“Better send those refunds.” Joe Burrow, after beating the Bills 27-10

First things first, I’m a diehard Cincinnati Bengals fan and have been my whole life. One of my first memories was the 1988 season and the crushing last-second defeat in the Super Bowl to Joe Montana and the 49ers. They didn’t win a playoff game for more than 30 years after that, so as a fan, I’m enjoying what winning feels like.

Here’s the catch, though, no one respects the Bengals or believes in them in the national media. The NFL literally changed the rules the last week of the regular season, and it directly hurt the Bengals but helped all the other teams. We don’t need to make this all about sports but read about Joe Burrow’s quote and why he said it. To me, this disrespect feels a lot like the stock market, as very few think stocks can go anywhere but lower. But thinking this way isn’t looking at all the data, and there are many reasons stocks could actually go higher, maybe much higher, in 2023.

The Bengals won the AFC last year, won the AFC North two years in a row, and were on a 9-game win streak heading into Buffalo, yet nearly every ‘expert’ on tv picked the Bills. Thank goodness you have to play the game, as it was clear who the better team was. Much like sports and playing the game, the stock market continues to defy all the bears on tv, and it looks like it will likely continue to go higher in our view. Much to the dismay of many bears.

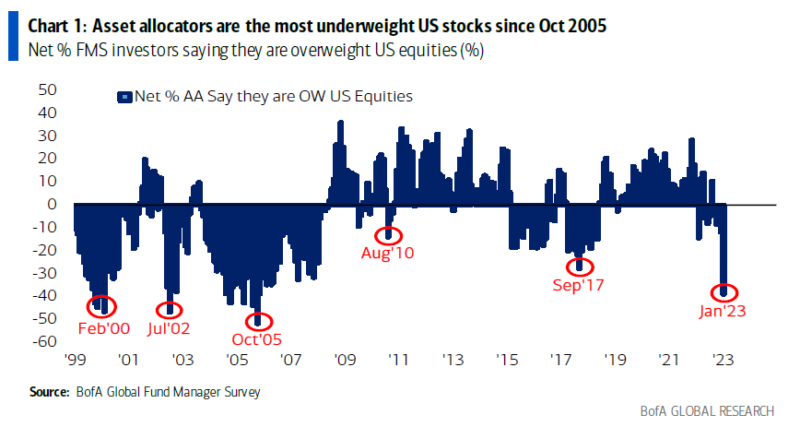

Look at this from the recent Bank of American Global Fund Manager Survey. Even after stocks are off to one of their best starts to a year ever, asset allocations are the most underweight US stocks they’ve been in more than 15 years. From a contrarian point of view, we think this could be quite bullish. Remember, markets like to cause pain to the masses, and the masses are expecting a bad first half of the year, which is something we think might not happen. We discussed this more in What Happens When Everyone Agrees Stocks Will Fall?

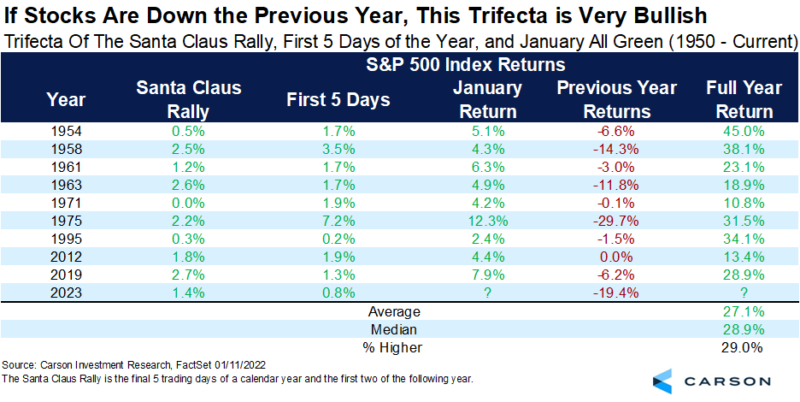

The S&P 500 is up close to 5% for the year, likely suggesting stocks should have a green January. Given that stocks gained during the Santa Claus Rally period and the first five days of the year in 2023, gaining in January would be quite the bullish trifecta. As we show below, when stocks fall the year before, a bullish trifecta signal meant that the following year could be exceptionally good. Just how good? Try never lower and up more than 27% on average. January isn’t over yet, but this is one to watch.

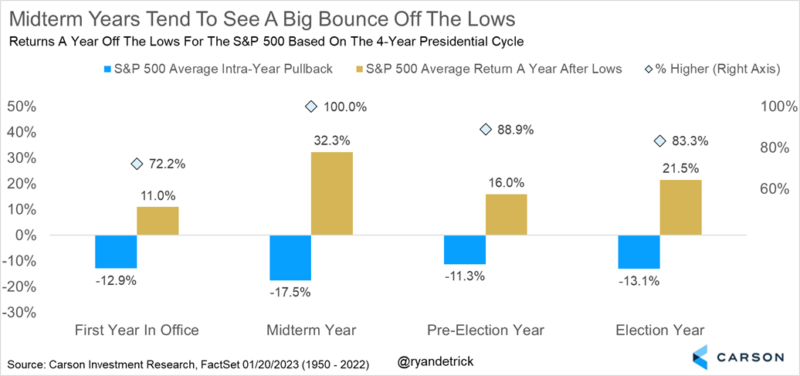

As bad as last year was, it wasn’t so abnormal for a midterm year to see trouble. In fact, looking at the four-year Presidential cycle shows that midterm years tend to see the largest intra-year correction, down 17.5% on average. Yes, the 25.2% bear market last year was worse than normal, but the good news is a year off midterm year lows tends to see a very large bounce, with the S&P 500 never lower a year later and up more than 32.3% on average.

Take note stocks bottomed on October 12 last year, and a 32.3% rally would put the S&P 500 less than 1.5% away from a new all-time high. We aren’t saying that’ll happen, but we are saying it isn’t as far-fetched as one might think.

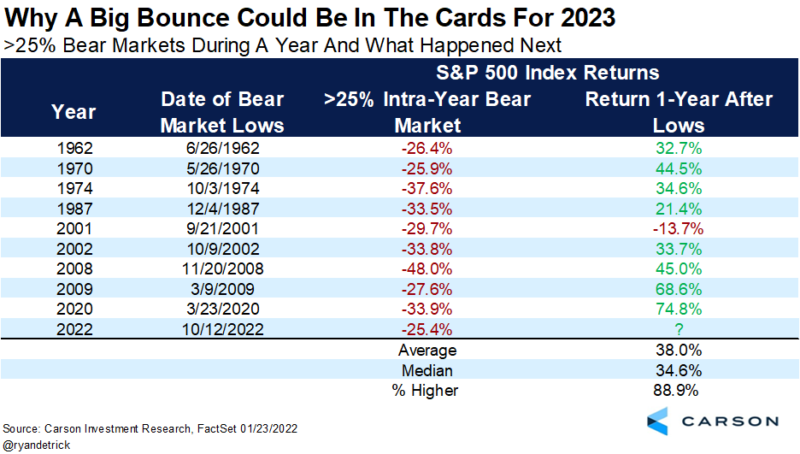

Lastly, 25% intra-year bear markets are quite rare, but once again, returns a year off the lows could be much better than most expect. We found nine other years had a 25% intra-year bear market, and only once were stocks lower a year after the low (and that was in 2001/2002). Up 38.0% on average a year off the lows is something many investors would gladly take in 2023 if you ask me.

The Carson Investment Research team upgraded our view on equities to overweight in late December after being market weight much of the year. It has been an incredibly lonely call, with many funny looks and some outright anger to see the positives out there, but we remain optimistic that 2023 could be a much better year for investors than most think.

Lastly, wouldn’t it be something if my Bengals could win two more gains and stocks gain in 2023? Let’s take it one thing at a time, and to be honest, I think I’d take two more wins over a bull market. Thanks for reading, and Who Dey!