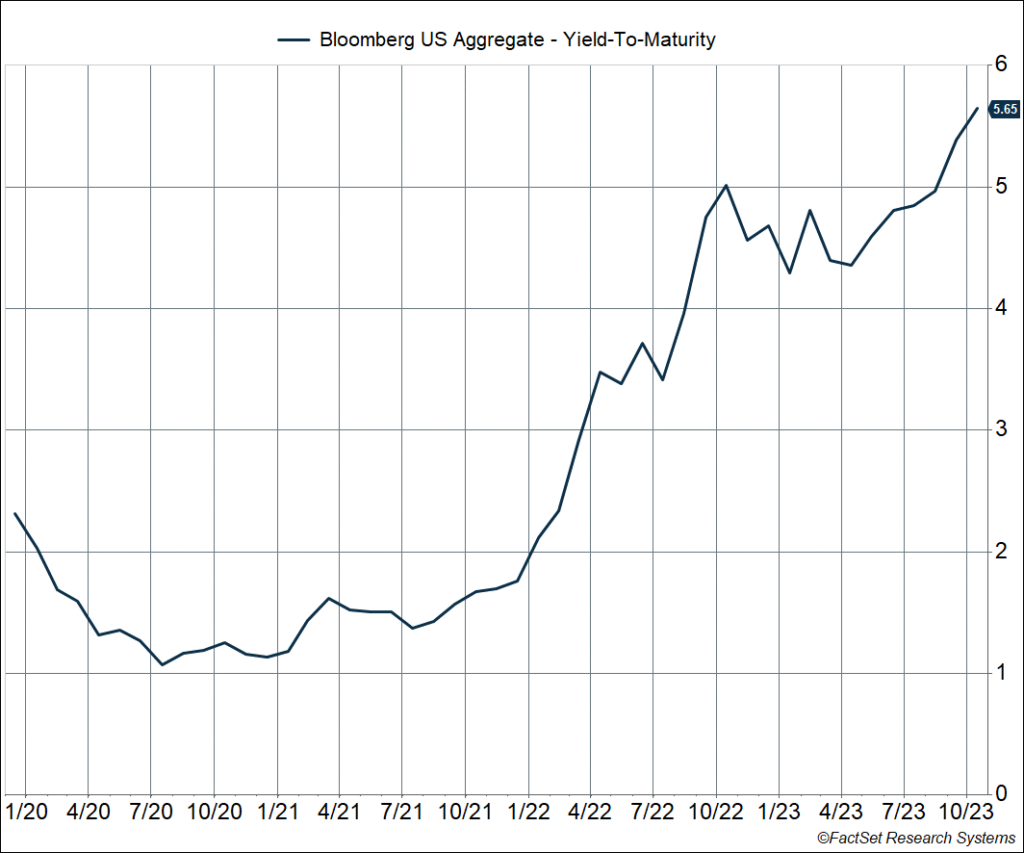

The sell-off in bonds from August 6, 2020 to October 24, 2022 was dramatic and difficult. The Bloomberg US Aggregate Bond Index (“Agg”) is actually up 3.6% off of the October 2022 lows despite additional volatility this year. We are often asked when it’s safe to add bond duration (the sensitivity of a bond or bond index to a change in its interest rate). Or, another way of asking the same question, when we are comfortable moving cash or ultra short maturity bonds back to intermediate maturity bonds. We have already recommended slowly adding some duration over time but our current recommendation remains positioning duration tactically meaningfully below the Agg.

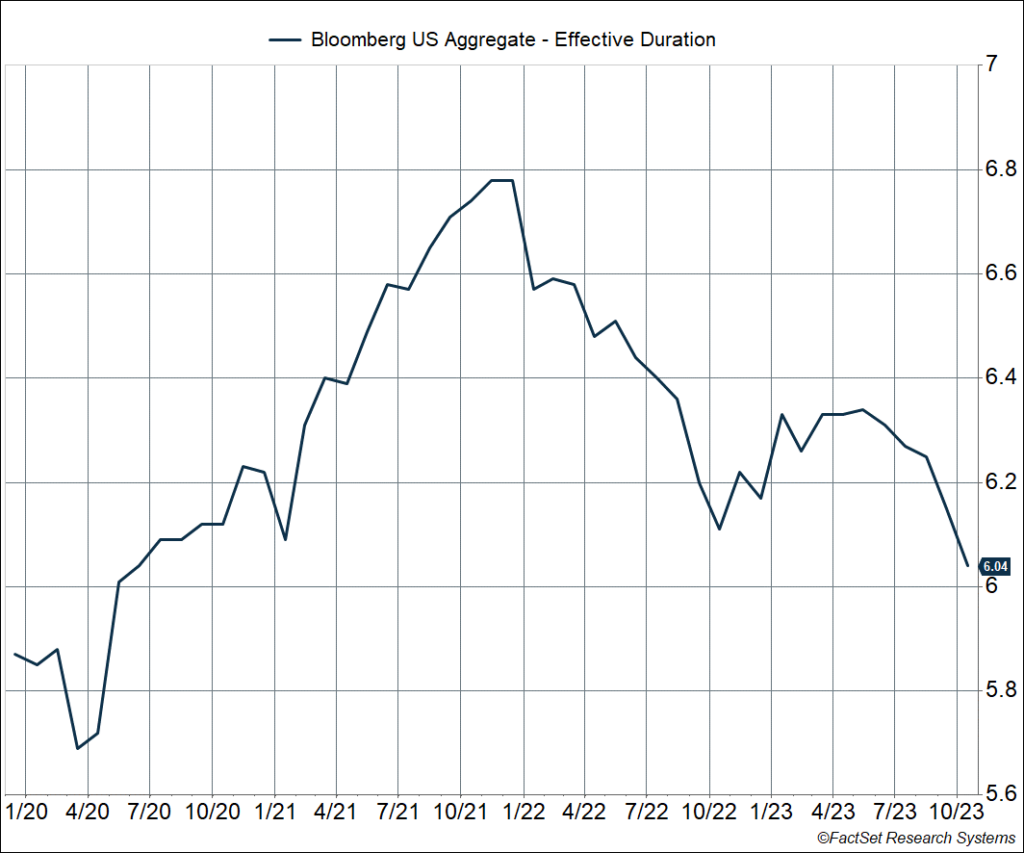

At the same time, the interest risk for the Agg has actually declined dramatically. This is a function of two things: 1) higher yields mean higher coupons, which offset the impact of price losses; 2) the interest rate sensitivity (duration) of the Agg has itself dropped.

While simplifying, we can create a rough interest rate “breakeven rate change” for the Agg by assuming the coupon is just the yield to maturity and the current measure of duration stays the same even if rates change. The breakeven is an estimate of how much the Agg’s yield would have to increase over the next year for the Agg to have a total return loss. As you can see, the breakeven change has climbed quite a bit. In other words, rising rates don’t hurt as much as they once did and the yield on the Agg can increase about 0.94% (percentage points) over the next year before it has a total return loss. Anything less would leave the Agg with a gain. In July 2020, it would have taken a yield increase of just 0.19% over a year for the Agg to experience a loss.

A Rising Yield Makes the Bloomberg US Aggregate Bond Less Sensitive to Rising Rates

While there is still some chance of yields moving higher and the Agg does also have some credit sensitivity, the odds of the kind of move we’ve seen over the last few years are very low. Even with a smaller move, the income that bonds throw off makes the return profile asymmetrical. The total return for the Agg as estimated at about 0% if its yield climbs 0.94% (percentage points) over a year, but at +11.3% if it declines a similar amount.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

In the near term we remain mindful of the attractiveness of short-term rates and the possibility that inflation concerns could last longer than expected, even if our base case is for continued disinflation. We also remain fairly bullish on the economy. The main risks with short-term bonds is that you may have to settle for a lower rate if yields drop (reinvestment risk) and that you lose the added portfolio ballast if equity markets become volatile and bonds return to their role as a diversifier.

A Lower Duration Makes the Bloomberg US Aggregate Bond Index Less Sensitive to Rising Rates

Weighing all these factors together, we are not ready to return to Agg-like duration yet. We are watching for when we believe reinvestment risk becomes elevated, which will largely be driven by when the Fed starts to lower rates. Since markets are forward looking, we would aim to be reasonably ahead of this move but are comfortable with just a step in that direction for now.

1978030-1123-A