Warren Buffett just released his 2023 shareholder letter, and as always, it was a masterclass in explaining corporate finance concepts in simple English (something all of us can aspire to). Buffett also had a nice tribute to his long-time business partner/friend, Charlie Munger, who passed a few months ago. One thing in that tribute caught my eye, something Buffett said Charlier advised him on way back in 1965:

Warren, forget about ever buying another company like Berkshire. But now that you control Berkshire, add to it wonderful businesses purchased at fair prices and give up buying fair businesses at wonderful prices. In other words, abandon everything you learned from your hero, Ben Graham. It works but only when practiced at small scale.

It’s interesting to think about that a bit. Munger essentially told Buffett to forgo “value” investing by itself. Instead, he asked him to focus on “quality,” “value,” and “low risk”.

Researchers from AQR published a fascinating paper on “Buffett’s Alpha” way back in 2013 (and updated in 2018). They found that Buffett buys stocks that are:

- Safe, i.e. less volatile

- Cheap, i.e. value stocks with low price-to-book ratios

- High quality, i.e. profitable and stable, with high payout ratios (to shareholders)

In short, just as Munger advised Buffett: buy low risk, cheap, and high quality companies.

But that’s not all …

Two Other Factors Boosted Buffett’s Performance

The AQR researchers found that Berkshire Hathaway’s Sharpe Ratio (a measure of returns after adjusting for risk) is 0.79 from 1976-2017. That’s about twice that of the broad market, but it’s not spectacular. They also found that Buffett’s Sharpe ratio reflected high average returns, but also significant risk and drawdowns. Berkshire’s volatility is significantly higher than the market despite a portfolio of relatively low risk, quality stocks – clocking in around 23%, which is about 1.5 time the volatility of the S&P 500.

By itself, the Sharpe ratio wasn’t enough to explain Buffett’s rise as one of the wealthiest individuals in the world. So, what else accounted for it?

Leverage

While a “dirty” word for a lot of investors, Buffett embraces it whole-heartedly. The researchers found that Buffett boosted his returns using leverage, to the tune of about 1.7-to-1. Applied to a low risk, cheap, and high quality stock portfolio, that leverage boosted returns (and risk). But, simply levering up a similar portfolio of stocks doesn’t get you the same massive returns. Instead, it’s the source of leverage, including their terms and costs.

Stable and Cheap Financing

Buffett’s not borrowing money on margin like you and I would perhaps do, and he’s not getting charged at a premium over the risk-free rate (currently at 5.25-5.5%, where the Fed sets it). Instead, Buffett’s able to borrow money at really low rates. For one thing, Berkshire was rated AAA for a very long time.

More importantly, it’s their “insurance float.” These are the insurance premiums Berkshire collects up front from their property/casualty insurance customers. And they have to pay claims only later, which leaves Berkshire holding large sums of money. Using Buffett’s own words, “We get to invest this float for Berkshire’s benefit.”

As a result, it turns out the estimated cost of Berkshire’s leverage has historically averaged about 1.72%. That’s 3%-points below the average risk-free Treasury bill rate. You and I, or anyone else, will typically pay a premium above the risk-free rate to borrow money.

Make no mistake. Buffett’s a great stock picker, and as the researchers note, his success is neither luck nor magic. It’s reward for successfully implementing a consistent investment philosophy of buying low risk, cheap, quality companies. Then he doubles down on that with cheap leverage.

Buffett’s latest letter actually highlighted this beautifully.

The Japan Bet Pays Off, Huge

Buffett noted in his letter that they now own about 9% of 5 large Japanese companies. They originally acquired a 5% stake in them by August 2020, for his 90th birthday. At the time, he said he was “confounded” by the opportunity, and amazed how cheap they were, while also having the potential to increase dividends over time. Buffett likes dividends, even though Berkshire doesn’t pay a penny out in dividends – read my blog from last year on why.

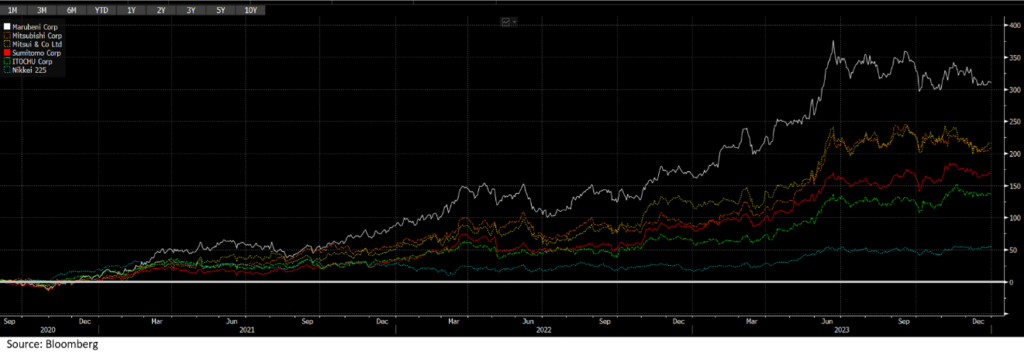

Anyway, Buffett’s “bets” have paid off handsomely. Here are returns from August 31, 2020 through December 31, 2023 (using Bloomberg) for the 5 companies he owns:

- Marubeni: 310%

- Mitsubishi: 209%

- Mitsui: 216%

- Sumitomo: 169%

- Itochu: 136%

Meanwhile, the Nikkei, which just hit a new all-time high last week, is up 55% over the same period. For comparison, the S&P 500 is up 44%. In fact, Buffett’s best performer, Marubeni, was running ahead of Nvidia up until the end of 2023, which had a total return of 271% over the same period (it’s surged ahead recently).

Anyway, that’s confirmation that his “stock picking” skills are still going gangbusters even at this age. But the story STILL isn’t over. It’s even better than that.

If you and I had to buy Japanese stocks, we’d have to first convert our US dollars into yen, and then use those yen to buy shares of Japanese companies on the Tokyo exchange. This is essentially what foreign stocks ETFs do. But that leaves the holdings exposed to currency risk.

Say for example, on Dec 31, 2020, an investor converted $100 into yen. They would have received JPY 10,300. And let’s assume they piggy-backed off Buffett’s skills and bought shares of Marubeni. That JPY 10,300 would have risen to JPY 44,200 by the end of last week (2/23/24), thanks to a 329% return. However, if we converted the yen back to USD, we’d get $295, i.e. a return of 195%. That’s not bad, but it’s a lot less than 329%, and the difference is because the yen depreciated about 50% against the US dollar.

Now, you can hedge for currency risk, but there’s costs associated with that, though it would’ve played in your favor recently (as our friends at WisdomTree will attest to).

But Buffett did better than that. As he wrote in his letter:

Neither Greg nor I believe we can forecast market prices of major currencies. We also don’t believe we can hire anyone with this ability.

Here’s what they did: The above numbers are hypothetical but they’re all part of what was going in the background. According to the letter, the cost of Buffett’s five holdings (accumulated over time) was 1.6 trillion yen. At the end of 2023, it was worth 2.9 trillion yen. As it turns out, Buffett “financed” most of his Japanese positions by selling bonds worth 1.3 trillion yen.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

In short, Buffett borrowed money (despite having a ton of cash), and he borrowed in yen from Japanese citizens. Then he bought stocks with that borrowed money. Not only did the stocks go up, but he was not exposed to the currency at all. The interest payments on that debt are likely at rates much lower than US interest rates, and since they’re denominated in yen, they’re worth less for Berkshire (which earns revenues in US dollars). Eventual principal payments are also going to be worth less in US dollar terms, offsetting any loss from currency depreciation on the stock side.

Once again, Buffett picked the right stocks, and pretty much levered the entire position with ultra cheap financing. It’s also nice that he tells us how he does it.

That’s why he’s a legend.

For more of Sonu’s thoughts click here.

02134175-0224-A