What a wild ride it has been the past few weeks in markets, but one thing we can’t deny is the calendar. We are in the thick of March Madness season, and today officially kicks off the First Round of the NCAA tournament.

Odds are, if you are reading this, you are probably sneaking off early to watch some basketball. I’m not judging, I might do the same thing. By the way, I’m an Xavier fan, so I’m pulling for them to go all the way, but that’s using my heart, using my head, and I’m saying UConn is the team to beat.

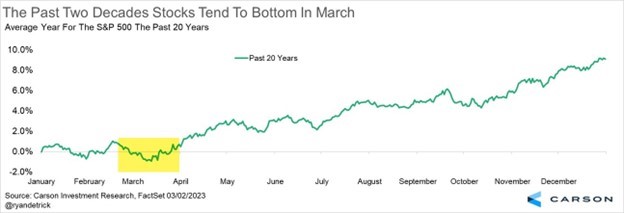

With all of that, what also is the calendar saying? Well, for the past 20 years, stocks have bottomed around the middle of March. Could we be looking at another major low in March? Time, of course will tell, but the economy remains strong, the Fed is doing all it can to calm the fears, and various signs of sentiment are flashing levels of worry we’ve seen at major lows before.

Here’s another way of looking at March for the past 20 years, but zooming into only the month of March. In like a lamb and out like a lion?

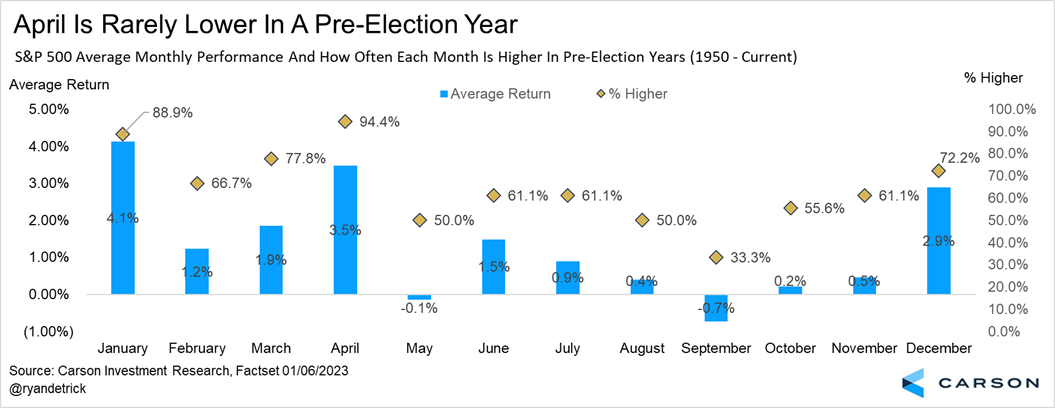

Something else investors need to be aware of here is that March is a very strong month for stocks in a pre-election year, but April is even better. In fact, 17 of the past 18 pre-election years saw stocks higher in April and up a very impressive 3.5% on average. We don’t expect that impressive trend to change in 2023.

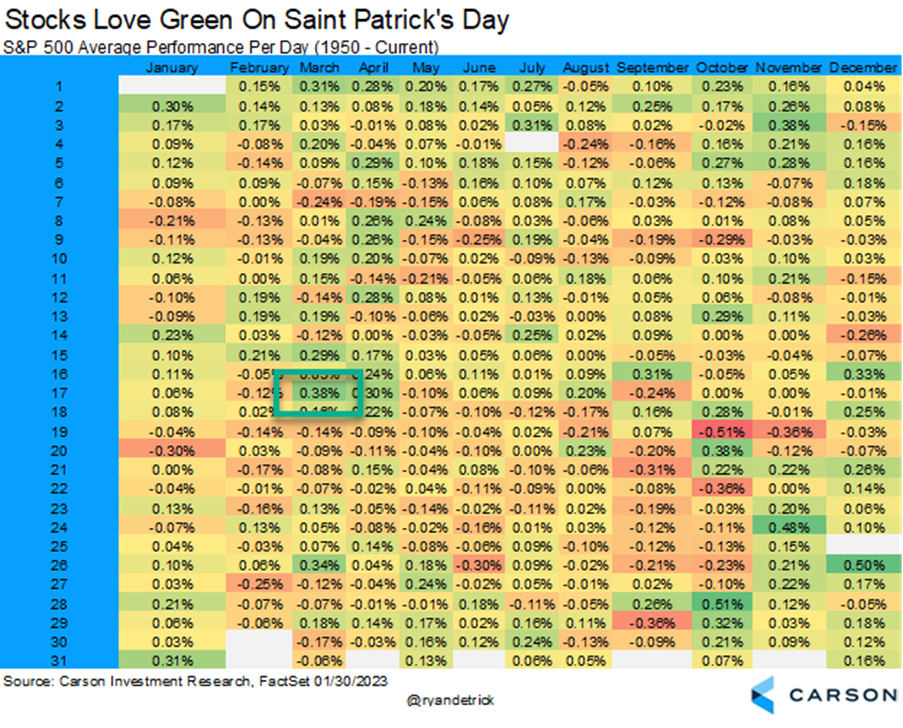

We will leave you on this note, and you can’t make this one up; stocks love green on St. Patrick’s Day. Seriously, the S&P 500 is up 0.38% on average on this day of green, putting it in the top five days of the year.

Believe me, we don’t think you should ever invest based on one day of likely randomness, but this has to be one of my favorite market stats. The bottom line, though, is that the Fed is doing a lot to instill faith in the system, and should they be able to pull it off, coupled with the economy that simply won’t slow down, be open to the potential of more green over the coming weeks.

For more of our thoughts on the latest with Silicon Valley Bank, the Fed, and the economy, be sure to listen to the latest Facts vs. Feelings podcast with Sonu and me.