We get a lot of questions about US debt, and a lot of concerns revolve around the fact that foreigners hold a lot of it. The question typically is: What happens if they decide to sell, especially the Chinese? I’m going to dive into all of it in this blog.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

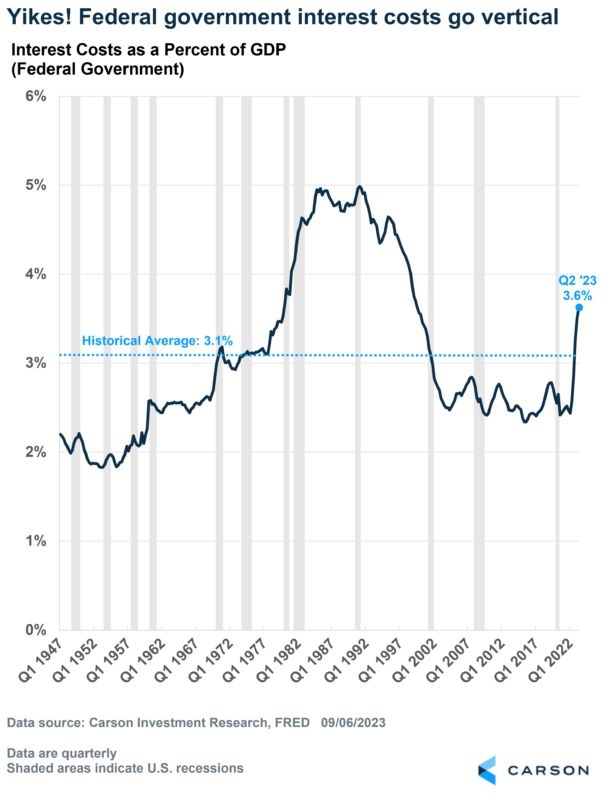

The US government has a total amount of about $32 trillion in debt outstanding! With interest rates surging, that’s sent interest payments vertical. Interest payments hit 3.6% of GDP in Q2 2023, up from 2.6% before the pandemic and above the historical average of 3.1% (1947 – 2022).

OK, that’s the government’s liability and a massive one. But the other side of the coin is: Whose asset is it, and who’s getting the bulk of interest payments?

Here’s where it gets interesting.

The Biggest Beneficiary of Higher Rates: The US Private Sector

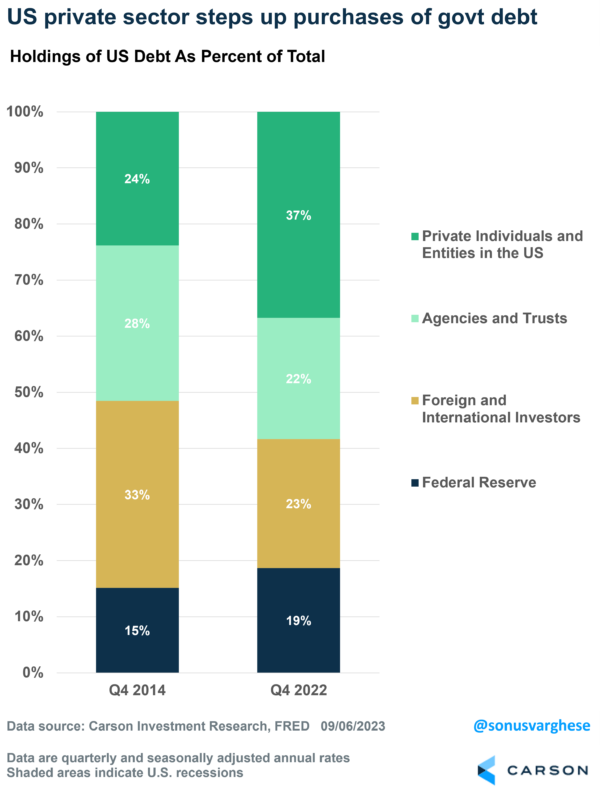

As of Q4 2022, the major holders of US debt are:

- The Federal Reserve: $5.9 trillion (19%)

- Foreigners (centrals banks and everyone else): $7.3 trillion (23%)

- Agencies and trusts (social security trust fund, etc): $6.9 trillion (22%)

- Private individuals and entities in the US (households, mutual funds, etc): $11.7 trillion (37%)

As you can see below, this is a marked shift from the end of 2014, when foreigners were the largest holders of US debt, while the US private sector held less than a quarter of the total.

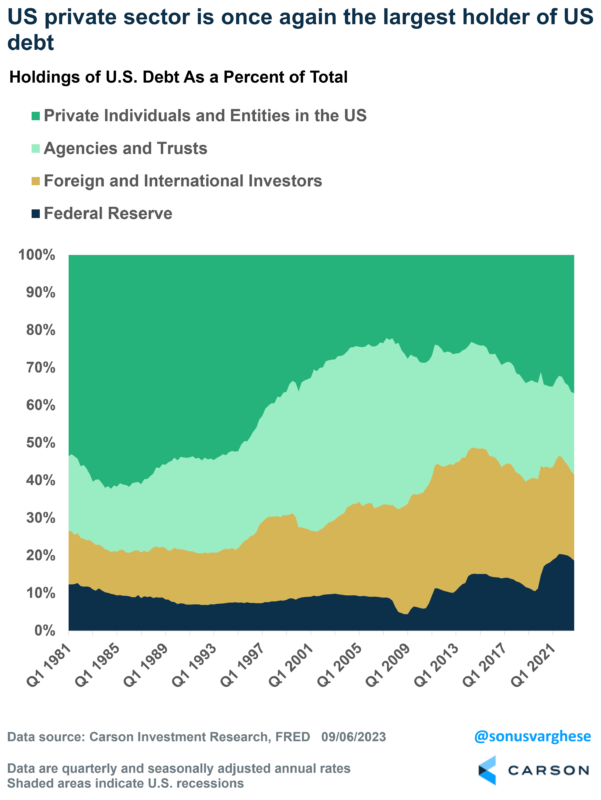

The share held by the Federal Reserve has jumped between 2014 and 2022, but as you can see in the following chart, that’s actually fallen over the last year as the Fed ends its bond purchases. The US private sector now holds the largest share of government debt since the late 1990s. The share held by foreigners peaked at just over 33% in 2014 and has been pulling back since then.

Most of the interest payments made by the government are going into the hands of the US private sector. I wouldn’t call this “stimulus”, since folks buying treasuries are unlikely to go out and spend all that extra income. But safe to say, that savers aren’t complaining about low rates anymore.

In fact, in aggregate, higher interest income has offset more than 80% of the increase in personal interest payments. From December 2021 through July 2023, which is the period when interest rates surged, personal interest income has risen by $183 billion (1% of disposable income). Over the same period, personal interest payments have risen by $223 billion (1.2% of disposable income).

What About Foreigners?

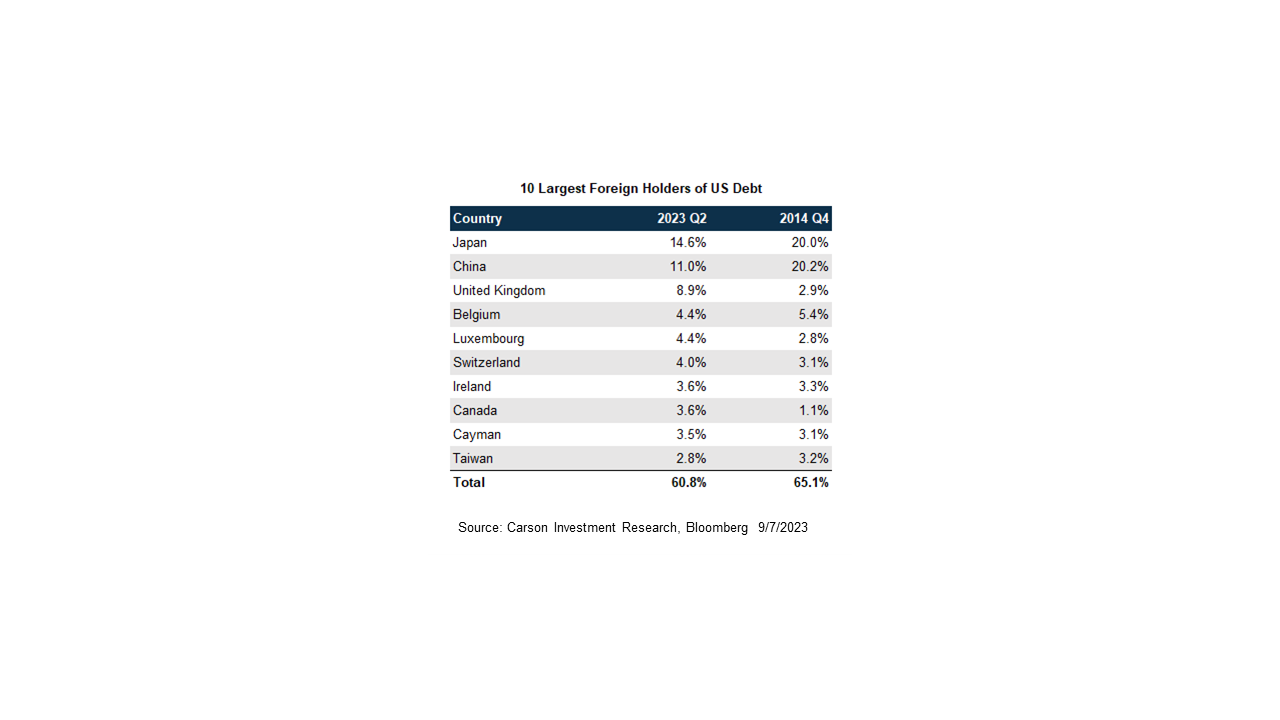

As you saw above, foreign holdings of US debt have fallen to under a quarter of the total. Japan remains the largest holder of US debt. China’s share has fallen. At the end of 2014, China held about a fifth of the foreign share. That’s fallen to 11% as of Q2 2023. It’s also likely China spreads out the source of its purchases of US Treasuries globally, notably using a Belgian custodian for a portion of its holdings – there’s a reason why tiny Belgium is the 4th largest foreign holder of US debt.

Even if you attribute all of Belgium’s holdings to the Chinese, China’s share of foreign US debt holders has fallen from 26% to 15% between 2014 and 2023. And remember that’s a smaller share of a smaller pie. As a percent of overall US debt, China’s share has fallen from about 9% to 4%. A big reason for this is that after 2014, China had to use some of its massive war chest of “foreign exchange reserves” (of which Treasuries are a big part) to fight capital flight and currency declines amid a weakening economy. China has different ways of poking the US economy, although many, including the recent announcement that government officials can’t use Apple phones, are largely for show. But even using one of its most powerful ever, selling Treasuries, just out of self-interest has not had any kind of outsized impact. Many market participants hardly noticed. (See our recent blog, “Eight Questions about China,” for more on what’s currently going on in China’s economy.)

If you look at the above table, you’ll also notice 5 other countries that are interesting namely, UK, Luxembourg, Switzerland, Ireland, and Cayman. Their share of foreign holdings of US debt has actually risen from 14% in 2014 to 25% as of last quarter.

This is a result of increased tax-shifting by US multinationals over the past decade. All these countries are well-known tax havens, and US multinationals (especially tech and pharma companies) transfer foreign profits to these locations to avoid US taxes. Of course, they don’t keep those profits, and excess cash, in foreign currency. Instead, they “invest” it in US bonds, both treasury and corporate bonds. For example, as of June 30, 2023, Microsoft had $111 billion in cash, cash equivalents, and short-term investments, on its balance sheet. Of that, about $61 billion is invested in US government debt – and a lot of that through its tax havens.

All this to say, a good-sized portion of the “foreign-holders” may also be US corporations. Which only adds to the fact that the biggest beneficiary of higher interest payments by the Federal government is the US private sector. There are always two sides to every coin.

For our quick take on China, see our recent “Take Five” discussion, now available on our YouTube channel:

1894843-0923-A