“Worldly wisdom teaches that it is better for reputation to fail conventionally than to succeed unconventionally.” -John Maynard Keynes

Stocks have had a great start to 2023 and the economy continues to surprise to the upside, with China specifically showing a turn for the better. If one of the largest economies in the world is quickly improving, what does that do for the odds of a US recession? Our base case has always been the US would avoid a recession in 2023 and we still are in the camp, with a better Chinese economy doing little to change our views. For more of our views on the macro backdrop, but sure to read all the amazing work that Sonu has been doing.

Here’s what is so fascinating about the current state of things, various signs of sentiment are showing over the top negativity. From a contrarian point of view, this type of negativity could be a very bullish catalyst. Think about it, if everyone is bearish, then they’ve already sold, leaving nothing but buyers. So any good news (or even less bad news) could spark a rally.

If this sounds familiar, it is because we’ve been bullish for this very reason, everyone else was negative. In mid-December we moved to overweight equities, at a time when nearly everyone else was spouting the usual end-of-the-world scenarios. We wrote about this in Is Anyone Bullish? Now after a great start to the year for stocks, we are hearing some of the same negativity.

Here are some things I’ve noticed recently which are all suggesting investors are a tad too pessimistic and this could be positive for stocks down the road.

- Net short positions on S&P 500 e-mini futures for non-commercial hedgers are at their highest level since 2011. This is more widely known as bets that hedge funds are making. This doesn’t mean they are outright bearish, they very well could be hedged to the tilt. Still, going back to 2011, it is clear when there are this many shorts, it has been a nice time to be looking for higher stocks, not lower.

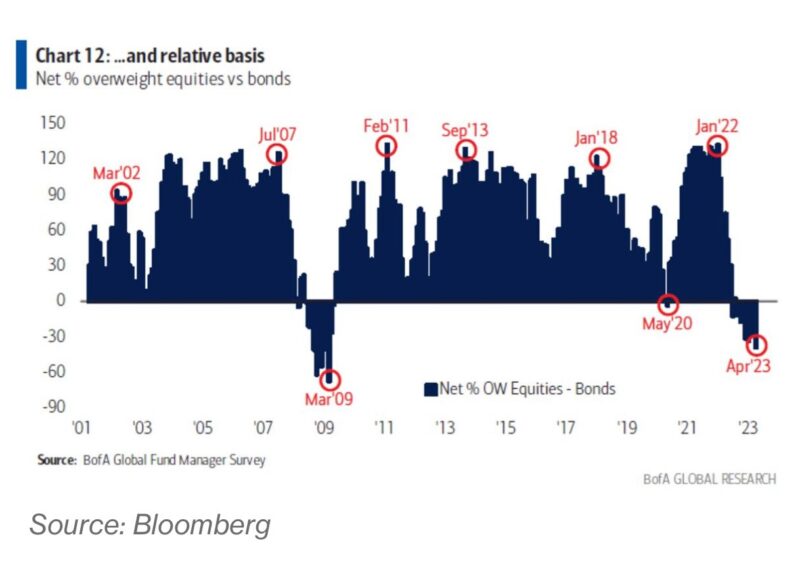

- The recent Bank of American Global Fund Manager Survey showed the most underweight stocks relative to bonds since the Great Financial Crisis. This survey looks at more than 600 money managers and it is clear again the crowd is quite defensive here. Note how popular stocks were relative to bonds in January 2022, just as stocks peaked and went into a vicious bear market.

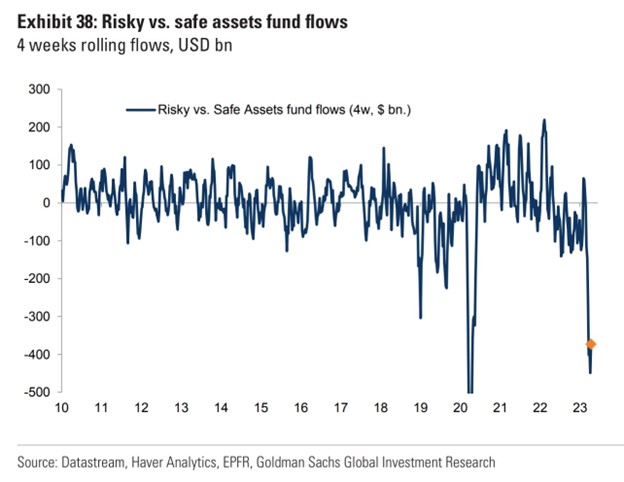

- Turning to flows, a recent Goldman Sachs report showed that flows were huge into safe assets versus risky assets. This is another way of showing very few investors are willing to step up and expect better times.

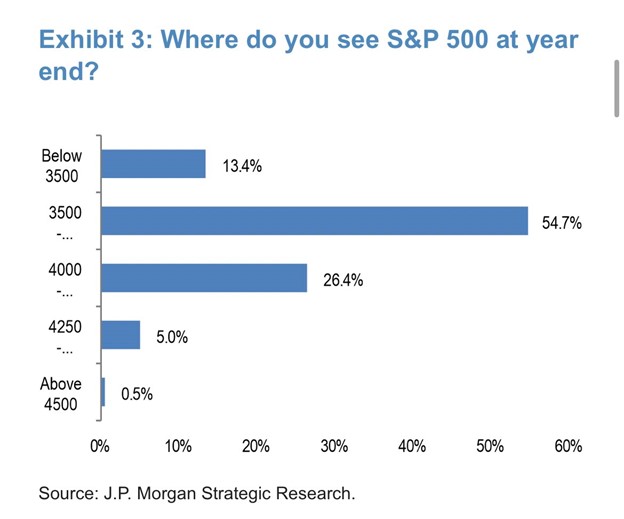

- JPM Morgan had this survey of institutional investors and it showed that 95% expected stocks to drop by the end of the year. Only 5% were looking for stocks to gain and virtually no one expected stocks to gain by the end of the year. This one amazes us, but shows just how much potential there is for a surprise rally the rest of 2023.

- Lastly, a CNBC survey showed public pessimism on the economy hit a new high. That’s right according to the latest CNBC All-American Economic Survey, 69% of those surveyed held negative views about the economy now and in the future, the most pessimistic ever. Also, just 24% said it was a good time to invest in stocks, the lowest in the 17-year history of the survey.

In conclusion, think about the Keynes quote above. Most money managers were in the same camp at the start of the year and that was underweight equities and a big bear market was coming. Turns out, most are still in that camp. Who knows, maybe not all of them really thought it was even true, but when everyone else was doing it, it was easier to follow the crowd for the sake of their career.

I’ve always lived by ‘if you do what is average, expect average returns’. At the Carson Investment Research team we aren’t about being contrary for the sake of being contrary, but when the macro backdrop, market technicals, fundamentals, and sentiment all line up in our favor, we will take the road less traveled and go against the herd. We continue to think the economy is on better footing than most expect, thanks to a strong consumer and healthy employment backdrop, while we also remain overweight equities in the models we run for our Carson Partners.