We just released our 2024 Market Outlook, “Seeing Eye to Eye”. We took an unpopular contrarian stance in 2023, calling for the economic expansion to continue and stocks to post solid gains. This was based on what we saw in the data, and since then consensus opinion has moved toward our view in 2024. Still, the gloom hasn’t entirely lifted, and there’re a number of strategists holding on to recession calls. We see even lower odds of a recession than we did at this time a year ago, and are looking for yet another year in which stocks post above average returns. We expect bonds to return 4-6%, based on a yield just under 5.5% and a stable outlook overall given our expected path for inflation, the Federal reserve (Fed) and the economy.

A key theme in 2024 is likely to be the Fed (sigh … again). In 2022, the big question was how high the Fed will raise interest rates (answer: a lot), and in 2023, the question was whether or not they’ll cut (answer: they didn’t).

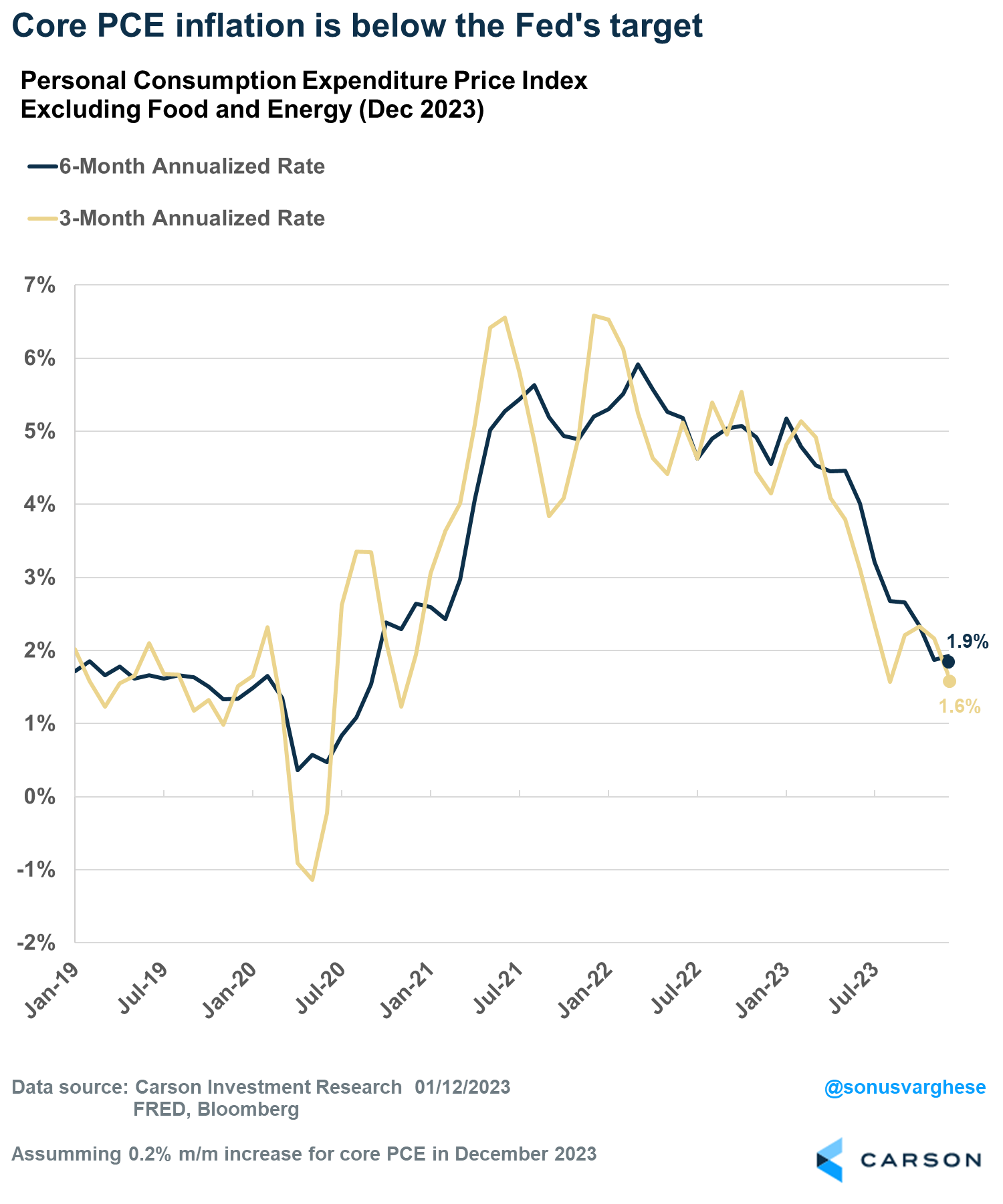

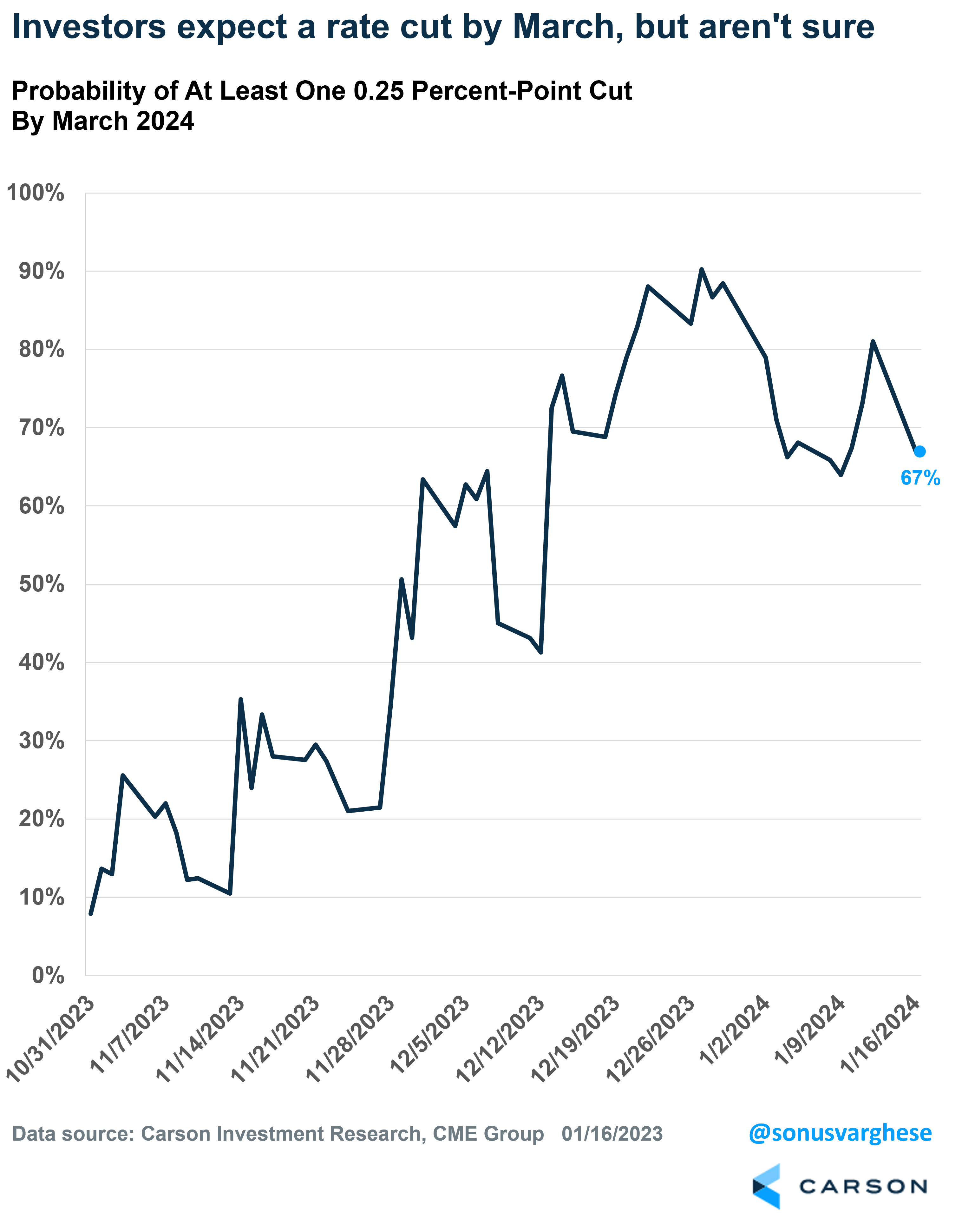

Coming into 2024, it seems fairly certain that they’ll cut rates. As we wrote in our Outlook, rate cuts are now on the horizon thanks to inflation easing back to the Fed’s target. In fact, at their December meeting, Fed members themselves projected three cuts (each worth 0.25%-points) in 2024. This was based on their projection of core inflation, as measured by the personal consumption expenditures index (PCE), easing to 2.4% by the end of 2024. Since then, we’ve gotten December inflation data for the consumer price index and the producer price index – which tell us that core PE is likely to rise less than 0.2% month over month in December. That translates to an annual rate of 1.9% over the last six months, and 1.6% over the last three months.

In short, the inflation problem is over. At least, for now. And therein lies two burning questions that investors are currently asking of the Fed:

- How soon will they start cutting rates?

- How much will they cut in 2024?

As I noted above, Fed members see just 0.75%-points of cuts this year, based on a core PCE projection of 2.4%. But core PCE is clearly running well below that. As a result, investors are a lot more optimistic about the prospect of rate cuts, and answering the above two questions as…

- Rate cuts will start as soon as March

- The Fed will cut interest rate by about 1.6%-points in 2024

But this is not a certainty. At the end of 2023, the probability of a cut in March had risen as high as 90%, and then pulled back to 67% this week. So, it’s gone from a near sure thing to something closer to coin toss odds.

Fed Officials Are Not Quite There Yet

On Tuesday, Fed Governor Christopher Waller, who’s been ahead of the curve with respect to policy within the Fed, suggested in a speech that the first cut may not come as early as March. In fact, the title of his speech was “Almost as good as it gets … but will it last.” That should tell you where Fed officials are currently.

He acknowledged the remarkable progress in getting inflation lower, even as the labor market stayed healthy and the unemployment rate sub-4%, but he wants to make sure that’s sustainable. As a result, the Fed doesn’t want to be rushed into cuts. He noted that in the past the Fed had lowered rates reactively and quickly and by large amounts, but that was after shocks to the economy threatened recession (like in 2000-2001 and 2007-2008). However, this time he sees no reason to “move as quickly” or “cut as rapidly” as in the past.

The key is that he believes the other part of their “dual” mandate, the labor market, is close to maximum employment right now and there’s no reason to think that’s deteriorating. Certain data have weakened recently, but Waller put that down to normalization more than a looming sign of collapse (we agree with this). That said, he noted that risks are certainly balanced right now. There is a risk that the labor market could break, just as there is a risk that inflation could rise again – in contrast to the last year and half, when their sole focus was on the risk of an inflation spiral.

All of this implies they are ready to cut, to avoid keeping policy too tight and risking a break in the labor market. However, they don’t appear ready to move as early as March. We believe the first interest rate cut may come only in May, unless inflation data over the next six weeks really surprises to the downside, or we get terrible payroll numbers.

As for how much they’ll cut in 2024, the jury is still out. For our part, we expect to see rate cuts but perhaps no more than 1-1.25%-points (the equivalent of 4-5 0.25% cuts), assuming the economy continues to avoid a recession and the labor market holds up.

In the meantime, don’t be surprised if markets swing back and forth wildly on the back of hopes for more rate cuts on the back of data and pushback from wary Fed officials.

Chief Market Strategist Ryan Detrick and I chatted about our 2024 Outlook, including the path of monetary policy, in our latest Facts vs Feelings episode. Take a listen.

For more of Sonu’s thoughts click here.

02073863-0124-A