“Can you take me higher? To a place where blind men see. Can you take me higher? To a place with golden streets.” Higher by Scott Stapp of Creed

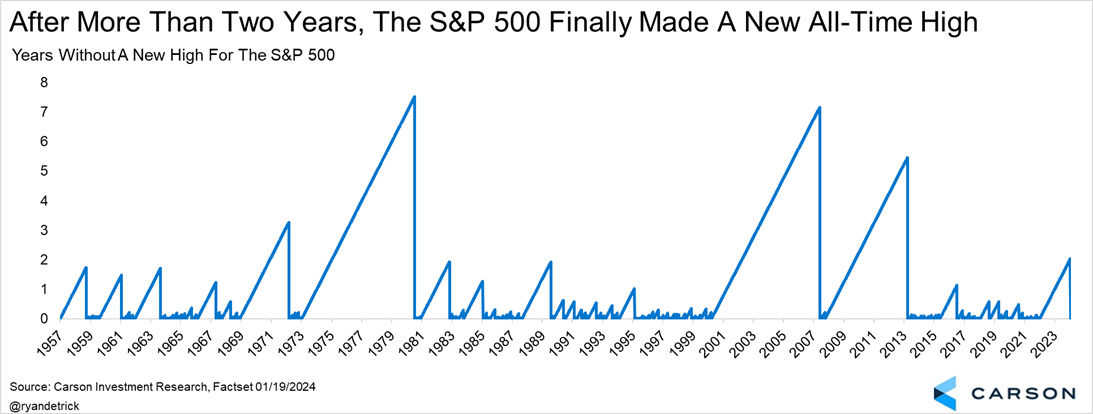

After a wait of more than two years, the S&P 500 finally closed at an all-time high last Friday. That’s right, the last time it hit a new all-time high was clear back on January 3, 2022, more than two years ago. This was quite a long wait for new highs, but note it went nearly eight years without a new high in the ‘70s and early ‘80s and then more than seven years to made a new high after the tech bubble implosion in the early ‘00s. Still, this recent streak was the longest since more than five years without a new high after the Great Financial Crisis.

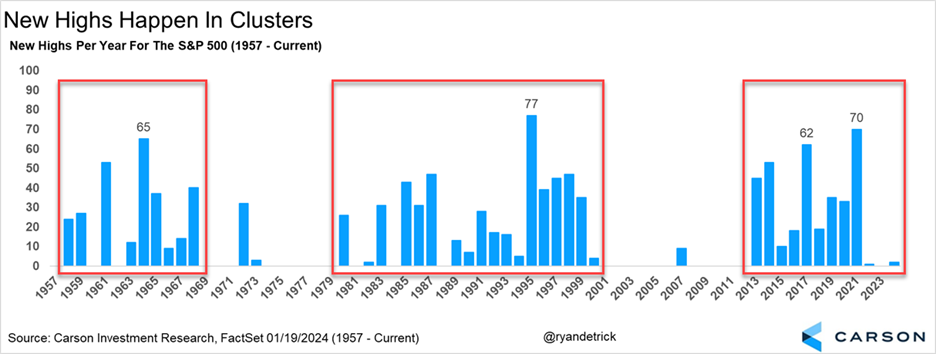

The second thing to know about new highs is they tend to happen in clusters that can last many years. Since 1957 (when the S&P 500 moved to 500 stocks) there have now been 1,186 all-time highs. But the majority of those new highs took place during three major clusters.

1958 – ’68 281 new highs

1980 – ’00 513 new highs

2013 – current 348 new highs

In other words, only 46 new highs took place outside of these three clusters (96.4% of all highs can be found in these three clusters). How much longer this new cluster could continue is hard to say, but we’d say be open to potentially many more years of new highs before it is all said and done. Or, to quote the great musical talent Scott Stapp as seen above, we could be going higher.

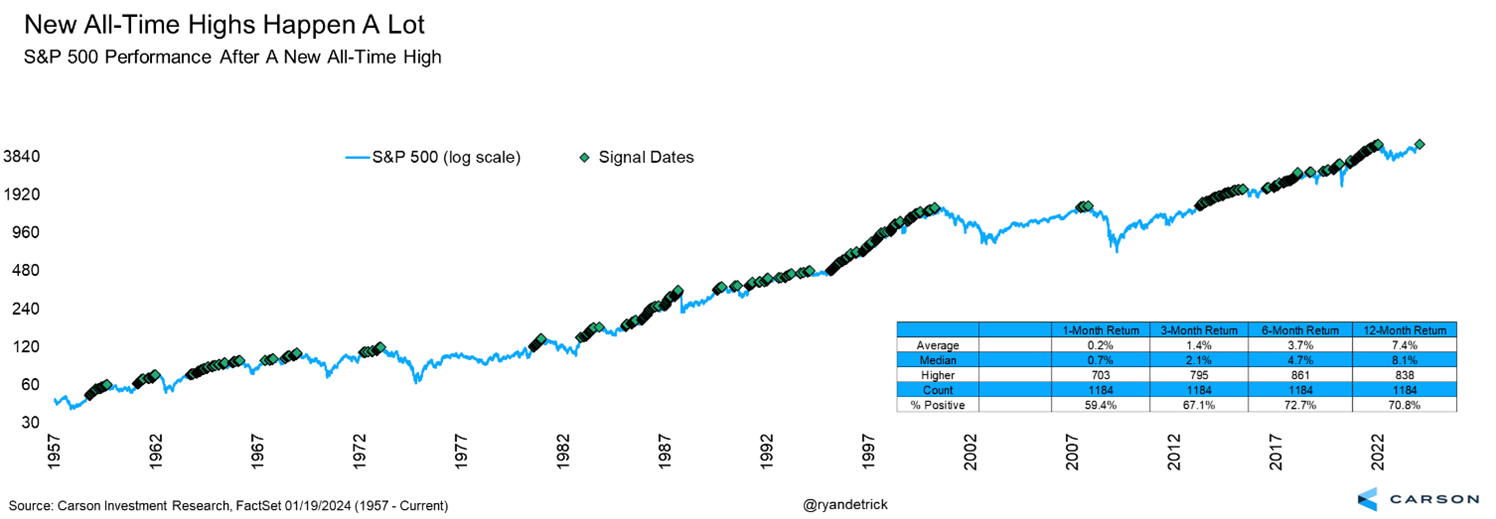

Third, new all-time highs happen a lot. In fact, 7.0% of all days since 1957 closed at an all-time high, that is a new high every 14 trading days. That is a lot of new highs!

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

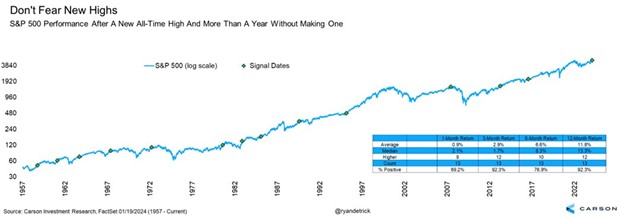

Here’s a chart showing all 1,186 new all-time highs (good luck counting them all). If you picked any random day a new high was made, the future returns aren’t too far away from average returns. A year later up 7.4% on average and up about 71% of the time isn’t spectacular, but it sure isn’t bearish either. We’ve heard from many that they are worried that stocks have gone too far too fast, but history would say this bull market probably has plenty of life left. As we will show in number five below, sometimes the wait is worth it (probably like the 10 year wait we’ve had to wait to see Creed live).

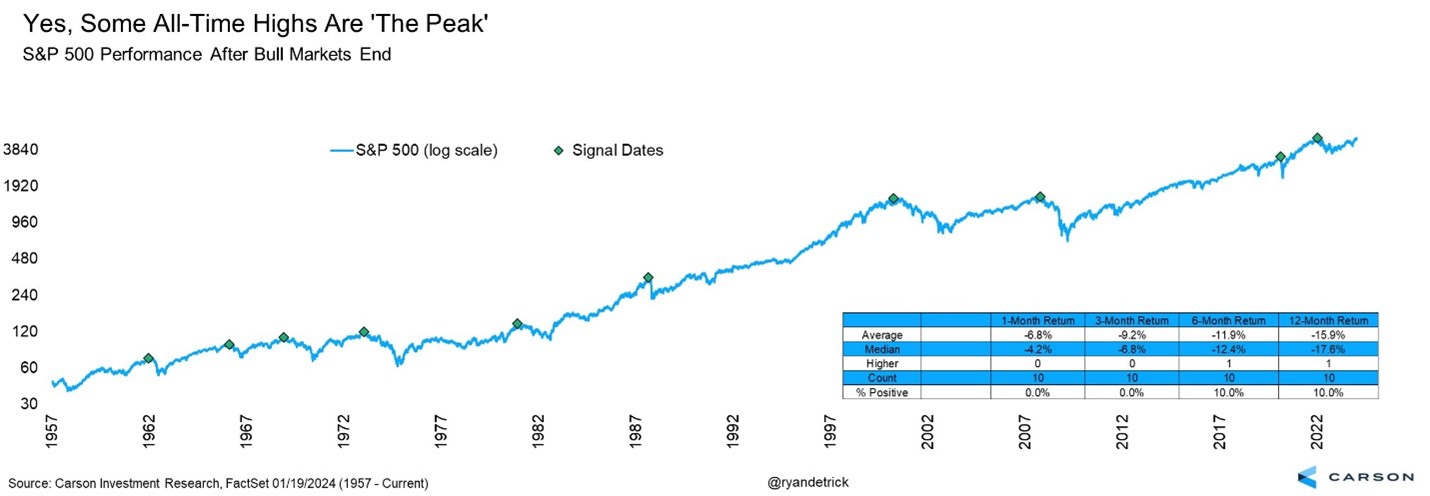

Fourth, yes, eventually there will be a new all-time high that marks the end of this bull market. But if you spend all your time worrying that each new high will be the final peak, like in ’87, ’00, or ’07, then you likely will miss out on historic gains along the way. Remember, these represent only three all-time highs out of 1,186 and even adding the previous bear markets going back to 1957 only gets you to 10 out of 1,186.

Here’s a chart I made that indeed showed the peak before the past 10 bear markets. Again, there will be a time this bull market peaks as well, we just don’t think it is now.

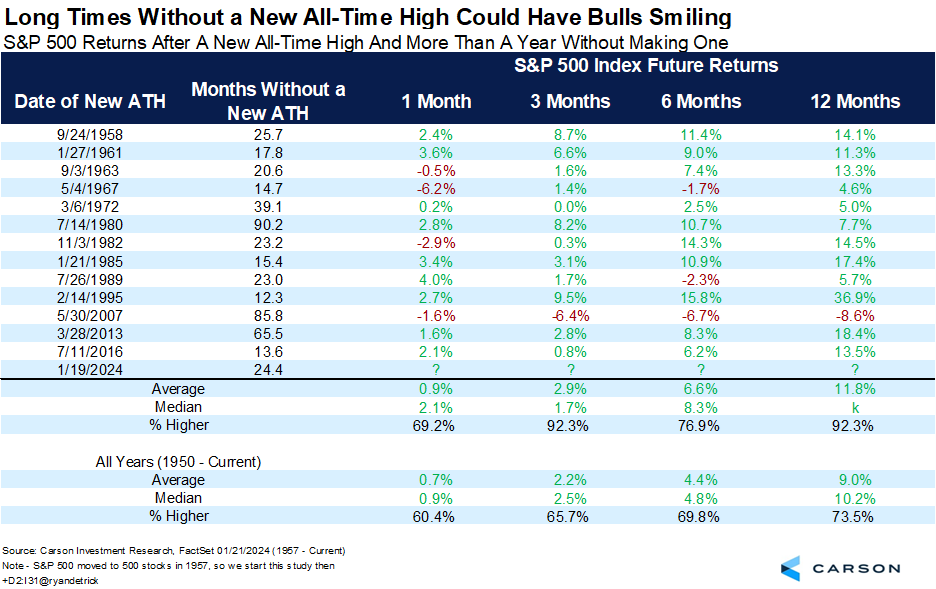

Fifth, time is your friend when it comes to investing and one of the strongest reasons to be bullish this year is the fact stocks just went so long with out a new all-time high. I found 13 previous times the S&P 500 went at least a full year without a new all-time high and then made one. The good news is stocks were higher a year later 12 times and up nearly 12% on average and even more looking at median returns. In our recently released Outlook ’24: Seeing Eye To Eye we noted we expected stocks to gain between 11-13% and this study fits right in that area.

Here’s a table with all the exact dates and returns. The bottom line is better-than-average returns going out one year is perfectly normal.

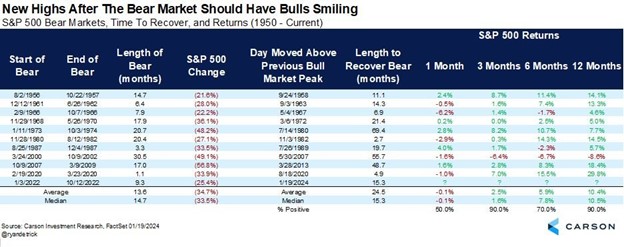

The sixth and final thing to know about new highs is once we finally made one after a bear market, the trend higher usually remained your friend. After the 25% bear market of 2022 bottomed in October ’22, it officially took more than 15 months to make a new all-time high.

The really good news for the bulls here is looking at the past 10 bear markets showed that a year later stocks were higher nine times when new highs were eventually made. Yes, 2007/08 was the one time this didn’t work, but we don’t see many signs of a pending major financial crisis is on the horizon and expect to see higher prices a year from now.

To sum it up, are we six feet from the edge (like Scott Stapp sang on One Last Breath)? We don’t think so, as this bull is alive and well, but I just had to make one final Creed reference.

Lastly, I joined Frank Holland on CNBC yesterday to discuss the market at new highs and you can watch the full interview below.

For more of Ryan’s thoughts click here.

02081882-0124-A