P 500 still our base case before the ball drops.

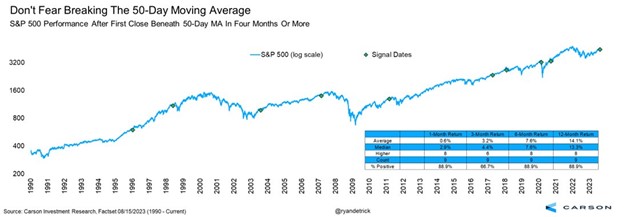

One final note is the S&P 500 recently closed beneath its 50-day moving average after being above it for more than four months. This got a lot of media attention and rightfully so. The good news (and I like to end on good news) is stocks did just fine when this triggered. In fact, since 1990, higher a month later eight of nine times and higher a year later (again) eight of nine times, but up more than 14% on average.

The bottom line is stocks had a great run, too many bears waved the white flag, and we entered a weak time seasonally. This is perfectly normal market behavior. We remain overweight equities here (like we have been since late December 2022), likely looking to use any continued weakness as an opportunity to add to positions.

For more of our thoughts on the economy and markets, be sure to listen to our latest Facts vs Feelings podcast, as this week Sonu and I were joined by Neal Dutta of RenMac. He has been one of the most accurate economists and you won’t want to miss what he has to say!

1871757-0823-A