We’ve been getting a string of “economic surprises” from the consumer side for several months now. Employment data is a prime example, with monthly payroll gains coming in above expectations for 14 straight months. For a change, we just got some good news from the business side, particularly business investment.

The Census Bureau collects data on manufacturers’ shipments and new orders for durable goods – big ticket items like transportation equipment (including vehicles and aircrafts), machinery, computers and electronic products, electrical equipment, and appliances, etc. New orders are particularly useful because it tells us how businesses are viewing current and future economic conditions and investing accordingly. It also tells us about future production commitments for manufacturers.

Well, new orders rose 1.7% in May, even as economists expected orders to decline almost 1%! New orders are now up 5.4% since last year, and this pace is higher than what we saw at any point in 2019.

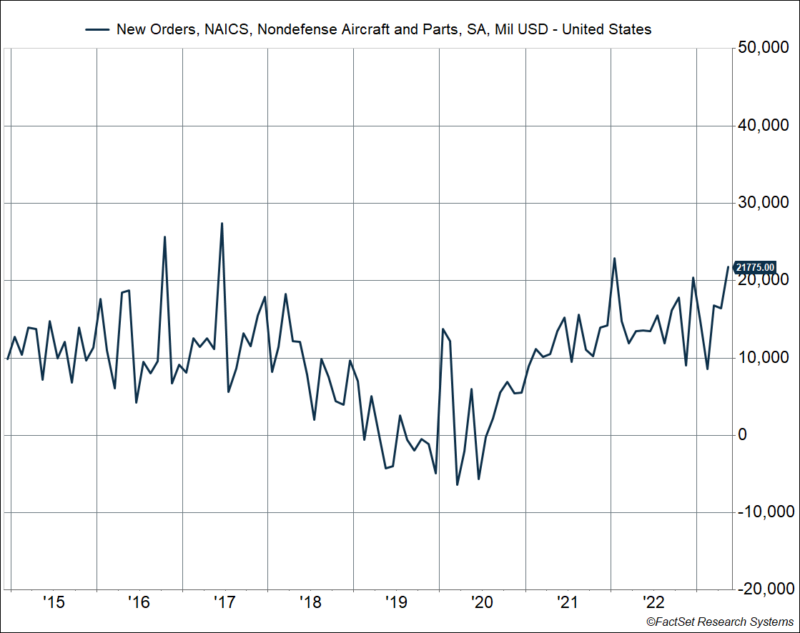

A large part of this is because of nondefense aircraft orders, which surged 32% in May, and a whopping 61% over the past year. This is huge for America’s aircraft industry – the recent uptrend stands in sharp contrast to what we saw in 2018-2019 when aircraft orders were declining amid Boeing’s 737-Max woes.

However, as you can see above, aircraft orders are really volatile. It helps to strip them out, along with new orders from the defense industry (which can also be quite volatile).

What’s left is a key economic datapoint – a category called nondefense capital goods ex aircraft, which is really a proxy for business investment, or capital expenditures (“capex”). This rose 0.7% in May, yet another datapoint that beat forecasts (expectations were for a 0.1% increase). New orders for these “core capital goods” are now up 2.1% from last year and rising at a 3.2% annualized pace over the first 5 months of this year.

Now, this data is nominal, in that it’s not adjusted for prices. And we’ve had a lot of inflation over the past year and a half. But even after you adjust for inflation, this proxy for business investment rose 0.3% in May, following a 0.5% increase in April. Investment in real terms has been falling since the beginning of 2022, and so the 0.8% uptick over the past two months is very welcome.

Here’s something a lot of people don’t talk about when they compare today’s economy to the pre-pandemic economy, which is widely recognized as strong: business investment collapsed in 2019, amid a lot of uncertainty around the trade war, and escalating tariffs. Hopefully, the recent uptick not only reverses the downtrend from last year, but also the pre-pandemic downtrend.

We do recognize that two months do not make a trend. But other data also corroborate the fact that businesses are investing again.

Something big is happening in America

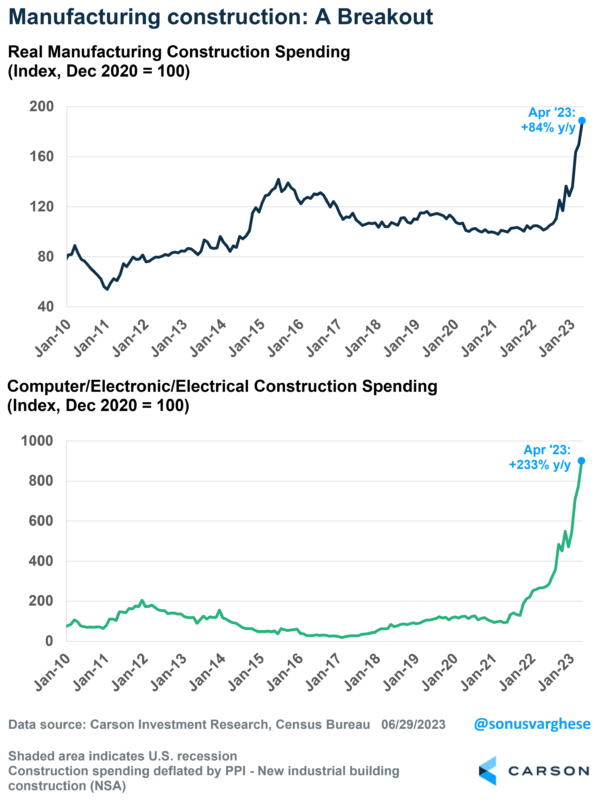

Nonresidential construction is booming, mostly thanks to manufacturing construction. I discussed what was happening a few months ago, but there has been no slowdown in the data since then. Even after adjusting for inflation, manufacturing construction is up 84% over the past year through April. Most of this is being driven by a 233% increase in construction in the computers, electronics, and electricals sector, i.e. semiconductor and electrical vehicle battery plants.

The chart below shows how manufacturing construction was stagnant across most of the past decade, but it seems to have broken out now. There was an inflection point last summer after Congress passed the CHIPS Act, and the Inflation Reduction Act (which had less to do with inflation and more to do with promoting investment via subsidies and tax credits). Also interesting, this is a phenomenon that is happening only in the US – other developed countries like Germany, Japan, UK, and Australia are not seeing a similar surge.

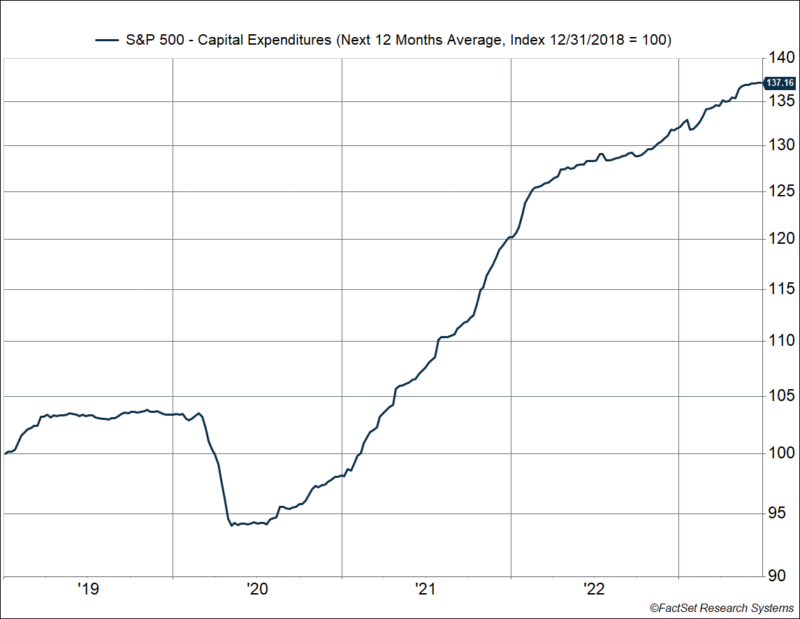

Finally, if you look at just S&P 500 companies, capital expenditure expectations over the next 12 months have been rising consistently this year. Forward-looking capex expectations are up almost 4% over the first six months of this year, and up 7% compared to a year ago.

This is not something that would be happening amid a slowdown, let alone a recession. The chart below shows how capex expectations were stagnant in 2019 amid higher uncertainty. That’s not the case today, even amid all the recession forecasts.

Business sentiment has been quite poor, perhaps because of all the headline-grabbing recession forecasts. However, the hard data suggests that businesses are investing and looking to expand capacity – a sign that they view future economic conditions positively when it comes to putting money to work.

Ryan and I talked about this in our latest Facts vs Feelings podcast. Take a listen.

Ultimately, this is good for the economy today, but also for the future, as increasing business investment is the best path to increasing productivity and a better economy for all of us.