Hotter-than-expected inflation data in the first quarter led to a lot of concern that inflation is likely to rear its ugly head again. However, as I pointed out in several blogs over the first few months of the year (including two weeks ago), there was really no need to panic if you just peeked under the hood. A lot of the heat was due to idiosyncratic factors that were likely to reverse as the year progressed. And the April personal consumption expenditures (PCE) report released this morning confirms that.

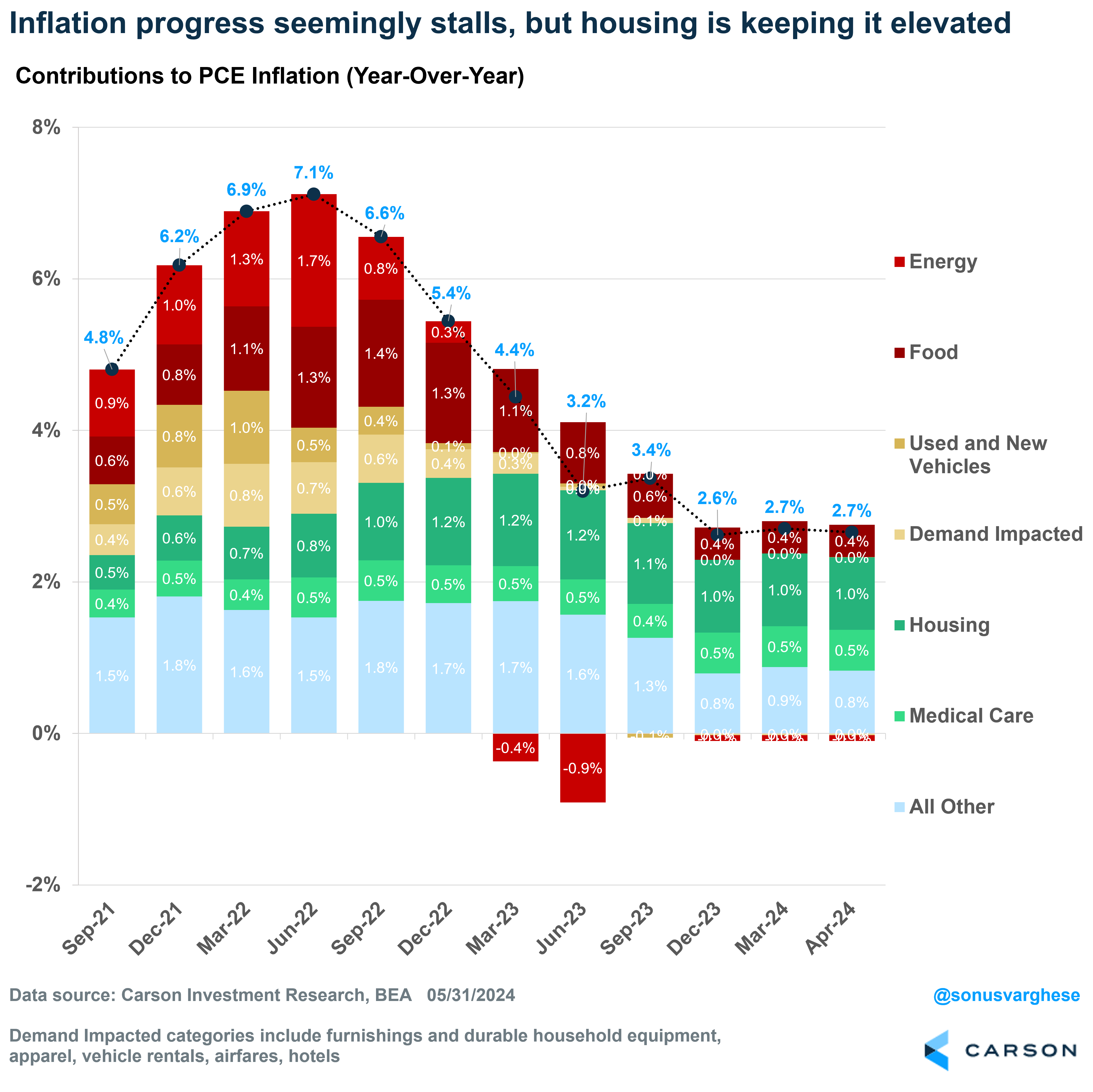

Note that PCE is the Fed’s preferred inflation metric, rather than the consumer price index (CPI), since it’s 1) broader, with more categories, 2) dynamic, as underlying category weights can change as consumers shift spending patterns, and 3) can be revised. PCE has been coming in softer than CPI (the so-called “wedge”) – with headline PCE running at 2.7% year over year versus headline CPI at 3.4%. A big reason is that housing (which Ryan and I have written and talked about, a lot) makes up over a third of CPI versus just 16% of PCE. Still, as you can see below, housing (dark green bar) is a big reason why even PCE remains above the Fed’s 2% target.

The impact of housing is even more pronounced if you look at core PCE inflation, which strips out volatile energy and food components. Core PCE is up 2.75% trailing year, which is the slowest pace since April 2021. However, housing is adding 1.04 percentage points to that total. On top of that, financial services inflation is adding another 0.29 percentage points, and that’s running hot because stock prices are up (which drives up the “prices” of portfolio management services). Together, housing and financial services are contributing 1.33 percentage points to the year-over-year core PCE pace of 2.75%, accounting for almost half of the increase! For perspective, in December 2019, housing and financial services contributed a total of 0.68 percentage points to core PCE inflation.

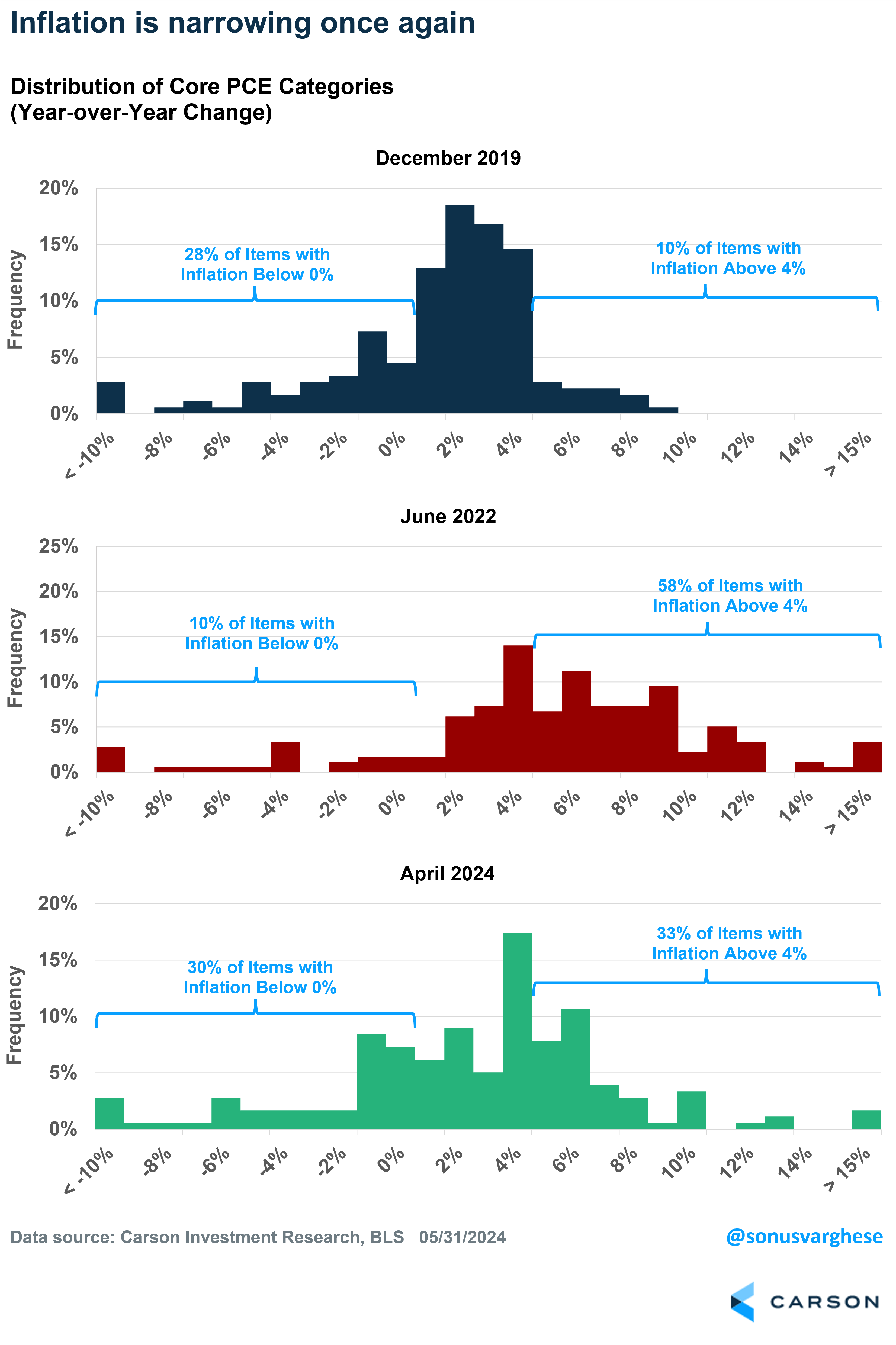

Another way to counter the notion that we haven’t made any progress on inflation since last October is to look under the hood at the distribution of inflation across all categories. I looked at 178 items within core PCE and calculated the distribution of year-over-year inflation at three different times. You can see how inflation really broadened out in June 2022 relative to December 2019. The good news is that the distribution is narrowing once again. The picture for April 2024 looks closer to what it looked like in December 2019, than June 2022.

- In December 2019, just 10% of items had inflation rates above 4%.

- In June 2022, 58% of items had inflation rates above 4%.

- In April 2024, 33% of items had inflation rates above 4%.

On the other side, looking at categories that are currently experiencing inflation less than 0%, i.e. falling prices:

- December 2019: 28% of items

- June 2022: 10% of items

- April 2024: 30% of items

Even if inflation remains elevated, we’ve made considerable progress on inflation over the last two years and we expect that to continue. In fact, we actually made some progress on inflation even in 2024. Back in December 2023, 42% of items had inflation rates above 4%, versus 33% in April. And 21% of items were experiencing deflation in December 2023, versus 30% in April.

Ideally, we’d have seen even more progress, but it’s still progress. The improvement gets to why the Fed didn’t panic about the Q1 inflation data. Neither did we.

In fact, as we look ahead, we see disinflation in the pipeline. We’re continuing to see disinflation for durable goods like vehicles, household furnishings, and appliances. Grocery prices have also been falling, both in the official inflation data and anecdotally. Walmart’s CEO recently said they’re seeing the same thing in their stores. On the services side, we should see disinflation for both housing and financial services (unless stocks jump another 20% over the next 3-6 months, which frankly, we wouldn’t complain about).

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

The big picture is that the overall inflation outlook looks good, and that likely keeps the Fed on track to start cutting rates this year, perhaps in September, assuming we get a few more positive inflation reports. That’s also be a big positive for equity markets, which, as Ryan discussed in his latest blog, already have quite a bit of momentum and seasonality going for them.

Take a listen to the latest Facts vs Feelings podcast, in which Ryan and I got to chat with Jeremey Schwartz, the Global Chief Investment Officer at WisdomTree (also the co-author on the 6th edition of Stocks for the Long Run with Professor Jeremy Siegel). We talked about stocks, and where there may be pockets of opportunities right now from a valuation perspective, amongst a lot of other things.

For more content by Sonu Varghese, VP, Global Macro Strategist click here.

02261176-0524-A