Consumer credit card has recently been in the news after it hit a record $1 trillion. However, Ryan walked us through several reasons why this eye-popping number is not that concerning.

On the business side, rising bankruptcies have also been making headlines month after month, as chapter 11 filings this year exceed what we saw last year. There were 402 bankruptcy filings over the first seven months of 2023, close to double the 2022 rate and the highest since 2010. The blame has landed on higher interest rates and a tough operating environment.

Bond Markets Don’t Seem Concerned

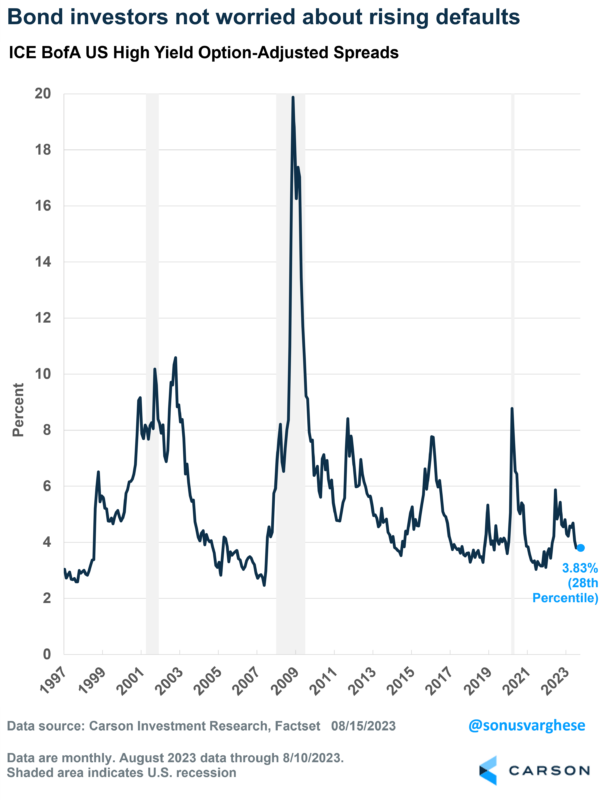

Interest rates have certainly risen thanks to an aggressive Federal Reserve looking to push inflation lower. However, bond investors don’t seem worried about a potential rise in bankruptcies and associated loan defaults, even for below investment-grade borrowers.

One way to monitor this to look at spreads for “high-yield” borrowers. These spreads represent the interest rate premium that companies rated below investment-grade companies have to pay over risk-free Treasury interest rates.

Typically, if investors expect economic hardship, and a higher likelihood of default, they will charge these companies higher interest rates on loans. That would result in larger spreads against Treasury rates.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

The good news is that high-yield spreads are currently at 3.8%, which is in just the 28th percentile across the data going back to 1997. The average spread across the entire period is 5.4%. The current spread is also below what we saw last June, which is when the Federal Reserve signaled they were going to get a lot more aggressive. Notably, as you can see in the chart below, the current level remains well below what we’ve seen ahead of prior crises, including in 2000 and late 2007.

Bond investors typically sniff out hard economic times for companies well ahead of other investors. And right now, they don’t see any signs of that.

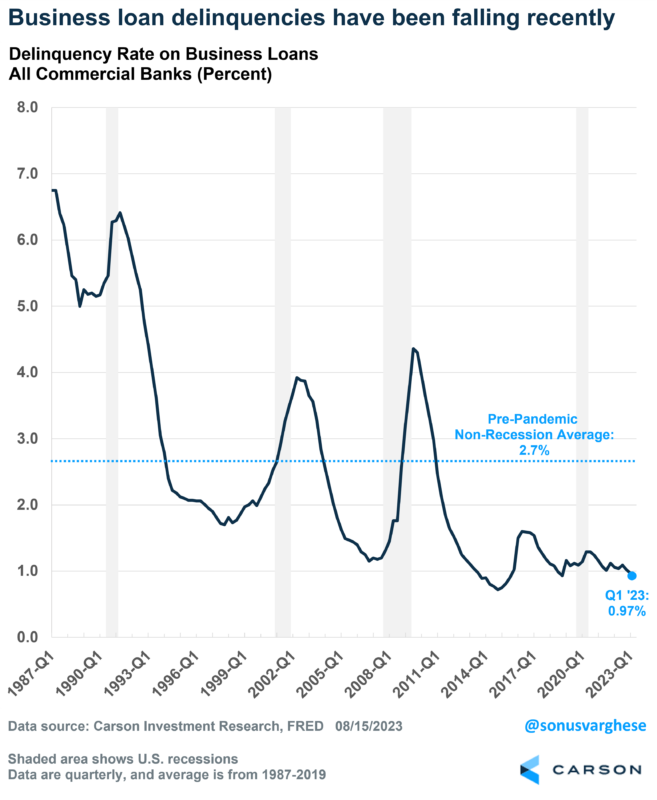

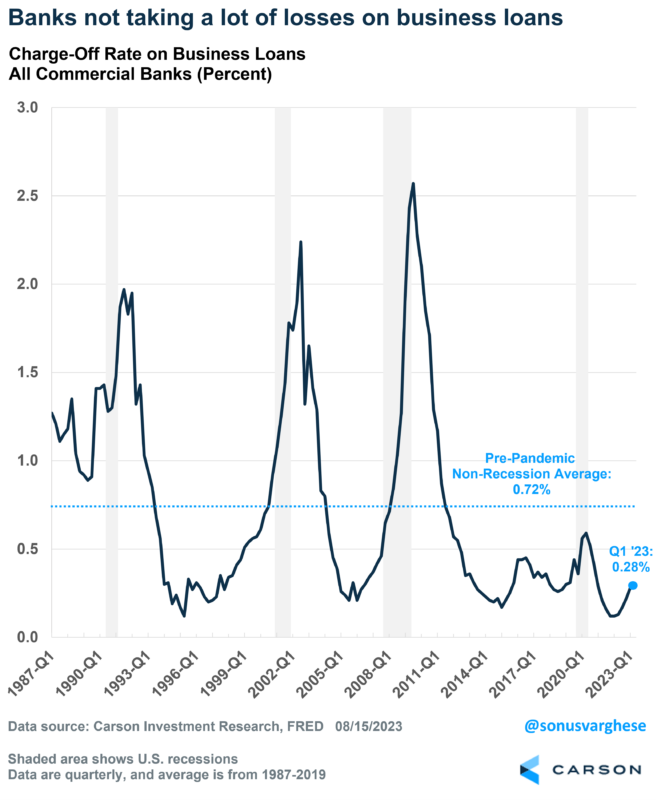

Banks Aren’t Seeing Elevated Risk Either

The other group that deeply cares about potential defaults are banks, since their entire business model is based on lending money out and getting paid back interest and principal. There are always some loans that default but the goal is to minimize these. The good news is that delinquency rates on business loans have been falling for a couple of quarters now, and as of Q1 they’re just under 1%. Delinquency rates were at 1.1% before the pandemic, and historically, they’ve averaged about 2.7% outside of recessions.

The Federal Reserve also collects “charge-off” data from all commercial banks – these are losses on loans that a bank recognizes, after they consider any recovery on defaulted loans. As a percent of average loans outstanding over a quarter, the “charge-off rate” in the first quarter was just 0.28%. This is obviously lagging data but that’s still well below the pre-pandemic non-recessionary average of 0.72%. We’re a long way below that right now.

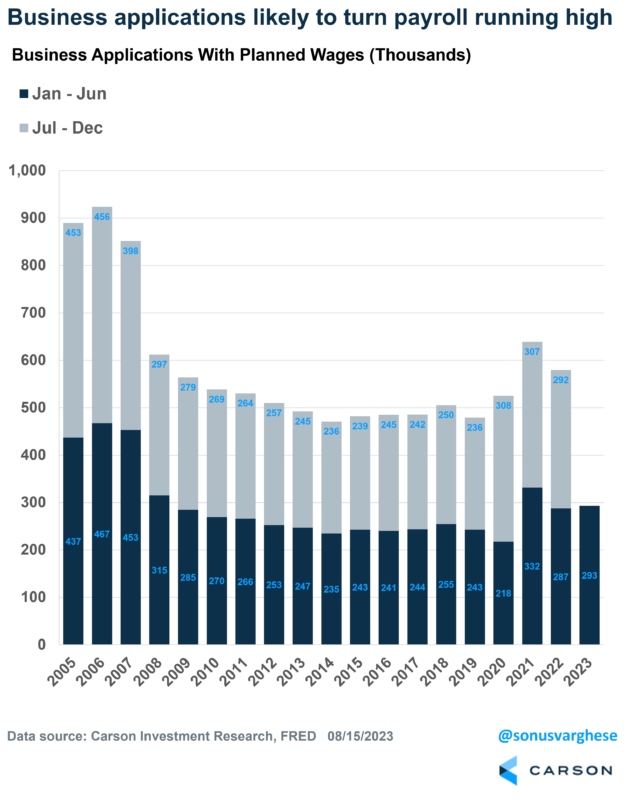

Entrepreneurship Is Rising

The other side of bankruptcies is entrepreneurship, especially entrepreneurs who plan to turn payroll. The Census Bureau tracks monthly business applications. Especially useful is a category called business applications with “planned wages.” These are applications that include a first wages-paid date on the IRS form SS-4, indicating a high likelihood of transitioning into a business with payroll.

There were more than 293,000 such business applications in the first half of 2023, which is 2% higher than what we saw last year. It’s also 21% higher than what we saw in the first half of 2019, the year prior to the pandemic.

Entrepreneurship kicked into overdrive after the pandemic, as people ended up with more money in their pockets – thanks to federal aid and money saved from limited spending during lockdowns.

Applications jumped in 2020 and 2021 to an average of 582,000 a year, which was a 17% increase from the average we saw in the previous decade. And the good news is that we didn’t see a huge falloff in 2022 despite aggressive rate hikes by the Fed.

It looks like applications are picking up again in 2023. Score that against rising bankruptcy data, and yet another data point to put things in perspective.

1868257-0823-A