It is that wonderful time of year again where mutual fund capital gain distributions are compared to lumps of coal in investor’s stockings. A rebounding stock market and another year of outflows from actively managed mutual funds means capital gains distributions for remaining shareholders. Traditional mutual funds face this problem due to the fact that they have to sell securities to fund investor outflows, as well as through the ongoing management of the strategy. This creates gains inside of the mutual fund, and therefore capital gains tax, that must be paid by investors who didn’t leave. On top of that, investors that sell out of the fund before the capital gains distributions pay out magnify this effect, as the fund then must take gains to fulfill the redemption request and the investor base shrinks. Remaining investors pay the price in the form of other investors’ capital gains.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

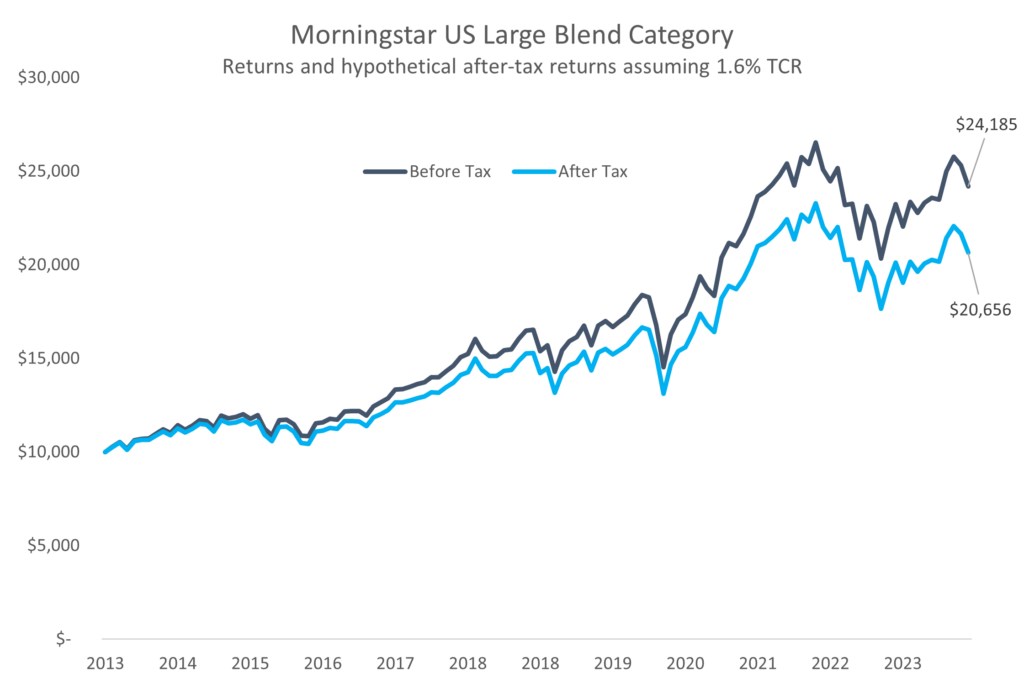

While capital gains do not directly affect returns, they do affect the overall wealth level of taxable investors. The chart below shows this effect over time, assuming 1.6% of your returns are paid in taxes annually (the current 10-year tax cost ratio for the large blend category). The total wealth outcome can be substantial even at a fairly low tax cost ratio.

Source: Morningstar as of 10/31/23

Luckily, Exchange-Traded Funds (ETFs) have been able to largely solve this problem. Redemptions from ETFs can be funded in-kind, using a basket of securities that represent the fund’s holdings. By funding redemptions this way, there is no gain taken inside of the ETF, and therefore no capital gains distribution to pay out. There is also a degree of cost basis selection the manager can make during these transactions, generally sending out the lowest cost basis stock shares and therefore reducing the ongoing tax burden of the ETF even further. This transaction occurs behind the scenes between ETF issuers and market makers, so don’t worry, if you sell your ETF you will have a capital gain or loss depending on your cost basis, but won’t be stuck with hundreds of underlying securities.

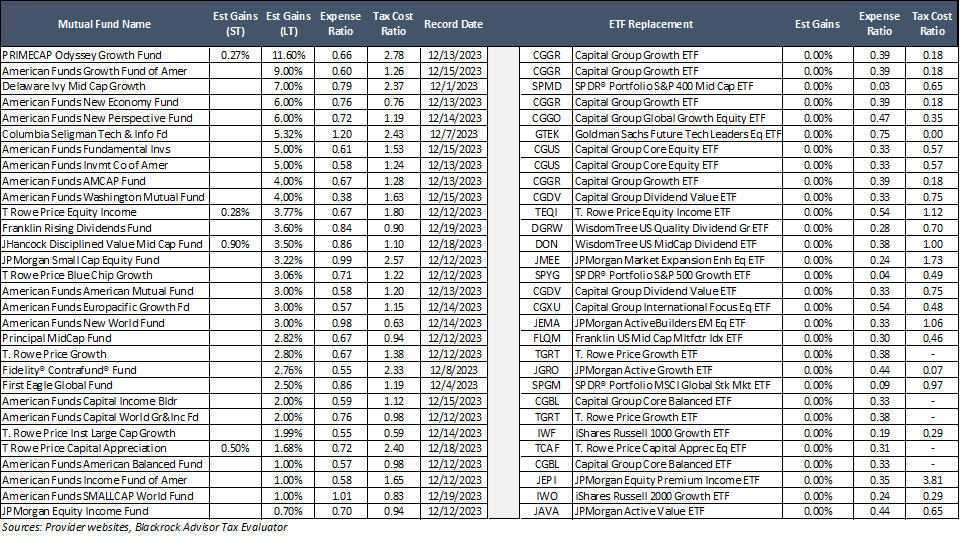

As capital gain estimates for this year have been released across a number of large active mutual fund firms, we wanted to take a look at some of the largest legacy mutual funds on our platform. Many of these funds are actively managed U.S. equity strategies that have faced outflows and are sitting on appreciated securities. As a result, there are expectations for gains ranging from 1% to as high as 11%. The chart below shows these estimates (if a range was given, the high end was chosen) as well as an ETF on the Carson platform that can be used as a replacement. Generally, these ETFs will have a similar correlation, risk profile, and strategy objective to the mutual fund replacement. For some balanced or allocation funds, selling and moving into a multi-asset model would also be a strong option. We also included ‘Tax Cost Ratio’ which is essentially the amount of return over the past 1-3 years that would have been lost to taxes. For example, a 2% tax cost ratio indicates that over the past year, 2% of returns would have been owed in taxes either due to capital gains or income. Note that high-income strategies will show a larger tax cost ratio.

Keep in mind that selling in advance of the capital gains paying out will be subject to taxes as well. Generally speaking, if the gain on the mutual fund is lower than the expected capital gain (taking into account short vs long-term) it would make sense to sell and avoid the gain. However, every client’s tax situation is different.

Please reach out to the Carson Investment Research team by emailing investments@carsongroup.com if you have questions or want to discuss additional ETF replacements.

1973194-1123-A