“It has happened before.” Coach Lou Brown on winning streaks in Major League II

Stocks have picked up right where they left off last year, with new highs across the board and the S&P 500 officially closing above 5,000 for the first time. Although on the surface there isn’t much of a difference between 5,000 and 4,999, it’s an important psychological milestone for investors. One year ago, investors were being bombarded by talk of the bear market and an imminent recession. But now we have a healthy economy, well-contained inflation, a Federal Reserve (Fed) set to cut rates, improving productivity, record earnings, and stocks at all-time highs. What a ride it has been, but investors were once again rewarded for sticking to their investment plans.

So, what now? At Carson, we remain overweight equities and expect this bull market to continue. But stocks have truly had a rally for the ages, so a well-deserved break or consolidation could happen at any time. A downturn would be perfectly normal, but higher prices remain likely to follow.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

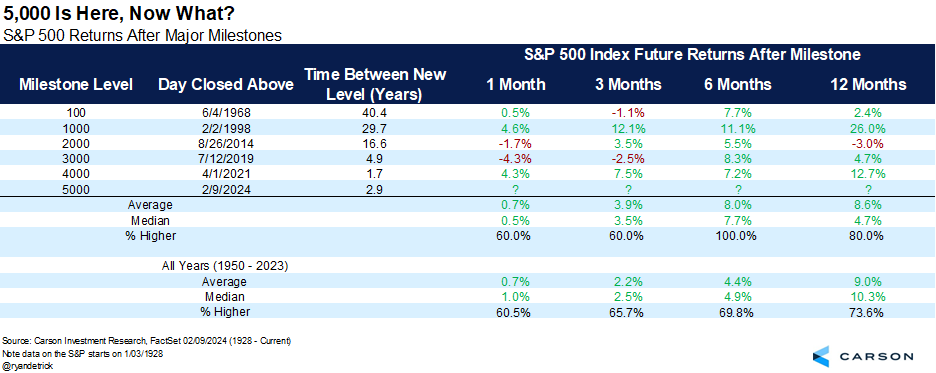

The chart below lists previous major S&P 500 milestones and the returns that followed. The good news is the S&P 500 was higher six months later every time and up a solid 8.0% on average, versus the average six-month return of 4.4%.

A Truly Historic Bull Move

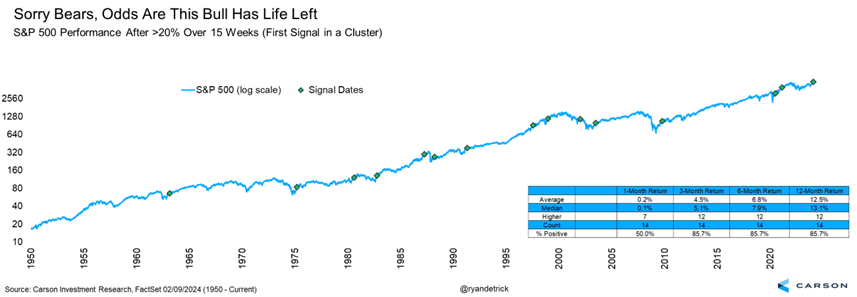

The S&P 500 has finished higher 14 of the last 15 weeks, something it hasn’t done since early 1972. Over those 15 weeks it gained 22%. In its entire history, the S&P 500 has never been higher 14 out of 15 weeks and gained more than 20% over that time. If you’ve been invested these last 15 weeks, congrats, as it is safe to say you’ve been enjoying a historic stretch for the bull market.

After a 20%-or-better rally over 15 weeks, would you believe the market tends to see stronger longer-term returns moving forward? That’s right, this type of strength isn’t typical of the end of a bull market or the middle of a bear market. Instead, it’s more typical of the start to a longer-term bullish move.

We found 14 other times the S&P 500 gained 20% or more in 15 weeks. One year later the index had added another 12.5% on average and was higher 85.7% of the time.

Time for a Break?

We’ve been bullish, but we agree stocks can’t continue on a trajectory like this forever. But remember, a pause to refresh and let the bull catch its breath would be perfectly normal.

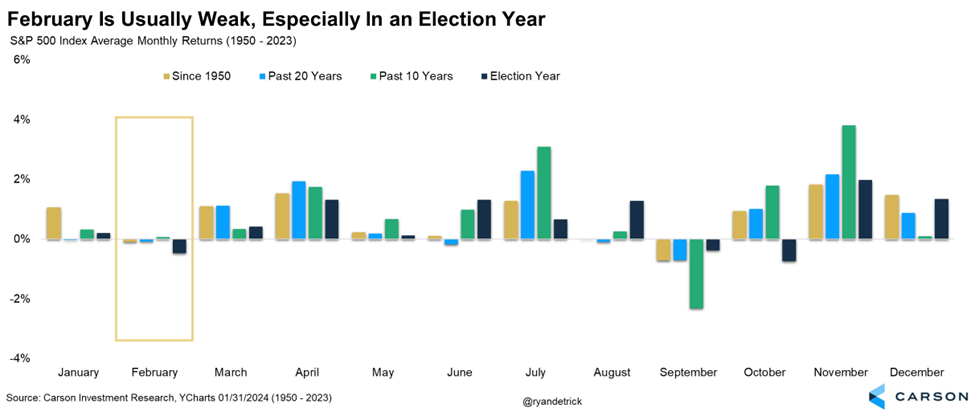

First up, February historically isn’t a very strong month and it is later in the month when most of the weakness tends to happen. Additionally, election years tend to be weak this month as well.

Next is our Carson Cycle Composite, which combines multiple different types of years to form one overall composite. Included are things like the average year, the past 20 years, the presidential cycle, the year after a 20% gain, and years with a positive January. Looking at this proprietary composite shows that the next six weeks or so could be ripe for a well deserved break. Take note, our Carson Cycle Composite worked very well last year.

Putting It All Together

The economy remains strong, earnings are expected to hit an all-time high this year, consumers are in great shape, the employment backdrop is solid, inflation is under control, productivity is soaring unlike anything we’ve seen since the mid to late ‘90s, the Fed will likely begin to cut over the coming months, and we don’t have to watch Taylor Swift every single Sunday anymore. Things really are good and should continue to stay that way.

But markets rarely work that way. When things are too good could be just the time for the rug to get pulled out from under it, even if it’s just a pause. We aren’t expecting a major correction here, but be open to a little more weakness than we’ve been spoiled by the past 15 weeks.

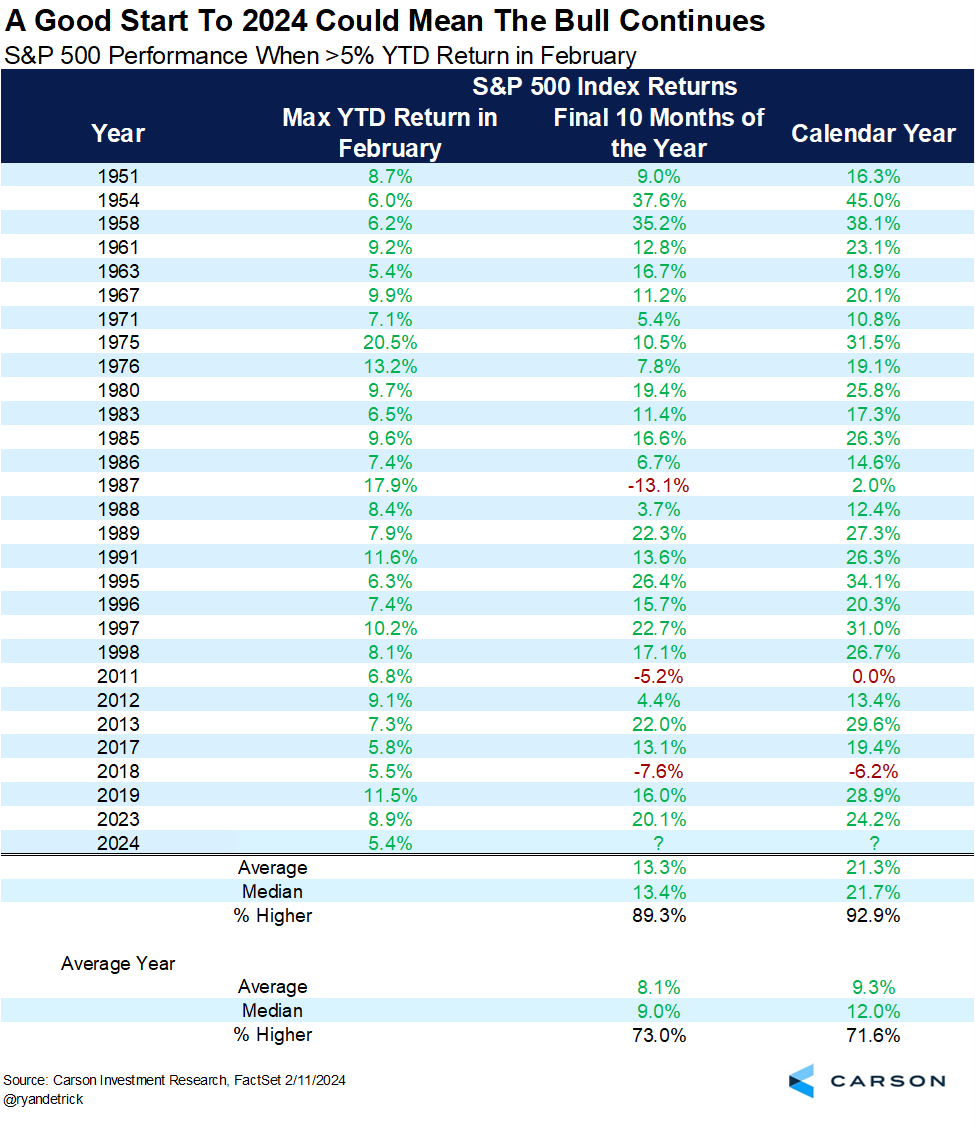

I’ll leave you on this note, the S&P 500 is up more than 5% for the year during the month of February. We would classify this as a good start to the year. 28 other years saw this happen, and the final 10 months gained 25 times and the full year 26 times, in both cases with much better than average returns as well. So should we see any well-deserved weakness in the near-term, it could be an opportunity to add before likely higher prices.

For some good news and some bad news, Sonu Varghese, VP, Global Macro Strategist, and I break it all down in five minutes in our latest Take Five video below.

For more of Ryan’s thoughts click here.

02113695-0224-A