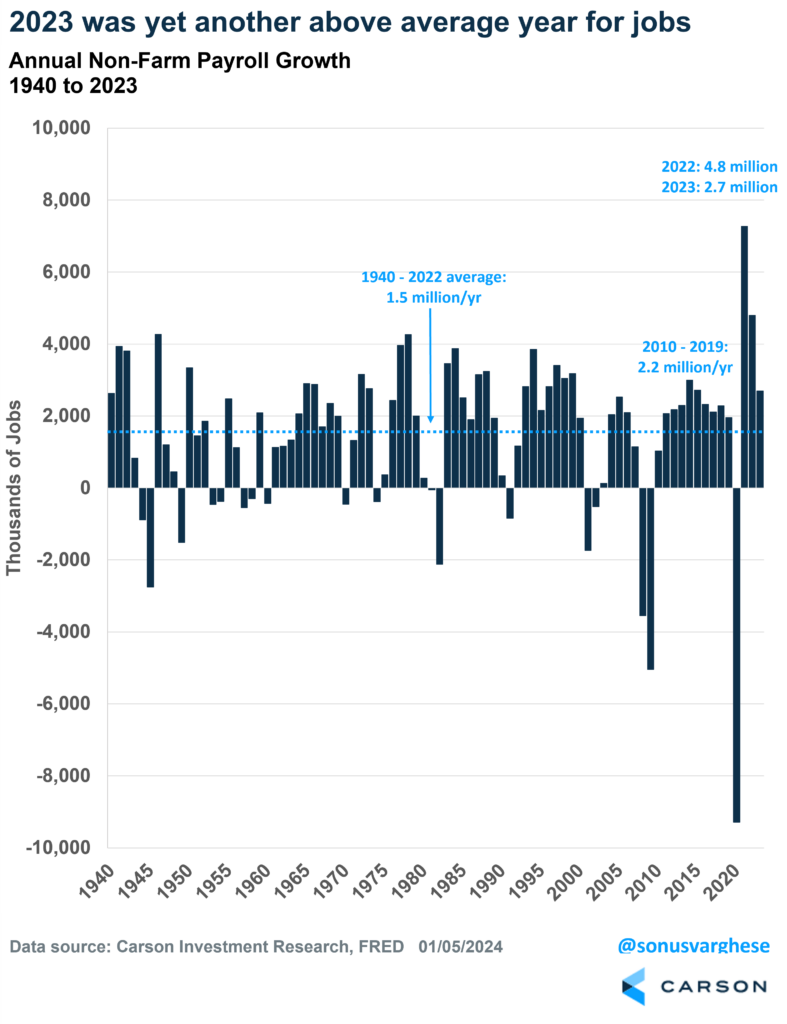

The December payroll was strong on the surface, with 216,000 jobs created last month and the unemployment rate staying at 3.7%. That’s the 23rd straight month in which the unemployment rate has remained below 4%, the longest stretch since the late 1960s – which should tell you that the economy is in a healthy place. All in all, 2023 was another banner year for job creation, with 2.7 million jobs created. That’s obviously lower than the 4.8 million in 2022, but keep in mind that average annual job creation per year since 1940 is just 1.5 million, but 2.6 million if you exclude years with negative job growth (which occurs amidst recessions). In fact, the average from 2010-2019 was 2.2 million.

Job Growth Has Slowed, But That’s Just Normalization

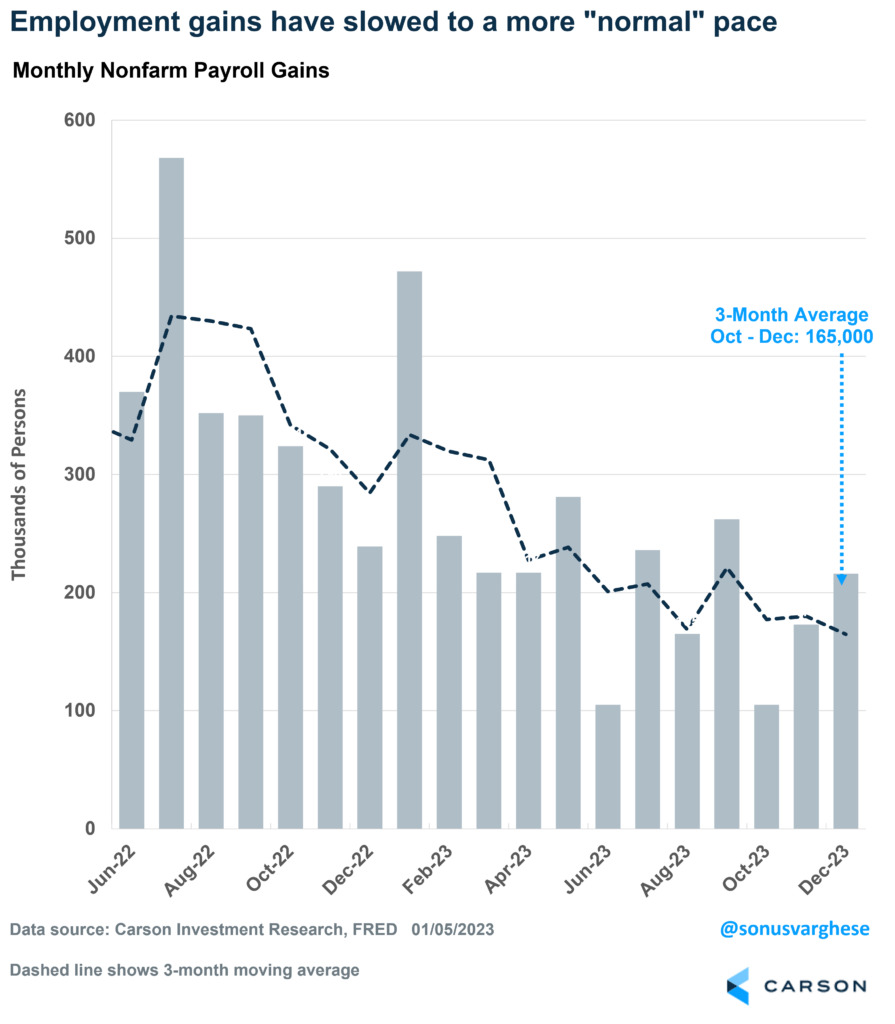

Now, we did see some revisions to job creation in prior months, but that’s why the 3-month average is useful, and that’s at 165,000 now. It’s obviously fallen since the beginning of 2023, when job creation was red hot, but that’s still a very healthy pace and more than what’s required to keep up with population growth. In fact, monthly job creation averaged 163,000 in 2019, a year of solid economic growth.

Should we worry that the slowdown will continue, and the dashed line in the chart above will continue moving down? At this point, no. At least when looking at the totality of labor market data. In a healthy economy, there’s always pieces of data that are positive (really positive), and others that show a more mixed picture.

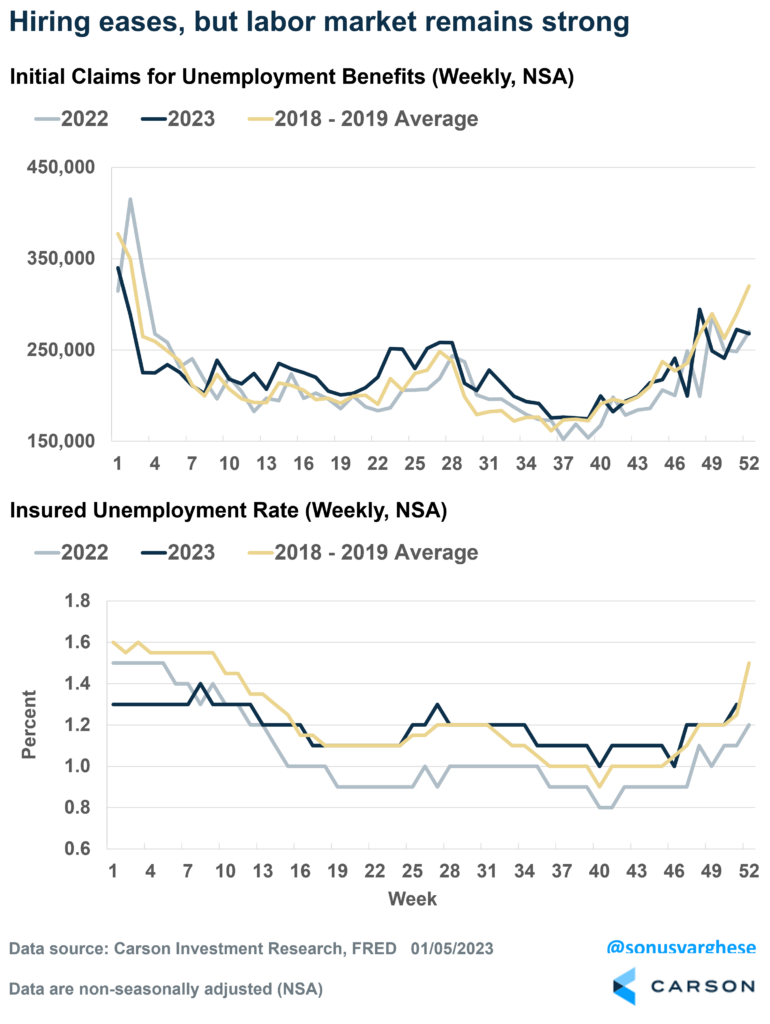

One of the better leading indicators for employment, and the economy really, are claims for unemployment benefits. The top panel of the chart below shows initial claims for unemployment benefits across the entire year (2023 in dark blue), compared to claims in 2022 (gray) and the average across 2018-2019 (yellow). It tells us that layoffs remain really low, which is why initial claims for unemployment benefits matches the low levels we saw in 2022 and even 2018-2019.

The bottom panel shows the “insured unemployment rate” – which is the number of unemployed workers continuing to receive benefits as a percent of the labor force. The latest data for 2023 is running around 1.3%, which is historically low and matches what we saw in 2018-2019. But it is slightly higher than what we saw in 2022, when the insured unemployment rate was at record low levels. The story here is that unemployed workers are finding jobs fairly quickly, which is why the rolls of continuing claims is not surging above 2018-2019 levels. However, that’s happening at a slower pace than in 2022, when the labor market was running really hot.

All in all, the employment data tells us that the economy is in a very healthy place.

What Really Matters for the Economy Is Income Growth

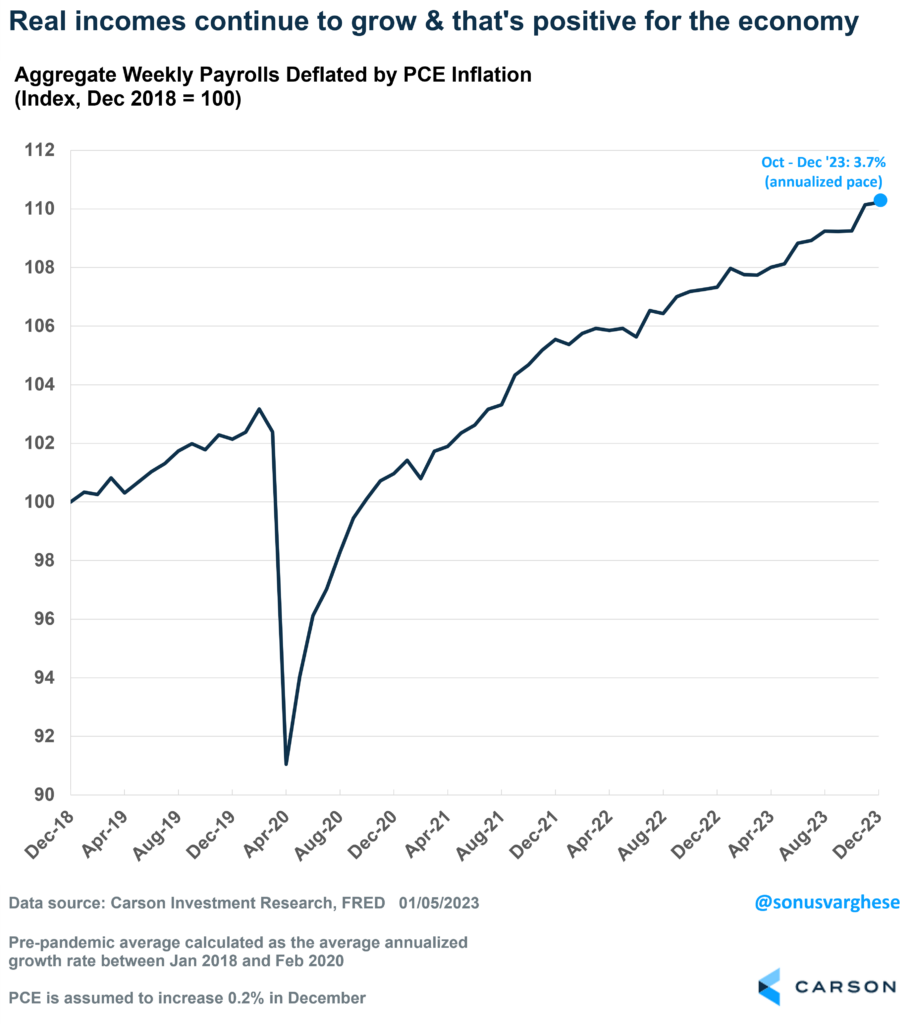

As Ryan and I frequently point out, close to 70% of the economy is household consumption, and that’s directly driven by income growth. If you want to know the underlying potential speed of the economy, there’s probably no better place to look than aggregate income growth, i.e. income growth across all workers in the economy. It’s a combination of

- Employment gains – which are solid now

- Hours worked – which are running steady

- Wage growth – which is running strong

Over the last three months, aggregate income growth is running at an annual rate of 4.3%, which is healthy in itself. Adding to that, inflation has pulled back significantly over the last few months, mostly thanks to lower gas prices but with broad support from a lot of other areas. If you adjust aggregate income growth for inflation, “real” income growth over the last 3 months is running at an annual rate of 3.7%! That’s really strong, and underlines the fact that the economy is in a very healthy place.

A healthy economy means the Federal Reserve may not cut rates as much, and perhaps as early, as markets expect – investors expect close to 6 rate cuts (each worth 0.25%-points) in 2024, with the first one coming as early as March. Those aggressive expectations may be behind the first week market jitters, not to mention some consolidation following the blockbuster gains we saw over the last couple of months, as Ryan pointed out in his latest blog.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Ryan and I discussed markets, the economy, and what it all means for Fed policy in our latest Facts vs Feelings episode, the first one of 2024. Take a listen below.

For more of Sonu’s thoughts click here.

02053144-0124-A