We started the year believing the economy would avoid a recession and that markets would rebound, and everything that’s happened since has mostly reinforced that view, which we outlined in our Mid-Year Outlook. At the same time, investing is about dealing with probabilities as opposed to thinking in terms of binary outcomes.

Ryan and I were recently honored to join Investment Masterminds with Jeff Thomas from Swan Global Investments, and one of the questions we got were what risks we were worried about (you can watch the full interview here). It seems like this is in the air quite a bit – I’ve been invited to speak at a wealth management retreat on a panel titled “All the things that could go wrong.”

So, I thought I’d write about it. I could name any number of things that could potentially go wrong – a bank crisis (a la SVB), commercial real estate, etc. – but I’m not too worried about those things.

What I do worry about is an energy price shock.

Falling energy prices have been the big reason why inflation’s fallen from a peak of 9.1% to 3.2% as of July. Of that 5.9 percentage point drop, 4.0 percentage points were due to falling energy prices.

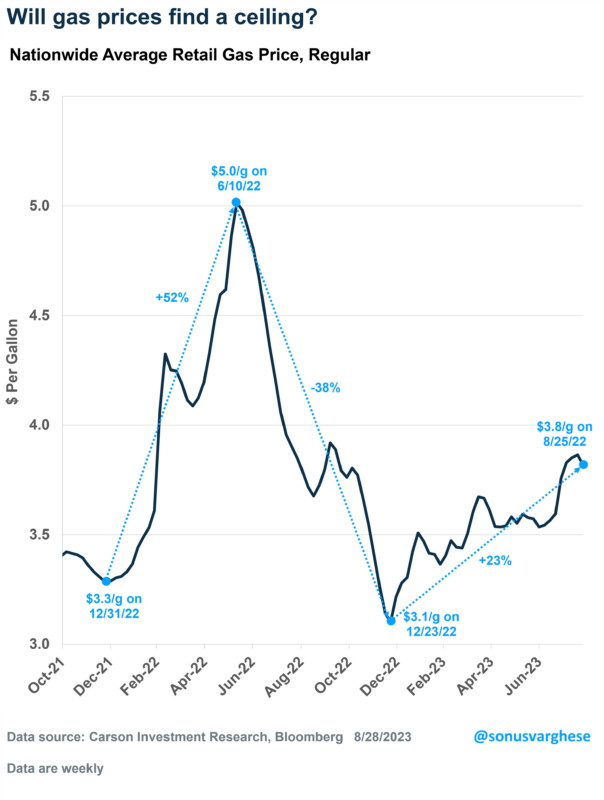

Gas Prices Have Been Moving Higher Recently

The nationwide average gas price hit a peak of $5.0/gal in June 2022 (the month inflation peaked). It subsequently collapsed 38% to hit $3.10 at the end of last year. Since then, it’s been rising fairly steadily up until June, and over the past 6-7 weeks, we saw bit of a spike to $3.80. Note that energy prices in the official inflation data have remained flat (through July) because of falling gas utility prices, which have come on the back of collapsing natural gas prices. Of course, the question is what happens next.

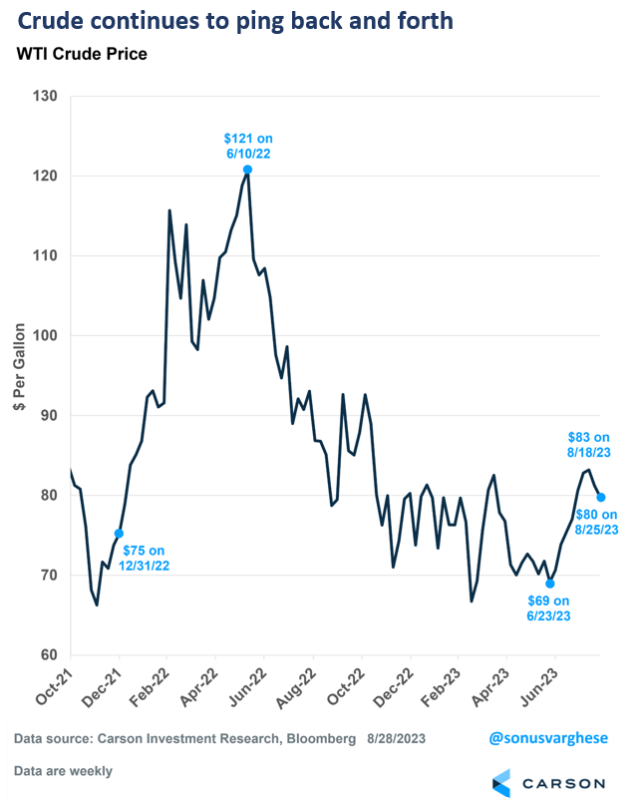

Gas prices are mostly driven by oil prices, and oil’s rebounded over the past two months as well. WTI crude prices have risen from about $69 a barrel to $83. There was a pullback last week to $80, bringing it back into the fairly tight range we’ve seen since last November.

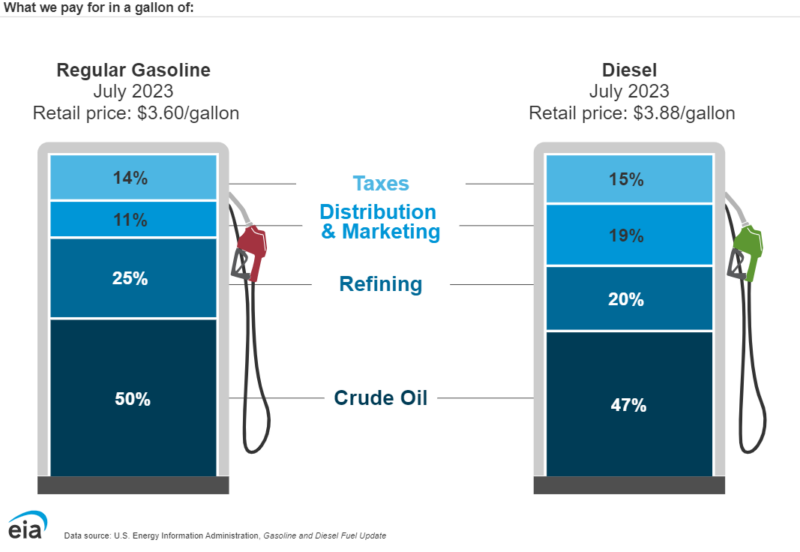

However, oil prices are not the only thing that determine gas prices, or even diesel prices. Another major factor (and a volatile one) is refining spreads. Refining or “crack” spreads are the price difference between crude oil and refined product. Here’s a schematic from the Energy Information Administration (EIA) showing what makes up prices at the pump. Oil prices account for just about 50% , while refining spreads make up 20-25% of the rest. High refining spreads are why gas prices at the pump didn’t fall significantly even when crude oil prices fell below $70 a barrel back in June – average gas prices remained around $3.60.

The chart below shows crack spreads for gasoline and diesel, and a few things stand out. Spreads spiked last summer, contributing to high inflation. They’ve pulled back since then but remain well above pre-pandemic levels (when they averaged below $20 a barrel). Spreads are rising once again, especially diesel crack spreads. That worries me.

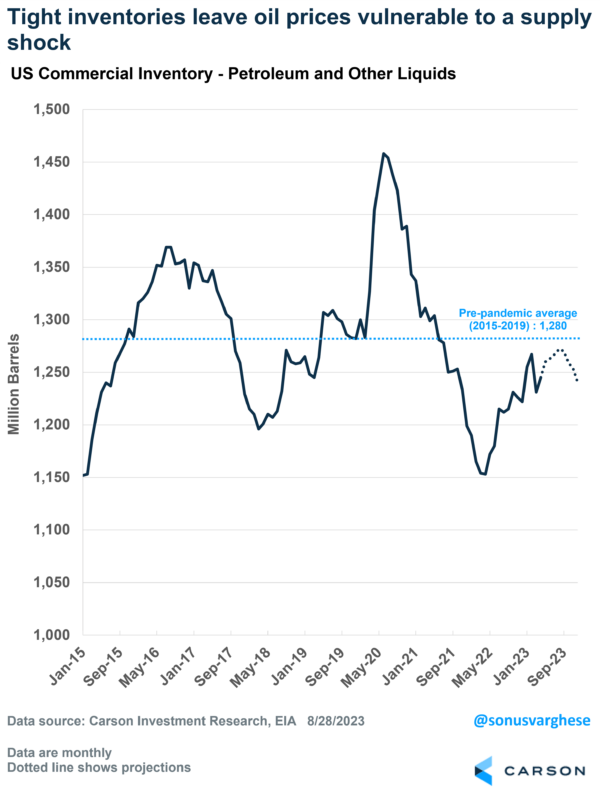

Low Inventory Leaves Us Vulnerable to a Supply Shock

Crack spreads usually rise when there’s not much inventory of refined product, i.e. low stocks of gasoline, diesel, and even jet fuel. This is due to various reasons, including refinery closures and lack of investment in capacity.

Also, US oil production is climbing on the back of improved productivity, and is on track to a hit a record high of 12.8 million barrels per day in 2023, and 13.1 million in 2024. Despite that petroleum inventories are running below 2015-2019 averages.

The problem with low inventories is that it leaves prices vulnerable to supply shock. This is what happened when Russia invaded Ukraine. We got another reminder of this last week, when a storage tank caught fire at an oil refinery in Louisiana, the third largest in the US. As a result, some fuel processing operations shut down, and that sent diesel and jet fuel prices up 5% last Friday. Prices pulled back more than 3% on Monday, but both jet fuel and diesel prices have been on an upward trajectory recently.

An Energy Spike Can Be Negative for the Economy

The immediate impact is on pump prices, which is most salient with consumers. That’s going to hit consumer confidence, which tends to be correlated with gas prices.

Then we also must think about how the Federal Reserve reacts. They focus on core inflation, which excludes energy. However, last year, they accelerated the pace of rate hikes in June from 0.5% to 0.75% on the back of an energy price shock.

At the same time, higher energy prices can also show up in core inflation, via higher diesel and jet fuel prices. As the economists at Employ America have noted, airfares are particularly sensitive to jet fuel prices. Food costs are also very vulnerable to diesel prices. And higher food costs can feed into restaurant prices, which is part of core inflation. It can also increase transportation costs, including freight.

This immediately becomes a problem for two reasons in particular:

- It may force the Fed to react and raise rates again, and quickly.

- It reduces households’ real income, i.e. incomes adjusted for inflation, which would hit consumption.

We saw both play out last year. The economy was resilient enough to get through it, but I’d rather not see the economy battle through that again.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Again, as I noted at the top, this is not our base case. We do think a lot more things are going right than wrong. However, we account for potential risk when creating portfolios. In our house view models, we remain overweight equities, underweight long-duration bonds, and overweight commodities, to account for all of this.

Ryan and I talk about a lot of these things every week on our podcast Facts vs Feelings. Take a listen below: