2023 was a year many economists and economic models called for a recession only to see accelerating growth; a year when soft data surveys and hard data economic “facts” diverged, with hard data presenting a better picture; and a year when inflation fears remained elevated even as inflation fell. We do not want to minimize the economic challenges many people face every day, but to reverse Allen Greenspan’s well-known phrase, from a market perspective, it was and remains a year of irrational sullenness.

That sullenness has not been as bad as the “irrational exuberance” that Alan Greenspan famously called out in December 1996. (Although it’s worth mentioning that the S&P 500 still doubled in the next three years!) There have been reasons to be cautious, with an aggressive Federal Reserve, higher borrowing costs, and falling but still elevated inflation. But “irrational sullenness” certainly contributed to the misassessment of the economy in 2023 and has come not only from economists, but businesses and consumers as well, based on survey data.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

From an economic perspective, this led to several mistakes for forecasters across the financial industry (although generally “markets” have known better, as they often do). That has included:

- Underweighting the importance of the approximately 15% historical probability of a recession in a neutral year.

- Overweighting the impact of evidence that has been consistent with recessions in the past, but in many models only lifted the odds to somewhat over 50% odds of a recession over a small number of samples.

- Paying attention to genuine economic shocks (inflation, an aggressive Fed), but not paying enough attention to underlying economic factors not typical during a recession, such as strong balance sheets for households and businesses with little of the overconfidence, overborrowing (except for the government), and overspending often seen at economic peaks.

- Underweighting the added uncertainty that the post-COVID environment even now adds to all economic forecasts as the economy continues to find its post-COVID equilibrium.

While we cannot call the outlook for the economy sunny, irrational sullenness persists and the skies may be less dark than what continues to cloud many forecasts. The growth rate will almost certainly slow next quarter and into 2024 after such an unexpectedly strong year, but the economy may still prove surprisingly resilient.

Here are some standout characteristics of the 2023 economy missed by most prognosticators and what they may mean for 2024.

The Explosive Growth in Manufacturing

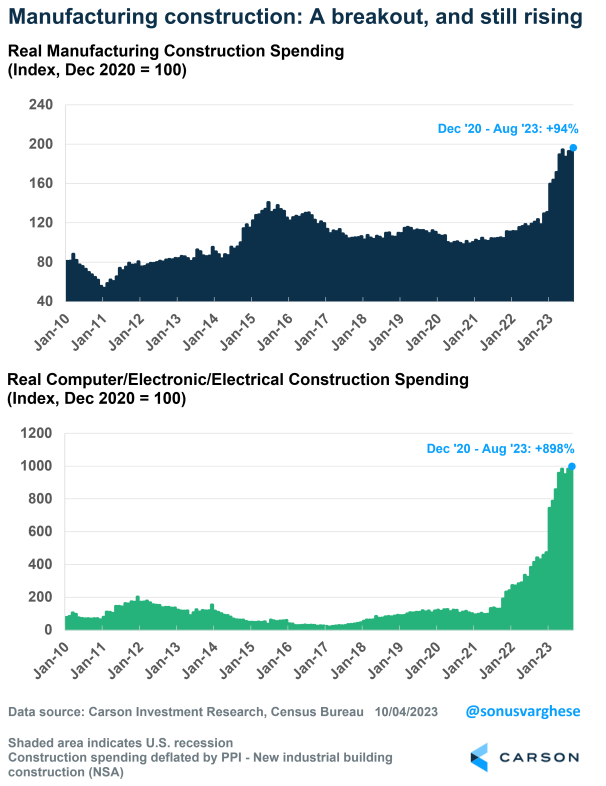

Investment in manufacturing in the last year has been nothing short of extraordinary, supported by fiscal stimulus (the bipartisan infrastructure bill, the CHIPS and Science Act, and the Inflation Reduction Act); the broader economic trend towards homeshoring; and a declining advantage in foreign labor costs compared to the high productivity of the U.S. workforce.

As of the end of August, manufacturing construction is up 66% year over year and 166% since December 2020, a big shift from the slight decline we saw from 2015-2020. The big driver has been high tech, which includes, for example, semiconductor chips and electric vehicle batteries. High tech manufacturing construction increased another 1.9% in August, taking it to +149% year over year and a whopping +1,266% since December 2020.

Manufacturing construction outside of high tech has seen strong growth as well. Construction outside of high tech rose 0.4% in August, is up 17% over the last year, and up 32% since December 2020. Even after adjusting for inflation, overall manufacturing is up +61% year (+94% since December 2020). That includes a 141% gain for high tech over the last year and a 13% gain excluding high tech.

Indeed, the chart below is my colleague Sonu Varghese’s Chart of the Year and captures an important underemphasized feature of the economy that has lent it greater resilience. The fiscal boost has pulled in massive amounts of private investment. In the near term, it has helped overcome even the strong headwind from higher rates. In the long term, borrowing for investment in particular can often pay for itself through the long-term GDP boost it can provide.

Looking toward 2024, the effect of fiscal stimulus has not yet exhausted itself but is fading. But we expect to continue to see some benefits next year. However, the additive impact of the additional capacity brought on line has barely been felt, both through direct increase in productive capacity and the potential downstream impact on productivity. The manufacturing story has certainly not yet run its course.

The Strength of Consumer Balance Sheets

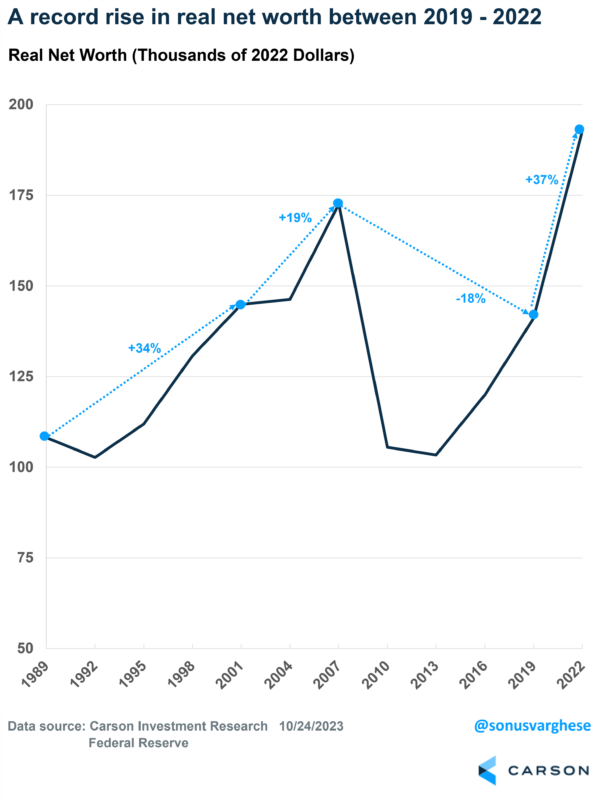

The Fed released its triennial “Survey of Consumer Finances” last week. This is the “gold standard” of data related to Americans’ financial condition. Household balance sheets showed tremendous improvement relative to 2019 figures, both in absolute terms and relative to what we’ve seen historically. (Note that the 2022 release is for 2021 data, while the 2019 survey is for data collected in 2018.)

Median real net worth jumped by 37% between 2019 and 2022, the largest 3-year increase since the survey was started in 1989. That is in sharp contrast to what we saw over the last decade, when real net worth actually fell 18%.

Not only that, but less wealthy households saw relatively larger gains in net worth. The lowest quartile of net worth (0-25%) saw median real net worth rise 864% between 2019-2022. Contrast that to the 81% decline between 2007 and 2019, mostly because home prices fell. Median net worth of households in the 25th- 50th percentile rose by 40%, versus a 14% drop between 2007 and 2019, which is higher than what we saw for the top decile of net worth. Note that the big percentage gains for less wealthy households are mostly because their net worth is far lower to start with, and the gains in absolute terms were trivial compared to wealthier households. Nevertheless, the gains are still important.

While we expect the gains in net worth to have a smaller impact in 2024 as excess savings continue to return to normal levels, excess savings overall have been underestimated and we still expect the strength of consumer balance sheets to be a tailwind for the economy.

Labor Market Strength

One data point the Bureau of Labor Statistics tracks is the prime age employment-to-population ratio, otherwise known as the participation rate. “Prime age” participation (ages 25-54) is considered an important neutral gauge of the economy’s impact on labor force participation, as it largely avoids the impact of those pursuing an education, at the younger end, or early retirements, at the older end.

Prime age participation has topped the peak of the last cycle and is close to the highest level since 2001 at a two-decade high of 83.5%. Better still, the corresponding ratio for women is at 75.3%, which is an all-time record high.

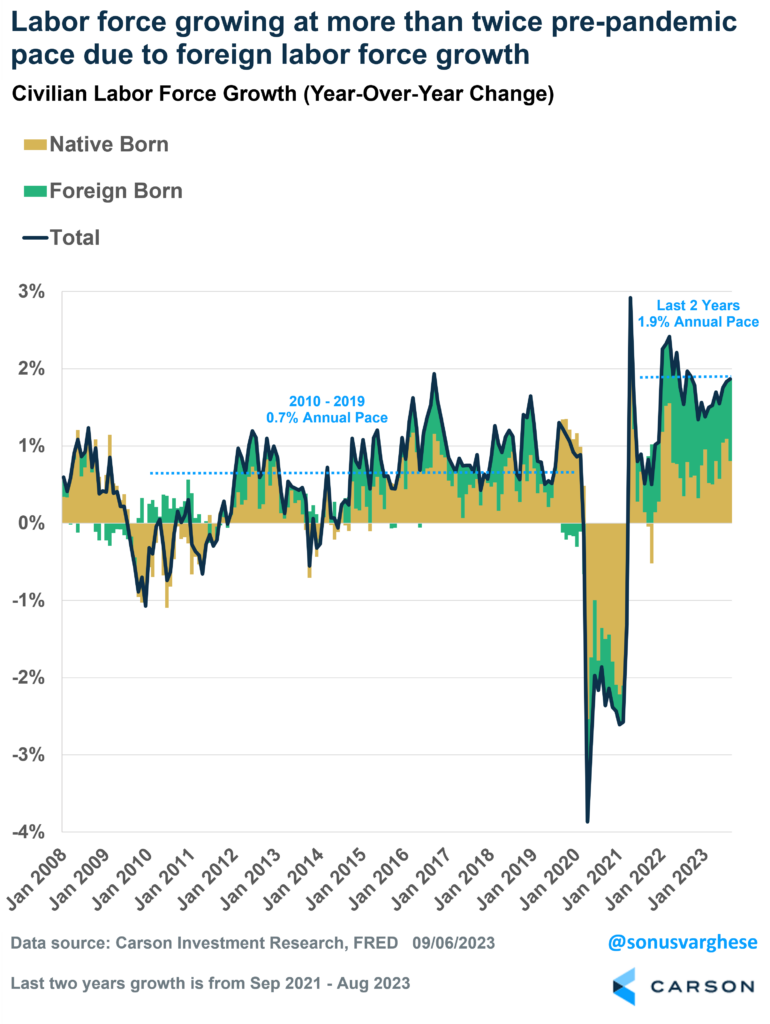

Not only is the participation rate high, but the labor force has also been expanding. According to September data, the labor force has grown at a 1.9% annual pace over the last two years, much faster than the pre-pandemic rate of about 1% and a clear break from the last decade. That’s the fastest pace we’ve seen in a long time. For comparison, the labor force grew at an annual pace of 0.7% from 2010-2019, and the pace was 0.9% over the decade before that. Labor force expansion has played an important role in 2023’s economic dynamism, as it helped control inflation both by relieving wage pressure and making it easier for supply to meet demand. As important, it also supported aggregate income growth.

As the U.S. faces increasingly tight labor markets, foreign labor has become an important added resource for expanding the labor pool. Competition for global labor, skilled labor in particular, has grown increasingly pressing as populations get older in developed economies and the number of current workers per retirees falls.

Immigration has been the main driver of above-trend labor force growth of late. Over the last two years, the foreign-born labor force has grown at an annual pace of 6.3%, versus a pace of 1.6% over the last decade. Even the native-born labor force, which makes up just over 80% of the total, has grown at a 1% annual pace over the past two years. That’s twice the pace of the last decade.

Restrictions on businesses’ ability to attract and employ foreign labor where needed remains a significant direct and indirect regulatory burden and we expect a more balanced approach will increasingly become part of a pro-business platform across developed economies.

If manufacturing strength is our chart of the year, the below chart is a strong candidate for runner up.

Looking ahead to 2024, we expect labor markets to continue to tighten, which will increasingly limit job growth. While prime age participation could continue to climb, we are near historical peaks and the room for further growth may be limited, although there’s still room for improvement among non-prime age workers. Above-trend labor pool expansion from foreign workers could continue near the current pace but is also likely near its peak. There is some room for continued steady job creation throughout 2024 but the gains will slowly become harder to come by. That will make potential productivity improvements among current workers an increasingly important issue for maintaining near-trend GDP growth.

While irrational sullenness marred forecasts in 2023 and seems to be just as sour now as we start to hear 2024 forecasts, actions have spoken louder than words, or surveys. Businesses may have concerns about the macroeconomic environment, but they have been hiring and investing. Consumers may be worried about inflation, but they continue to show confidence in their balance sheets and income by spending. 2024 will have its own challenges, but we wouldn’t be too hasty to dismiss the opportunities present as well, a topic the Carson Investment Research team is carefully reviewing as we continue to think about our outlook for 2024.

01959262-1023-A