Last year, the Carson Investment Research team did not see eye to eye on leading economic indicators compared to the widely used Conference Board Leading Economic Index.

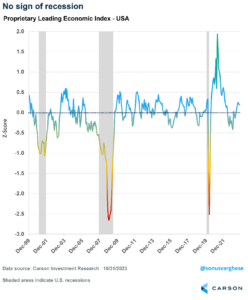

For 2024, our proprietary leading economic index (LEI) for the U.S. points to on-trend economic growth and remains far from a recession signal.

Our index includes more than 20 components, including consumer-related indicators (which make up 50% of the index), housing activity, business and manufacturing activity and sentiment and financial markets. This contrasts with other popular LEIs, which are premised on the fact that the manufacturing sector and business activity/sentiment are leading indicators of the economy.

The LEI captures whether the economy is growing below trend, on-trend (a value close to zero) or above trend. It can capture major turning points in the business cycle. For example, it declined ahead of the actual start of the 2001 and 2008 recessions.

Last year, the index signaled that the economy was growing below trend, and that the risk of a recession was elevated. Note that it didn’t point to an actual recession, just that “risk” of one was higher than normal. In fact, our LEI held close to the lows we saw over the last decade for non-recession periods, especially in 2011 and 2016 (after which the economy, and even the stock market, recovered).

Right now, the situation looks better than it did a year ago.

In a nutshell, the consumer has driven the recovery and carried the economy through last year. That’s in the face of major headwinds, mostly driven by a very aggressive Fed, which adversely impacted financial conditions and borrowing costs, housing and business investment and manufacturing. The good news is that with inflation pulling back, we could potentially see the Federal Reserve cutting rates next year, and that means all those headwinds are fading and could even become tailwinds in 2024. That should be supportive of corporate profits, and therefore stocks.

Let’s take a look at the economic dynamics that may be in play in 2024.

Household Balance Sheets Are Strong

Falling inflation (“disinflation”) should be a tailwind for household wallets in 2024. Stronger inflation-adjusted incomes will likely power consumption going forward, and thus the economy.

As we pointed out above, consumption has driven growth over the last few years, even in the face of an aggressive Fed whose tightening historically often resulted in a recession. Households’ high excess savings, built up during the pandemic, was a big factor in making things different this time.

A large portion of that was used to pay down debt and used up during the inflationary period of 2022 and after. But our estimate is that there’s still a meaningful $500 billion to $1 trillion left – and keep in mind, that’s savings in excess of the longer-term norm.

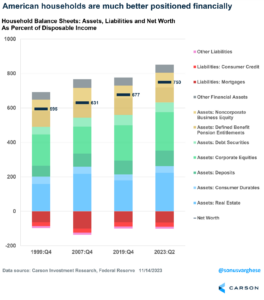

Nevertheless, consumption has been mostly powered by rising incomes and lower savings rates. It’s not surprising that savings rates have fallen relative to pre-pandemic levels – a big reason is that households are much wealthier now than they were then, thanks to higher home prices and stock prices. At the same time, the ability to lock in low mortgage rates when interest rates were low means debt hasn’t increased as much as household assets have.

As a percentage of disposable income, household net worth is now 750%, much higher than the 677% just before the pandemic. And as the chart below shows, it’s entirely because asset values have increased, while liabilities have stayed more or less the same. In fact, liabilities as a percentage of disposable income are closer to where they were in the late 1990s (near 100%), and well below 2007 levels of 136%, when households were more heavily leveraged.

Easing Rates Could Boost Cyclical Economic Activity

There’s good reason to think inflation is headed sustainably lower, potentially allowing the Fed to make a few rate cuts in 2024, starting perhaps as early as the spring. That’s going to ease borrowing costs.

The immediate beneficiary of lower borrowing costs will be residential investment (home and apartment building construction). We got a preview in 2023 – housing activity, especially on the single-family side (which makes up the largest part of residential investment), picked up as mortgage rates eased early in the year. Things cooled down as mortgage rates surged above 8% in the fall, but we could once again see starts and new home sales pick up as rate ease once again.

It’s very unlikely mortgage rates pull back to the low levels of 2021, but even moving toward 6% could unlock a lot of activity, especially since there’s a lot of pent-up demand. The largest age cohort in America is 25-34-year-olds (“millennials”), and those are prime home-buying years. Demographic demand is the reason housing activity in the new homes market hasn’t collapsed despite higher rates.

A lot of that demand is focused on new homes, since high rates are leading current homeowners with low existing mortgage rates to stay put. As a result, single-family starts were up 9% year over year in late 2023, while new home sales are up 18%. Economically, new homes sales contribute more to economic growth than existing homes because of design, construction and engineering costs, in addition to brokers’ commissions and other transaction costs (which apply to existing homes as well).

In addition, sales of new and existing homes both typically provide a secondary boost to demand as new owners make purchases to transform their new house into a home.

How It Fits into the Bigger Picture

The strong consumer and easing interest rates are just a couple of pieces of the puzzle when it comes to our economic forecast for 2024. See how they fit into the rest of the picture and get other insights by checking out Outlook ’24: Seeing Eye to AI.