“The Fed’s job is to take away the punchbowl, just as the party is getting good.” William McChesney Martin Jr., the ninth Chair of the Federal Reserve of the United States (Fed)

Rate cuts are coming, but after last week’s Fed meeting and then Chairperson Powell’s appearance on 60 Minutes on Sunday, the expectations are the first cut will probably be in May, not March. The odds were in the March camp this time a few weeks ago, but stronger economic data and direct comments from Powell have pushed market expectations to May.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

We’ve long been in the camp that the first cut would be May and pushed back against March. Think about it like this: The Fed was very wrong when they told anyone and everyone that inflation was ‘transitory.’ That didn’t go so well, so now we think they’ll want to be extra careful on the other side before cutting, as the biggest worry is they cut too soon and inflation comes roaring back, especially in an election year. Of course, the Fed and Washington politicians are totally separate and no one would ever think like that 😉.

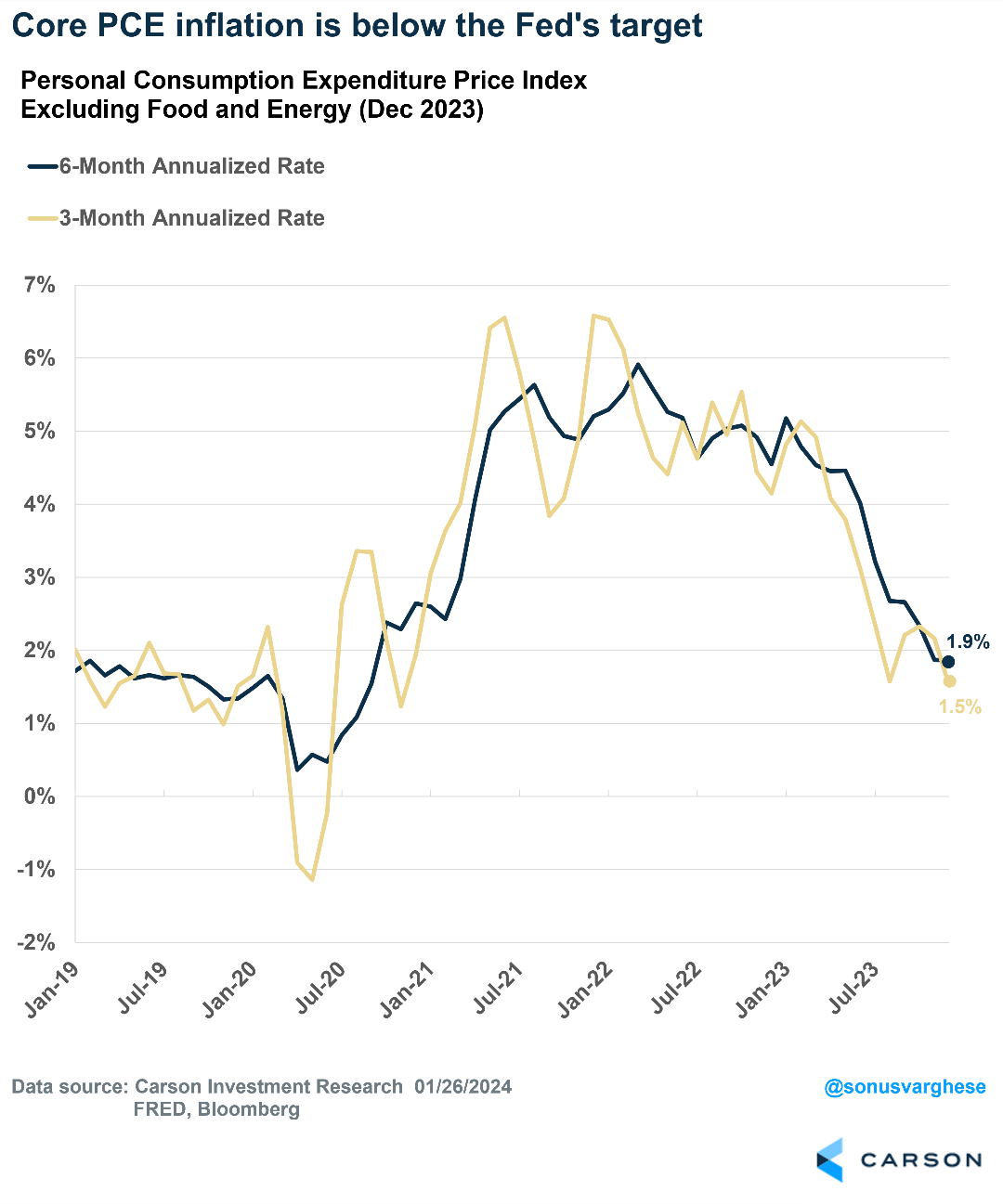

The bottom line is the Fed probably wants to see a few more months of data that indeed confirms inflation isn’t an issue. Our take for many months now has been that inflation is last year’s problem and the door is wide open for cuts, with annualized core PCE (the Fed’s preferred measure of inflation) running sub 2% the past 3 and 6 months. Yes, over the past year it is still above the Fed’s mandate of 2% inflation, but the more recent tame inflation numbers are what matters more in our opinion, not what was happened a year ago.

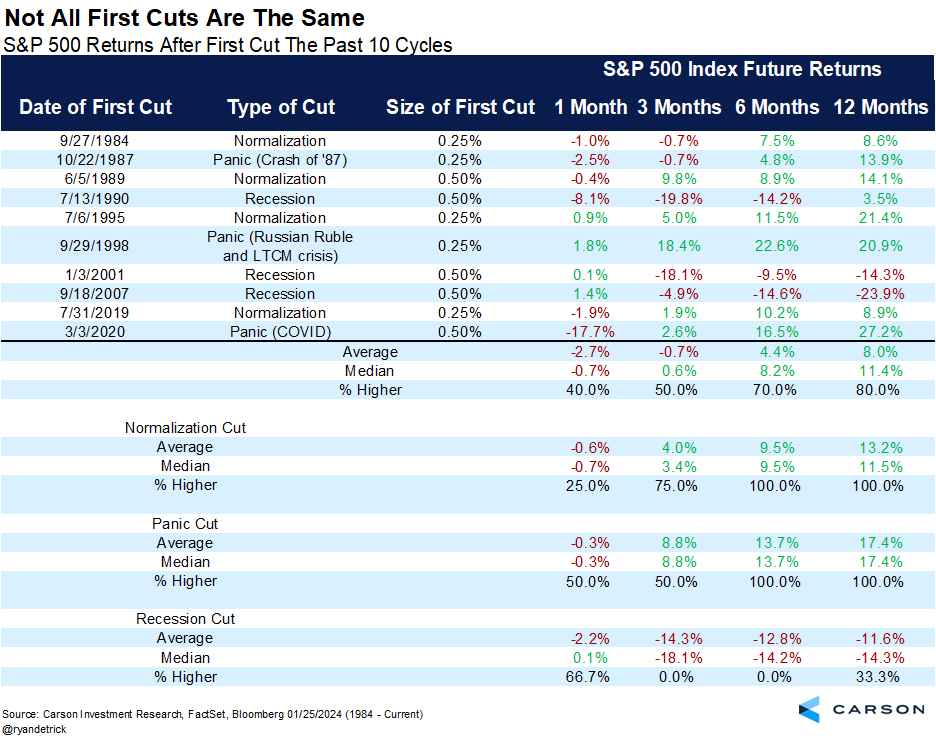

Let’s talk more about rate cuts, as there are greatly varying opinions out there. Here’s the thing—many think the Fed cutting rates is a sign we’re in or near a recession. It is true that some rate cuts have come during times of economic weakness, even recessions. Many immediately think about 2001, 2007, and 2020 as times the Fed cut to stimulate the economy amid troubles. Here’s the truth: Not all rate cuts are the same, as some take place during what we would call periods of normalization.

A normalizing first cut is a cut that takes place likely after the Fed hiked to slow things down, the economy wobbled but didn’t fall into a recession, and then began to expand again amid lower inflation. Think of this like the first cuts in 1984, 1995, and 2019. Then of course there are what we’d classify as panic cuts. Think times like after the 1987 crash, the fall of 1998 during the Russian ruble and Long-term Capital Management crises, and of course March 2020.

Breaking it down by these three types of cuts shows very interesting results. When the Fed cut during a recession, the S&P 500 has been down an average of more than 14% only three months later and down nearly 12% a year later! Compare that with a cut to normalize and stocks are up nicely across the board and higher 13.2% on average a year later. Panic cuts see the best performance, up 17.4% a year later. That makes sense, as times of panic and pure fear are historically great buying opportunities. As Sonu Varghese, our VP, Global Macro Strategist, has noted time and time again, we simply aren’t seeing any signs of a recession on the horizon and believe any cuts now would be to normalize.

Another way to look at this is the Fed hiked rates more than 5%, from virtually 0% after the pandemic to 5.50% in order to slow down the generational inflation we were seeing. Well, now that inflation is no longer an issue, the door is wide open for a few cuts this year. We think four total cuts (0.25% each) starting in May makes a lot of sense.

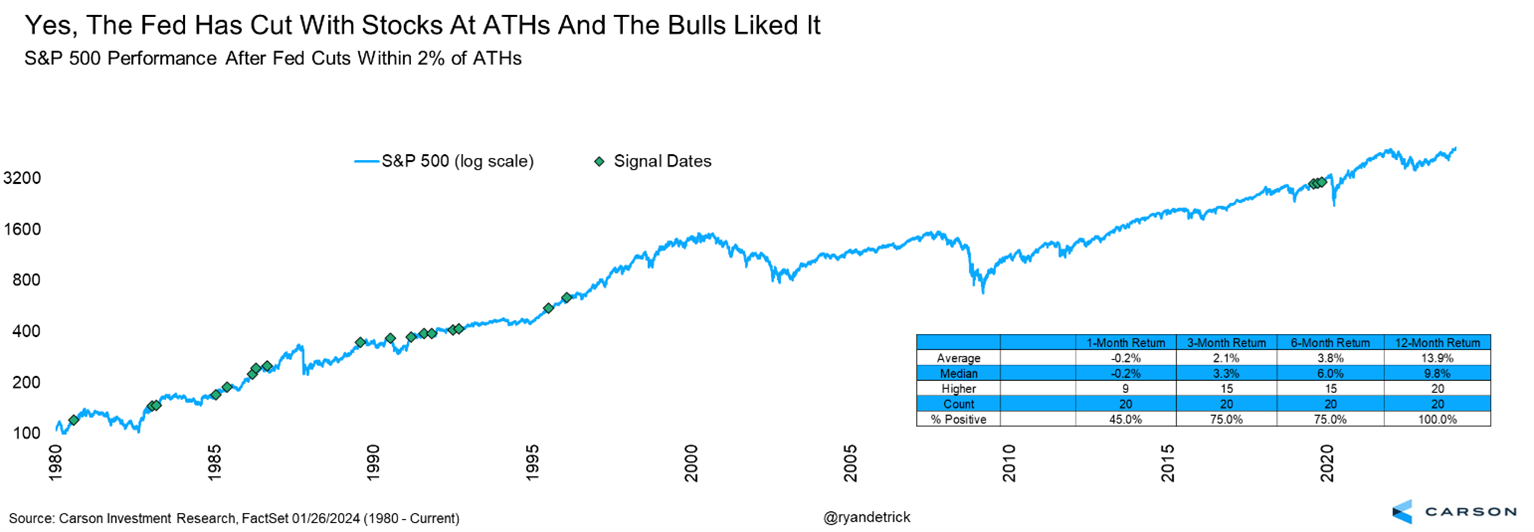

But will the Fed really cut with the stock market at an all-time high? Let’s remember their dual mandate, which is full employment and stable prices. Nowhere does it say how stocks are doing should matter, but the world isn’t so black and white. Still, I looked back and found 20 other times they cut when the S&P 500 was within 2% of an all-time high (based on the day before the cut) and wouldn’t you know it, stocks were higher a year later EVERY. SINGLE. TIME.

2019 was the last time we saw this. You have to go back to the mid-‘90s before that. We’ve said many times we see many similarities between the mid-‘90s and now. Both periods saw an aggressive Fed amid an economy that avoided a recession, inflation tame, strong wages, and high productivity. We think we are going to see additional productivity strength, which is the key to all of it. High productivity allows the Fed to cut rates and not worry about higher inflation, while wages stay strong. Bottom line, the Fed has cut near all-time highs before and usually it has been a bullish development.

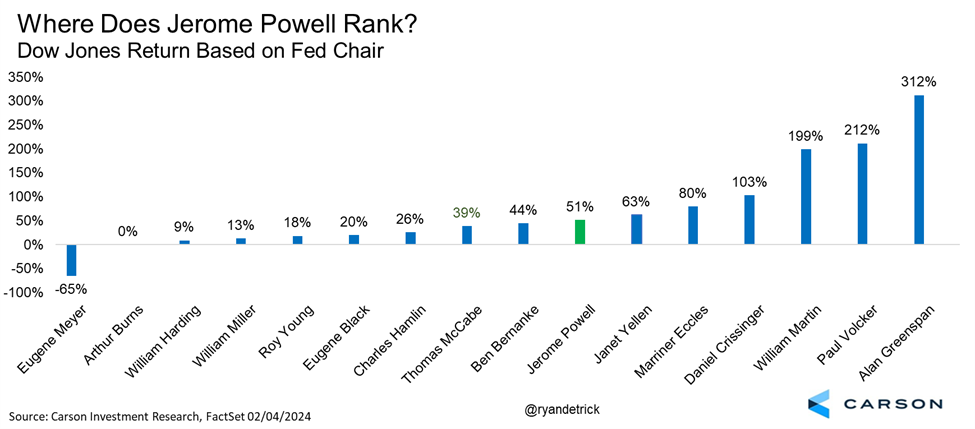

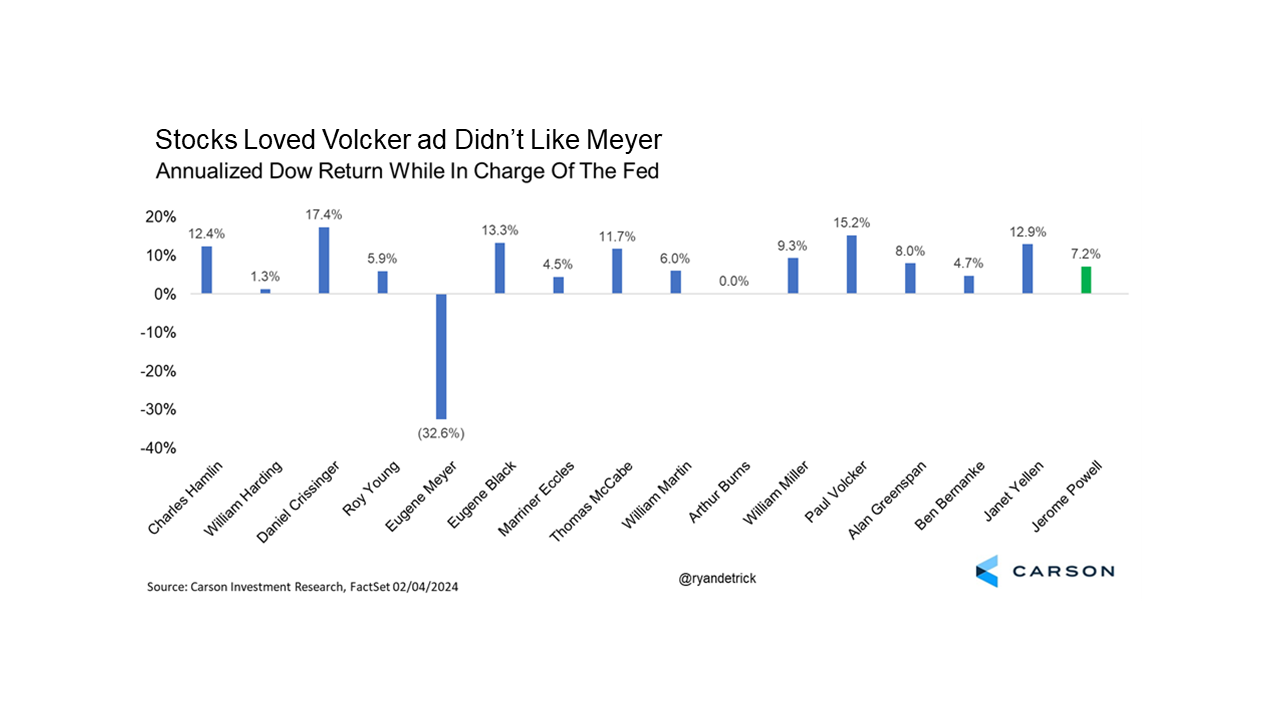

For fun, did you know that Jerome Powell took over at the Fed six years ago? That’s right, on February 5, 2018 he was sworn into office. Turned out the Dow fell 4.6% that day for the worst first day ever out of 16 total Fed chairs. Was it due to him? Not at all, as this was the first day of the trade war with China.

How have stocks done under his leadership? The Dow is up 51% since he took charge, right in the middle of the pack, so after a rough start it clearly came back nicely. The best return ever? Alan Greenspan, with Volcker coming in second. Only once did stocks fall over any Fed Chairman’s tenure and that was Eugene Meyer during the Great Depression, highlighting that the path for stocks is usually higher.

Of course, Greenspan was in charge a very long time, second only to Martin and his 19 years, so they should have higher returns all things considered. Below I annualized things. Janet Yellen might go down as the shortest leader at the Fed ever, but she was quite mighty in terms of market performance. I was rather surprised to see the annualized return for Volcker coming in so high, as when you think of his leadership, you also think of higher inflation and higher rates. Guess it isn’t that simple. Then poor Meyer checks in with an annualized loss of more than 30%. Ouch.

For more on our latest views, I was honored to join BNN Bloomberg to discuss some recent earnings, the state of the economy, the bull market, and more.

For more of Ryan’s thoughts click here.

02105566-0224-A