“Now this is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning.” Winston Churchill

First off, happy Leap Day! We get an extra day every four years and hopefully you have fun today.

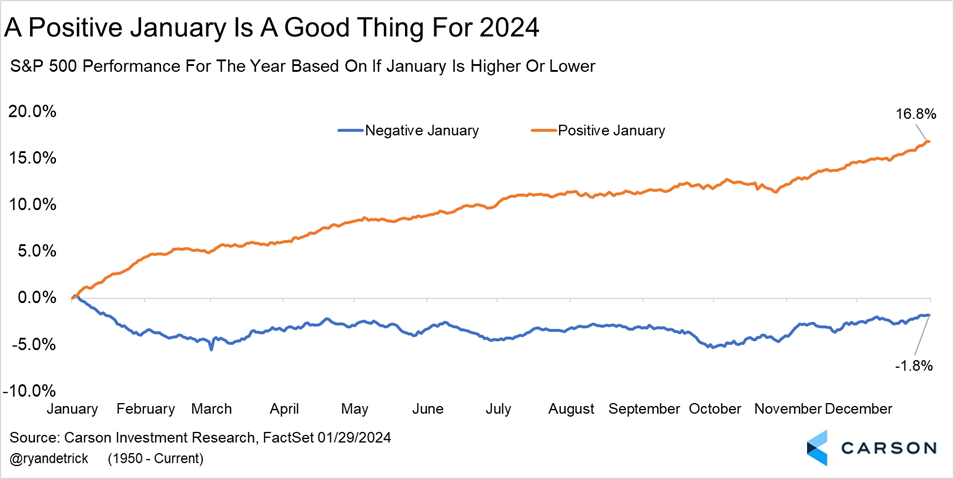

Well, so much for February being a historically weak month. The amazing bull market continued and the S&P 500 is about to close higher in both January and February. We noted in As Goes January, So Goes the Year? The Bulls Hope So that a higher January tended to suggest future strength, well, things get even better when the first two months are higher. Here’s what tends to happen after a positive January.

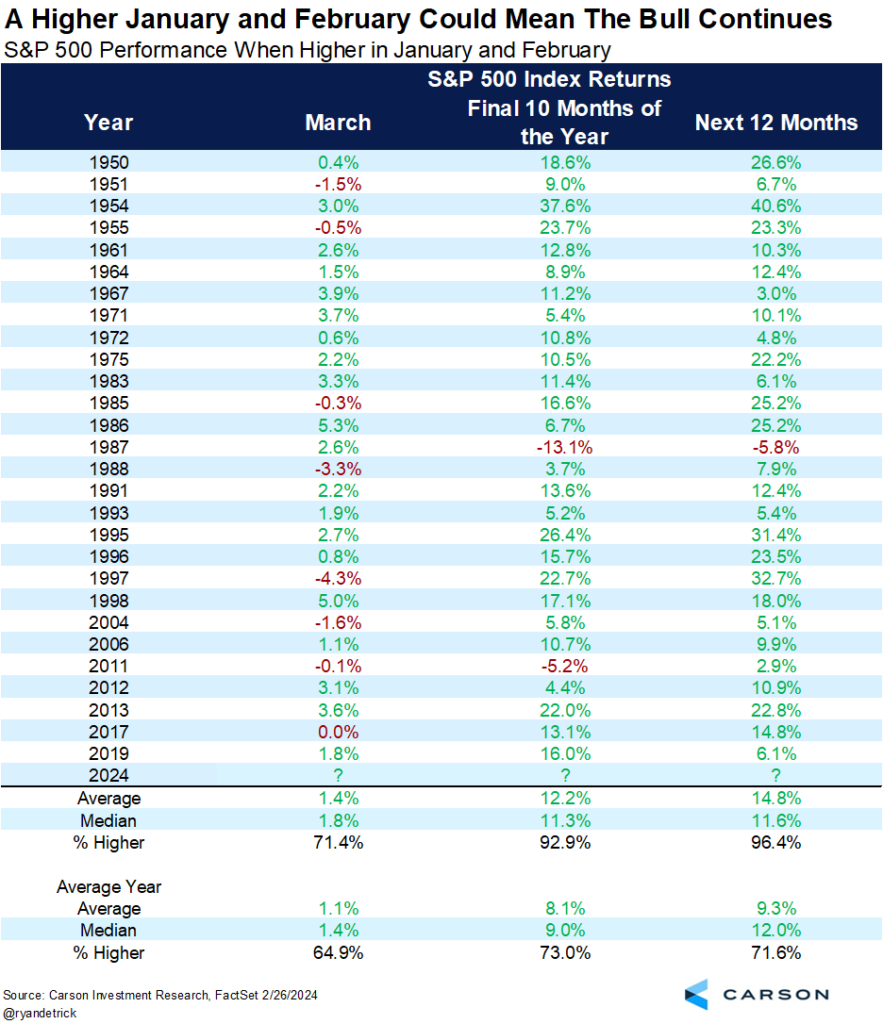

How amazing is this? After the S&P 500 gained in both January and February (like 2024 is about to do) the next 12 months were higher an amazing 27 out of 28 times! The final 10 months were higher 26 out of 28 times, with the returns in both cases much better than the average returns.

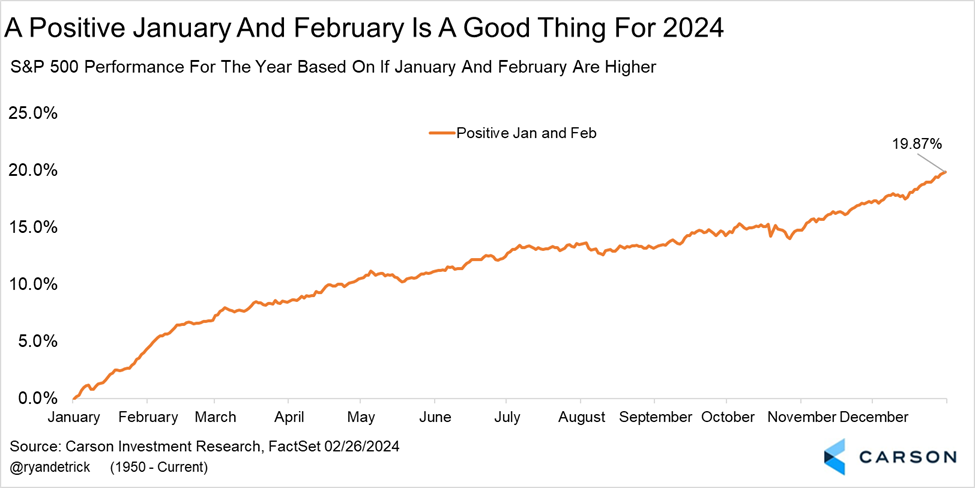

The S&P 500 was up 19.9% in years that saw both January and February higher, as the chart below shows. We aren’t expecting 20% gains this year, but we sure wouldn’t complain about them if they happened!

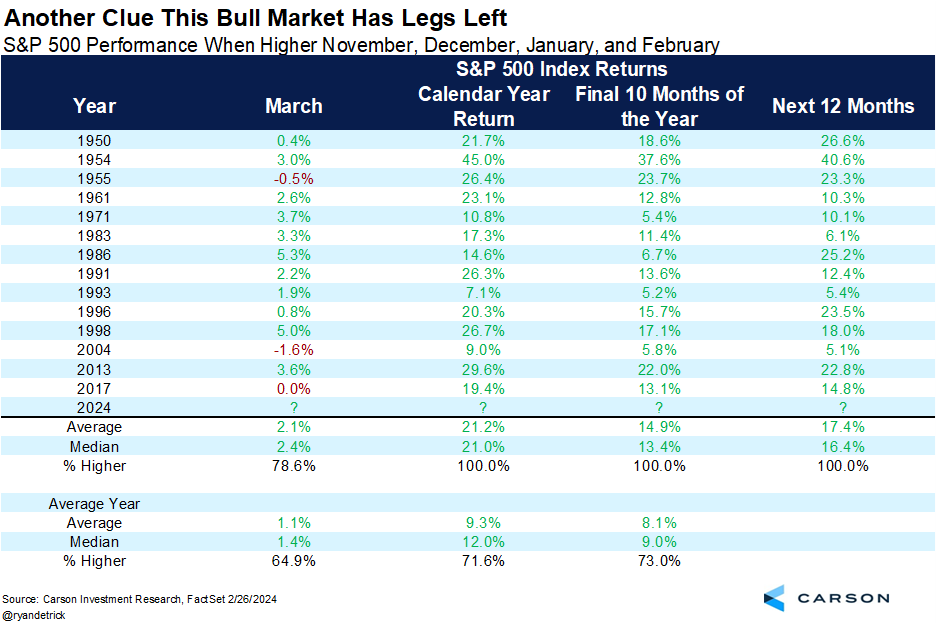

Lastly, it isn’t just the first two months of 2024, as remember we saw a big rally the final two months of last year as well. We found 14 other times stocks were higher in November, December, January, and February and for the full calendar year (so 2023 returns) the bulls were smiling every single time, with an average return of 21.2%.

We’ve been overweight equities since late 2022 and have remained there ever since. It wasn’t very popular this time a year ago saying stocks were going higher and a recession wasn’t happening, as it went against what the masses were saying. Well, right now we see very few reasons to change our bullish outlook and a higher January and February does little to change that.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

For more of our latest thoughts on NVIDIA, the Mag 7 in a bubble, the bull market, Japan at new highs, and Warren Buffett’s latest letter, please be sure to listen or watch our latest Facts vs Feelings below.

For more of Ryan’s thoughts click here.

02136128-0224-A