The Federal Reserve (Fed) didn’t raise rates in June, leaving the Federal Funds rate in the 5-5.25% range. This was the first meeting in which they held back ever since they started raising rates back in March 2022.

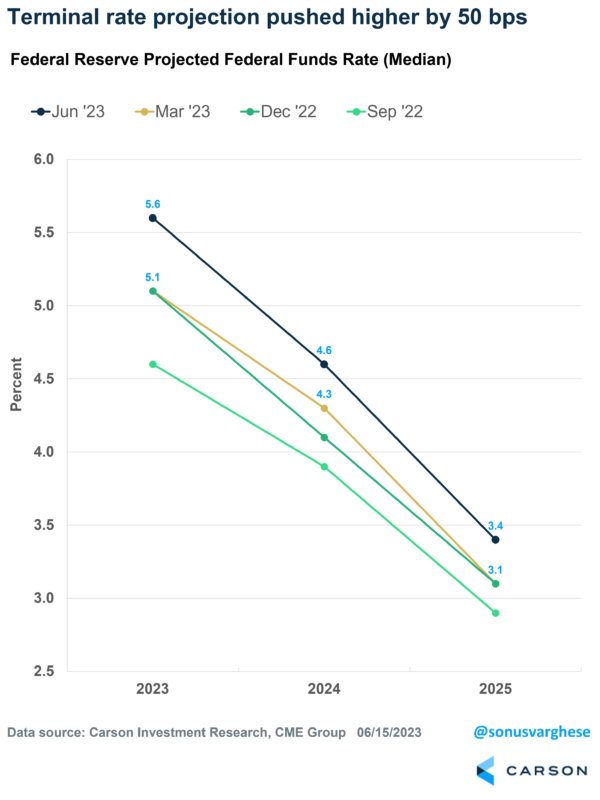

However, the big news was that Fed members project rates to be 0.5%-points higher than what they projected back in March. Members updated their projections for rates to hit 5.6% at the end of 2023, up from the previous estimate of 5.1%. By itself, this was viewed as a very hawkish signal, despite the pause in rate hikes.

If you recall, the last set of projections was made in March soon after the Silicon Valley Bank crisis. At the time, they said that potential credit tightening would be equivalent to rate hikes, so they left projections unchanged.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Fast forward three months and the economy looks to have weathered the banking crisis, even as core inflation (excluding food and energy) remains elevated. Hence the update to where they believe rates should be at the end of 2023.

However, the rest of the materials they released, along with Fed Chair Powell’s comments suggest more rate hikes are not a certainty.

The Fed is (finally) acknowledging the economy’s resilience

Along with interest rate projections, Fed members also updated their economic projections. This is where things got interesting. The updated projections included:

- Raising 2023 real GDP growth from 0.4% to 1%

- Dropping the 2023 unemployment rate from 4.5% to 4.1%

Despite projecting more rate hikes, they seem to believe that economic growth will be stronger than they expected back in March, and the unemployment rate lower.

At the same time, they also expect inflation as measured by the core personal consumption expenditures index (their preferred measure) to be 3.9% y the end of 2023. In March, the expectation was 3.6%. The higher projection makes sense within the context of the economic strength we’re seeing currently (we’ve written about this).

Moreover, Fed members expect core inflation to slow to 2.6% in 2024, leading them to project interest rate cuts worth about 1%. Even as the economy grows 1.1% in 2024.

Take all these projections with several grains of salt. Moreover, these projections are not forecasts – instead, they’re more like best guesses.

However, it is a sign that Fed officials finally believe that inflation can slow down without a recession. That’s a significant turnaround from what they’ve been signaling over the last year, i.e. a huge economic slowdown/recession is necessary for inflation to fall.

In fact, Powell acknowledged that the conditions are in place for inflation to slow down – economic growth has fallen below trend though activity remains strong, the labor market is less tight, and goods supply chain disruptions are easing.

Pausing in June allows them to get more information about the impact of rate hikes and the banking crisis. Now, the July Fed meeting is only 6 weeks away and there’s not enough data that will give them that information. Instead, they’re looking for at least 3 months of data to see how things evolve.

That buys time and indicates that 2 more rate hikes (each worth 0.25%) are not a sure thing. At the same time, raising the 2023 estimate ensures that investors believe they are serious about curbing inflation, and gives them the optionality to increase rates if inflation remains persistent.

Good news: inflation looks to be headed lower

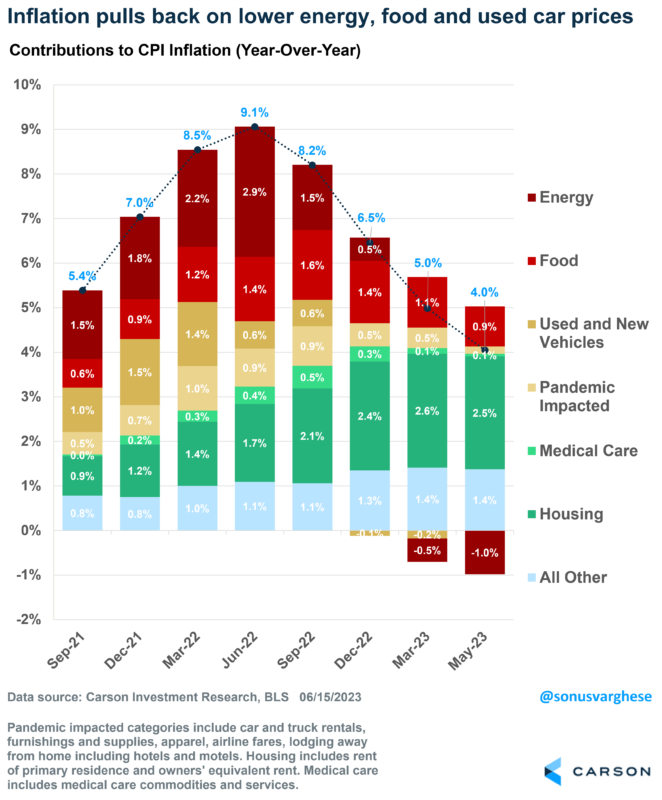

Headline CPI inflation has decelerated from a peak of 9.1% year-over-year in June 2022 to 4% in May. Over the past three months, inflation is running at a 2.2% annualized pace, the slowest 3-month pace since two and half years.

The big driver of the pullback has been energy, but more recently, food prices have also started falling. Vehicle prices, which boosted inflation last year, are also moving lower – used car prices rose over the last two months, but private data indicates that it’s going to reverse soon.

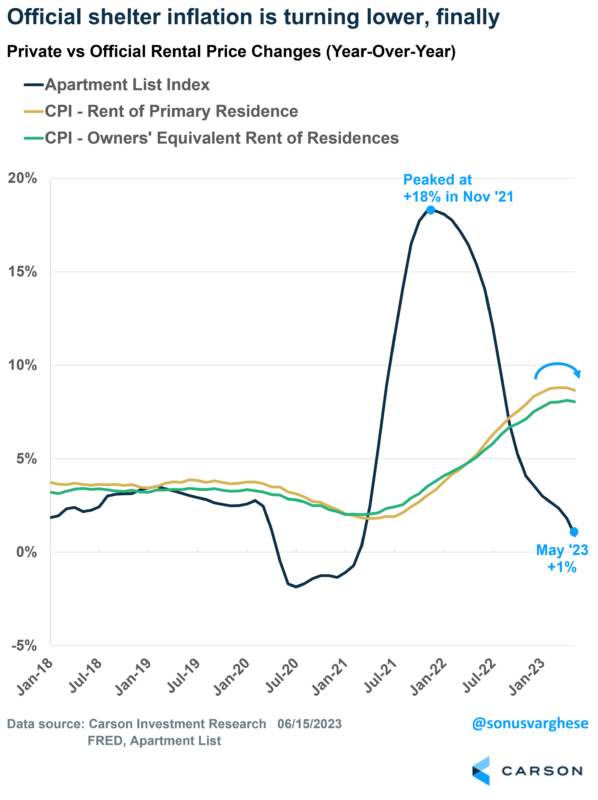

What’s left? As the chart below indicates, a lot of it is shelter inflation (the dark green bar). This is the main reason why core inflation remains elevated, running at a 5% annualized pace over the last three months. That’s simply too high for the Fed.

The good news is that shelter inflation looks to be at an inflection point. We’ve discussed in the past how the official rental inflation data has a significant lag to the private market data. Private data have been showing rents to be decelerating for more than a year now. It’s taken a while, but the official data is now turning around as well. It is a bit like turning an aircraft carrier around, and so it is going to take a while. But it is just a matter of time before core inflation decelerates on the back of falling shelter inflation.

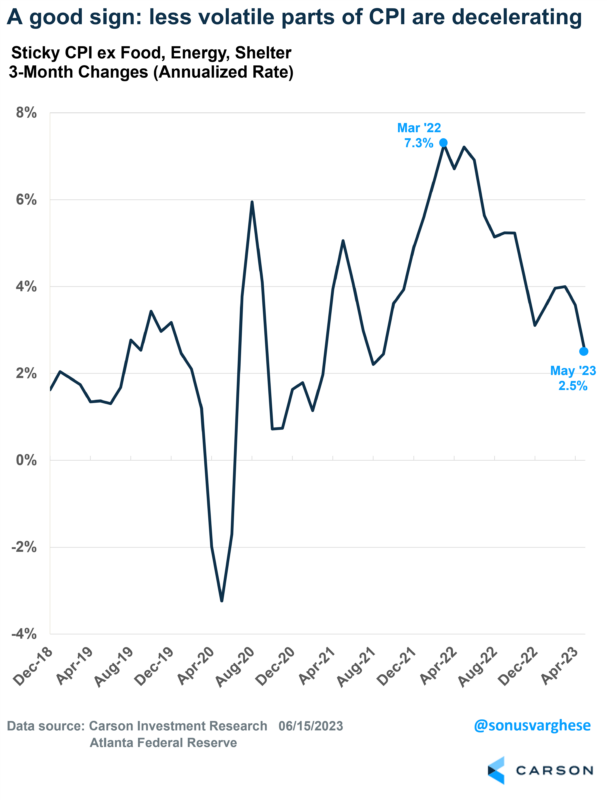

Now, the Fed has said that they need to see even services inflation excluding shelter decelerate. We received good news on that front. The Atlanta Federal Reserve calculates something called the Sticky Price CPI excluding food, energy, and shelter. It measures inflation for items whose prices typically don’t change frequently. Over the past 3 months, this measure is running at a 2.5% annualized pace, well below the peak of 7.3% we saw last year.

On top of this, the producer price index, which measures input prices for businesses and typically leads inflation, has collapsed to just 1.2% year-over-year in May. That’s well off the peak pace of 11.6% we saw in March 2022, and lower than the pre-pandemic average of 2%. Even excluding food and energy, PPI is down to 2.8% now from 9.7% 14 months ago.

All in all, there’s encouraging news on the inflation front even as the economy remains resilient. Powell’s comments reflect that. This

is why we’re not quite so convinced that two more rate hikes are baked in. But expect them to leave rates higher for longer.