Hello from Las Vegas! The team is currently out here for Carson’s 37th Excell experience. It’ll be a jam-packed three days of fun and learning, with more than 1,500 advisors from all over the country in attendance.

The Investment Research team is here, presenting, sharing, learning, and helping our Partners and advisors. As a result, the next few days of blogs might be a tad shorter than normal, but with all that is happening, we wanted to continue to get our real-time thoughts out there.

There’s no way to hide it, yesterday’s consumer price index (CPI) number wasn’t pretty. The headline number came in at 0.1% versus expected down 0.1% and core CPI (excluding food and energy) was 0.6%, twice what was expected. Tobacco, new vehicles, vehicle repairs, dental services and hospital services all came in hotter than expected.

This likely cements the Fed hiking 75 basis points later this month and gives cover for more rate hikes, and as a result stocks had a very rough day.

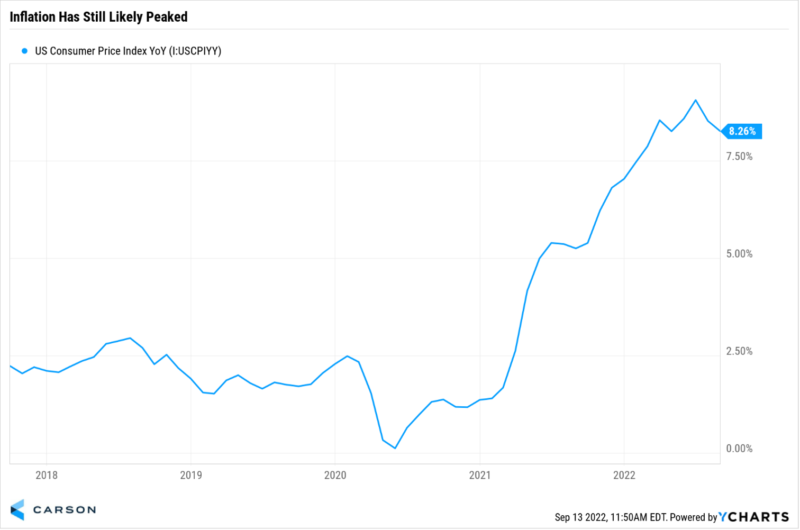

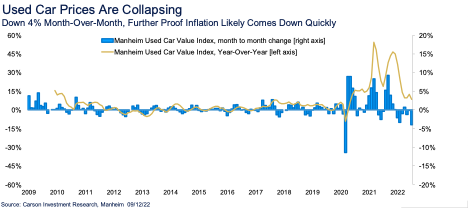

There are still some positives. For starters, CPI likely peaked in June at more than 9% year-over-year and will continue to trend lower now. Not to mention we’ve seen huge drops in prices paid in various manufacturing surveys, time to delivery is improving, and used car prices have imploded.

Speaking of used cars, the Manheim Used Car Index fell 4% last month, one of the largest drops ever. This data likely didn’t show up in this month’s inflation data and will be a big part of next month.

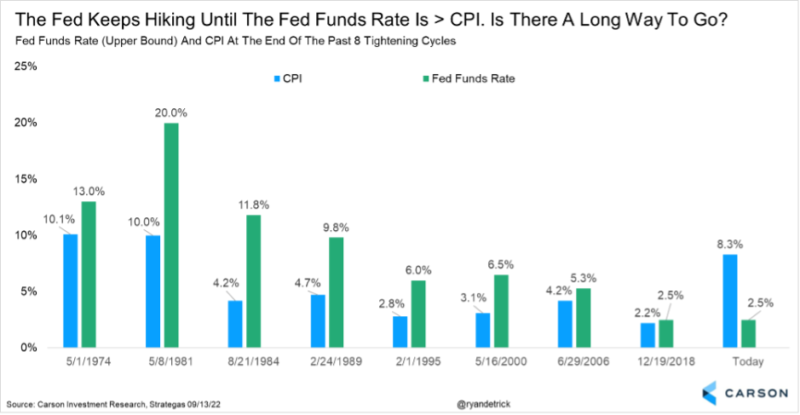

We will leave you with this. Historically, the Fed hiked rates until rates are above CPI. Given inflation is 8.3% year-over-year and the Fed funds rate is 2.5%, there still could be a long way to go before these flip. This is why it is so important for inflation to come back down, as the Fed won’t have to hike quite as much.

We are still optimistic prices will come back down and likely soon, but this month was no doubt a surprise and potential worry.