They call it March Madness for a reason, but this is getting a tad extreme. Besides the fact that no 1, 2, or 3 seeds made the Final Four, the real madness can be found in the financial world.

What we’ve seen so far this March has been unbelievable in so many ways. In fact, at the start of the month, if someone would have told you all the incredible things that would happen, yet stocks would take it in stride, I’m not sure most of us would ever believe it.

Here are some of the things that we’ve seen so far this month:

- One of the worst banking crises in U.S. history, with the second and third-largest bank failures seemingly happening overnight.

- More than 100-year-old banks in Europe going under or on the edge of failure.

- One of the most volatile bond markets ever, with the cherry on top being the 2-year yield falling from 5% to 4% in two days during the worst of the worry.

- A Fed that was all set to hike by 50 basis points (and probably a few more after that) to a 25-basis point hike and potentially only one more. In other words, perhaps the fastest Fed pivot in history.

- As a result, the volatility in the bond market and yields was unlike anything we’ve ever seen before.

- We even had Jerome Powell say for that depositors should assume their deposits are safe, while Janet Yellen said she hadn’t even considered increasing FDIC insurance. These two things happened at the same time last Wednesday afternoon! Talk about confusing messages.

- Bank stocks tanked, with many smaller regional banks getting cut in half or worse.

- Gold found a bid and moved close to $2,000 an ounce as trust in the entire system deteriorated.

- I’m sure there are more, but you get the point here. Not a lot of good news in March.

Now would you believe me if I told you all those things would happen, yet stocks would be up? That’s right, the S&P 500 was up the past two weeks and is flat for the month, while the Nasdaq-100 hit seven-month highs last week.

I’ll be the first to admit that isn’t what I would have expected in the face of those horrible headlines. Yet, here we are. It was the most volatile bond market ever, yet stocks were incredibly calm, all things considered. Madness indeed.

How is this possible? Here are a few ideas:

- A dovish Fed is what the market wants.

- Inflation continues to come back to earth, while supply chains are improving as well.

- The economy remains strong and, to the chagrin of many vocal bears, will still be able to avoid a recession.

- March has been a month of major lows lately, and history could be repeating. 2003, 2009, and 2020 all stand out as months that felt like the end of the world, yet were actually great buying opportunities.

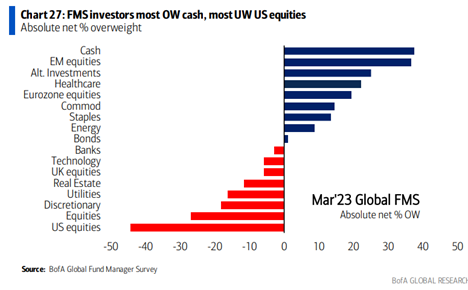

- Lastly, overall market sentiment is over-the-top negative. Once everyone who will sell has sold, that is how bottoms form. The table below from the recent Bank of America Global Fund Manager Survey showed that the most loved asset last month was cash, and the most hated was U.S. stocks.

This doesn’t mean stocks have to bottom, but this is the type of thing you tend to see at major lows and suggests there very well could be plenty of cash to move back into U.S. equities on any good news.

It has been a wild month, and it isn’t over yet, but continue to follow the Carson Investment Research team as we break it all down.