Inflation’s running quite hot, but I believe the Federal Reserve (Fed) is going to cut interest rates next week for two reasons: 1) the labor market is weak; 2) they’ll argue that hot inflation is transitory.

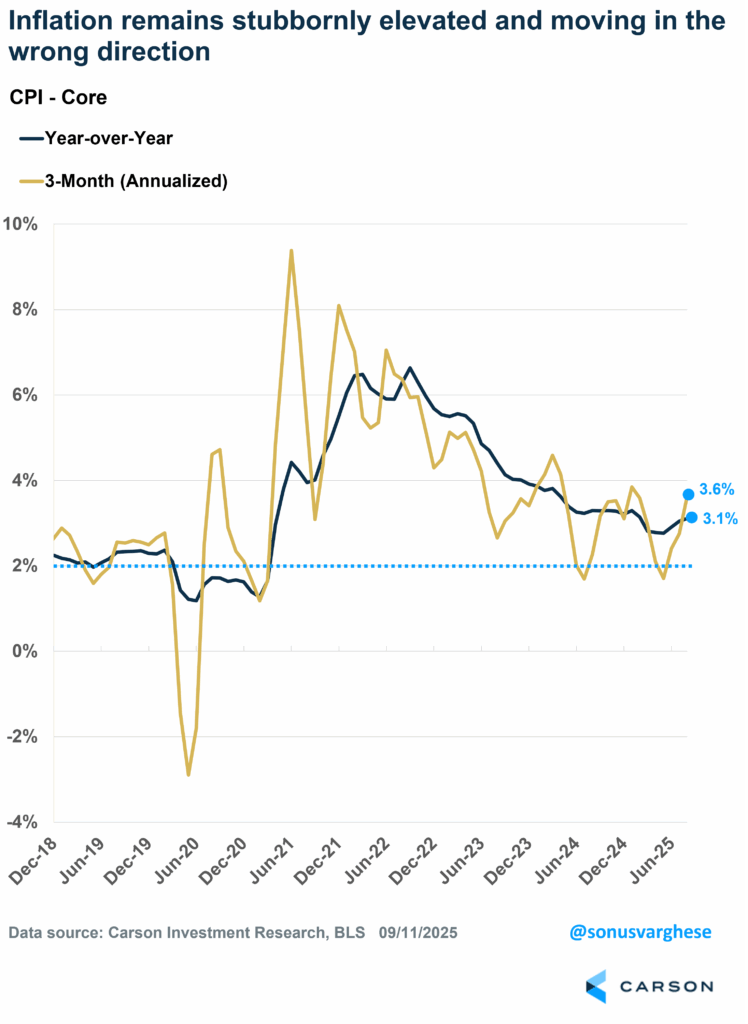

Let’s start with the inflation data. The Consumer Price Index (CPI) for August showed that inflation is running hot. Headline CPI rose at an annualized pace of 4.7% in August on the back of hotter food and energy inflation. The index is now up 2.9% over the last twelve months, the fastest pace since January. The Fed tends to focus on “core inflation,” which strips out volatile food and energy prices, but that was hot too. Core CPI rose at annualized pace of 4.2% in August and is up 3.1% over the past year. A year ago, in August 2024, core CPI was 2.6% and trending lower. That’s not the case now, as inflation remains well above the Fed’s target of 2% and crucially is moving in the wrong direction.

Blame Tariffs, but That’s Not the Only Cause

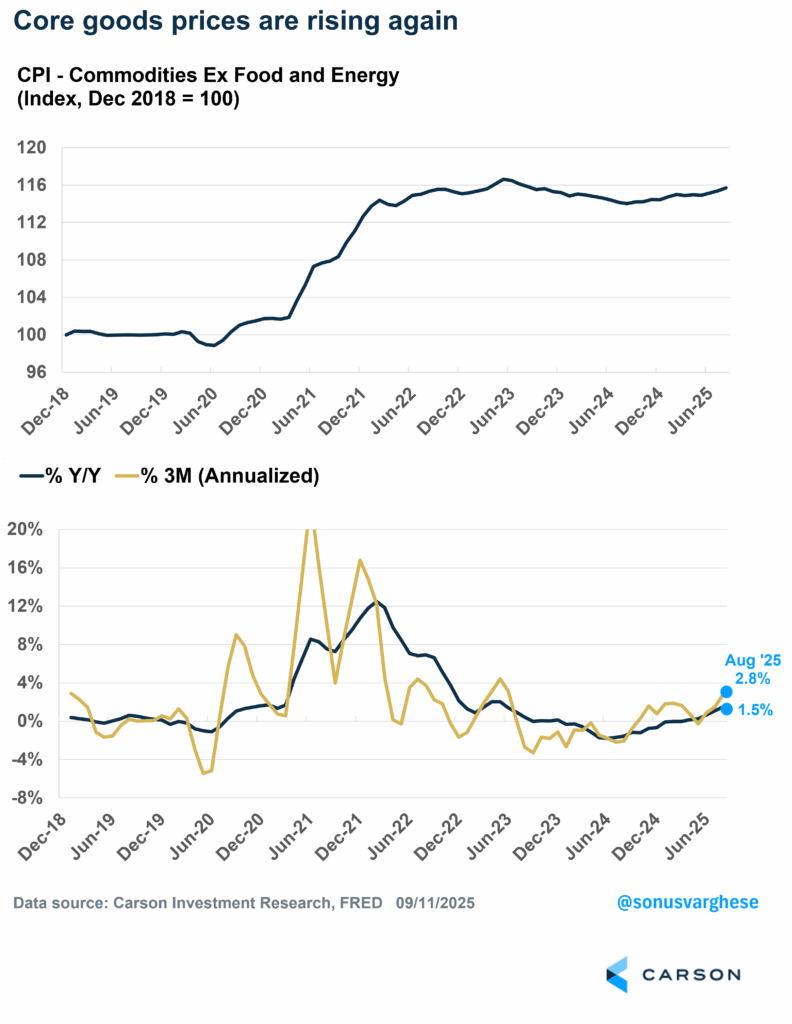

The most obvious source of heat is tariffs, and it’s showing up where you would expect it to— in durable goods. Here’s how CPI for durable goods has moved:

- August: +3.4% annualized pace

- Last 3 months (June – August): +2.8% annualized

- Last 12 months: +1.5%

There’s no question that we’re seeing accelerating durable goods inflation on the back of tariffs. Here’s a look at annualized inflation over the last 3 months for several categories within durable goods:

- Used cars: +3.4%

- Apparel: +4.1%

- Household furnishings and supplies: +7.3%

- Tools and hardware: +11.8%

- Video and audio products (like TVs): +10.1%

Keep in mind that prices for durable goods were actually falling prior to March, reverting to their pre-pandemic trend after the big spike in 2021–2022. So the pickup in inflation is a big reason why overall inflation numbers are going the wrong way. At the same time, tariffs should only have a one-time impact on prices, unless tariffs continuously ratchet higher. That means any tariff-related inflation should be “transitory” (though it may show up over the course of several months). The Fed is likely to make this argument, allowing them to look past elevated inflation.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

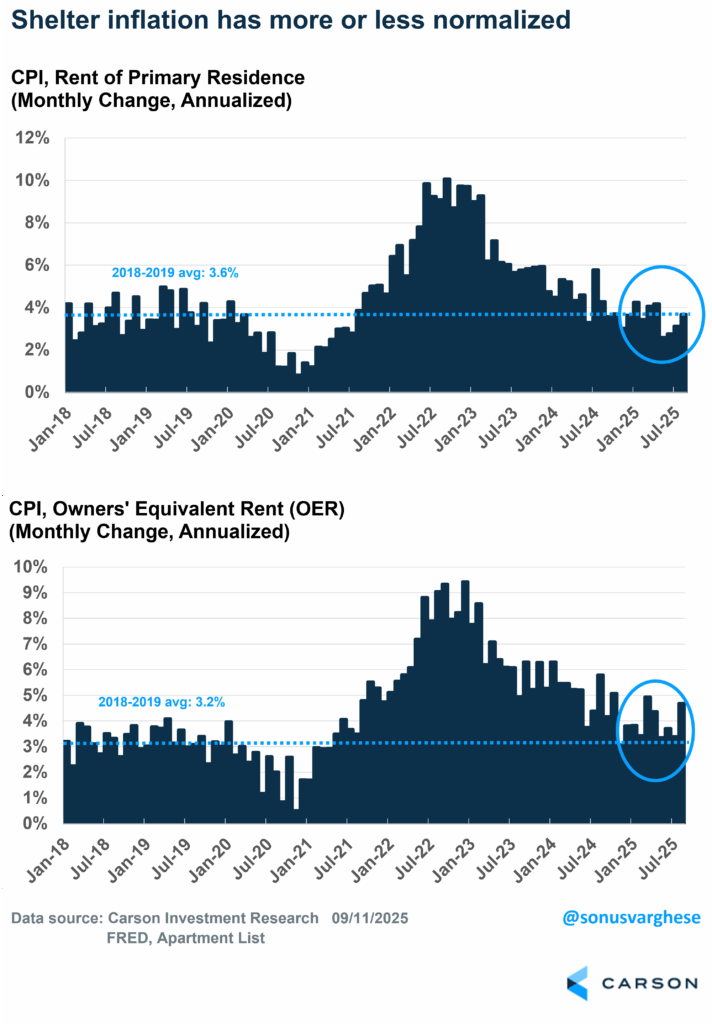

But tariff-related inflation is not the only source of inflation heat. The two other big pieces of the inflation basket are housing (shelter) and services outside of housing. We’ve written a lot about housing over the last few years, as in how official shelter inflation has a severe lag to what’s happening in real time. Until last year official statistics were still showing elevated shelter inflation, but that was capturing what happened a couple of years ago when rents were rising. Private data indicates that rents have been cooling for over two years now. The good news is that official inflation data is finally starting to reflect that reality and is a major source of disinflation. (Rent and owners’ equivalent rent make up 44% of the core CPI basket, and so it matters a lot.) Rents did pick up in August but that’s likely to reverse given what we’re seeing in the private data.

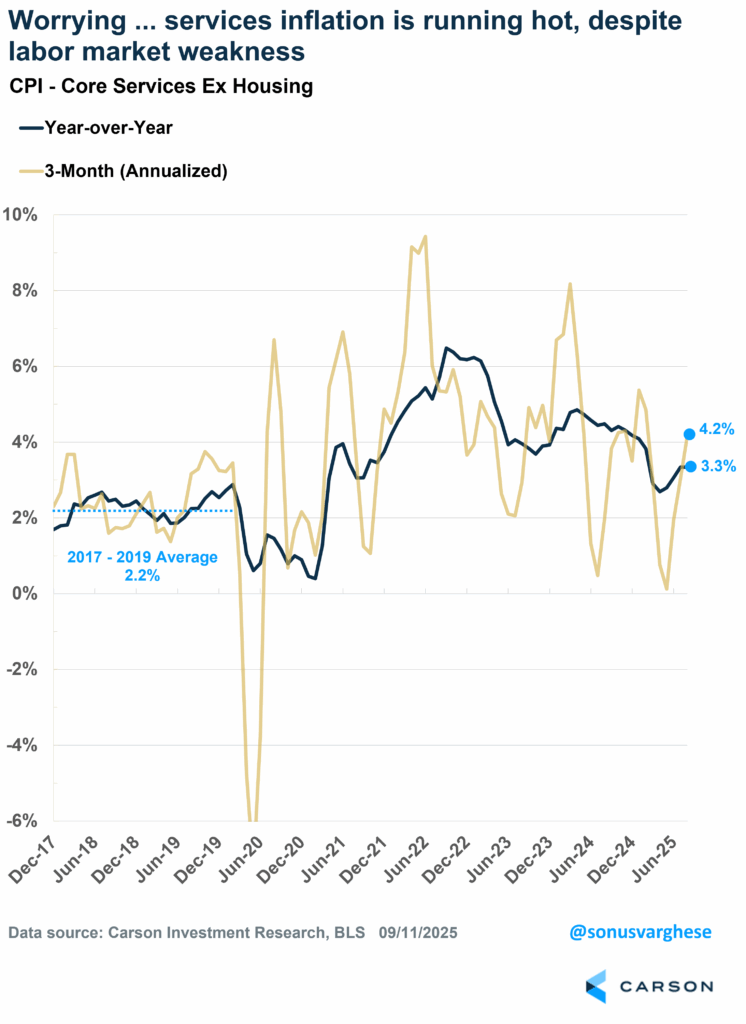

The problem is services outside of housing, including things like transportation services, pet services, personal care, and medical care. Normally, you’d expect to see elevated inflation in these categories when the labor market is running hot—if people earn more, they’ll tend to spend more on these services (like in 2021–2023). But the labor market is clearly running weak, and so it’s bit of a puzzle as to why services inflation remains elevated. But the reality is that it is, and CPI for services excluding housing has been accelerating recently:

- August: +4.0% annualized pace

- Last 3 months (June – August): +4.2% annualized

- Last 12 months: +3.3%

For perspective, CPI for services ex housing ran at an annualized pace of 2.2% in 2017–2019.

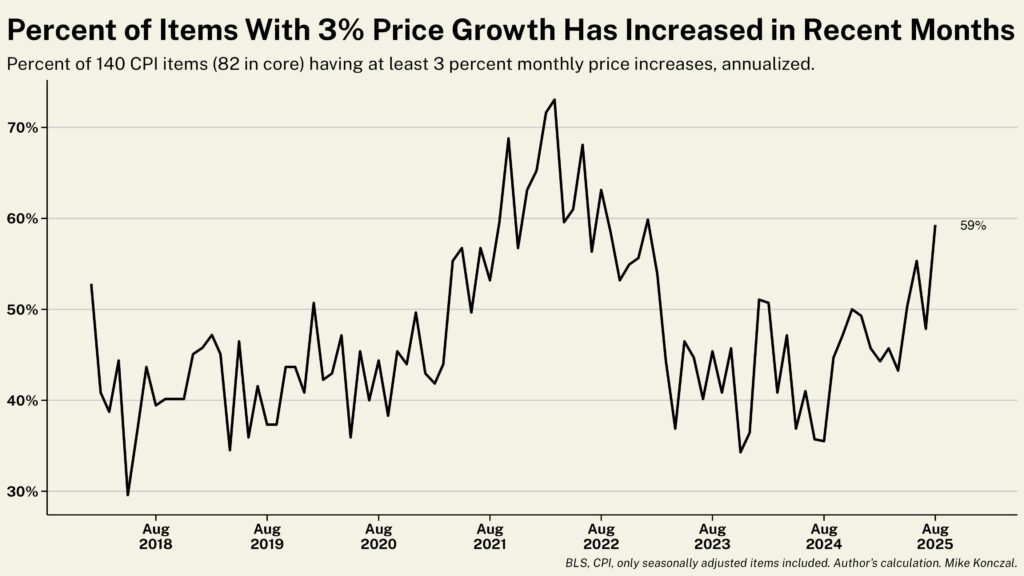

None of this is good news. And it’s not because a few items are pushing inflation higher. Inflation is broadening. Mike Konczal, the former Chief Economist at the National Economic Council, points out that 60% percent of items had at least a 3 percent (annualized) price increase over the last month—it was below 50% earlier this year. I discussed this in a recent blog as well.

The Fed’s Probable Case for Cutting: A Weak Labor Market

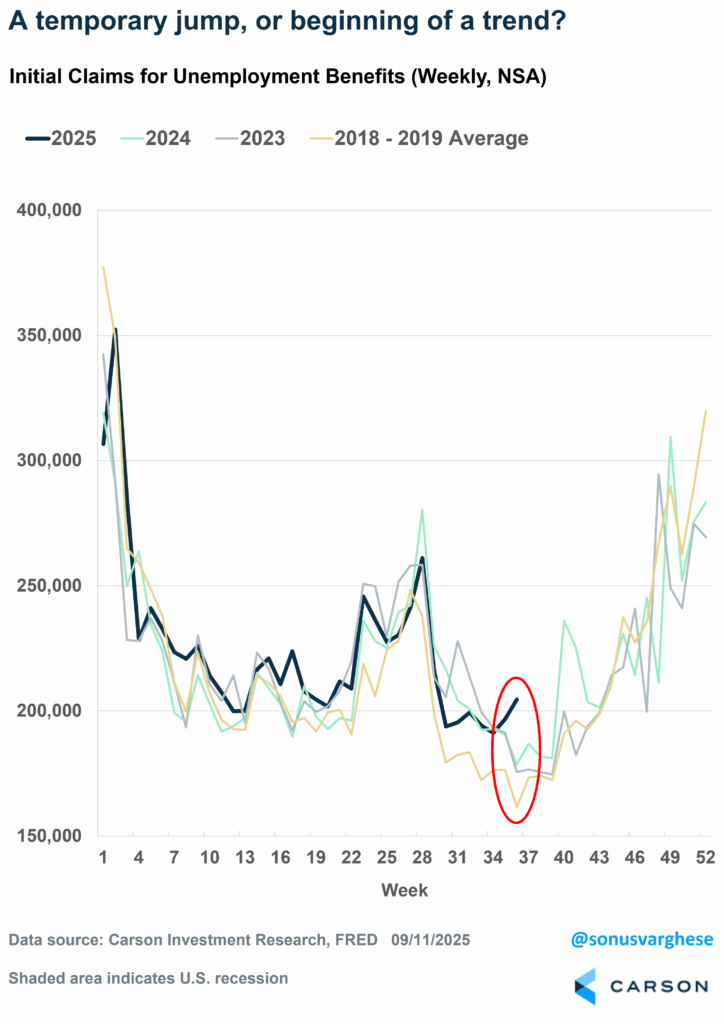

August payrolls were weak, especially with revisions and a higher unemployment rate, and that pushed investors to price in a 100% probability of a rate cut at the Fed’s meeting next week. The latest report on unemployment claims also showed a concerning increase last week, indicating more workers got laid off and filed for unemployment benefits. Claims are now well above levels we saw during this same week in 2023–2024 and even 2018–2019. Granted, this is only one week of data (and driven by a large increase in claims from Texas) and so it’s an open question whether it’s the start of a trend. Still, it only bolsters the Fed’s case for cutting rates on the back of labor market weakness.

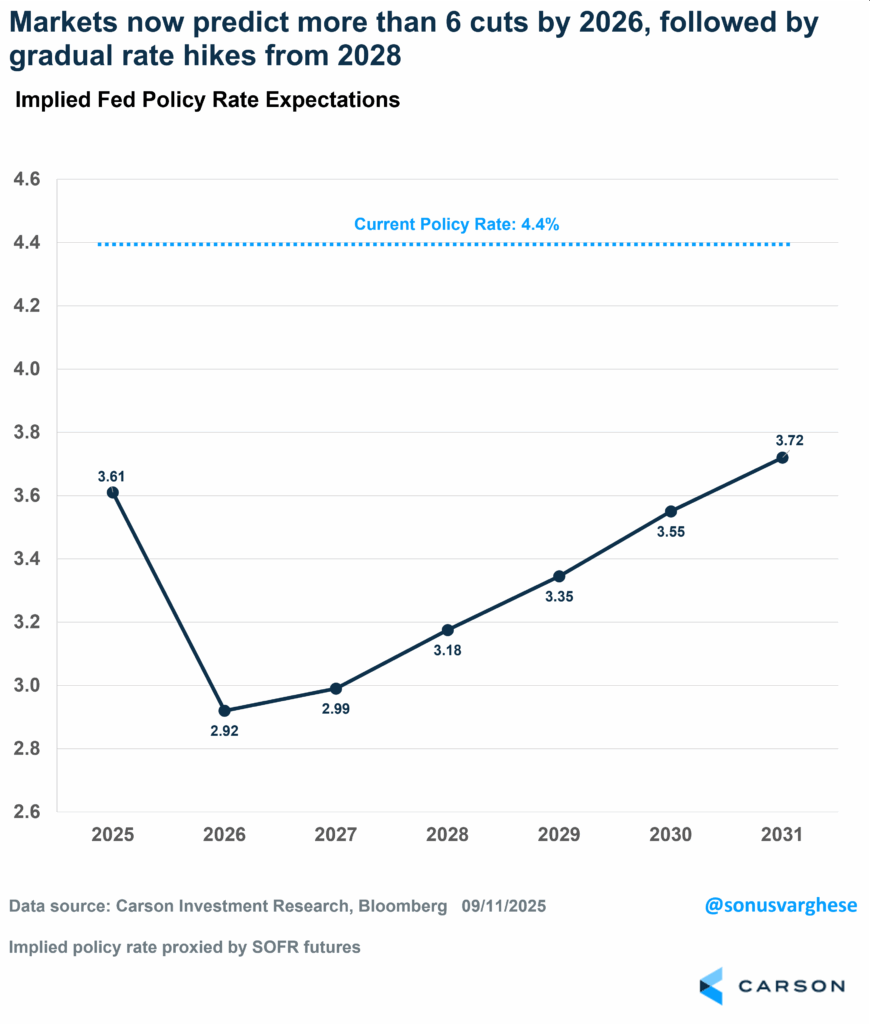

Markets currently expect the Fed to start a series of rate cuts beginning in September, taking the Fed policy rate from 4.4% to below 3% by the end of 2026. And investors don’t expect rates to go back up until at least 2028, and only gradually. In other words, markets expect the Fed to cut rates quite rapidly over the next year or so. But this is where there may be a disconnect between what the market expects and Fed members. Given inflation heat, the Fed may not be ready to commit to a series of rate cuts beyond a couple of more this year, at least not as much as the market expects.

Nevertheless, the big picture is that we think the Fed is going to start cutting rates once again after a nine-month pause, even as inflation remains elevated (and going in the wrong direction). That is bullish for the market. It means the Fed’s priority is to protect the labor market (and the economy) even at the risk of running things hot. There’s a reason why stocks continue to rally and make one new all-time high after another, and the profit outlook really hasn’t dimmed.

Ryan and I got to sit down with a couple of wonderful macro thinkers at our Excell conference earlier this week for a live recording of Facts vs Feelings – Samuel Rines (Macro Strategist at WisdomTree) and Strider Elass (Senior Economist at First Trust). We talked about the economy, the labor market, inflation, and the Fed. Take a listen below.

For more content by Sonu Varghese, VP, Global Macro Strategist click here.

8384919.1.-09.11.25A