The 2024 Presidential Election is looking like a toss-up, as is control of Congress, although Republicans are solidly favored to flip the Senate. At the same time, the candidates haven’t really discussed their post-election policy preferences in any detail beyond just broad statements. There’re clearly a lot of things that will depend on who wins the election and control of Congress. However, I want to focus on five things that are likely to continue irrespective of who wins the election.

Defense Spending Is Likely to Rise

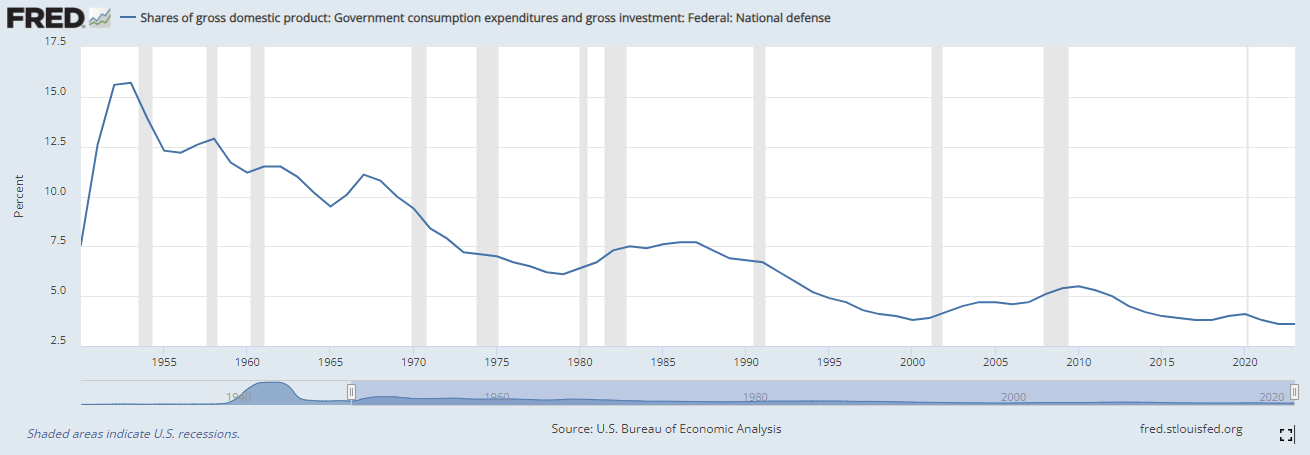

Defense spending is currently just 3.6% of GDP, which is close to the lowest on record. It’s very likely that this will only increase in the years ahead, in contrast to what happened in the 1990s or in the early 2010s.

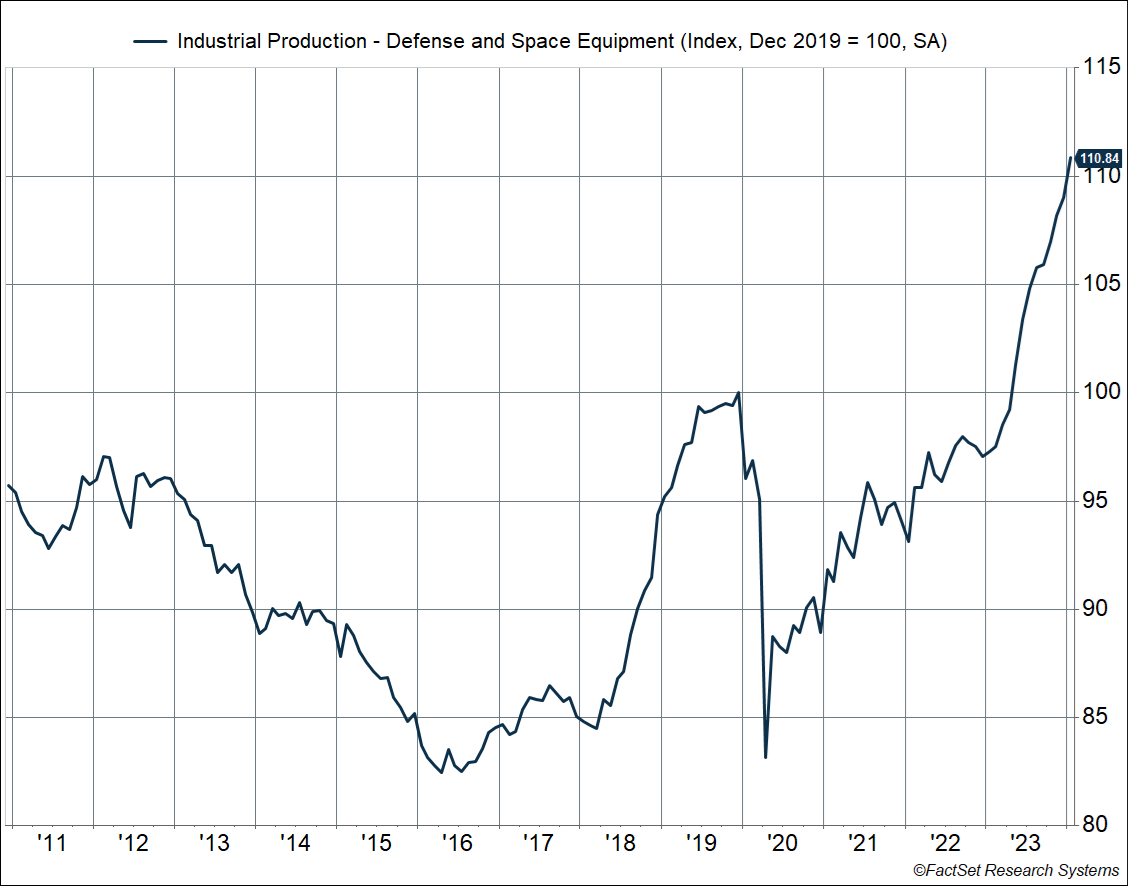

In fact, production of defense and space equipment has been ramping up recently. It was up 14% year over year as of January and is currently running 11% above 2019 levels. This will be a tailwind for the economy.

The US Is Likely to Remain the Largest Oil Producer in the World

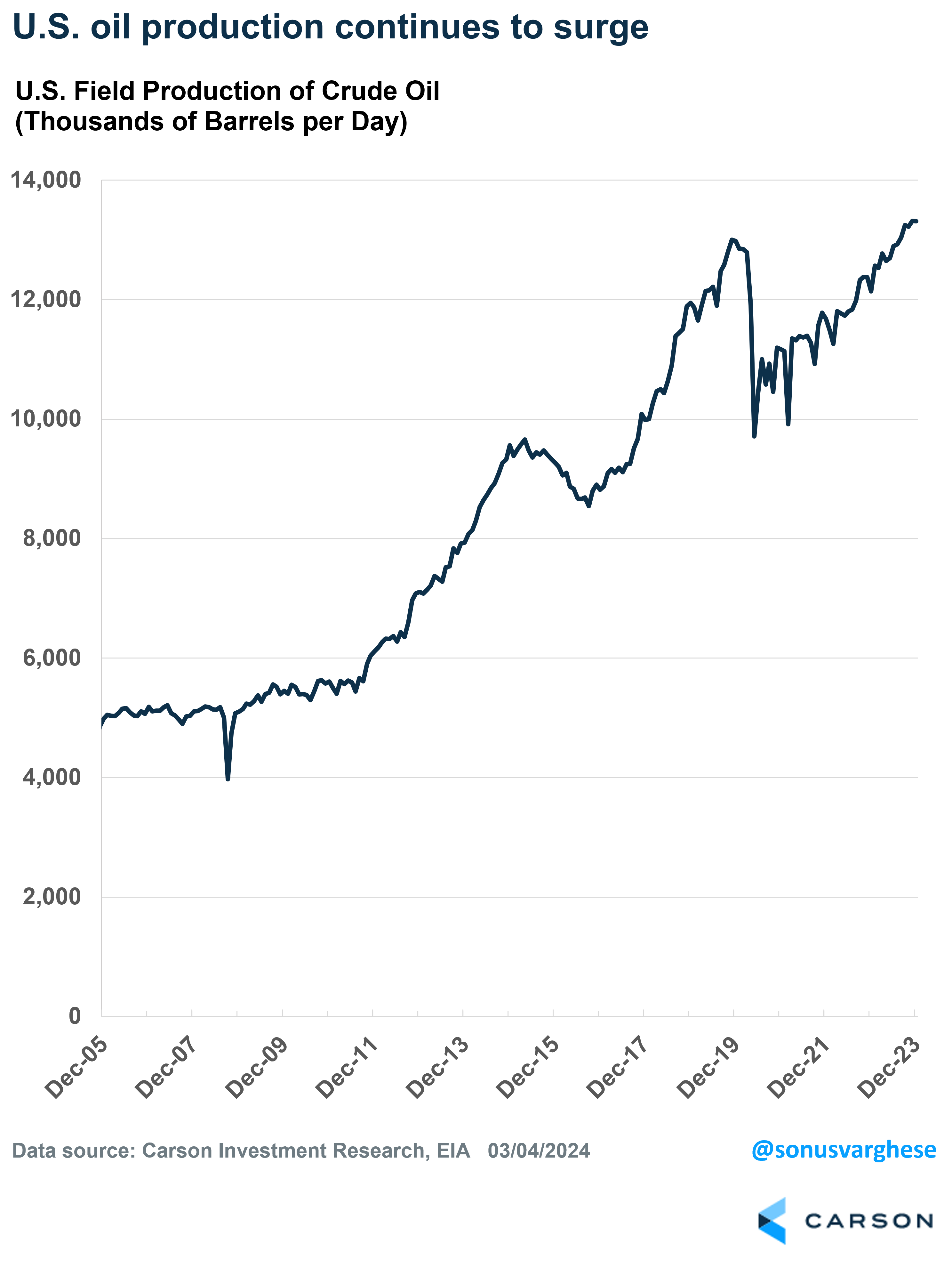

US oil production has been hitting new records month after month, rising to 13.3 million barrels per day (bpd) in December 2023, which is 10% above its December 2022 level. Prior to the pandemic, production had peaked just under 13 million bpd. Production has now doubled since 2011.

US oil production raises a lot of hackles on both sides of the aisle. But the reality is that oil production has surged under the Obama, Trump, and Biden administrations. The couple of times it pulled back was in 2015-2016 and in 2020, in both cases due to economic stress rather than any policy coming from the White House. Oil production in the US is going to mostly depend on the economy and the worldwide demand for oil, rather than who’s president.

The Budget Deficit Is Likely to Remain High

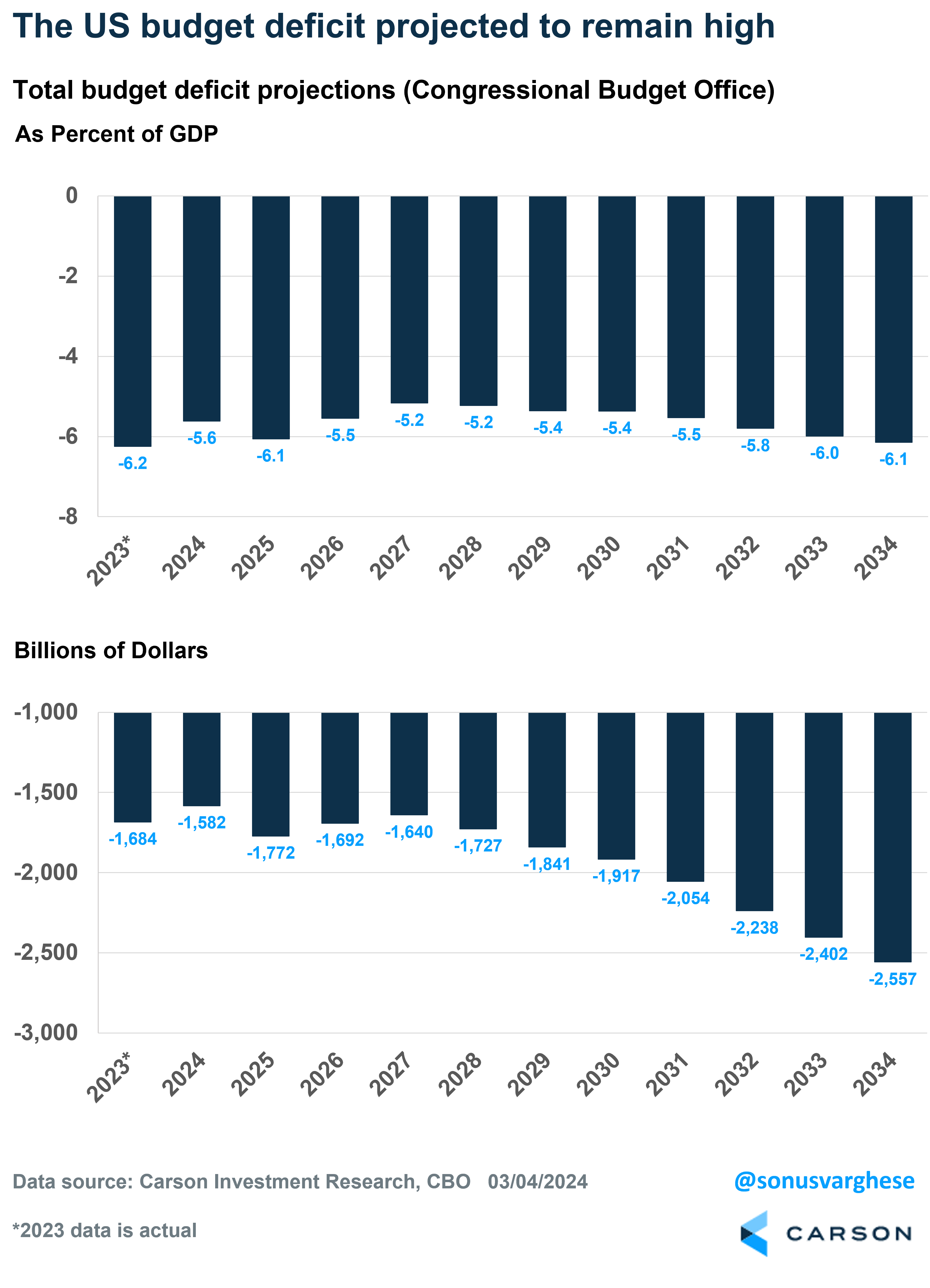

Irrespective of who’s president, or who controls Congress, the path of least resistance seems to be more spending, which means the deficit is likely to remain high. The deficit was about 6% of GDP in 2023, and the Congressional Budget Office (CBO) projects it’s going to remain close to that mark over the next decade.

Here’s the thing: It’s very likely to actually be more than the numbers in the charts above. CBO assumes parts of the Tax Cut and Jobs Act (TCJA) that President Trump signed into law in 2017 will “sunset” (expire). The TCJA had two parts: Corporate tax cuts, which were mostly permanent, and individual tax cuts, which are set to sunset at the end of 2025, which means individual taxes are set to jump higher on January 1, 2026. Expect a lot of market anxiety as we get closer to that deadline, since it’s a big “economic cliff” that will immediately hit consumer spending.

Safe to say, neither party is likely to let that happen (remember, 2026 is also a midterm election year). Fromer President Trump has already said he’ll renew all the tax cuts. President Biden has said tax cuts will be renewed for households earning less than $400,000, while expiring for wealthy individuals. He also wants to raise the corporate tax from 21% to 28% (it was 35% pre-TCJA), but this is likely to face stiff opposition from his own party, let alone Republicans (who are very likely to control the Senate).

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

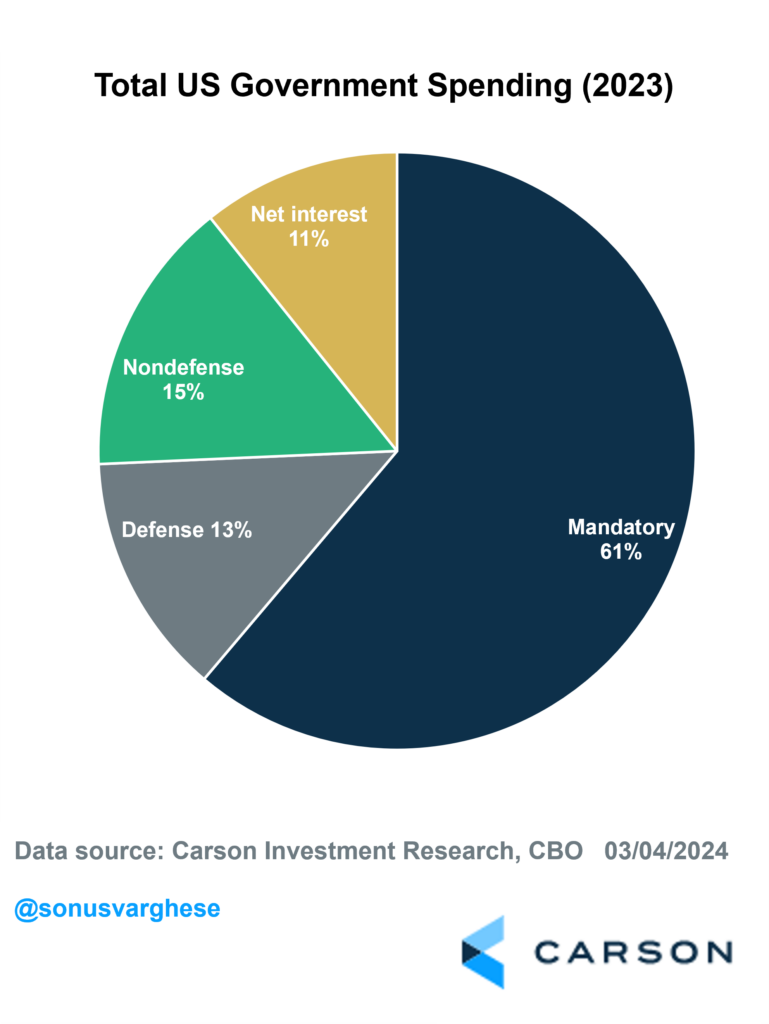

In any case, the budget deficit is likely to increase. Realistically, cutting entitlement benefits, especially Social Security or Medicare, is the only way to make a big dent in the deficit. Together, they make up more than a third of the federal budget, and spending on these is only projected to rise. Defense and non-defense discretionary spending make up under 30% of the budget. For perspective, only if these were cut to zero in 2023 would the federal government have run a slight surplus.

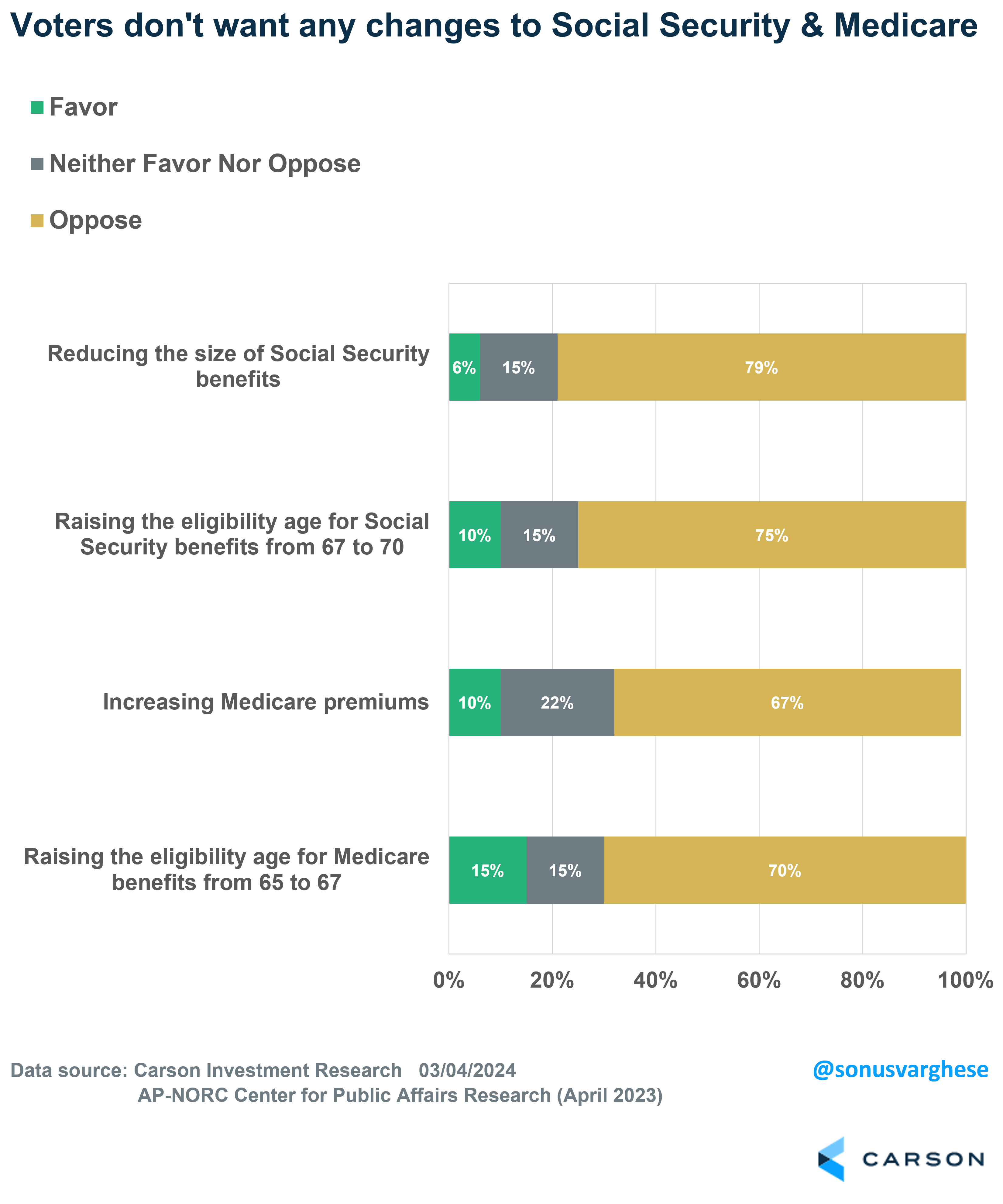

At the same time, a large majority of Americans don’t want Congress to touch entitlements, and politicians know that. President Biden and former President Trump have already said they’re not going to touch Social Security or Medicare. There ends any realistic path to “tackle” the deficit.

Interest Rates Are Likely to Remain High

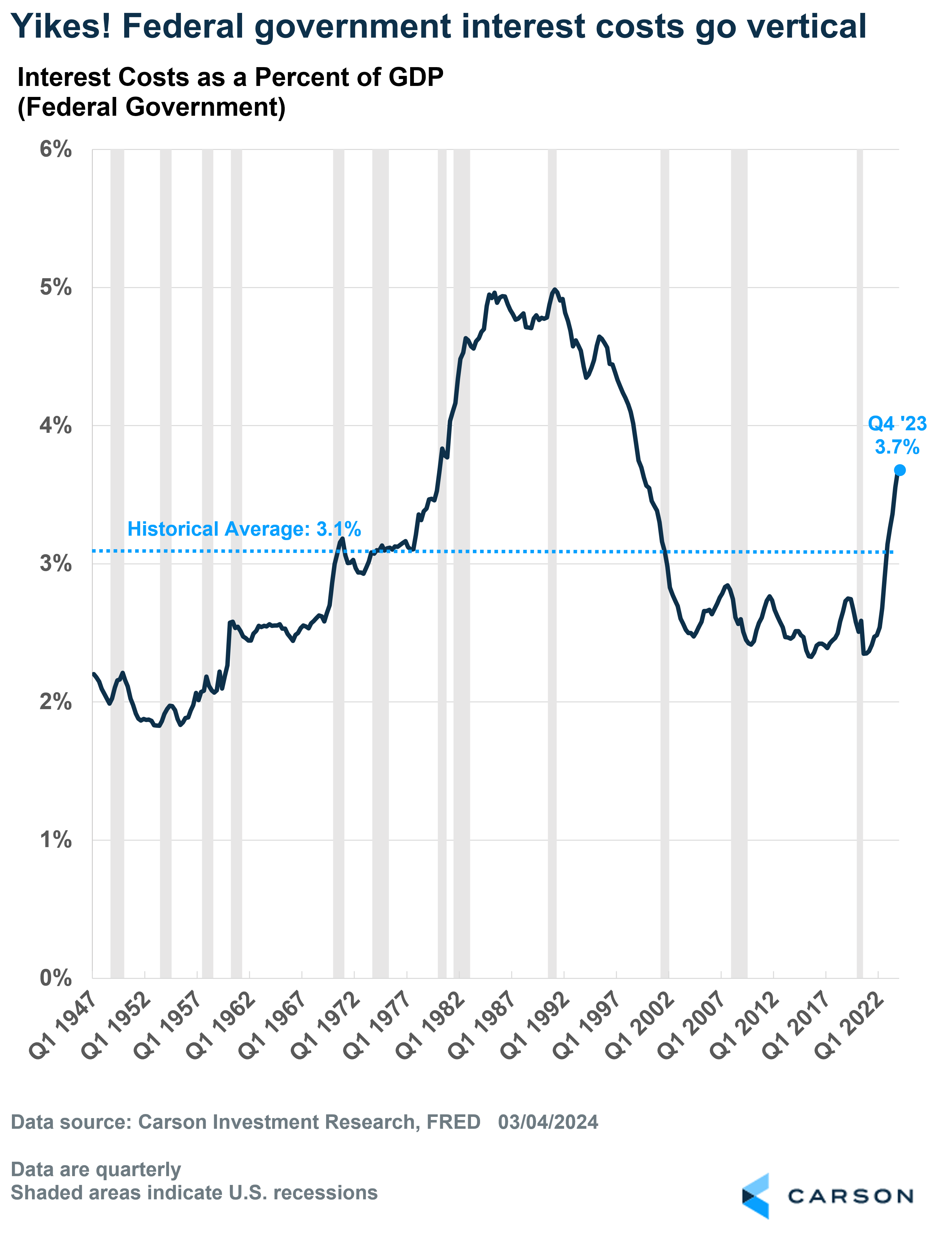

It seems logical to go from high budget deficits to high interest rates. In fact, interest costs for the federal government have spiked recently, rising to 3.7% of GDP. This is higher than what we saw over the 2010-2019 period, and the historical average of 3.1%. However, interest costs averaged more in the 1980s and 1990s, and the economy did fine. In fact, between 1995 and 1999, interest costs averaged 4.1% of GDP.

The reality is that interest rates are set by the Federal Reserve (Fed), at least short-term rates. But even longer-term rates depend on Fed policy expectations. And rates are likely to stay higher because the economy is likely to be stronger over the next few years. Even if we do see a recession, it seems unlikely that the Fed will lower rates to almost zero percent again.

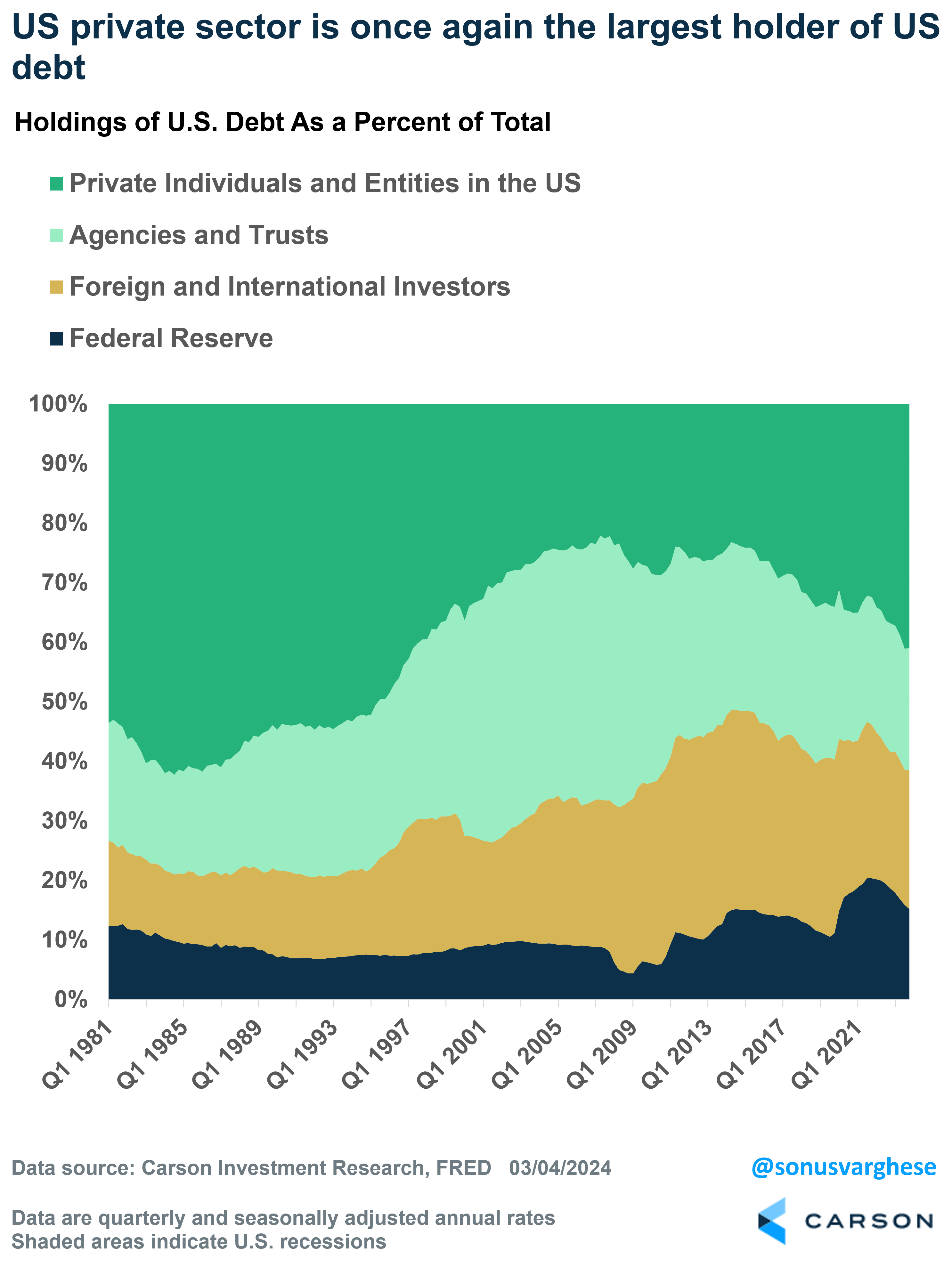

The other side of higher rates, and higher costs for the Federal government, is that American savers are the biggest beneficiary. American savers are now getting more than 5% on cash, and they like it. In fact, 41% of US government debt is held by the US private sector – households, nonprofits, and businesses. That’s up from just 24% in 2014. On the other hand, foreigners hold just 23% of federal debt, down from 33% in 2014.

The Dollar Is Likely to Remain the World’s Reserve Currency

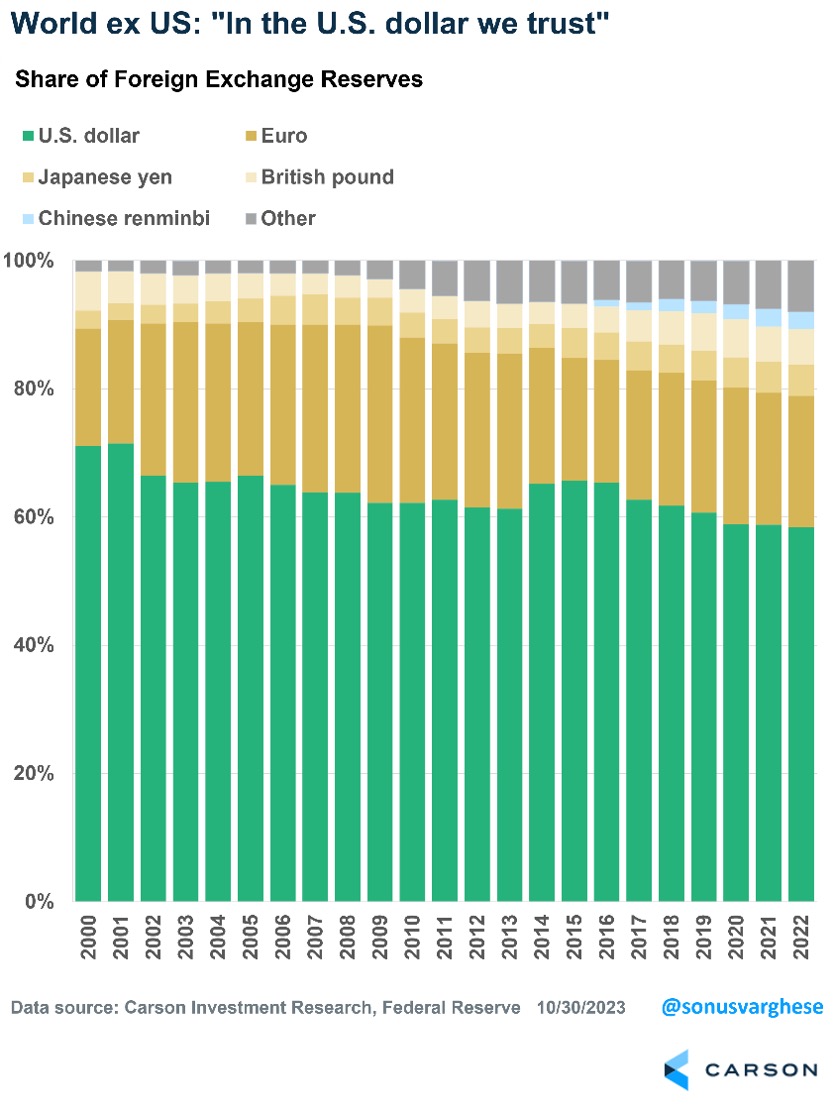

There’s always talk about the US dollar (USD) losing its dominant currency status, and the chatter usually rises during election season. To put it plain and simple, the USD’s dominant role is unlikely to end any time soon for three reasons:

First, the world has confidence in the US, and thereby the dollar. And this isn’t just about being the “cleanest shirt in a dirty laundry.” The US has several structural advantages. We have the world’s deepest and most liquid financial markets, thanks to the size and strength of the US economy. We generally emphasize open trade and unrestricted capital flows relative to other countries. Finally, we have a strong rule of law and property rights, and a history of enforcing them.

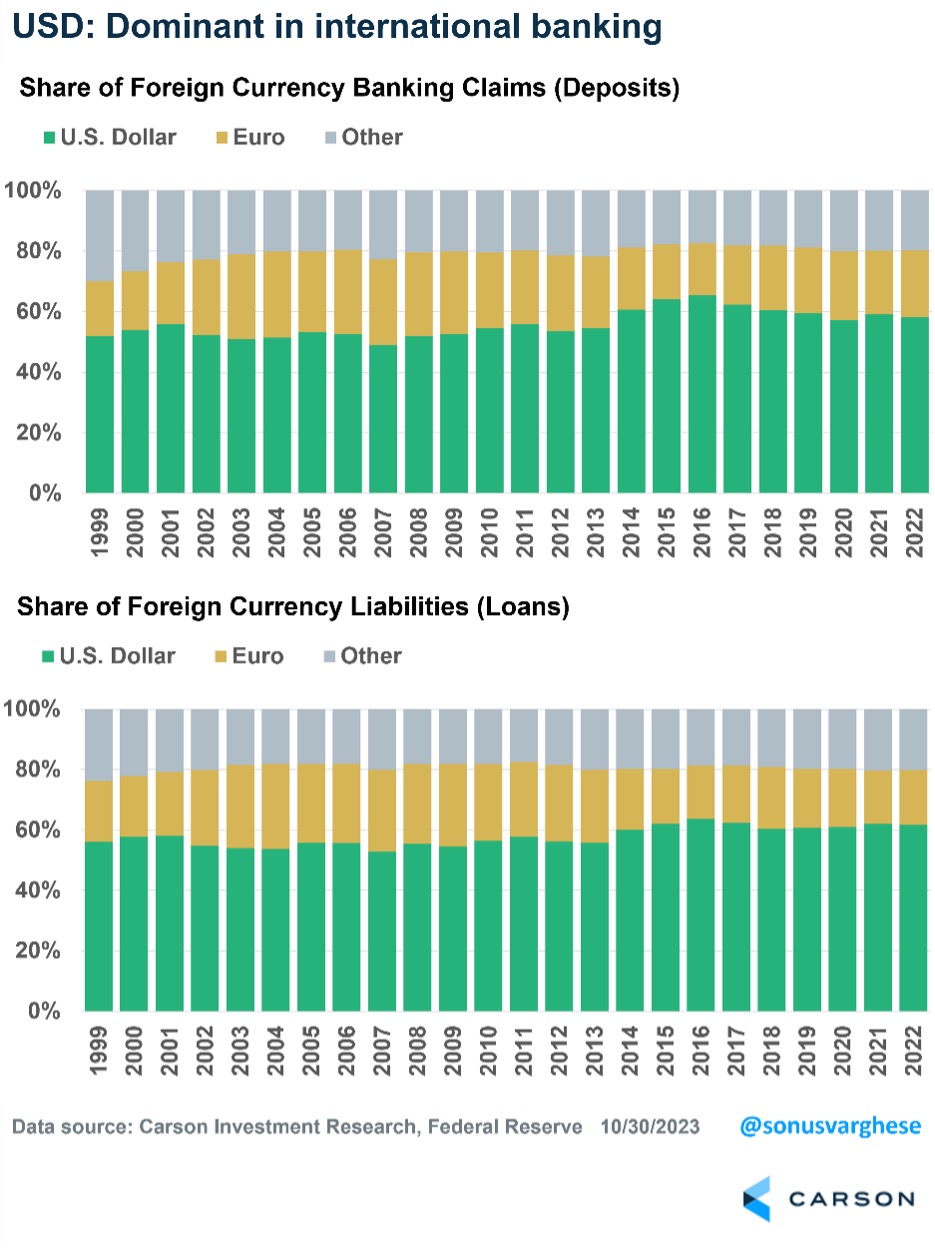

Second, the USD is the world’s most popular medium of exchange when it comes to trade, and even trade not involving the US. On top of that, foreigners like to borrow in dollars as well, and even more so over the last decade. Of the total amount borrowed in foreign currency, dollar-based borrowing accounts for 62% of it, up from 56% in 2012. Network effects can be very hard to dislodge.

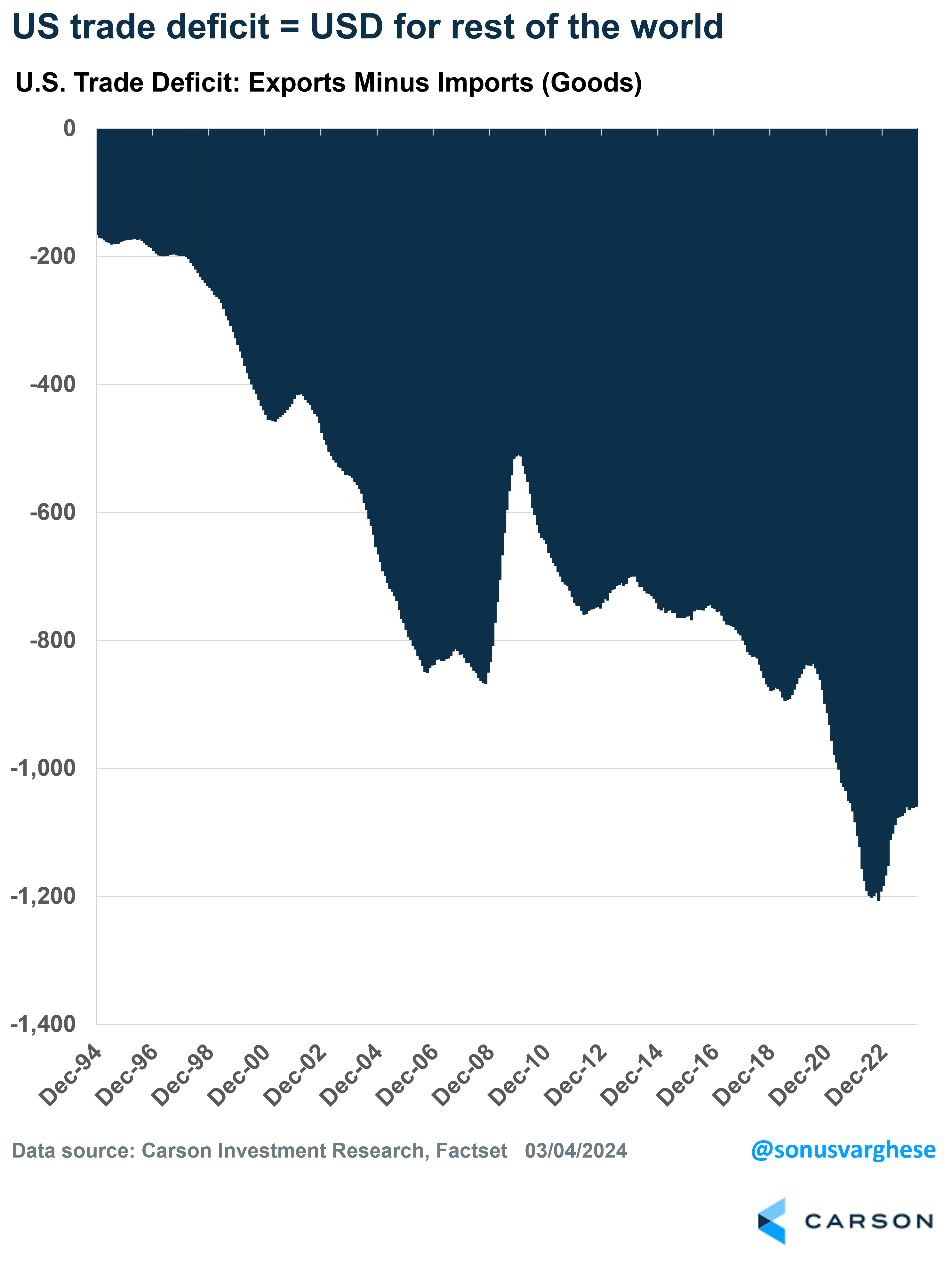

Third, the US is “willing” to maintain massive trade deficits. Foreigners sell a lot of stuff to Americans, and they get USD in return. Instead of using all those USD to buy US manufactured goods, they hoard it. Or buy US financial assets with it, including Treasuries, which are the safest, most liquid securities in the world (for the reasons mentioned above). This is why there are so many dollars, and Treasuries, held by the rest of the world, and the dynamic is unlikely to shift any time soon.

So, there you go. Amidst all the noise you’re going to hear about the 2024 elections, these are five key things that are likely to stay on their current path. Of course, central to all this is the state of the economy, and right now we’re optimistic about where it’s going. Markets are too, amidst rising profitability. Ryan and I discussed this in our Facts vs Feelings Leap Day Livestream Special.

For more of Sonu’s thoughts click here.

02142483-0324-A