The S&P 500 rallied again last week and was more than 10% off the October 12 closing lows, before selling off some yesterday. Nonetheless, the truth is the overall news really hasn’t really been that great, yet stocks have staged a strong rally over the past month. What gives?

Turns out, this is what tends to happen coming off major lows for stocks more often than not. Our friends at JPM Asset Management put together some of the best charts I’ve ever seen to describe this phenomenon. You can read the whole report from Michael Cembalest here.

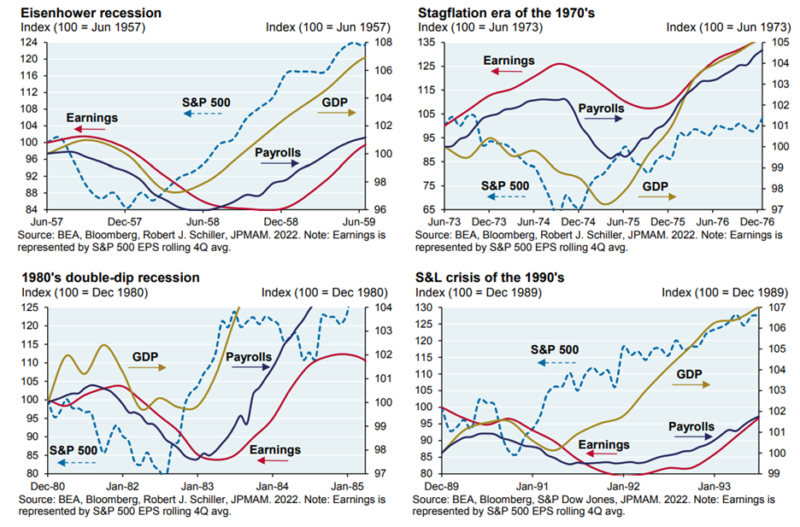

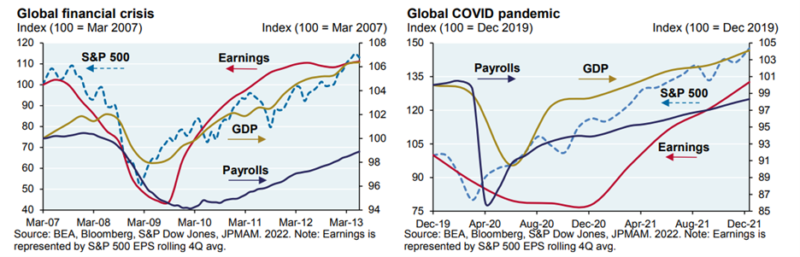

They found that from the Eisenhower recession in 1957 to stagflation in the 1970s, to the early 1980s double dip recession, to the 1990 recession, stocks turned higher well before the other parts of the economy began to turn higher. As you can see below, stocks tended to bottom months (and sometimes years) before earnings, GDP, and payrolls officially turn higher.

More recently we saw similar action during the Financial Crisis and then again during the worst of COVID. I’ll never forget how stocks soared in April, May, and June of 2020, yet we saw some of the very worst headlines in our country’s history. The truth is the stock market isn’t looking in the rear-view mirror, it is always looking forward and discounting what could be out there in the future.

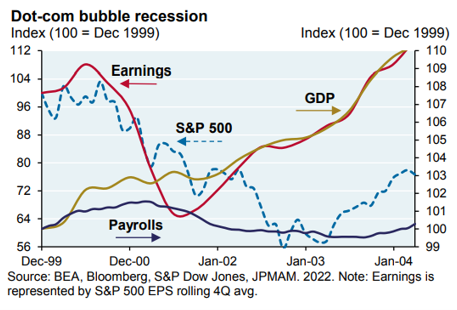

To keep things honest, this doesn’t have a perfect track record, as, after the dot-com burst, GDP and earnings both turned higher well before stocks officially bottomed.

This in one of the more confusing concepts for many investors, but it is one that is so important to understand. Stocks can rise even as the news is bad, this is how it works. If you are waiting for things to officially improve, you could likely miss out on substantial gains along the way.

Burt White likes to say if you are playing a video game and you are going toward the monsters, you are going in the right direction. Investing is similar, as times will sometimes be extra scary, but this is part of the process. If you are scared or uncomfortable, that is all part of investing in a lot of ways and if you run the other way every time things get scary, you’ll likely never be able to meet your investment goals.

Thanks again to JPM Asset Management for the awesome set of charts. Lastly, I had the honor of joining Bloomberg Radio recently for more than 10 minutes to discuss some of these concepts and more. You can listen to the full interview here.