What a strange year we had in 2023. There were few places where market participants, strategists, policymakers and the economy saw eye to eye. Most strategists missed the underlying strength in the economy, leading to too much pessimism about stocks in what turned out to be a strong year. Skepticism about the bond outlook and a flight to money market funds looked justified until the last quarter, when bonds rallied sharply. And consumers remained gloomy for most of the year about what was really a pretty good economy despite the most aggressive Federal Reserve (Fed) rate hike cycle in decades.

Carson Investment Research took an unpopular contrarian stance in 2023, calling for the expansion to continue and stocks to post solid gains, based simply on what we were seeing in the data. Consensus has moved toward our view in 2024, but we still see quite a bit of gloom out there, with a number of strategists holding to their recession calls. We take a deep dive into our Outlook for 2024 in Carson Investment Research’s Outlook ‘24: Seeing Eye to Eye.

DOWNLOAD OUR 2024 MARKET OUTLOOK

The Macroeconomic Backdrop

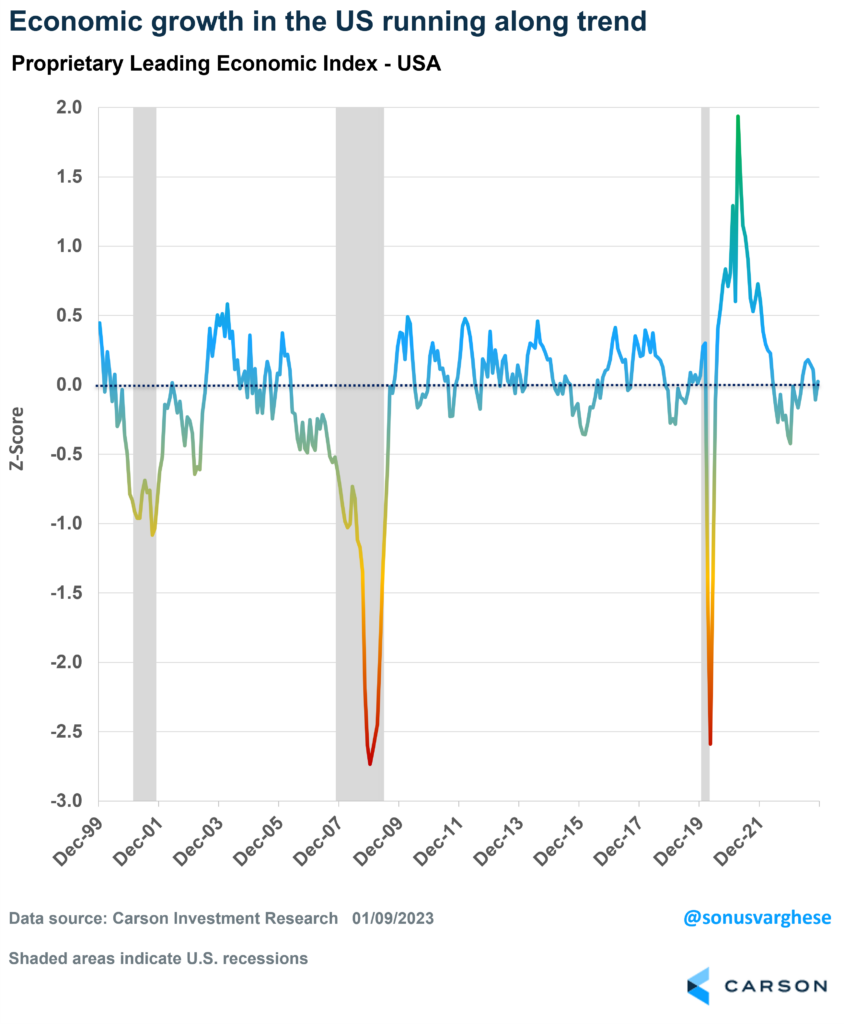

As we look at the year ahead, we see even lower odds of a recession than we did in 2023, as signaled by our proprietary Leading Economic Index (LEI), which places less emphasis on manufacturing and business sentiment and more on consumer spending (which makes up more than 2/3 of the economy) than some of the more widely followed LEIs. With the Federal Reserve very likely to start cutting rates in the first half of the year, and a solid job market supporting incomes, there’s plenty in place to support continued growth.

We also see strong potential for some pick-up in productivity growth as falling interest rates support business investment. Lower rates may also help sustain momentum in new businesses creation, which typically also gives a boost to productivity. And let’s not forget technological advances. It usually takes a decade or more for new technologies to impact the broad economy, but the pipeline is strong (artificial intelligence was already being actively deployed a decade ago even if “generative AI” is new). In addition, the investment in the U.S. high technology manufacturing base in the last year has been extraordinary.

This economic environment should support solid earnings growth and improved margins, leading to a good year for markets. Yes, 2023 was a strong year, but historically that has not been a harbinger of market downside. To the contrary, it’s actually pointed to a pretty good market in the following year, only limiting the likelihood of a blockbuster follow-up year. The four-year election market cycle, which has held largely true to form in 2022 and 2023, also signals a solid year, especially when we have a first term president (independent of party).

What may look different for stocks in 2024 is for the market rally to broaden. While a lot of attention was given to the strength of U.S. mega-cap stocks in 2023, we were already seeing increased market breadth and valuations point to the possibility of that trend continuing, potentially support small- and mid-cap stocks.

After a strong late year run for fixed income, some of the expected returns for bonds may have been pulled forward, but we still see as solid year ahead for bond as inflation continues to fall, the Fed lowers short-term rates, and flows from money market funds and other short-term instruments supports demand after the great flight from bonds in 2022 and 2023. Something close to the yield-to-maturity for the broad investment-grade Bloomberg US Aggregate Bond Index would be perfectly satisfactory. As important, with a higher starting yields and falling inflation, bonds are less vulnerable to losses and are once again more likely to add some ballast to a portfolio during periods of volatility.

Our bottom line: We expect markets, many strategists, and policymakers to once again largely see eye to eye in 2024 on broad outcomes, although we continue to tilt more optimistic than most based on the underlying data. We continue to favor the U.S., although valuations should help international markets see reasonable gains as well. While emerging market valuations are depressed, policy uncertainty, especially in China, continues to weigh on prospects. In fixed income, our economic outlook supports some tilt toward credit-sensitive bonds but we prefer reflecting our economic outlook by overweighting equities.

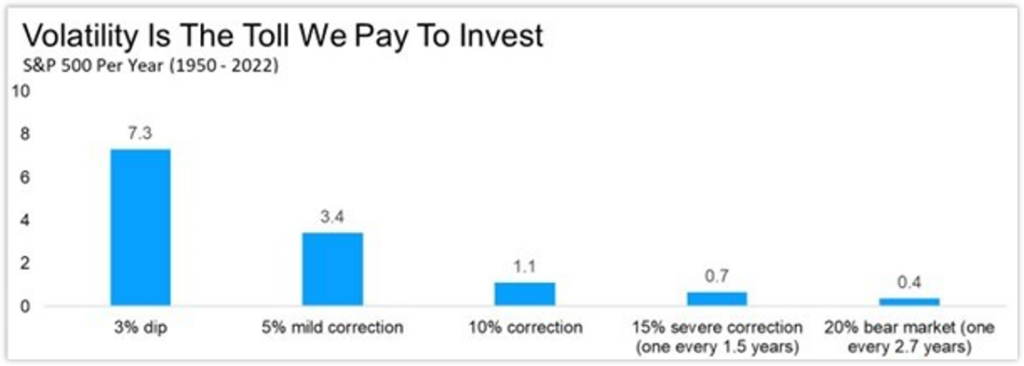

Remember, even good years exhibit some volatility so it’s important to be prepared to weather the market’s normal ups and downs. A 5% pullback in stocks is something that has historically occurred around 3-4 times a year, while a 10% correction occurs at least once a year. And a 20% bear market has historically occurred once every three years.

Carson Investment Research will be there to help, continuing to emphasize facts, not feelings, in our blogs, podcasts, and commentaries as we navigate the markets in 2024.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

For more of Ryan’s thoughts click here.

02068915-0124-A