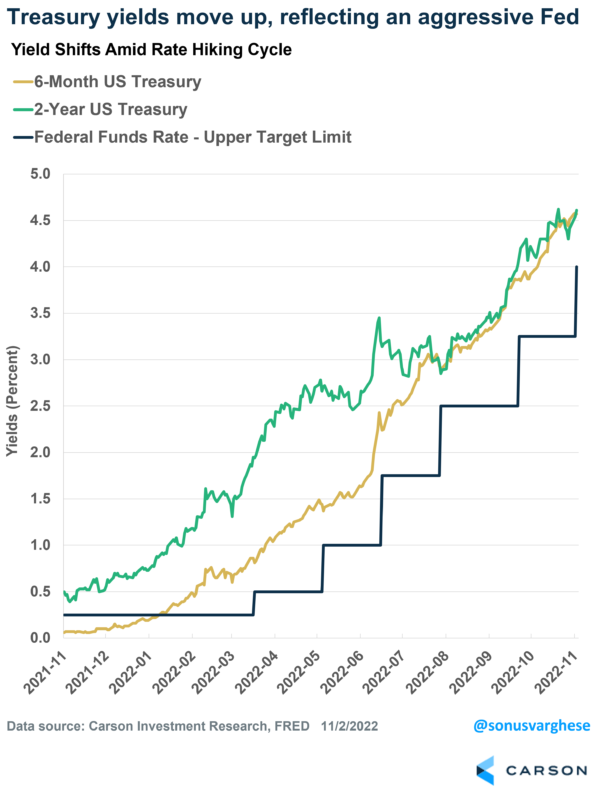

The Federal Reserve (Fed) just raised rates by 0.75%, taking the federal funds rate to a target 3.75-4.0% range. This is the 4th consecutive 0.75% interest rate increase and comes as the Fed tries to get on top of inflation. The bond market has been anticipating this aggressive pace of tightening, and treasury yields have moved in sync. Short-term yields are a gauge of what investors believe is the path of monetary policy over the near future.

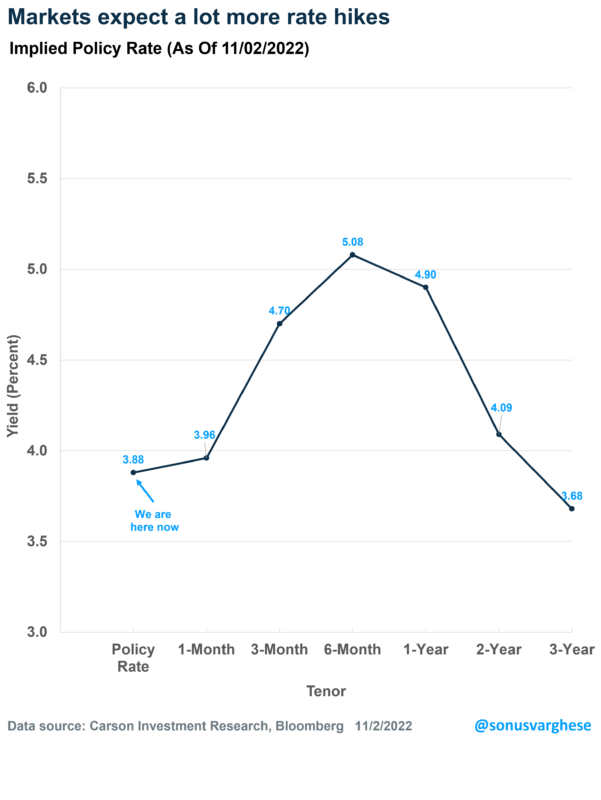

The bad news is that markets don’t think rate increases are done, and Fed Chair Jerome Powell more or less suggested this in his remarks. Investors now expect the target policy rate to peak at 5% six months from now.

So, what’s the positive news?

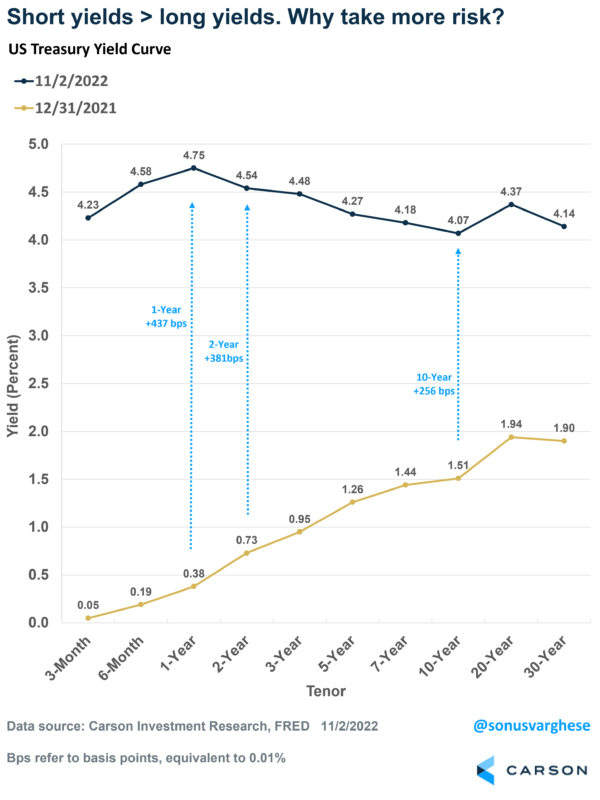

Well, interest rates are higher, and that means you can get a greater yield on bonds. And since the yield curve is inverted, with short-term yields higher than long-term yields, short-term bonds are potentially a very attractive option. They have less “duration” risk, in that they’re less sensitive to interest rate changes, especially if interest rates continue to move higher.

Extremely short-term bonds are more attractive now than they have been in more than a decade and a half. The 3-month treasury yield is currently at 4.2% and the 6-month treasury yield is at 4.6%, the highest yields in more than fifteen years. These “ultra-short” bonds could potentially be used as a potential cash-like solution, especially if that cash is not needed in the immediate future.

But Which Cash Solution?

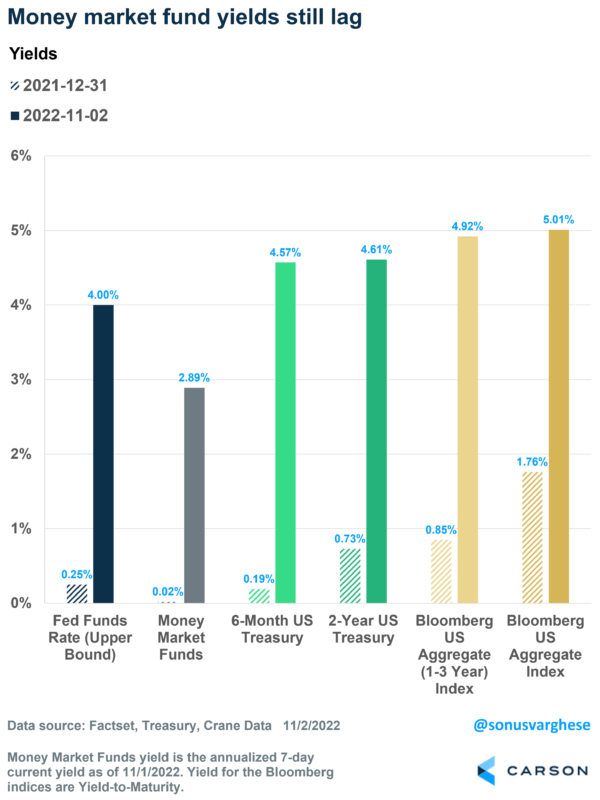

I mentioned above that yields have moved up as the Fed raised interest rates. But yields haven’t moved up in tandem across all the different types of savings and short-term investment vehicles out there.

Savings accounts at some of the major banks are still paying interest rates well below the treasury yields I quoted above. And as the next chart illustrates, money market funds are also paying much lower yields, currently averaging about 2.9%. On top of that, they’ve started increasing fees. As Jason Zweig at the Wall Street Journal recently wrote, not a single U.S. money market fund was charging more than 0.18% in annual expenses at the end of 2021 – as of September 30th, the average expense is 0.39%.

CDs offer better yields and are gaining in popularity once again. However, the best rates (4% or more) tend to be offered by banks to their wealthiest customers, so-called brokered CDs which are purchased through brokerage firms.

The downside of CDs is that they are illiquid, locking up money for a longer period. Moreover, if yields continue to increase, you could be stuck with a CD that pays out a lower rate of interest. Also, CDs are subject to state and local income taxes, unlike treasuries (and funds that hold treasuries), and you also must pay taxes on accrued interest for each year, unless it’s in a tax-deferred retirement account.

This brings us to ultra-short-term bond ETFs. Now, you must be careful when picking one of these – being aware of the “duration” risk as well as the quality of bonds in the fund, i.e., “credit risk”.

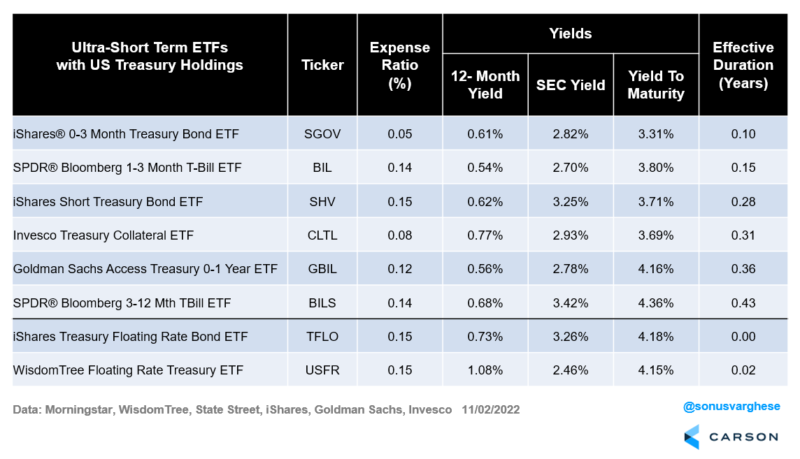

I combed through the universe of ultra-short bond ETFs and selected 8 that hold treasuries. The table below shows the expense ratios, yields, and effective duration for these ETFs. (Please note that this is NOT a recommendation to buy or sell any of these securities, and you must do your own research before doing so, given your unique circumstances.)

If you notice, there are 3 different kinds of yields listed above. The first two are the 12-month yield and SEC yield, which are typically what’s shown if you pull up a site like Morningstar. These are both backward-looking yields. The 12-month yield is the sum of the ETF’s trailing 12-month interest payments divided by the last month’s ending share price (net asset value) – which is not helpful because interest rates were much lower over the past 12 months. The SEC yield is slightly better since it’s a little more recent – it divides the income received during the 30-day period that ended on the last day of the prior month by the share price on the last day of the period. The problem is the income received can vary from month to month, and it’s still backward-looking.

The yield you want to focus on is the “yield-to-maturity”, which can be found on the issuer websites, and is best reflective of the future expected return. The average effective duration can also be found on the issuer’s website, and as you can see, these ETFs all have extremely low duration. This means they have very little interest rate risk, even as they offer very attractive yields. And since these ETFs hold treasuries, there is no credit risk (unless the US government defaults). There are plenty of ultra-short ETFs that I didn’t list here which have much more attractive yields, but they do tend to stretch more out onto the credit risk spectrum.

A couple of interesting ETFs at the bottom of the table (tickers: TFLO and USFR) have practically zero duration risk. These hold “floating rate” treasury bonds that seek to take advantage of rising interest rates – they mature in two years, but the interest rate resets every week when the US Treasury auctions the 13-week treasury bill.

We believe all these ETFs are fairly attractive options that can be used as potential cash solutions. Ideally, you can tier your cash to maximize the yield – with money market funds used for immediate liquidity needs (say, a week or two) and ultra-short treasury bond ETFs like the ones listed above for longer-term needs.

The silver lining of an aggressive Fed is that now you can put your cash to work.