Another strong quarter in markets can be met with skepticism if the fundamentals are not keeping up with price returns. Quarter end is a great time to dive in and take a look at the health of equity performance this year, and see where the opportunities are here and abroad.

Earnings

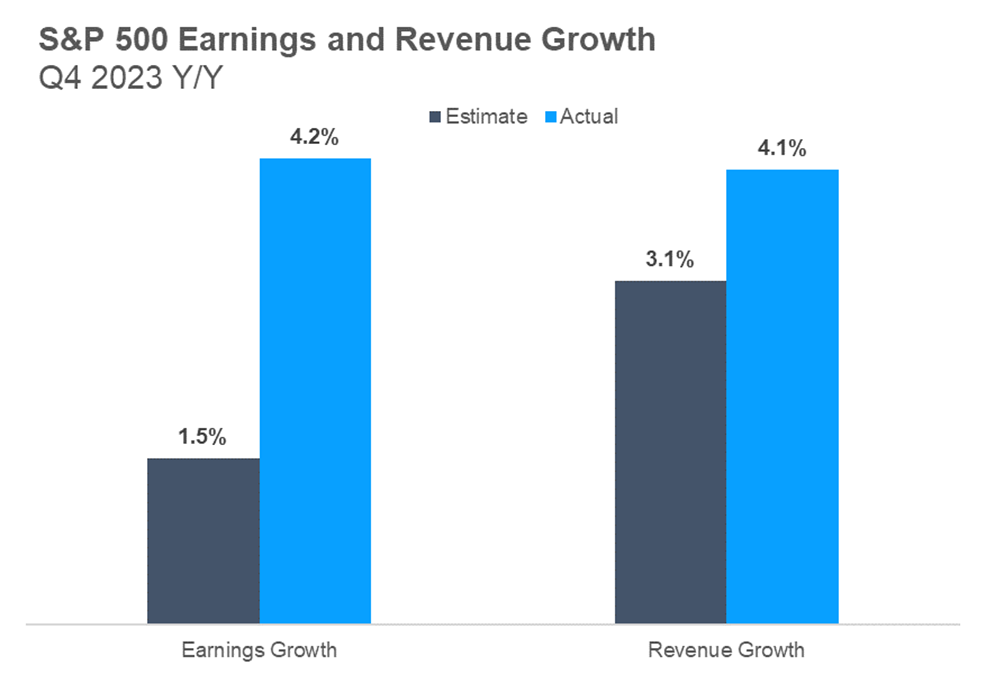

As we say often, over the long term, earnings growth drives stock prices. We have also noted that over the past 5 years, earnings have had a larger contribution to stock price growth than other factors – specifically multiple expansion (stocks getting more expensive). Throughout the first quarter, companies reported earnings results for the fourth quarter of 2023. Not surprisingly, companies continue to exceed expectations and prove their resiliency. Prior to the reporting season starting, analysts expected S&P 500 companies to grow earnings by 1.5% and revenues by 3.1%. As it turns out, 73% of companies exceeded earnings estimates, and another 65% beat on revenues – both numbers above recent and long-term averages. This resulted in 4.2% reported earnings growth and 4.1% reported revenue growth, strong year-over-year numbers.

Source: Factset 3/28/2024

Looking at individual sectors, the results were led by technology related sectors – but strength expanded beyond to other areas such as industrials and even recent laggards utilities and real estate. Technology, industrials, and healthcare exceeded estimates the most of any sectors.

On a side note, the term “A.I.” was mentioned on earnings calls for nearly 180 S&P 500 companies. Companies that mentioned A.I. outperformed those that did not by more than 12% over the prior year. With that information and the benefit of hindsight, it is somewhat surprising that more companies haven’t mentioned A.I.!

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

For more on specific company earnings, be sure and review the below blogs from our team and be on the lookout throughout the coming earnings season for the latest updates.

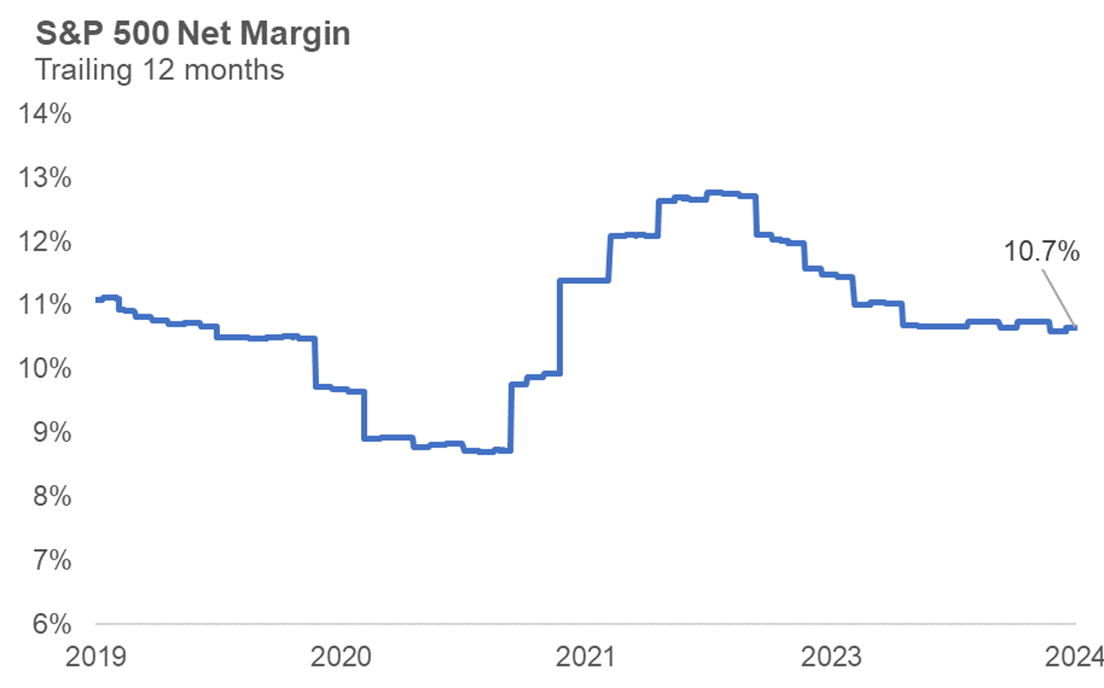

Margins

You cannot review the fundamentals of any company without looking at the company’s income statement. Earnings, revenues, and future expectations for each often get all the attention during earnings season. Just as important for the health of a company, industry, and broader corporate America are margins. Net margins show the percentage of top-line sales/revenues actually become earnings (profit) after expenses. Higher margins are preferred, and we’ve seen an upward movement in the absolute level of margins across the market due to the rise of technology companies that generally have wider margins due to the scalability of their businesses.

As companies report earnings, we can see an updated picture of margins across the index. Margins are generally a very stable series, but as you can see in the chart below, the past 5 years have seen significant movement. From the pandemic lows to the euphoria of 2021, and then rising inflation in 2022 and 2023, the margin roller coaster has flattened out at a healthy level just under 11%.

The importance of margins extends to future earnings growth. All else equal, the more margin cushion a company has, the more they can stretch their revenues into stronger future earnings. 55% of S&P 500 companies increased their profit margins during the quarter, another healthy sign.

Source: Factset, Carson Investment Research 3/28/2024

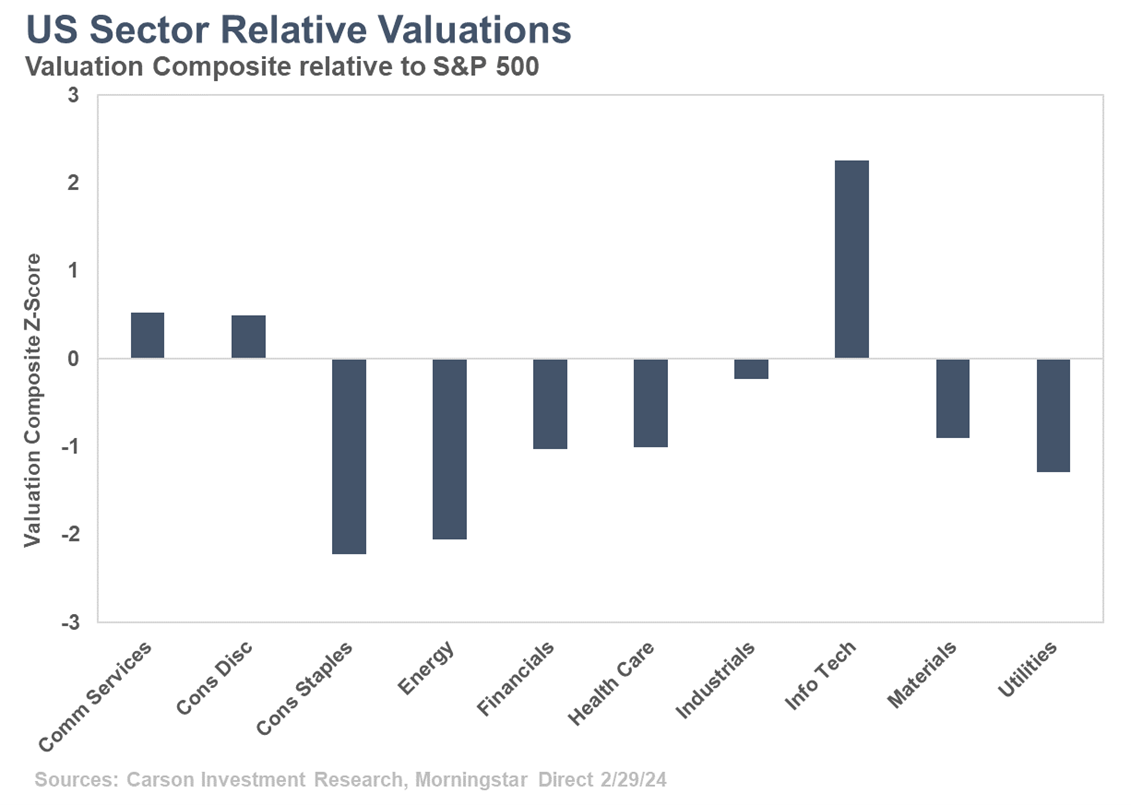

Valuations

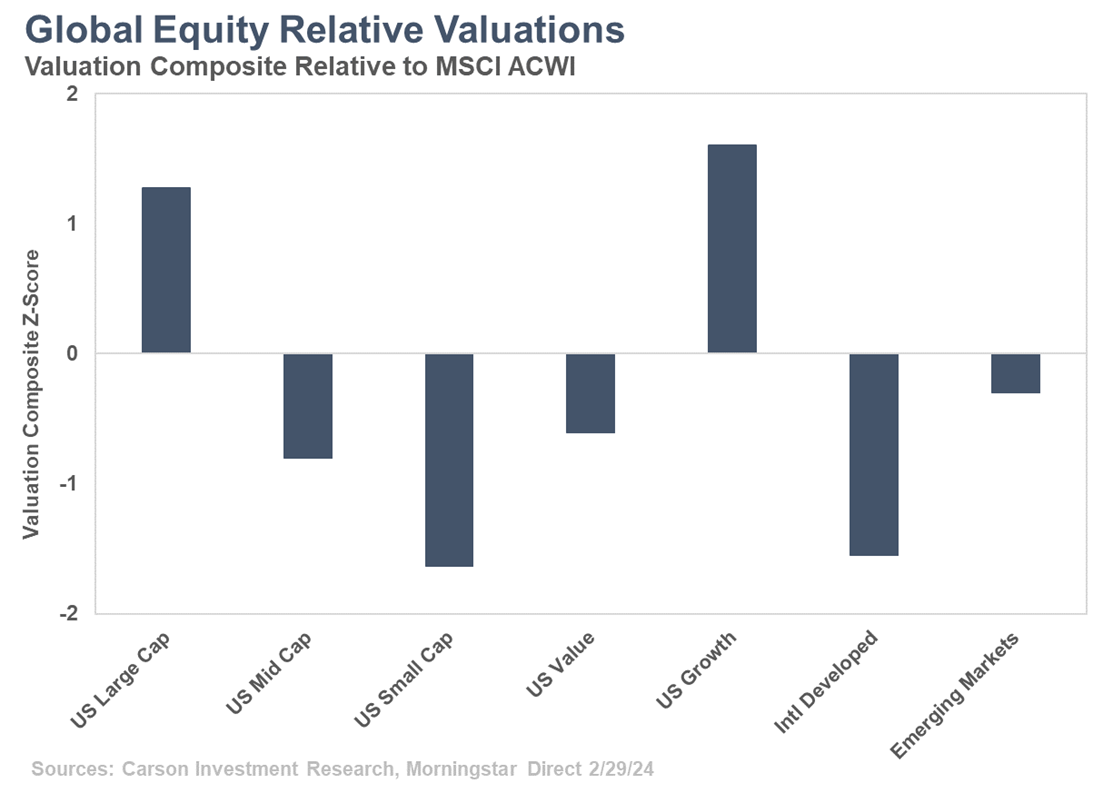

Revenues, earnings, margins, and other fundamental factors all contribute to the valuation of a company. We can view this at any number of levels – company, sector, index, or country. One important way to view valuations is to look at earnings of various asset classes relative to the broader market and their own history. There are always reasons why certain areas are over- or under-valued at certain periods of time, and we do not use valuations as a timing mechanism, but it is important to review where we can find value as there are years when investors reward lower valuations (such as 2022).

Looking at a composite of valuation metrics relative to the S&P 500 index, technology and technology-related sectors have higher valuations relative to their history (with Information technology nearly 2 standard deviations overvalued, or higher than all but just over 2% of its past history). Defensive and cyclical sectors are trading at discounts relative to the rest of the market and their own history.

Looking globally, the same methodology can be applied to broad equity asset classes relative to the global index. Here we continue to see significant valuation discounts in domestic small and mid-cap stocks, especially given the dominance of large cap growth in the global index.

While some areas of the market are showing above-average valuations, their strong earnings support can keep valuations elevated for some time. We have been emphasizing a broadening of market returns, which also can be met with strength in the underlying earnings of these companies. Keeping an eye on the fundamentals of the market from both a bottoms-up and a top-down macro perspective uniquely positions the Carson Investment Research team to add value for our advisors and their clients.

For more content by Grant Engelbart, VP, Investment Strategist click here.

02186513-0424-A