It was anything but smooth, but stocks are set to begin 2023 with a solid start, with the S&P 500 up more than 5% for the year with one day to go in the first quarter. Although we continue to hear how bad things are, we’d like to note that these gains came on the heels of a 7.1% gain for stocks in the fourth quarter of 2022. Most investors probably have no idea stocks have done so well, given the barrage of negative news out there.

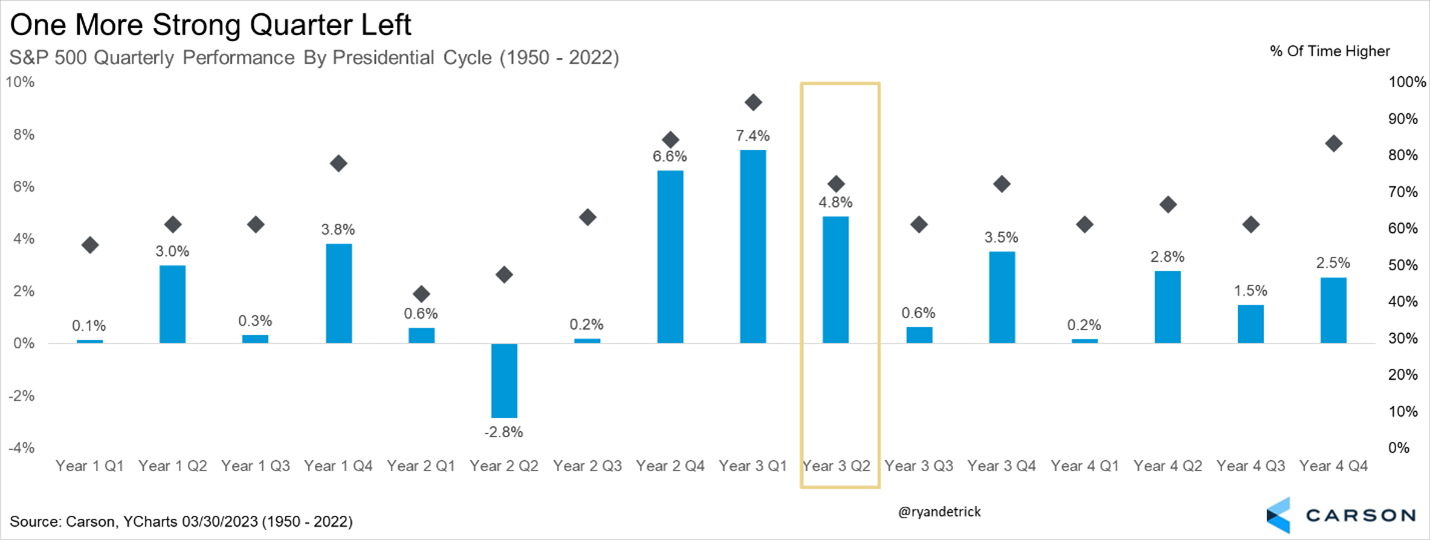

Here’s a chart we’ve shared a lot, but it is playing out nicely. If you look at a four-year Presidential cycle, we are in the midst of the strongest period for stocks. In fact, historically, the second quarter of a pre-election year is up a solid 4.8% on average and higher 72.2% of the time. Given the overall negative sentiment, an economy that continues to defy the skeptics, and this positive seasonality, we’d be open to a continuation of the rally off the October lows last year.

Take one more look at the above. Last quarter was higher, making that 18 out of 19 times that stocks gained in the first quarter of a pre-election year.

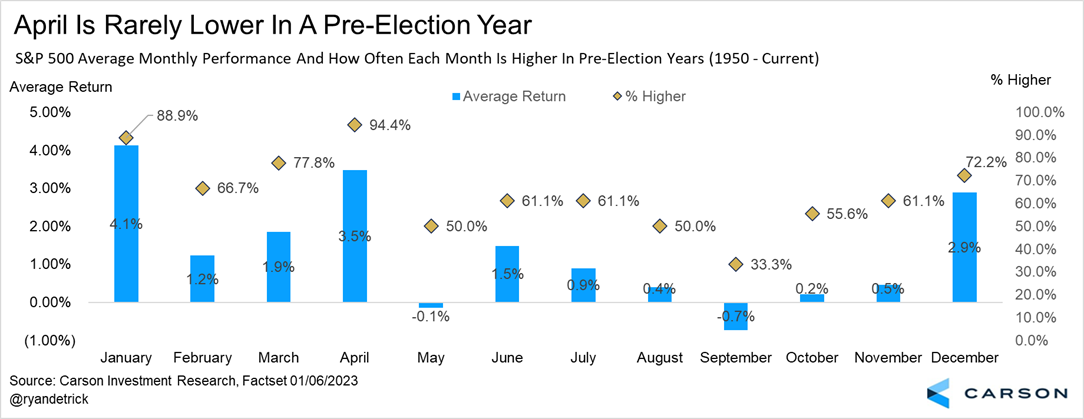

Turning to April, turns out stocks have historically been higher this month during a pre-election year an incredible 17 out of 18 times since 1950, with only a 1.2% drop back in 1987, the only blemish. As you can see below, only January has a higher average return during a pre-election year, which played out this year with a huge 6.2% gain in January 2023. Why is April usually strong? It could be a combination of springtime buying, good riddance to winter, or putting tax refunds to work. But the bottom line is that this is something we’d rather know than ignore.

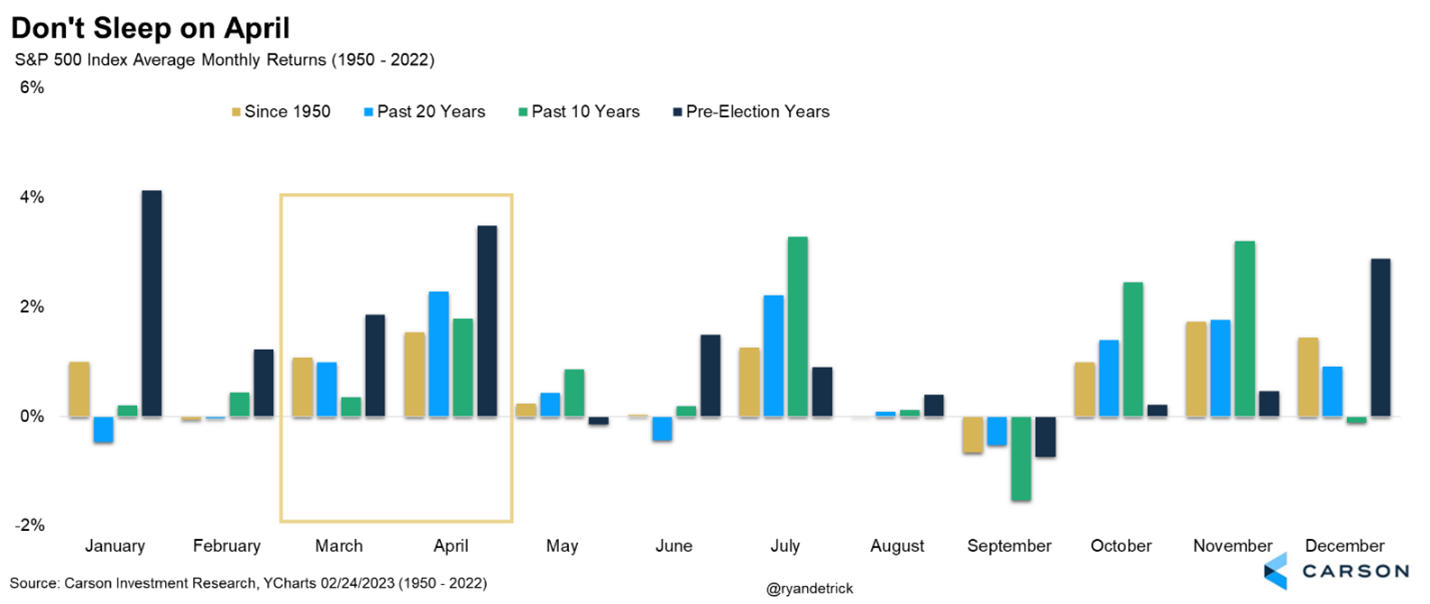

But it isn’t just pre-election years when April does well. Since 1950, it is the second-best month (only November is better); for the past 10 years, it ranks fourth, and for the past 20 years, it has been the best month of the year.

The elephant in the room is that April last year was terrible, with the S&P 500 down 8.8%, for the worst April since 1970. Of course, back then, the start of the war, higher inflation fears, a Fed just starting to hike, and economic worries lead to the historic drop.

We remain overweight stocks and expect the lowered expectations amid a better economy to have the potential to drive higher stock prices in 2023, with gains that could reach between 12-15% this year.