Ryan and I recently hosted Meb Faber of Cambria Investments on our Facts vs Feelings podcast. We covered a lot in that episode, but I want to pick out one thread in particular, i.e. dividends vs buybacks. As we discussed, dividends are one way corporation can return excess cash to shareholders. However, they can also do so by buying back stock, or paying down debt.

Here’s the thing though: compared to dividends, buybacks are a more tax-efficient way to pay out excess cash. Meb aptly called them “tax-efficient dividends.”

As I wrote a few months ago when discussing Warren Buffet’s annual letter, Buffet likes dividends from companies he invests in but doesn’t pay out dividends for Berkshire stock. Actually, as Meb pointed out, Berkshire paid a dividend just once ($0.10 in 1967) and Buffett joked:

“I must have been in the bathroom when the decision was made.”

Anyway, Buffet understands the power of compounding all too well. And he understands the US tax code.

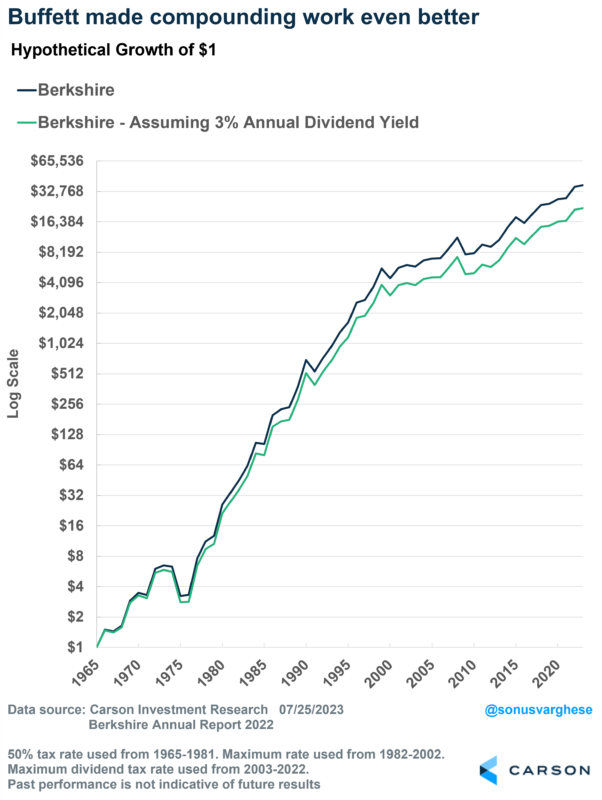

I looked at returns if Berkshire had chosen to pay out a dividend of, say 3% annually from its start.

I also looked up historical dividend tax rates, which was interesting in and of itself. Up until 2003, dividends were taxed like ordinary income. And the maximum tax bracket for ordinary income between 1965 and 1981 was 70%. But rather than use this, I assumed that dividends were taxed at 50% during this period in our hypothetical scenario. After that I used the maximum dividend tax rates.

Recall that the compounded annual return for Berkshire from 1965 to 2022 was 19.8%, which meant $1 invested at the beginning of 1965 grew to $about $38,000 by the end of 2022.

If Berkshire paid a 3% dividend every year, the compounded annual return would have dropped by 1%-point to 18.8 after the extra impact of the tax on dividends. Which doesn’t sound like a lot, except that the hypothetical $1 would have grown to “only” about $22,000 over the same period!

After-Tax Returns are What Matter

Let’s consider a more general example, which also gets to the tax drag on investing.

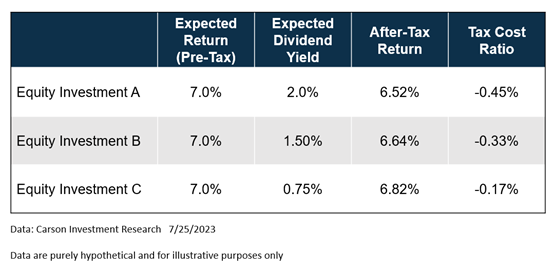

Say you expect a stock to return 7% annually over the next decade. But of that, say you expect 2% dividends to be paid out every year. Assuming those are qualified dividends, they will be taxed at the preferential rate – let’s assume 23.8% at the highest bracket. Paying taxes for the dividends that are paid out annually reduces the amount of money available for compounding.

In this case, the annual returns drop from 7% to 6.52%, a “drag” of 0.42 percentage-points (assuming no liquidation).

For perspective, the asset-weighted average equity mutual fund fee was 0.44 percentage-points in 2022.

All else equal, if the company opted to “return cash to shareholders” in the form of buybacks, instead of dividends, there wouldn’t be a tax drag.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

This is not to say that you should avoid stocks paying dividends. Dividend paying stocks have traditionally been though of as “quality” and “value”. However, consider that things may look different when you consider after-tax returns.

Here’s a table showing the after-tax expected return and tax cost ratio for three investments with similar pre-tax expected return, but different dividend yields.

The tax cost ratio is thus an important consideration for investors, in addition to the expense ratio. With low-cost ETFs now widely available, tax cost is a relatively larger drag on investment performance.

One approach to minimize tax drag is to optimize tax location. For example: placing higher dividend stocks in tax-exempt accounts and lower dividend stocks in a taxable account.

This is something we think a lot about on the Carson Investment Research Team, i.e. maximizing after-tax returns.

Finally, here’s the full episode of the podcast we did with Meb Faber, which was a lot of fun to do. I highly recommend a listen.

Footnote: all return calculations were done using the Berkshire and S&P 500 returns data from Berkshire’s annual report for 2022.