This was a big week if you wanted to get a picture of the economy, inflation, and even policy (both monetary and tariffs). Here’s the big picture:

- The labor market is clearly slowing, despite a low headline unemployment rate of 4.2%.

- Soft payroll growth and easing wage growth means aggregate income growth is slowing.

- Inflation is stubbornly elevated, with disinflationary forces in shelter and travel offset by a tariff-related pickup in core goods prices and even food prices.

- As a result, consumers are just about able to keep up with inflation, but not much more, and so real consumption has slowed significantly.

- Elevated inflation, driven by goods prices, is staying the Fed’s hand despite labor market weakness, and more tariffs on August 1st will not help.

- Elevated interest rates are hurting rate-sensitive areas of the economy like housing, which are now dragging on economic growth.

- The economy would be at stall speed, if not recession, if not for the absolute boom in AI-related spending.

Let’s dig in.

The Labor Market Hits Stall Speed

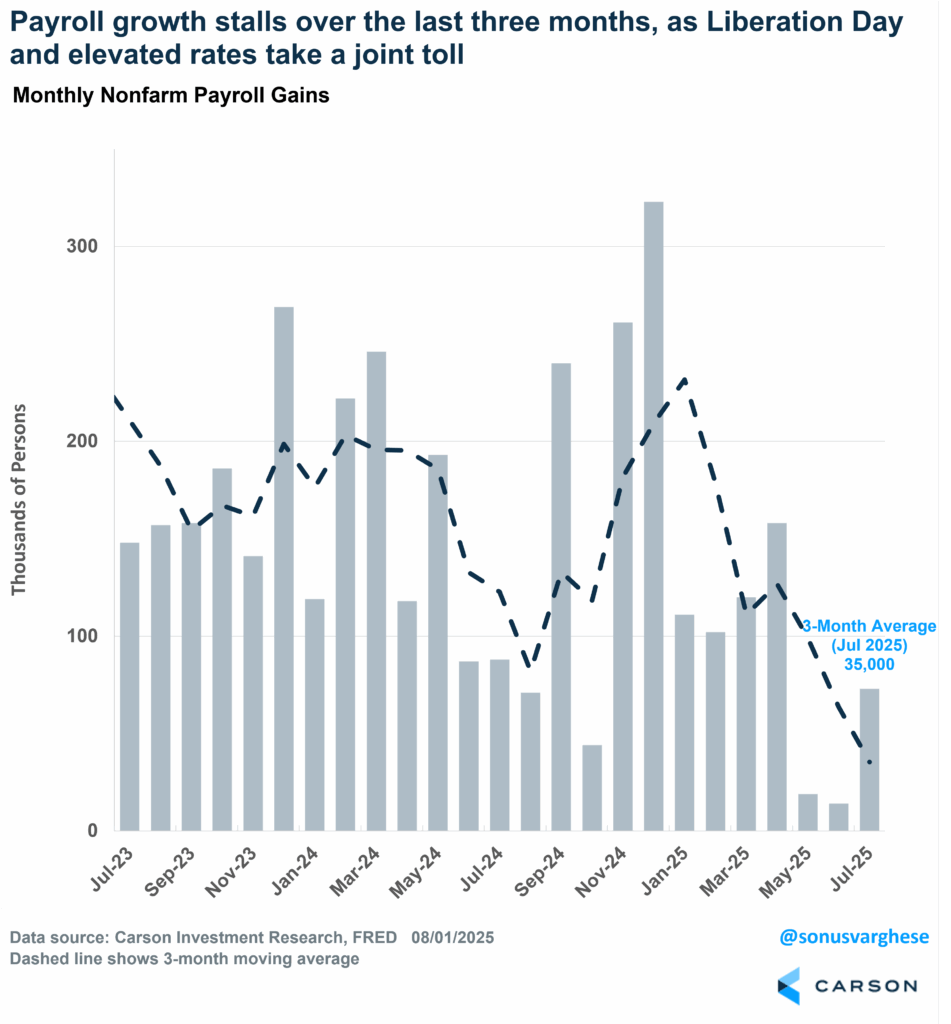

The unemployment rate remains at a historically low level of 4.2% but that hides a lot of underlying weakness. The economy created 73,000 jobs in July (with 83,000 jobs private sector jobs). That may be just about enough to keep up with population growth since immigration has collapsed. The problem is that the prior two months were revised down by a whopping 258,000 jobs:

- May job growth was revised down from 144,000 to 19,000.

- June was revised from 147,000 to 14,000.

This brings the 3-month average to just 35,000, assuming we take the July number at face value. For perspective, the prior 3-month average (February–April) was 127,000, which was already a slowdown from the 2024 average of 168,000. Manufacturing has lost 37,000 jobs over the last 3 months. Liberation Day and associated tariff chaos clearly took a toll, along with elevated interest rates. What’s uncertain here is whether May–June was the worst of it, and things look better now because the administration has pulled back on extreme tariffs.

Combine really soft payroll growth with easing wage growth and a stall in hours worked, and we’re looking at softer aggregate income growth (across all workers in the economy). Over the last three months, aggregate income growth is running at a 4.5% annualized pace. That would be similar to what we saw pre-pandemic in 2018–19, but here’s the thing: inflation was running below 2% at the time, whereas it’s running closer to 3% now.

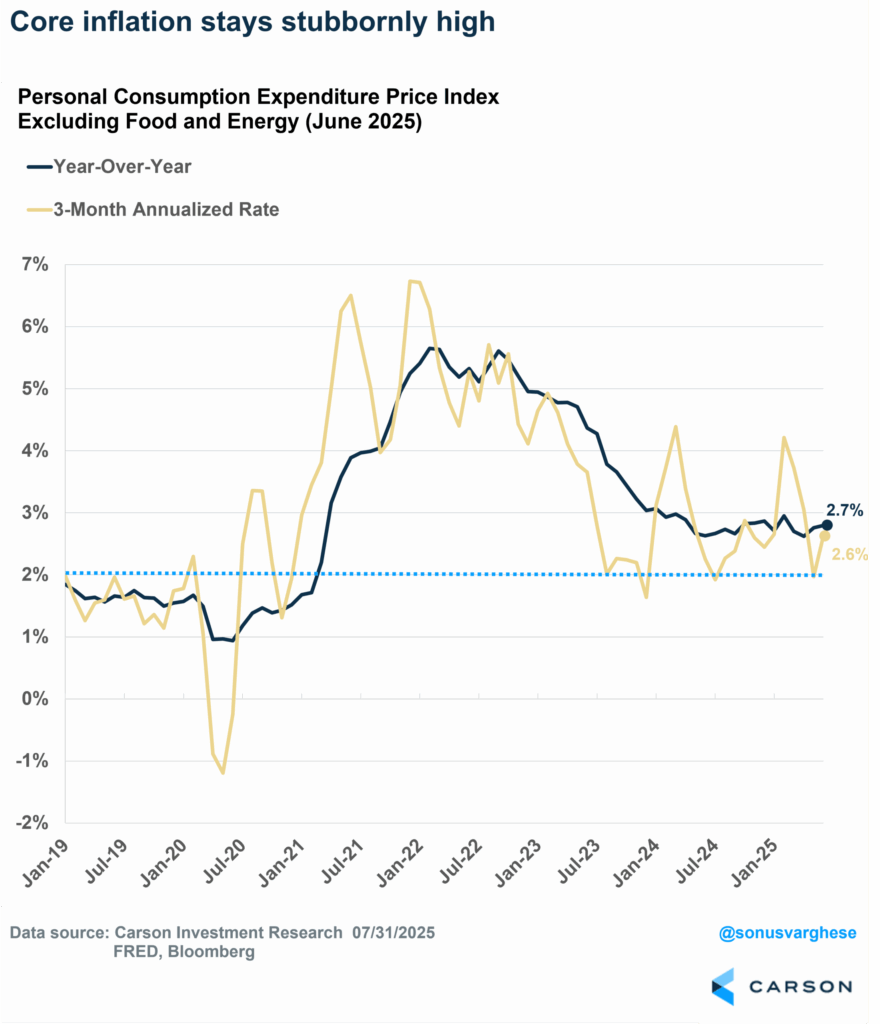

Inflation Remains Stubbornly Elevated, Leaving the Fed With a Problem

Core inflation (excluding food and energy), as measured by the Federal Reserve’s (Fed) preferred personal consumption expenditures (PCE) index, rose at an annualized pace of 3.1% in June, and is up 2.6% over the last 3 months. Core PCE is up 2.8% over the last year, and the big picture here is that inflation remains stubbornly elevated over the Fed’s target of 2% and has moved sideways for about 14 months now.

The picture was quite different at the start of the year, when we expected inflation to head lower across the year, especially on the back of shelter disinflation. That’s actually happening, and in fact we’re even seeing lower prices for recreation services, hotels, and airfares—which also tells us spending in these areas is easing.

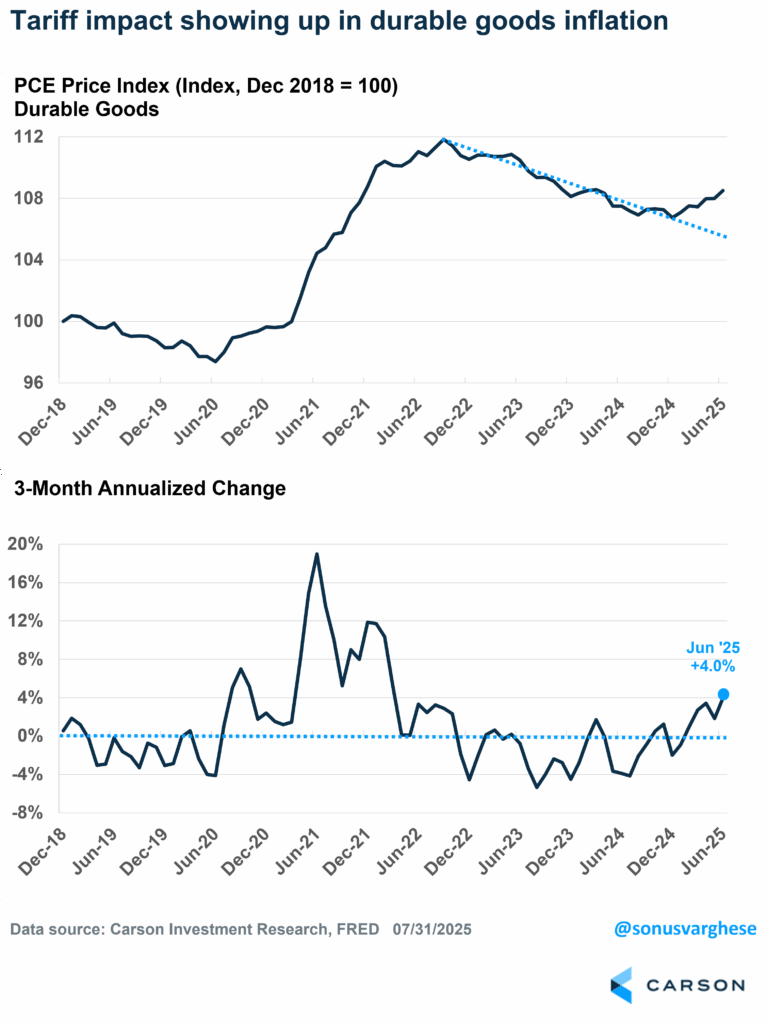

The problem is that all of this is being offset by a pickup in core goods inflation (things like furnishings, appliances, and recreational goods). Core goods prices rose at an annualized pace of almost 6% in June and are up 4% over the last 3 months. That is the fastest pace since March 2022, when we had the supply chain crisis. Outside of Covid, it is actually the fastest 3-month pace since 1991! Since the 1990s we have seen a continuous decline in core goods prices. as we got cheap goods on the back of globalization. The big break came after Covid when global supply chains broke, but the downtrend resumed in 2023–2024. Until now, that is, and this is where the tariffs are making their most direct impact.

Even beyond core goods, we’re seeing inflation in a couple of other key areas that matter to household wallets:

- Restaurant price inflation has been accelerating, running at an annualized pace of 4.6% over the last 3 months. That’s well above a “normal” pace of about 3%, which would be consistent with the Fed’s target of 2% inflation.

- Utilities prices (electricity and gas) are also surging, growing at an annualized pace of 12.5% over the last 3 months. The main reason is more artificial intelligence (AI)-related demand, while supply isn’t expanding at the same pace.

Consumer Spending Stalls

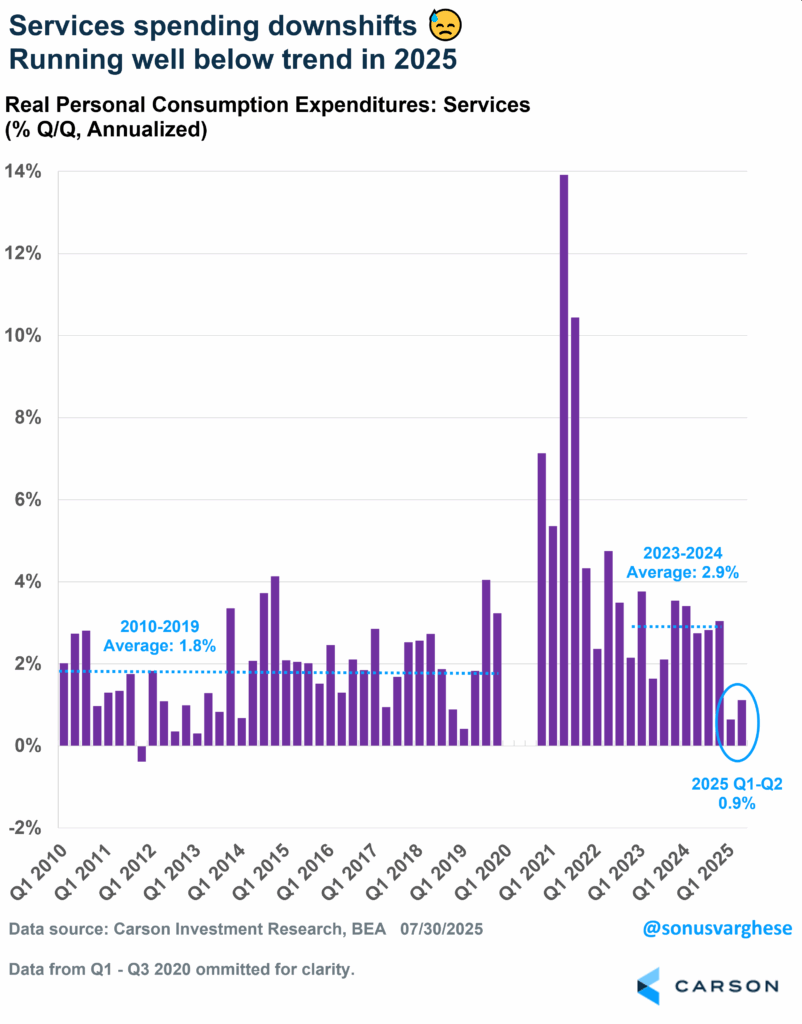

Lower aggregate income growth and higher inflation should translate to lower “real” spending, i.e. spending adjusted for inflation. And that’s exactly what we’re seeing. Real consumption grew at an annualized pace of just 0.9% in the first half of 2025. That’s well below the 2023–2024 pace of 3.1% (which is why GDP growth clocked in near 3% over the prior two years) and even the 2010-2019 pace of 2.4%.

A big reason is a sharp easing of services spending, which matters because it makes up 45% of the economy. Services spending ran at a 0.9% annual pace in the first half, a sharp downshift from the 2023–2024 pace of 2.9% and even the 2010–2019 pace of 1.8%.

In short, consumers are just about able to keep up with inflation. But since wage growth is easing, we’re seeing a slowdown in real spending.

The Fed Stays on Pause, Buffeted by Opposing Forces

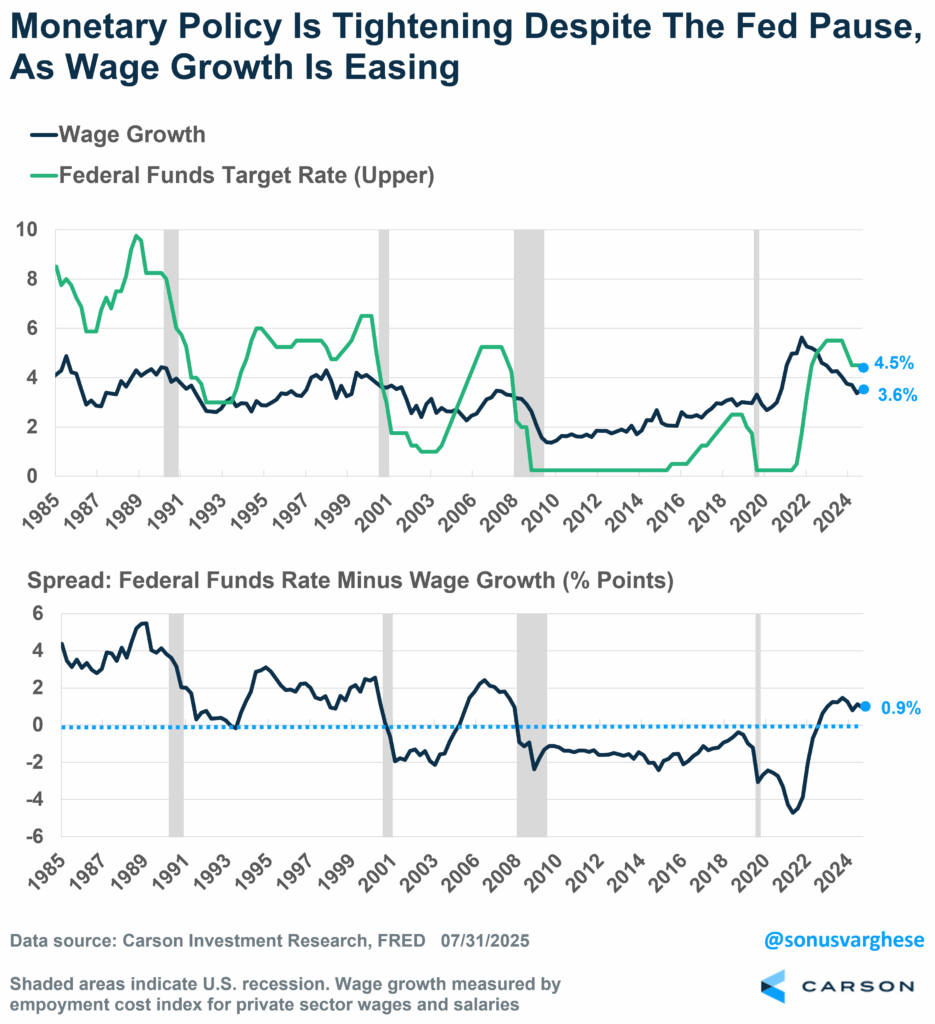

The labor market is clearly slowing, and that by itself ought to trigger interest rate cuts. Policy rates are clearly elevated near the 4.5% level, especially since wage growth is near 3.5%. As we wrote in our Midyear Outlook ’25, as wage growth continues to soften, policy is getting tighter if the Fed doesn’t cut rates.

Here’s the Fed’s problem: stubbornly high inflation, even with the impact of tariffs only just starting to show up in the data.

The Fed took a pass on cutting rates at their July meeting because of this. Powell pointed out that they have two mandates: stable prices and maximum employment. They believe that the labor market is in good shape right now and the low unemployment rate is consistent with their mandate of maximum employment. However, they’re worried about inflation remaining elevated, and pass-through effects of tariffs, which they believe will take several months to show up. The White House also has a new tariff blitz starting on August 1st.

Moreover, in his post-Fed meeting press conference, Powell noted that the economy isn’t performing as if restrictive rates are holding it back, and if anything, rates are only modestly restrictive. This implies they’re willing to wait longer to get more data, and even if they cut, it may not be by much.

It’ll be interesting to see how the July payroll data reshapes their thinking, but in all likelihood, we’ll probably get a better picture of the policy rate path only after the next one or two inflation reports. Markets originally priced in a 66% probability of a September rate cut before the Fed’s July meeting, and dropped it to 40% after Powell’s comments during the post-meeting press conference. However, the weak payroll data sent the probability of a September cut surging to over 80%. This is going to continue shifting over the next month, until we get clarity from the Fed.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Economic Growth is Being Held Up by AI

Real GDP growth clocked in at a 3% annual pace in the second quarter, a sharp upswing from the 0.5% pullback in Q1. But that was on the back of trade volatility, as imports swung wildly up and down due to tariff front-running, along with inventories. Net exports (exports minus imports) dragged from GDP growth by 4.5%-points in Q1 and added 5%-points in Q2. Both were the largest ever on either side.

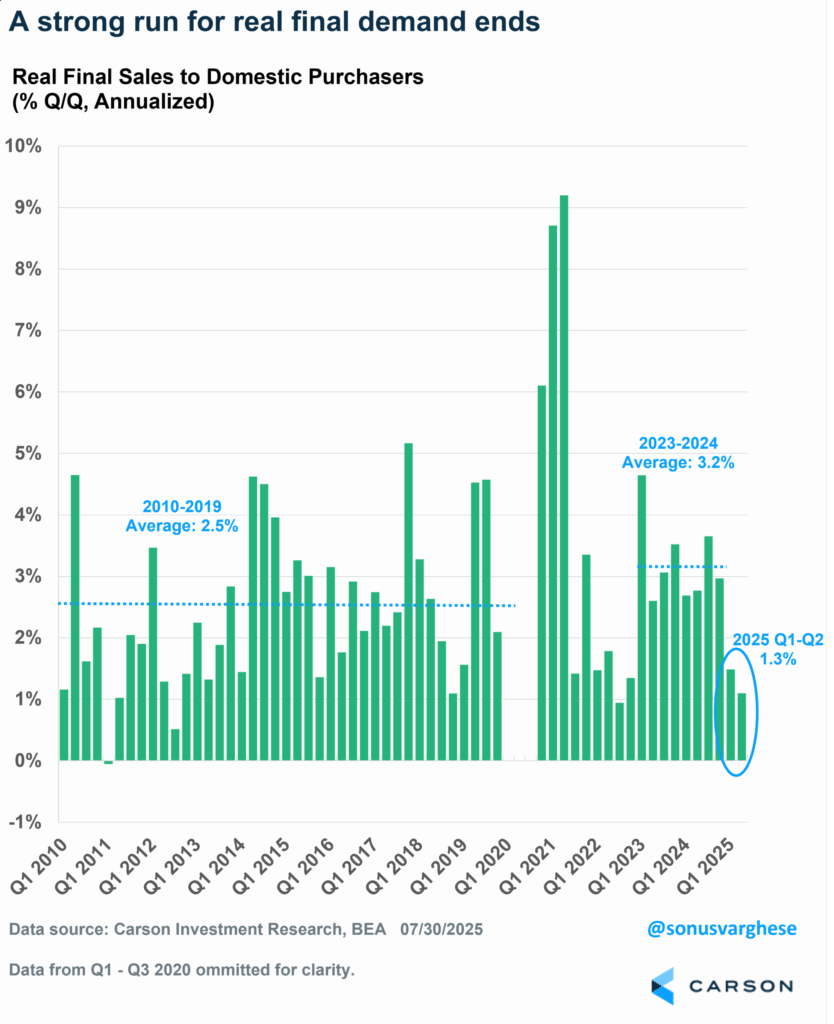

But the headline strength in Q2 GDP growth hides underlying weakness. “Real final sales,” which essentially measures consumer, business, and government spending and investment, rose 1.1% in Q2, slowing from an already below-trend pace of 1.5% in Q1—thus averaging 1.3% over the first half. For comparison, this measure rose at an annual pace of 3.2% in 2023–2024 and 2.5% in 2010–2019. There’s a real slowdown in place.

The big driver of the slowdown is consumption, as I discussed previously. And thanks to elevated rates, business investment (especially in structures) and residential investment (housing) are also a drag. Government spending is also slowing.

All of this by itself would have meant the economy stalled in the first half of 2025. However, there was a major factor pushing things the other way, and helping the economy avoid the precipice of recession: AI spending, both on the hardware and software side.

- Equipment spending on computers and peripherals has been rising over the last two years but surged another 35% over the last six months (translating to an annualized pace of 83%!).

- Software spending rose at an annual pace of 6% in the first half.

As our friend, Neil Dutta (Head of Economics at Renaissance Macro) pointed out, AI spending contributed an average of 1.0%-point to GDP growth over the last two quarters. That’s more than the contribution of 0.6%-points from consumption, which makes up close to 70% of the economy.

Cash-rich tech companies are going on a capex spending spree, providing a crucial boost to the economy, and that’s not ending soon, based on recent tech company earnings calls. But it also hides the underlying weakness in the economy and makes the headline data look better than it is. When combined with tariff-related inflation in core goods, that’s pushing the Fed away from providing interest rate relief, which means rate-sensitive parts of the economy will continue to struggle.

There’s a reason we called our Midyear Outlook “Uncharted Waters.” All this is also cropping up right in time for a regular bout of August volatility in markets. As Ryan wrote earlier this week, “buckle up.”

For more content by Sonu Varghese, VP, Global Macro Strategist click here

8240528.1.-08.01.25A