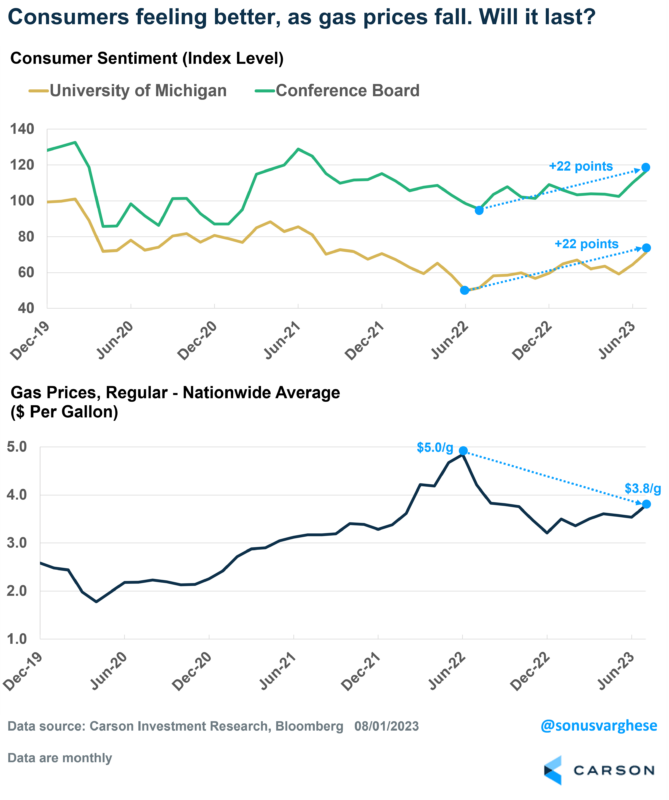

Consumer confidence has been rising since last summer, and over the last couple of months, it has jumped even more. Both the University of Michigan and the Conference Board’s measures of consumer confidence have risen 22 points since last summer. A simple reason is… gas prices.

Confidence hit a bottom right around the time gas prices hit a peak of $5 a gallon (nationwide average). Since then, gas prices have fallen by almost 25% to $3.78 a gallon as of last week. We’ve written in the past about how gas prices are correlated with consumer confidence. So, it wasn’t a huge surprise to see confidence tumble as gas prices surged, and then start to pick up again as pump prices fell.

Now, the worry is that gas prices are starting to creep up again. In fact, prices are up from a low of $3.10 a gallon back in December. The good news is that consumer confidence has continued to move higher during this period.

Offsetting the negative small rebound in gas prices are two other major items adding to consumers’ wallets.

One, grocery store prices are pulling back. The CPI index for “food at home” has fallen 0.5% since February, and signs point to that continuing. Remember egg prices? They had soared 70% year over year in January 2023. But prices have pulled back sharply since then and are now just 11% higher than in January 2022.

Two, prices for utility services are also pulling back. Natural gas prices surged in 2022, taking the CPI for piped gas services up 27% year-over-year in January 2023. Again, as with egg prices, there’s been a big pullback, and prices are now below where they were in January 2022.

Despite a small rebound in gas prices, if you throw all these together into one big “commodity” bucket, falling prices overall are boosting confidence.

Next up for rising confidence should be an obvious one. Stock prices.

The S&P 500 has rebounded 30% since its October low, leaving it just 2% off its prior all-time high. Those gains are probably welcome for anyone looking at their investment/401k accounts. Since last year, Ryan and I have been talking about how stocks could rally this year, but it is nice to get the confirmation. Even better, as we wrote in our Mid-Year Outlook last month, we expect more gains this year. Though the next two months could see a bit of a pullback – as Ryan wrote the other day, stocks have historically struggled in August and September.

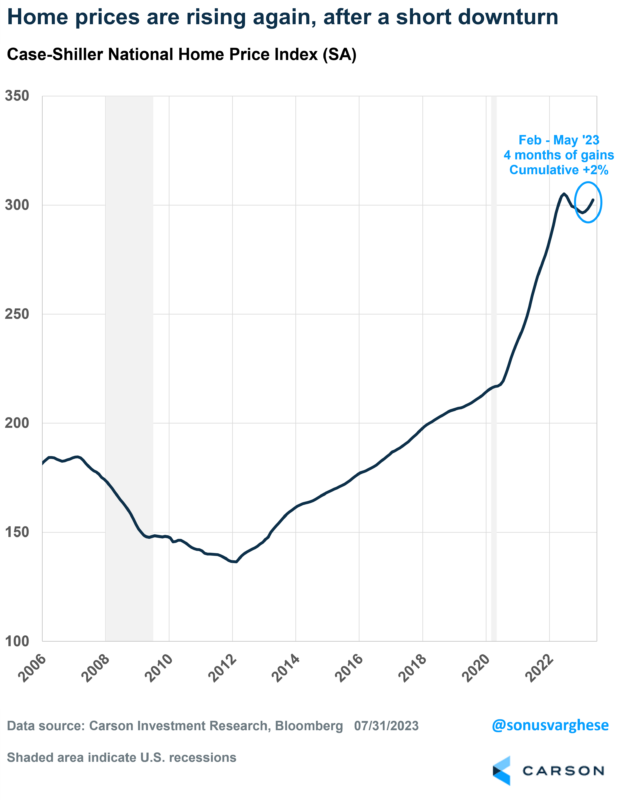

Finally, perhaps a not so obvious, but still a very important one: home prices.

66% of American households own their homes and have a lot of their wealth tied to it. So, it’s never pleasant to hear that home prices are falling. Obviously, there’s no one place where you can see the value of a home go up and down daily, like a stock portfolio. Nevertheless, it’s not far from headlines when home prices fall. Home prices did decline after the Federal Reserve raised rates last year to fight inflation. The Fed’s rate hikes sent mortgage rates from 3% to 7% and predictably, housing activity crashed.

But here’s what’s interesting: home prices are rising again. The Case-Shiller Nationwide home price index fell 3% between July 2022 and January. However, prices have seen four consecutive months of gains, rising 2% between February and May, offsetting a good portion of the decline. I want to note that this is a broad national average and may not reflect any particular market.

Most homeowners probably purchased their homes (or refinanced) when mortgage rates were at 3-4%. Safe to say, a lot of them are probably reluctant to part ways with that mortgage and buy a home that is more expensive, with a mortgage rate that is almost double their existing one. As a result, inventory of homes is running extremely low, around 1.1 million units as of June. For perspective, inventory hit 4 million units in 2007 (when home prices crashed) and was about 1.6 million just prior to the pandemic. At the same time, there’s a lot of demand – the largest age cohort in America right now are 25-34 year-old millennials, who are now in their prime-home-buying age. But there’re barely any homes to buy. No surprise that properties remained on the market for just 18 days in June. 76% of homes sold in June were on the market were for less than a month!

Low supply + high demand is a recipe for higher prices. That’s good for existing homeowners, but not so much for prospective buyers. The Fed has basically frozen the existing home sales market. A lot of buyers are being pushed to new homes – which is why builders are feeling good, but there’s just not enough inventory on the new homes side.

All this means there’s pent-up demand for homes. Think of all the Americans who have to move for the usual life-changing circumstances but can’t find a home to buy. We could potentially see a flood of inventory if mortgage rates pull back, perhaps to the 5-6% range next year, assuming inflation falls and the Fed starts to ease. But even then, we may not see falling prices as the market may be able to absorb even double the current inventory.

While housing has been a drag, it’s turning and we may have just witnessed one of the shortest housing downturn cycles on record. And as a result, homeowners are not seeing a drawdown of their home equity. Another reason to be positive.

1854186-0823-A