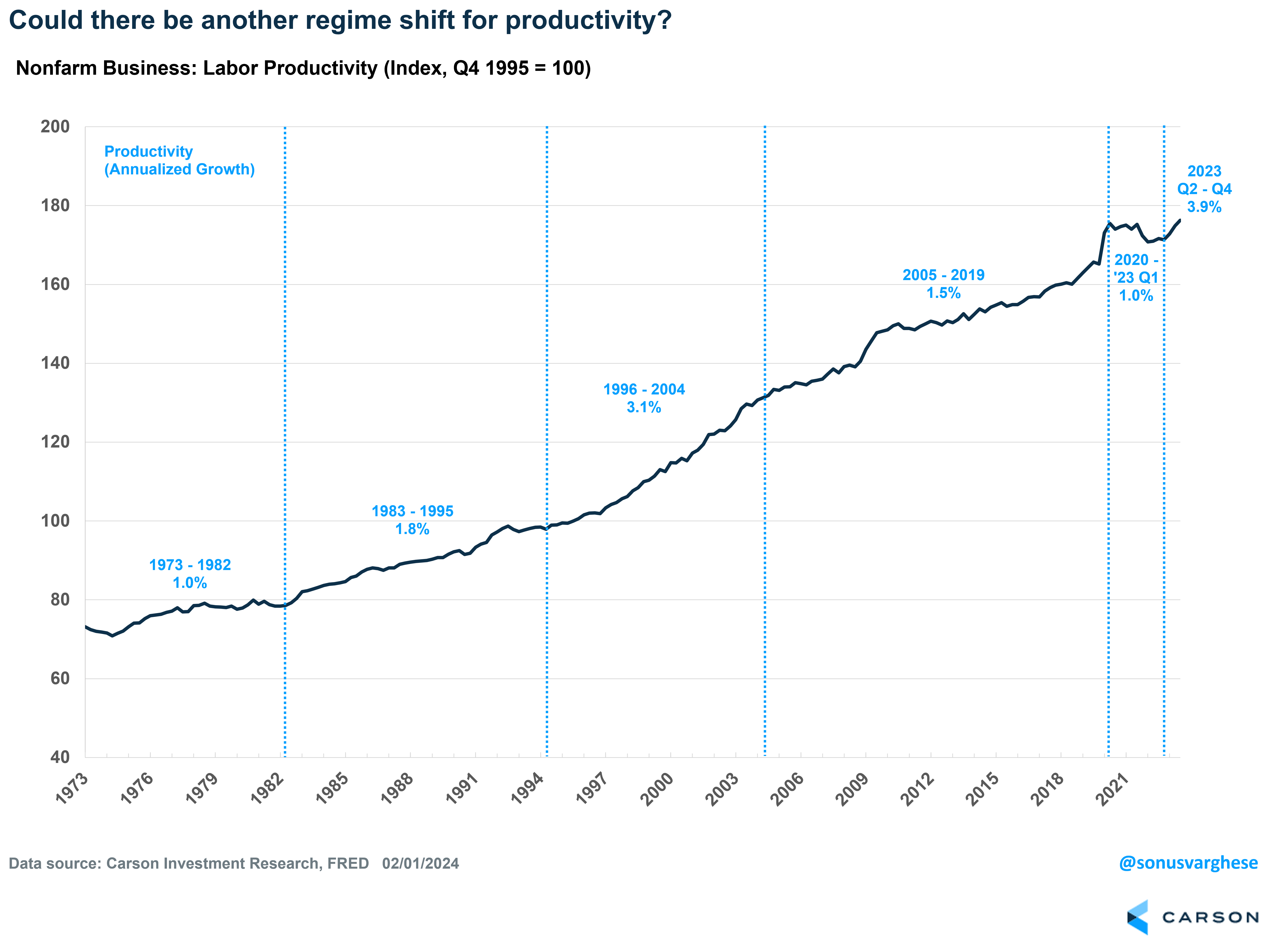

Productivity growth surged at an annual rate of 3.9% over the last three quarters of 2023, which is the largest non-recessionary gain we’ve seen since the late 1990s, and more than double the pace of productivity growth between 2005 and 2019.

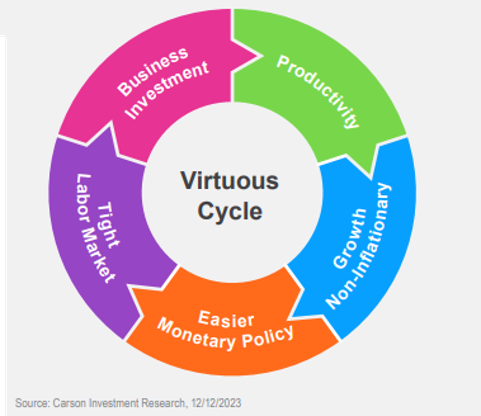

As we wrote in our 2024 Outlook, “Seeing Eye to Eye” (download here), productivity growth is a game-changer for the economy. Higher productivity means workers can have strong income gains without putting upward pressure on inflation. This in turn allows the Federal Reserve to back off from running interest rates at a very high level. Easier rates and the promise of higher demand, thanks to stronger incomes, can spur business investment – into labor, technological equipment, and structures – all of which can further boost productivity. That’s the virtuous productivity cycle, pictured below, which we last experienced in the late 1990s.

The good news is that we could be poised for another resurgence in productivity, at least above the low levels we experienced over the last decade and half.

A Strong Labor Market Is Key

There was a lot of hiring in 2021 and 2022, with the economy more than recovering all the jobs lost in 2020. However, newly hired workers are not immediately productive – businesses have to invest in training them. Also, businesses have an incentive to invest more when labor markets are tight. If a worker can get higher pay by switching jobs, which is what we saw in 2021-2022, employers may have to pony up more to keep them. At the time, it looked like productivity was falling. However, all this investment in labor bore fruit in 2023, and productivity started to surge.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Hiring did ease in 2023, but it was more normalization than a slowdown. The economy still created over 3.0 million jobs in 2023. As I wrote a week ago after the January payroll report was released, most indicators suggest the labor market is as strong as it was back in 2019. Wage growth is running above the pre-pandemic pace. Despite this, annual inflation fell from 5.4% at the end of 2022 to 2.6% at the end of 2023 (using the Fed’s preferred measure, the personal consumption expenditure price index). Why did strong wage growth not lead to upward pressure on inflation? Productivity growth, amid supply chain improvements. Consumption actually ran above trend in 2023, but a more productive workforce was able to produce more goods and services to keep inflation at bay.

All of which is why the Fed was able to stop hiking rates by July 2023, and is now potentially eyeing rate cuts, which gets us to what could drive productivity gains going forward.

Artificial Intelligence (AI) Is Not a Big Driver, but It’s Early Days Yet

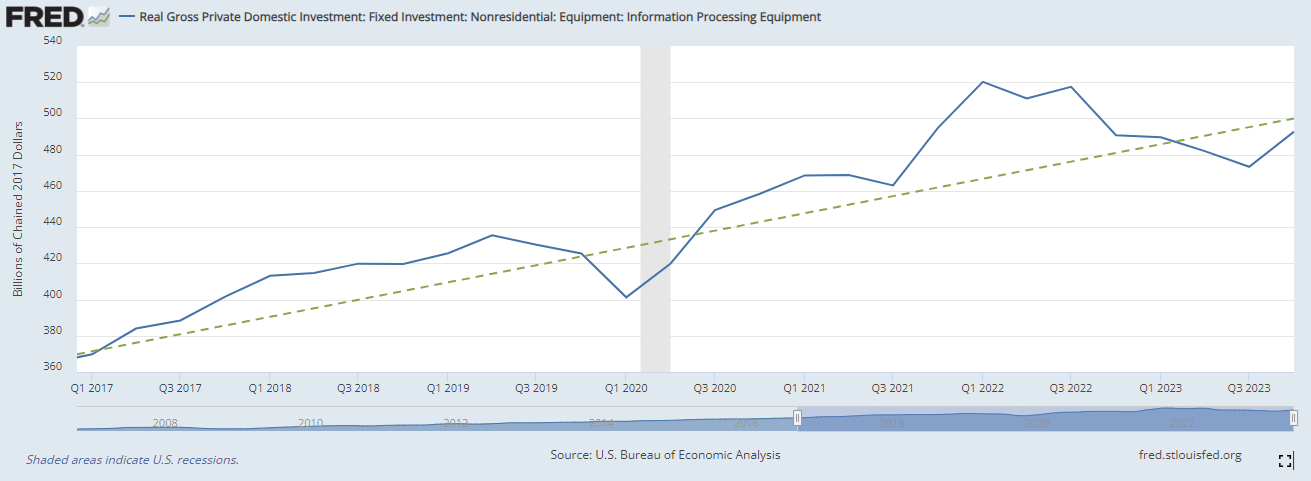

There’s been a lot of focus on generative artificial intelligence (AI) and its prospects to boost productivity. The reality is that we haven’t seen the impact of AI yet on a broad economic level. After adjusting for inflation, investment in information processing equipment is running below the 2017-2019 trend. It did pick up in the fourth quarter, but clearly we have some ways to go.

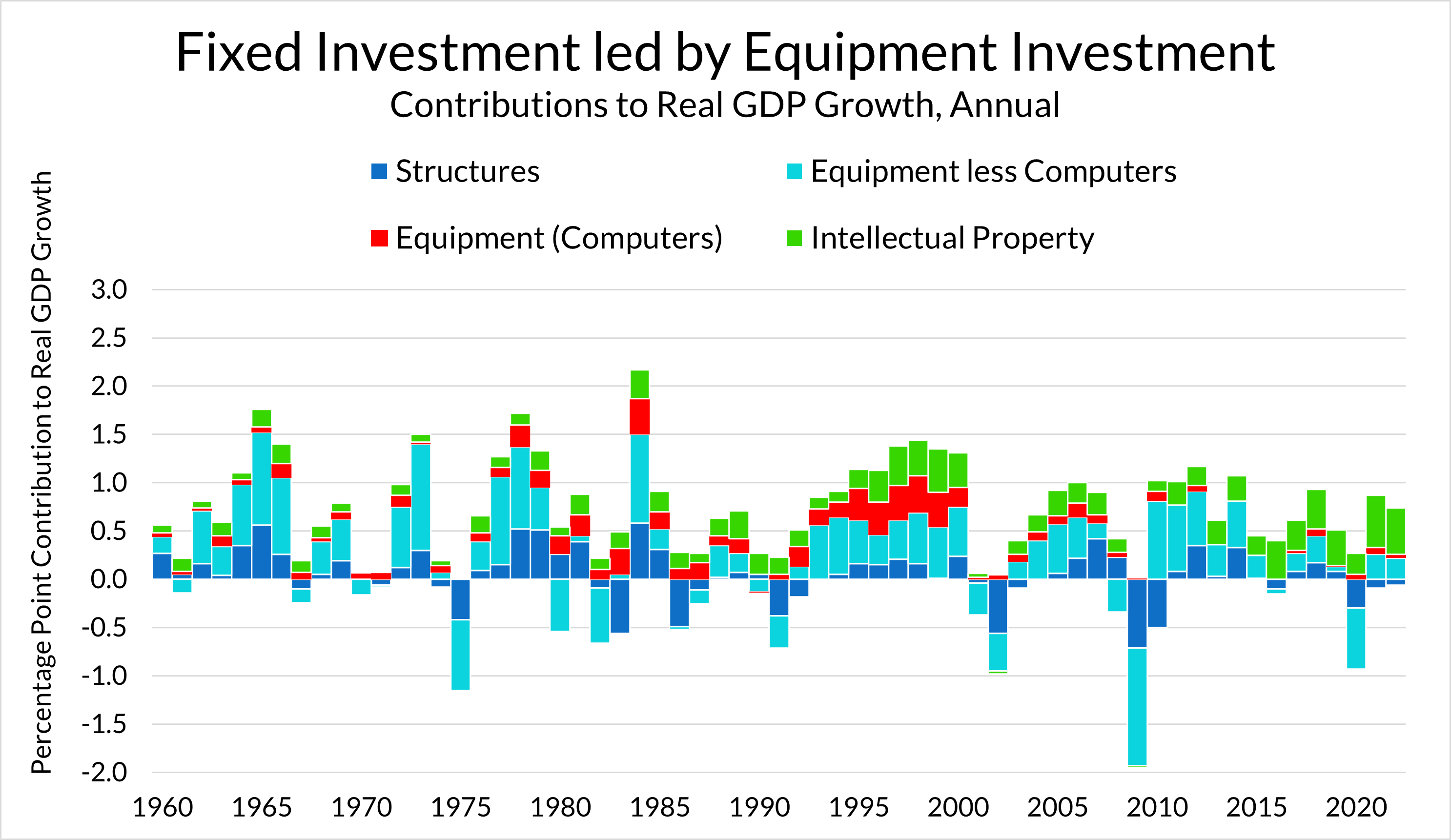

The productivity surge in the late 1990’s came on the back of a boom in business investment, and notably, investment in computer equipment. As Preston Mui, an economist at Employ America, points out, investment in computer equipment made a significant contribution to GDP growth between 1995 and 1999 (side note: I highly recommend their series on productivity “The Dream of the 90’s”). Investment in software is actually calculated as part of “intellectual property products investment” within GDP, and even this played a big role, as you can see in this chart from the folks at Employ America.

Coming to today, the good news is that we just got a surge in productivity growth without much of a contribution from AI. But going forward, over the next several years, AI could turn out to be a significant driver. Companies are increasingly investing in AI, and it’s going to take time for that to turn into increased productivity.

The key is that we need investment to rise above the recent trend, and that’s going to get a boost if the Federal Reserve pulls back on their aggressive interest rate stance. We believe they are going to start that process in a few months, especially as inflation continues to ease. Lower inflation combined with income growth that is propelled by a relatively strong labor market will keep consumption (and the economy) humming. That’s another key factor that will push businesses to invest. In contrast, if companies believe economic growth is going to ease to the relatively low levels we saw last decade, there’s going to be less incentive to invest.

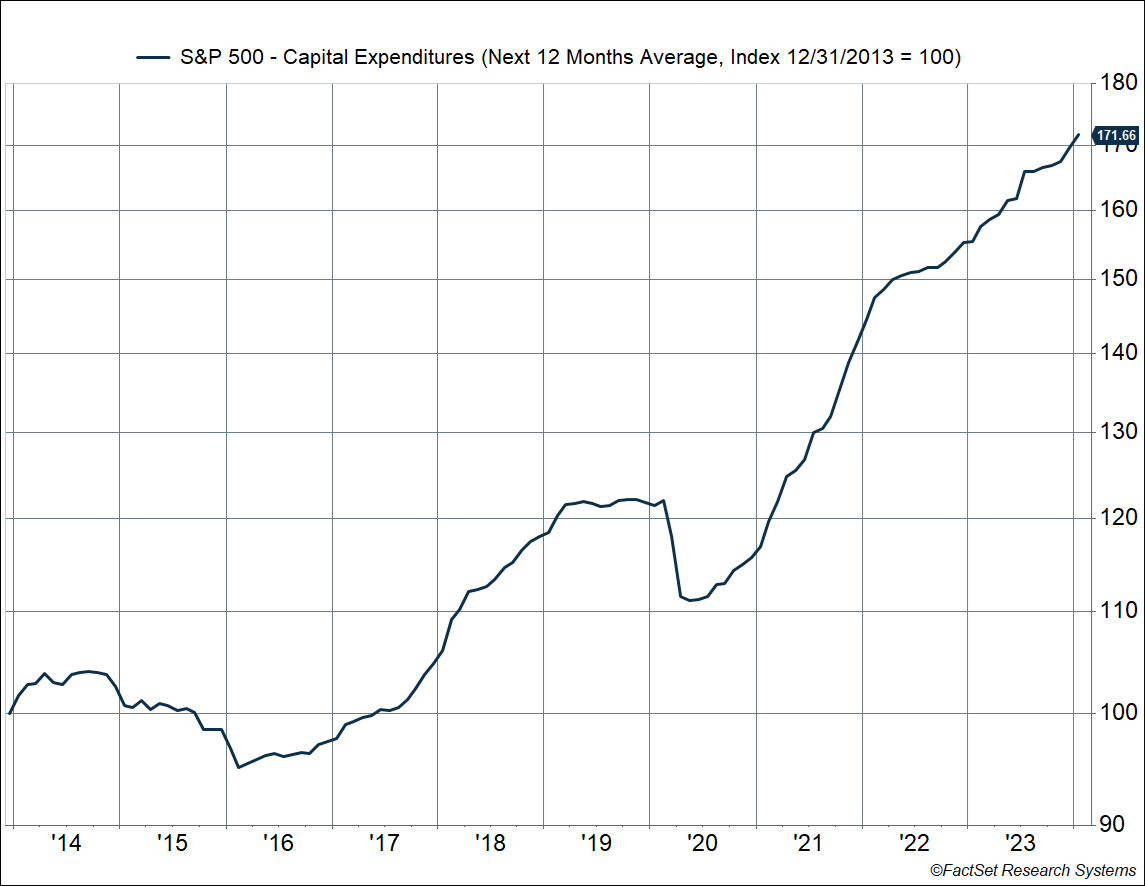

The good news is that the latest earnings season shows forward expectations of capital expenditures (capex) for companies in the S&P 500 continuing to push higher. Over the 6 years from 2014 to 2019, forward capex rose 22%. Since the end of 2021, through January 2024 (2 years and 1 month), forward capex has grown 21%.

We believe the economy may have turned the page on the last decade of lackluster economic growth and low productivity, which is also why we’re overweight equities in our strategic Carson House View portfolios, and overweight U.S. equities in particular. As we wrote in our 2024 Outlook, “seeing eye to AI” on productivity, it is not so much about the immediate impact of AI on economic growth, but rather the forces that create and foster it. AI itself is a strategic play that can support the long-term growth of corporate profits. And in the near term, it’s about continued innovation that investment makes possible.

Ryan and I talked about productivity and payrolls in our latest Facts vs Feelings episode. Take a listen below.