We’re just days away from closing out 2023, and from an economy and markets perspective, the year really couldn’t have gone better:

- Stocks have gained more than 25%.

- The unemployment rate is at 3.7% despite an aggressive Federal Reserve.

- The economy is on track to have grown more than 2.5% after adjusting for inflation, which is above the prior decade trend.

- Inflation has pulled back big time.

- The Federal Reserve (Fed) has signaled a pivot to rate cuts in 2024.

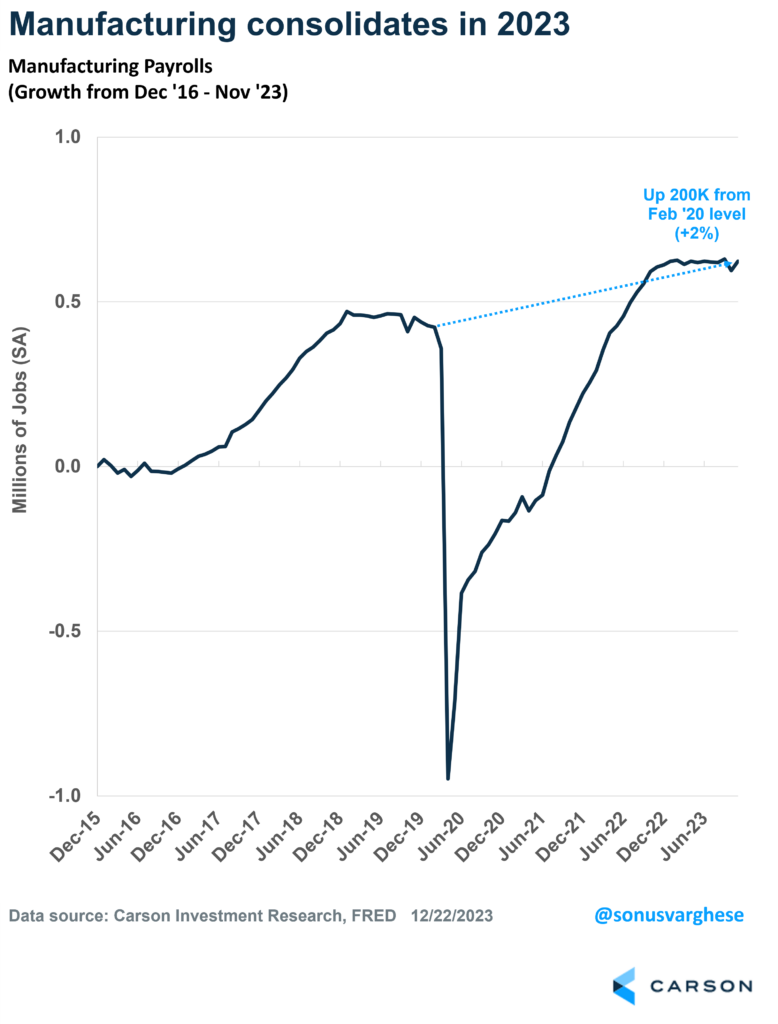

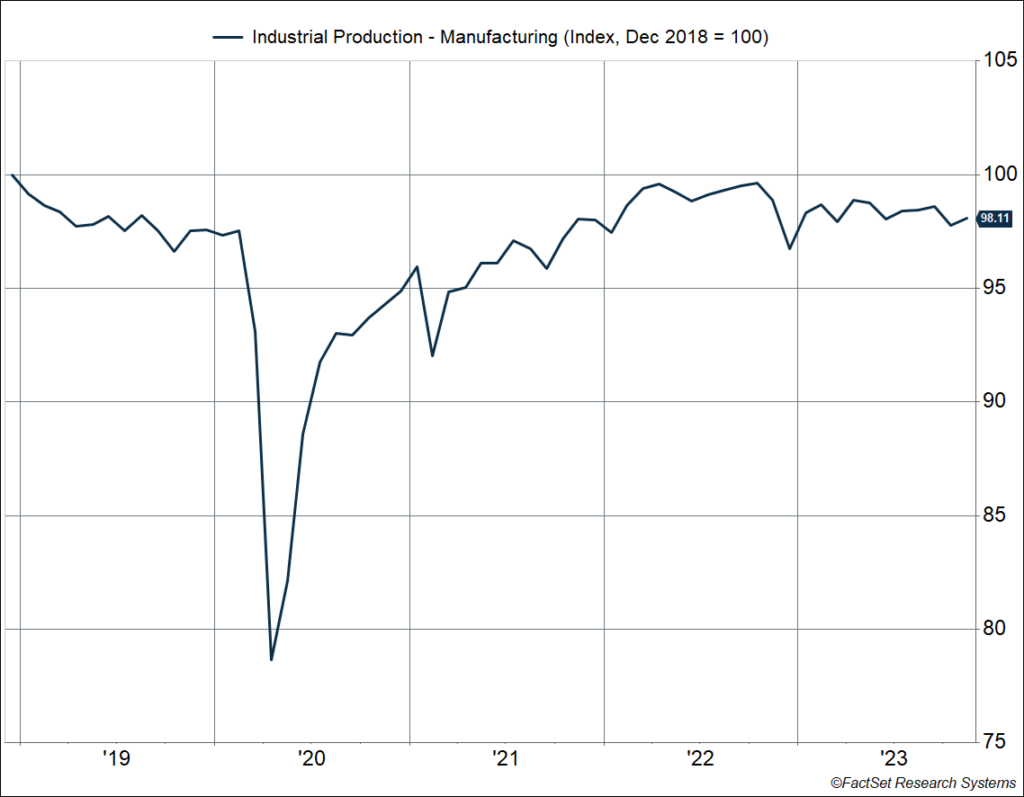

The one part of the economy that was held back was the manufacturing sector. Actual activity wasn’t as bad as gloomy sentiment numbers made it out to be – manufacturing production rose 1.4% year to date through November, and production is running slightly higher than it did just before the pandemic hit. The manufacturing sector also created 11,000 jobs. That isn’t great but it’s not exactly recessionary either. Some of it was probably due to the sector consolidating after a hiring surge in 2022 (+390,000 jobs) and 2021 (+385,000). Manufacturing employment is now 1.6% higher than it was in February 2020. Consolidation in 2023 shouldn’t be a huge surprise, as consumption switched to services this year after a surge in goods from 2020 to 2022.

One thing you may not know is that manufacturing was in the doldrums before the pandemic, a period we look back on as one with strong economic growth. In February 2020, manufacturing production had fallen 1% over the prior year, and manufacturing payrolls had fallen 37,000 during that time. It highlights that US economic strength no longer depends on manufacturing, which makes up only about 11% of the economy.

Nevertheless, manufacturing is a key sector of any country’s economy, something that we were all harshly reminded of as supply chains that stretched across the globe seized up during the pandemic. Manufacturing also requires specialized skills, and pay is generally higher, very good reasons to have a robust manufacturing industry.

As you can see in the chart below, production has yet to get back to 2018 levels — it’s about 2% lower right now – and has been flat recently. One catalyst that could push production higher could be Fed rate cuts, which could come as early as March.

All that said, there are actually three really positive stories happening within the industrial sector that I want to highlight.

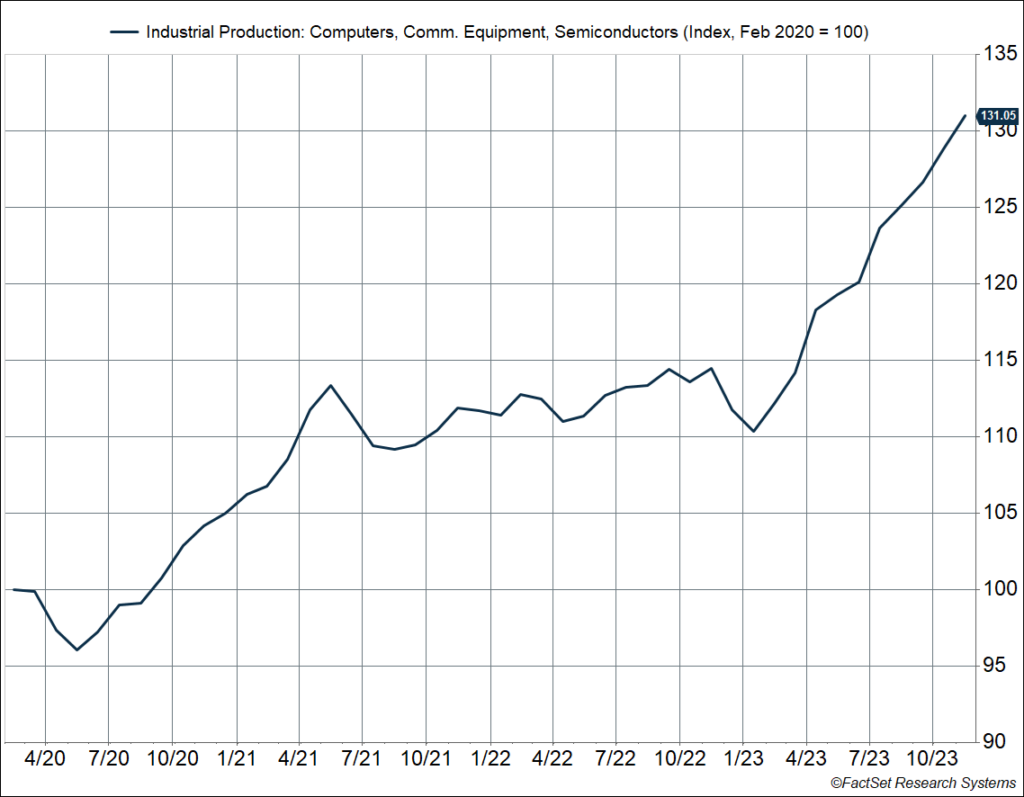

High-Tech Equipment Production Is On Fire

Manufacturing of high-tech equipment – computers, communication equipment, and semiconductors – surged in 2023. It rose 17% in 2023 (through November) and is a whopping 31% above February 2020 levels. A lot of this is because businesses are investing more in high-tech equipment as the labor market remains tight, not to mention investment in hardware related to artificial intelligence, including servers, storage, and chips. This is very positive for productivity as we move ahead.

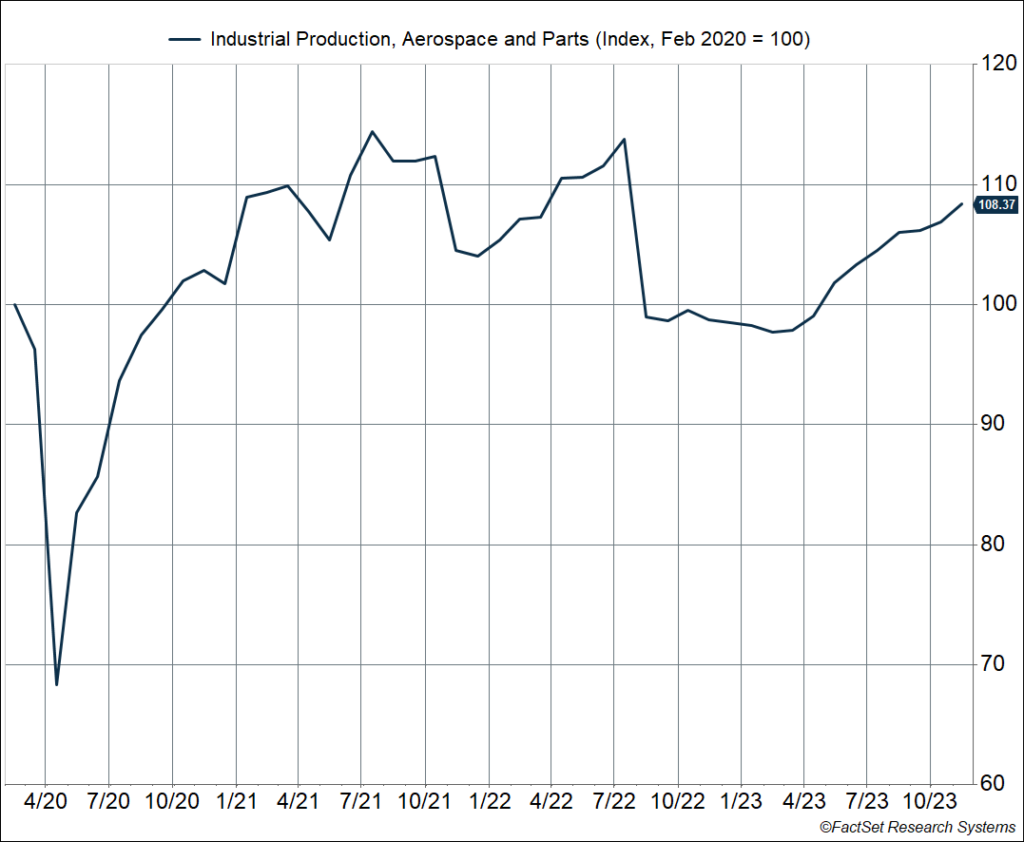

The Aerospace Industry Is Coming Back

New orders for nondefense aircrafts soared 49% this year (through November) relative to 2022, which tells you about what global airlines think about future demand for travel. Even new orders for defense aircraft have jumped 15%, another notable datapoint – Ryan and I have talked before about how rising defense spending can be a tailwind for economic growth over the next several years. Right now, defense spending is just 3.7% of GDP, close to the lowest in history.

As a result of demand, US aerospace industrial activity has been in a strong uptrend. Aerospace production rose 10% in 2023 (through November) and is running 8% higher than in February 2020.

U.S. Oil Production Is Hitting New Records Each Month

This is technically not manufacturing and falls under “mining,” but close enough. The US oil industry suffered three big busts over the last 15 years – 2008, 2015-2016, and 2020 – and there were questions as to whether it would ever come back in force. After the fallout from 2020, when we saw very briefly saw negative oil prices, all the talk was about the US oil industry moving their focus towards returning money to shareholders rather than investing in new production. The good news is that both are happening now.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

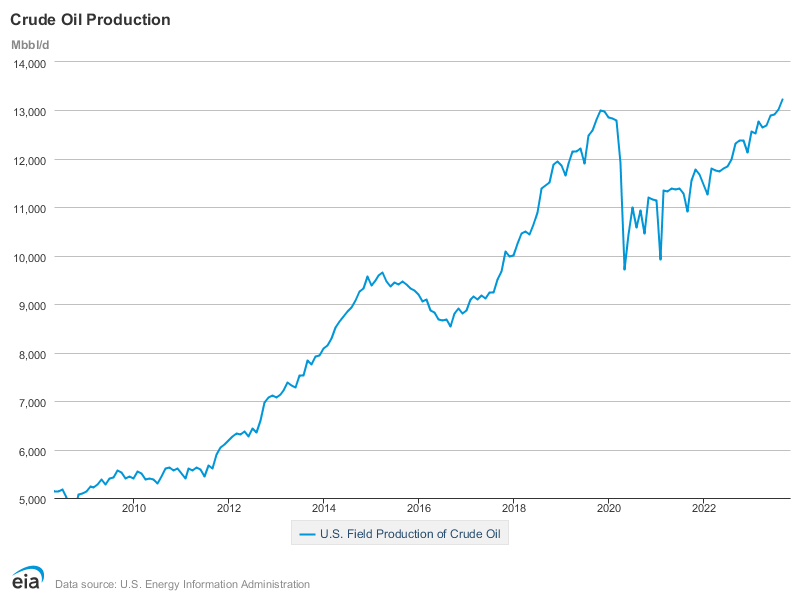

The US was already the largest producer of petroleum in the world, and US crude oil production hit a new record of 13.24 million barrel per day (bpd) in September. Crude oil production has doubled since 2012 and peaked at 13 million bpd before the pandemic.

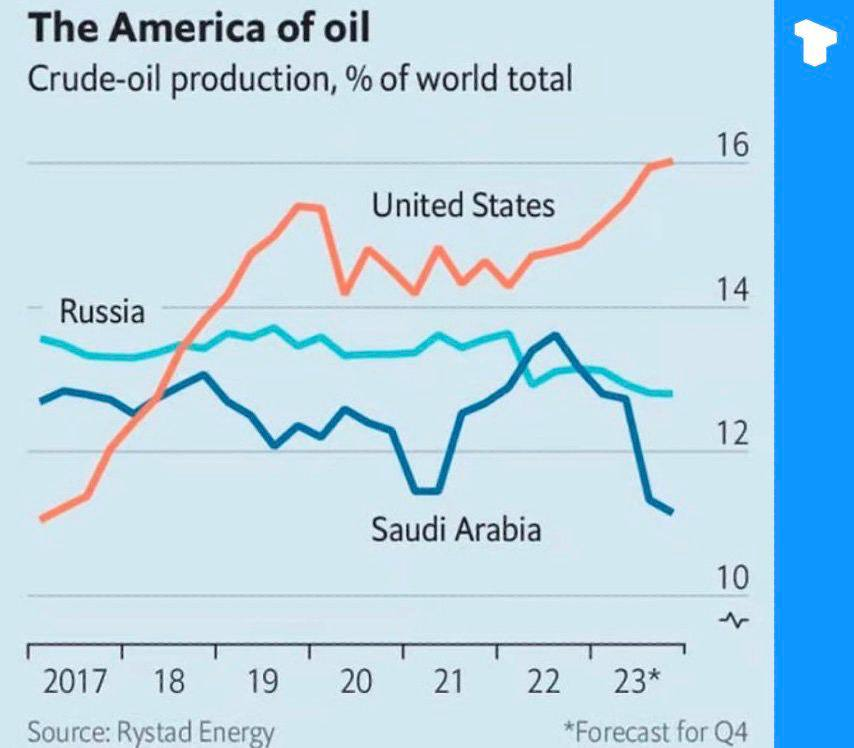

What’s key about this is that the US continues to take market share from OEPC+ (OEPC and Russia). Over the last year, OPEC has repeatedly cut production to keep a floor under oil prices – after all, their government revenues come mostly from oil, and so they like high prices. However, while OPEC cuts, US oil producers increase production and grab market share, nicely highlighted in this chart from The Economist.

Here’s wishing you a wonderful and happy 2024. Be sure to keep an eye out for our 2024 Outlook, as well as the Facts vs Feelings podcast, where Ryan and I put the latest market and economic data in perspective.