The Federal Reserve’s (Fed) January 2025 meeting held no surprises. They maintained policy rates within the 4.25-4.50% range and continued to trim their bond portfolio, as expected. However, their official statement did see a small, but notable, change. They did highlight that the unemployment rate has stabilized at low levels, but inflation remains “somewhat elevated.” By itself, this would indicate the Fed is hitting the snooze button on rate cuts, and the pause may last for a while. Fed Chair Jerome Powell’s response to a question about the possibility of a rate cut at their next meeting in March was that they’re not in a hurry to adjust their policy stance.

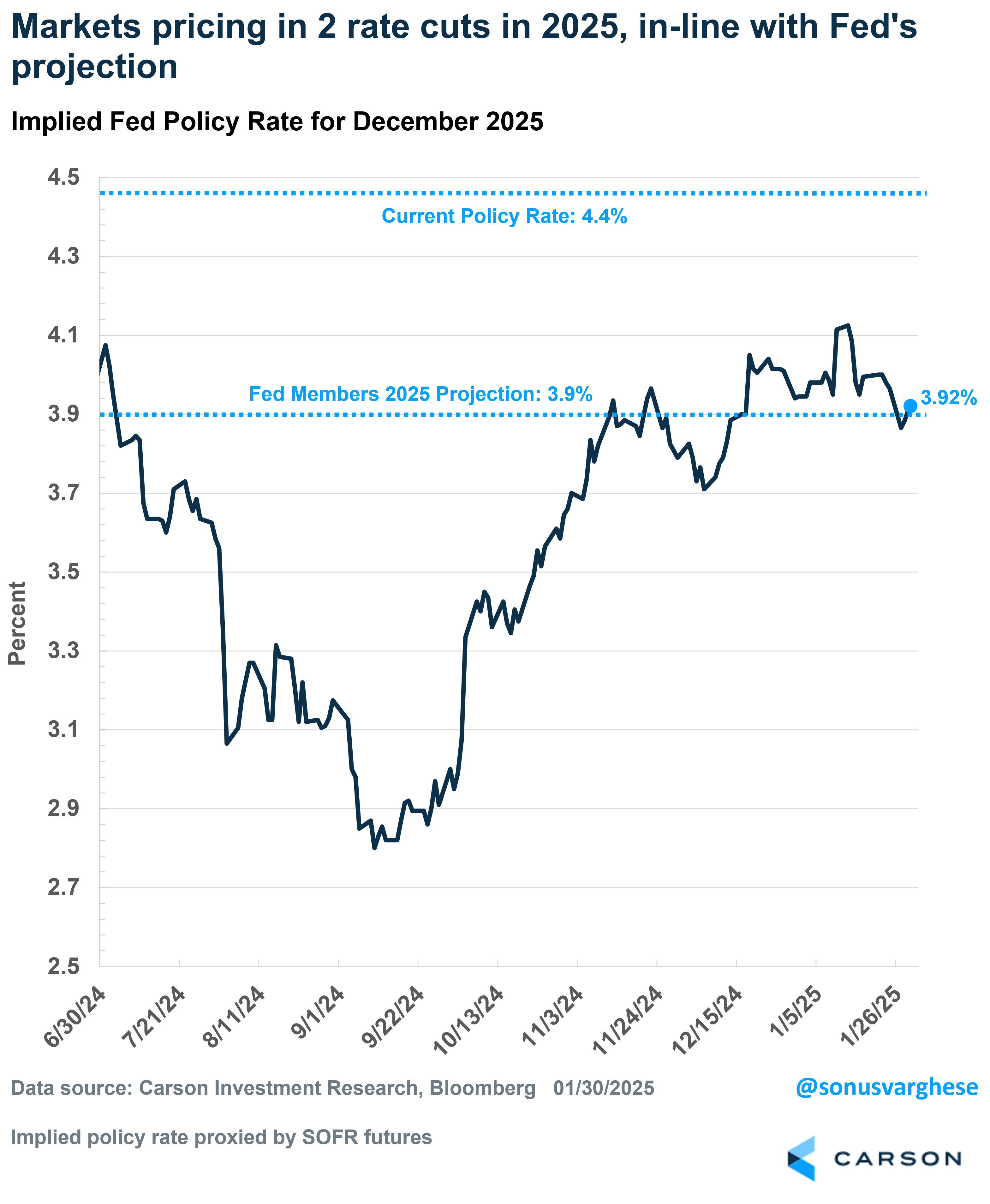

Markets are now expecting the Fed’s policy rate to be close to 3.9% at the end of 2025, implying two rate cuts in 2025 (each worth 0.25%-points). And the first one is not expected before June. This is consistent with the Fed’s own projections from their December meeting, where they projected a couple of cuts in 2025. As you can see in the chart below, expectations have shifted in a big way from last September, when markets expected the fed funds rate to hit 2.8% at the end of 2025. The difference is that we’ve gotten a string of strong economic data since then, resulting in fading recession fears (and fewer rate cuts being priced in as a result).

Still, Powell’s Quite Optimistic About the Inflation Outlook

Powell sounded quite positive about the inflation picture. In fact, he explicitly backed away from the inflation language in the statement, saying it was mostly about “cleaning up the language.” He noted that the inflation numbers a year ago (in Q1 2024) were quite strong (remember that scare?), and that’s setting upcoming Q1 2025 for better year-over-year inflation readings, i.e. positive “base effects.” This assumes we get benign monthly data over the next few months, akin to the positive data we got in December, which may be likely if shelter inflation continues to decelerate. At the same time, Powell does want to see the actual data evolve as they expect before moving. Hence the pause.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

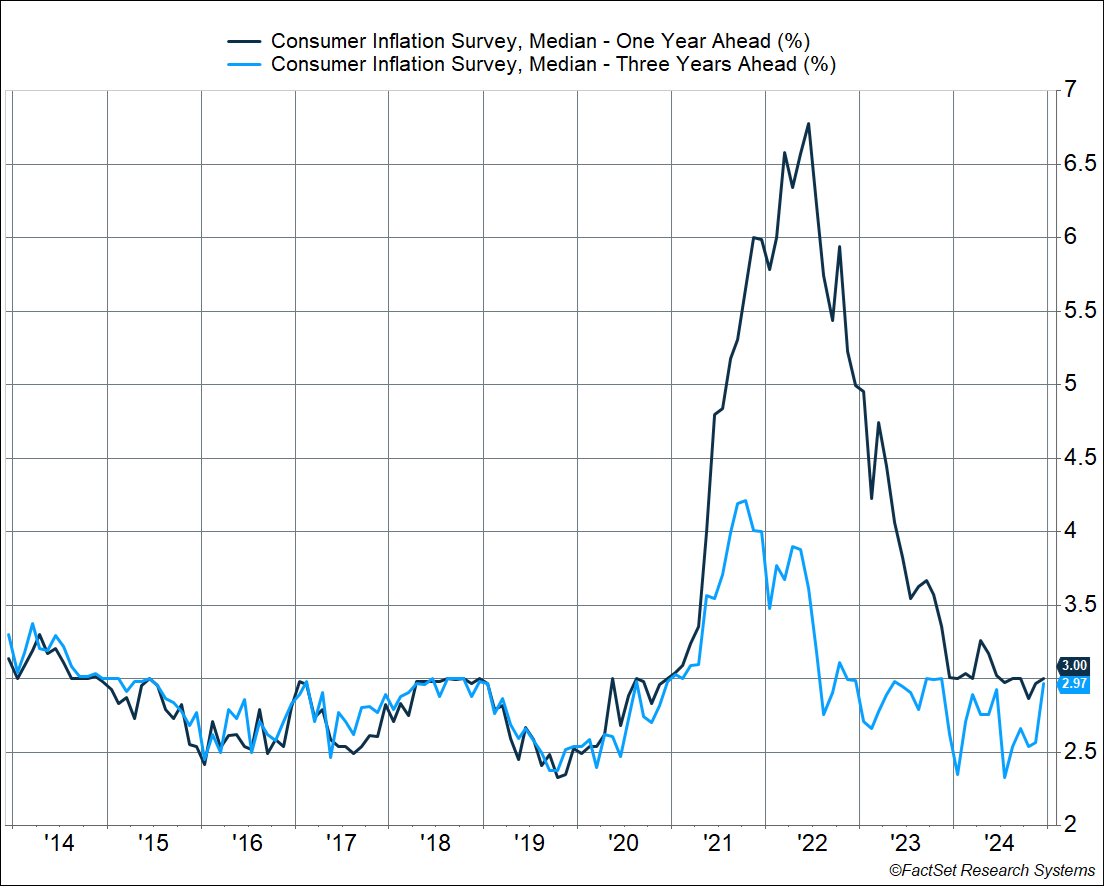

He underlined this by saying that even inflation expectations are in check. The latest New York Federal Reserve survey of consumers saw short-term inflation expectations rise to 3%. This is likely due to the recent rise in gas prices, but even this level is similar to what we saw in 2018. The more important longer-term 3-year ahead inflation expectations remained close to 3%. Again, this matches what we saw in 2018. In fact, back then the Fed’s preferred inflation metric (the Personal Consumption Expenditures Index) was running below the Fed’s 2% target. Consumers are typically quick to catch onto inflation, and will tell you so, like in mid-2021. So current levels of consumer inflation expectations tell you that inflation has normalized.

Business expectations of inflation, from an Atlanta Federal Reserve survey, are also close to 2%.

Powell also noted that the policy rate is still “meaningfully restrictive,” though less restrictive than before that they started cutting rates in September. He sounded confident that the labor market is solid, but went on to say that they don’t want it to cool further. He pointed out that if you have a job, things are good. But if you don’t, it’s harder to find a job. And they don’t intend to make it even harder than it already is, at least not as a result of overly restrictive policy. This implies that any further weakening of labor market data should see them cutting rates earlier than expected.

They’re Clearly Worried About Trump Administration Policies

Powell’s positive inflation outlook, and not wanting to cool the labor market further, begs the question: “Why not lower rates if they believe rates are meaningfully restrictive?” The short answer: rising inflation uncertainty. This was apparent in their December projections (I wrote about it a month ago), and Powell more explicitly admitted to the reason in his press conference.

He said there is elevated uncertainty due to significant policy shifts, across four areas: tariffs, immigration restrictions, fiscal policy (more deficits), and regulatory policy. He admitted that they do need to see what the actual policy will be before estimating the economic impact, let alone determining the appropriate policy. But for now, the uncertainty is why they’re pausing.

A Pause Is NOT Status Quo; It Can Hurt

An extended pause is far from a benign policy choice. If inflation continues to pull back, as Powell himself expects, doing nothing would mean policy is actually getting tighter. This is going to have an adverse impact on rate-sensitive sectors of the economy, like housing and business investment (outside of AI-driven capex, where other factors like the fear of being left behind will drive more investment).

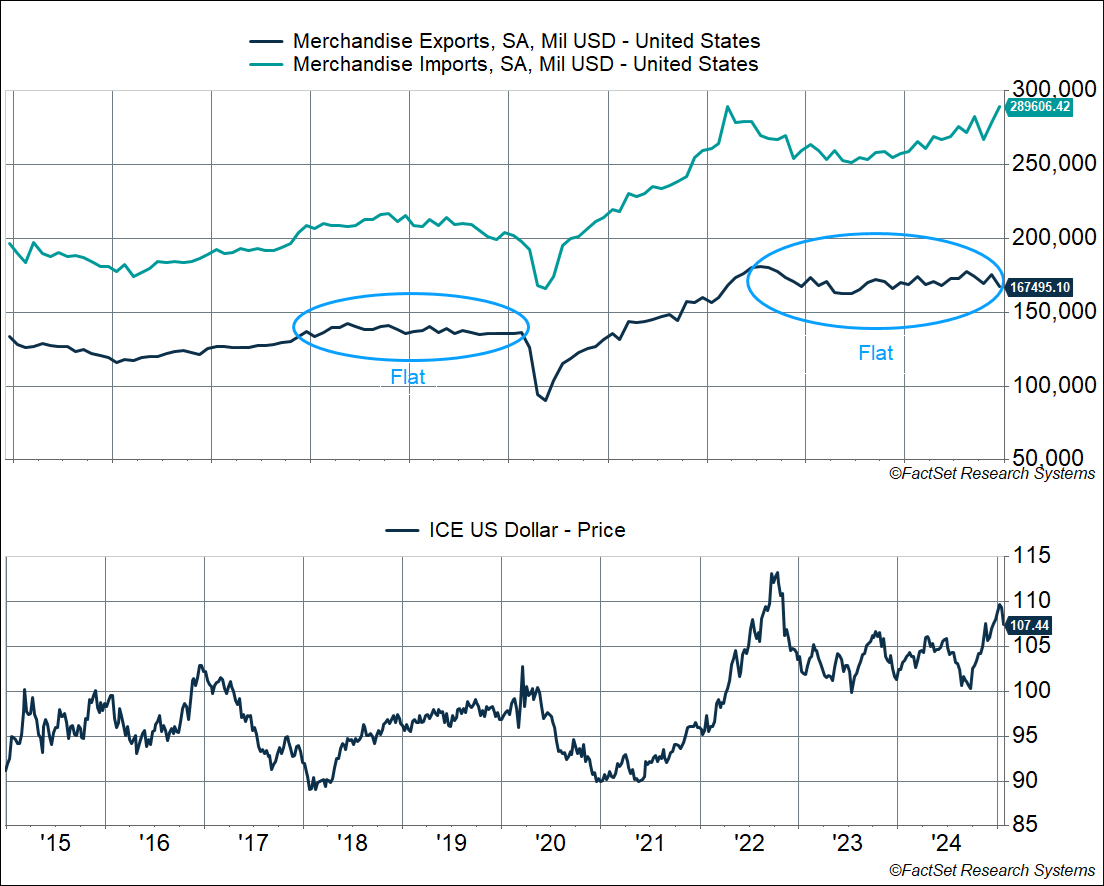

Elevated rates can also keep the dollar stronger, and as we wrote in our 2025 Outlook, that poses risks of its own. In particular, it hurts US exports, which is exactly what happened in the fourth quarter of 2024. The dollar index rose close to 8% over the quarter, and nominal goods exports pulled back at an annualized pace of 15%, while imports rose 10% annualized. Remember, a stronger dollar makes exports more expensive and imports cheaper. As you can see in the chart below, exports have now been flat for two years amid dollar strength. This is similar to what we saw in 2018-2019, when the dollar appreciated.

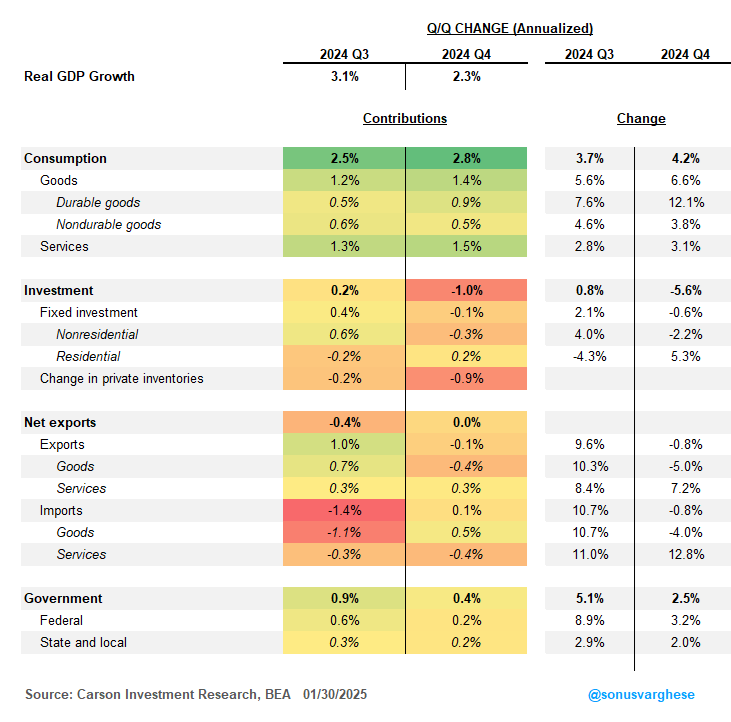

The latest GDP growth numbers underline the risk of elevated rates, and a strong dollar. Real GDP growth clocked in at 2.3% for Q4 2024, a tad below expectations but still a solid reading and along trend. Consumption was strong once again, contributing 2.8%-points to Q4 GDP growth. Consumption rose 4.2% in Q4, accelerating from the 3.7% increase in Q3. Government spending also provided a 0.4%-point boost.

However, a lot of this strength was offset by investment spending, which pulled GDP down by 1%-point. A chunk of this was due to falling inventories, which tend to be volatile. More worryingly, fixed nonresidential investment, i.e. business investment, fell 2.2%, driven by an 8% drop in equipment spending and a 2% decline in investment into structures like manufacturing facilities and other buildings. Goods exports pulled back 5%, pulling GDP growth down by 0.4%-points. It was offset by services exports (mostly on the back of foreigners travelling to the US, which counts as a “service export”). Residential investment (housing) did make a 0.2%-point contribution to GDP growth in Q4, rising over 5%, but if mortgage rates stay close to 7%, that’s likely to become a drag.

All this to say, don’t let anyone tell you that elevated rates are not having a significant impact on the economy because headline growth is still humming. Key areas of the economy like investment and manufacturing exports are being hit due to elevated rates and a strong dollar. And there’s unlikely to be a boost from the housing sector either. If this continues, it could be the difference between 3% GDP growth versus 2% GDP growth.

Ultimately, Fed policy is going to depend on how the inflation data evolves, but also some clarity on policies coming from other side of D.C. Of course, if we see a deterioration in labor market conditions, we’ll likely see rate cuts sooner rather than later — but bad news is not something to root for (we’re consistently in the camp that good news is good news and bad news is bad news).

Chief Market Strategist, Ryan Detrick and I discussed the recent news on DeepSeek on our latest Facts vs Feelings episode, but also the global macroeconomic context within which it’s happening, especially China’s rising technological prowess. Take a listen:

For more content by Sonu Varghese, VP, Global Macro Strategist click here.

7586254-0125-A