There are many ways to look at investor sentiment and one that we’ve been noticing lately is investors have been selling stocks on Friday. In other words, many investors do not want to hold over the weekend for fears over what could happen. If stocks were to shift into a more bullish phase, we’d expect to see more green on Fridays. Let’s dive into this.

In fact, Friday has been lower nine of the past 11 weeks and down five weeks in a row. Down five in a row is the longest losing streak since six in a row in March and April of 2017. Then if you dig into some of those recent declines, they are quite large with the past two down 2% or more. Friday hasn’t been down 2% or more three weeks in a row since 1938 to put things in context. Lastly, Friday has been down at least 1% for four consecutive weeks, the longest such streak since early 2016.

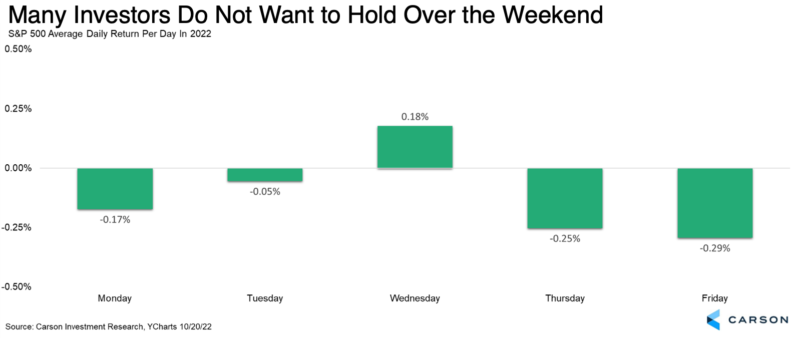

Here we break things by the days of the weak (see what we did there?). Things indeed have been weak, with the S&P 500 down 0.29% on average on Friday, the worst showing since 2001 and third worst ever. But it doesn’t stop there, as Thursday is down 0.25%, the worst return for Thursday since 1998. Adding to the fun, Monday is down 0.25% on average, the worst since 2008. At least we have hump day, with the S&P 500 up 0.20% on average on Wednesday, the best since 2010.

The bottom line is we are seeing signs stocks could be in the process of making a major low, as we discussed in Why Stocks Likely Just Bottomed. But one other signal we’d love to see is buyers willing to hold stocks (or even add to them) on a Friday.

Lastly, have you heard about our new podcast? Each week, Sonu Varghese and I will discuss all the latest macro and market events in the Facts Vs. Feelings podcast. Sure enough, this week we discussed this concept some, along what is spooking investors.

You can listen to the podcast here, or wherever you get your favorite podcast.