The midterm elections are over, and the results aren’t 100% official yet, but we do know that we’ll have a divided government. As of now, the Democrats have 50 seats in the Senate to maintain control there, while the Republicans gained their 218th seat in the House to take control there. The bottom line though is neither the Senate nor the House has large majorities, in fact, they are both near historically small margins.

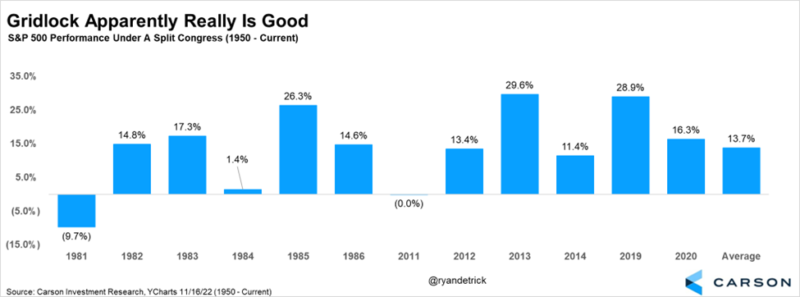

So that’s the big question, do stocks really like gridlock? Of course, things are never this simple, as there are so many other factors that matter to how stocks do, but it sure looks like gridlock could be a tailwind for stocks. Or at the very least, not a major headwind.

Here’s a chart that shows all the times since 1950 we’ve had a divided government and how the S&P 500 did in those years. The average return for stocks was a very solid 15.7% under a divided government, with only one-year falling significantly back in 1981, while 2011 was nearly exactly breakeven. The other years saw some solid returns.

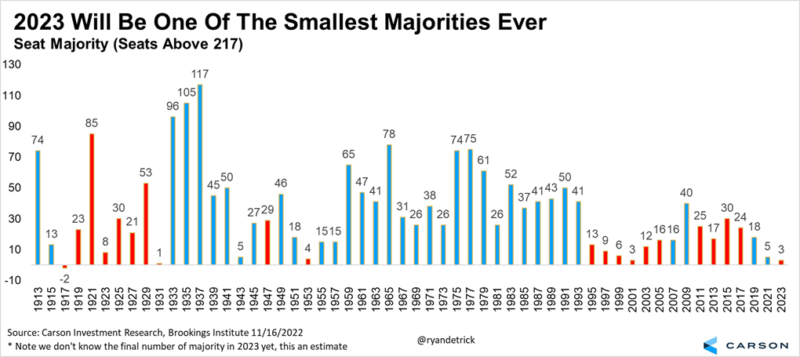

As of now, it is expected the Republicans will take a three-seat majority in the House (this could change, but it’ll likely be near this number). This would be the smallest majority for the Republicans since 3 seats in 2001 and 2002. Here’s a great chart that shows just how rare it is to have a majority this small. Fun stat, the House moved to 435 seats in 1913, meaning 218 seats gives a party the majority. Fun stat #2, the Democrats controlled the House from 1955 to 1994, but things have been more even over recent years.

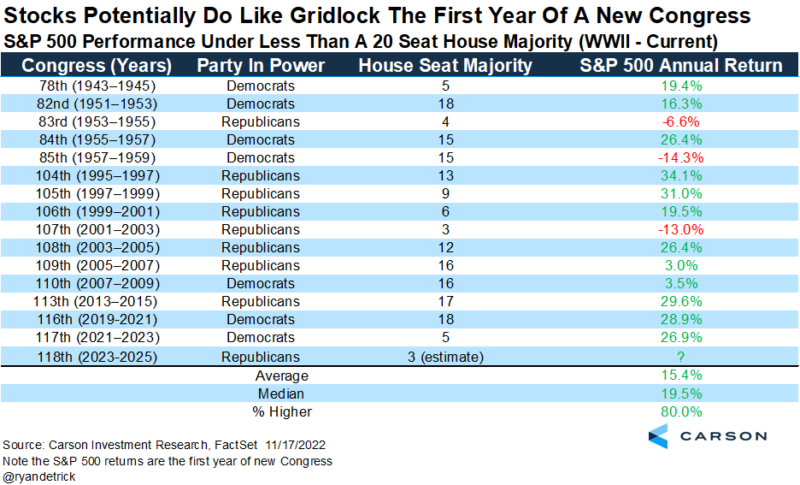

What exactly does a small-seat majority in the House mean? Odds are a small majority means there could be some gridlock, so do stocks like this? Below we show again this appears to be the case. When there is less than a 20-seat House majority, the S&P 500 gained a median of 19.5% and was higher 12 out of 15 times when looking at the first year of a new Congress. In fact, 9 of the past 10 times there was a new Congress and a small majority, stocks finished higher.

In conclusion, stocks really do appear to have no issues with a divided government and in many cases, stocks have done just fine under this scenario. Thanks for reading and for more of our latest market thoughts, be sure to listen to Sonu and me in the Facts vs. Feelings podcast here.