The Federal Reserve (Fed) left rates unchanged at their March meeting, but the headline was that the median official continues to project three interest rate cuts in 2024, each worth 0.25%-points. Going into this meeting, a big question was whether Fed members would lower that projection to just two cuts in their summary of economic projections (the “dot plot”). Keep in mind that even two cuts for an economy that’s running strong is a nice tailwind for growth. But there was concern that the Fed would signal a big shift in their thinking, spooked by two months of relatively hot inflation data. However, Fed Chair Powell pointed out that they’re not “overreacting” to recent data, just as they didn’t overreact to the soft inflation data over the prior six months. He stressed that the overall story remains the same: inflation is trending down along a bumpy path. I recently wrote about how the underlying inflation data points to more disinflation, and it’s positive that the Fed is viewing it the same way.

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today! "*" indicates required fieldsStay on Top of Market Trends

Bullish on the Economy, But Not Worried About Inflation

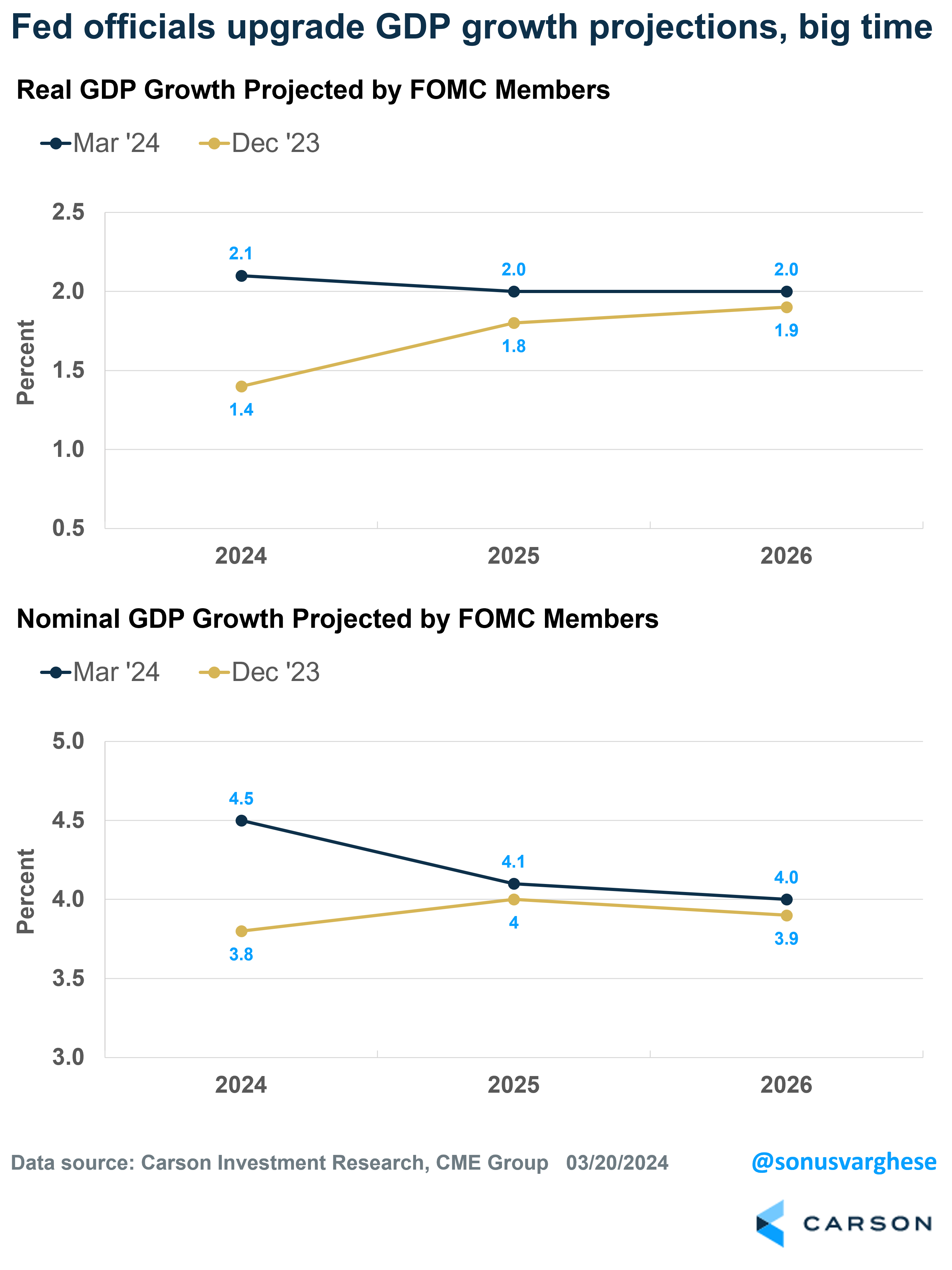

The details within the Fed’s dot plot were even more bullish. Fed officials upgraded their economic growth projections for 2024 from 1.4% to 2.1% (real GDP growth). That’s a big jump, and acknowledgement that the economy is strong. Their nominal GDP growth forecast for 2024 (real GDP growth + inflation) increased from 3.8% to 4.5%. Nominal GDP growth is where company profits come from, and by itself that’s positive as far as markets are concerned.

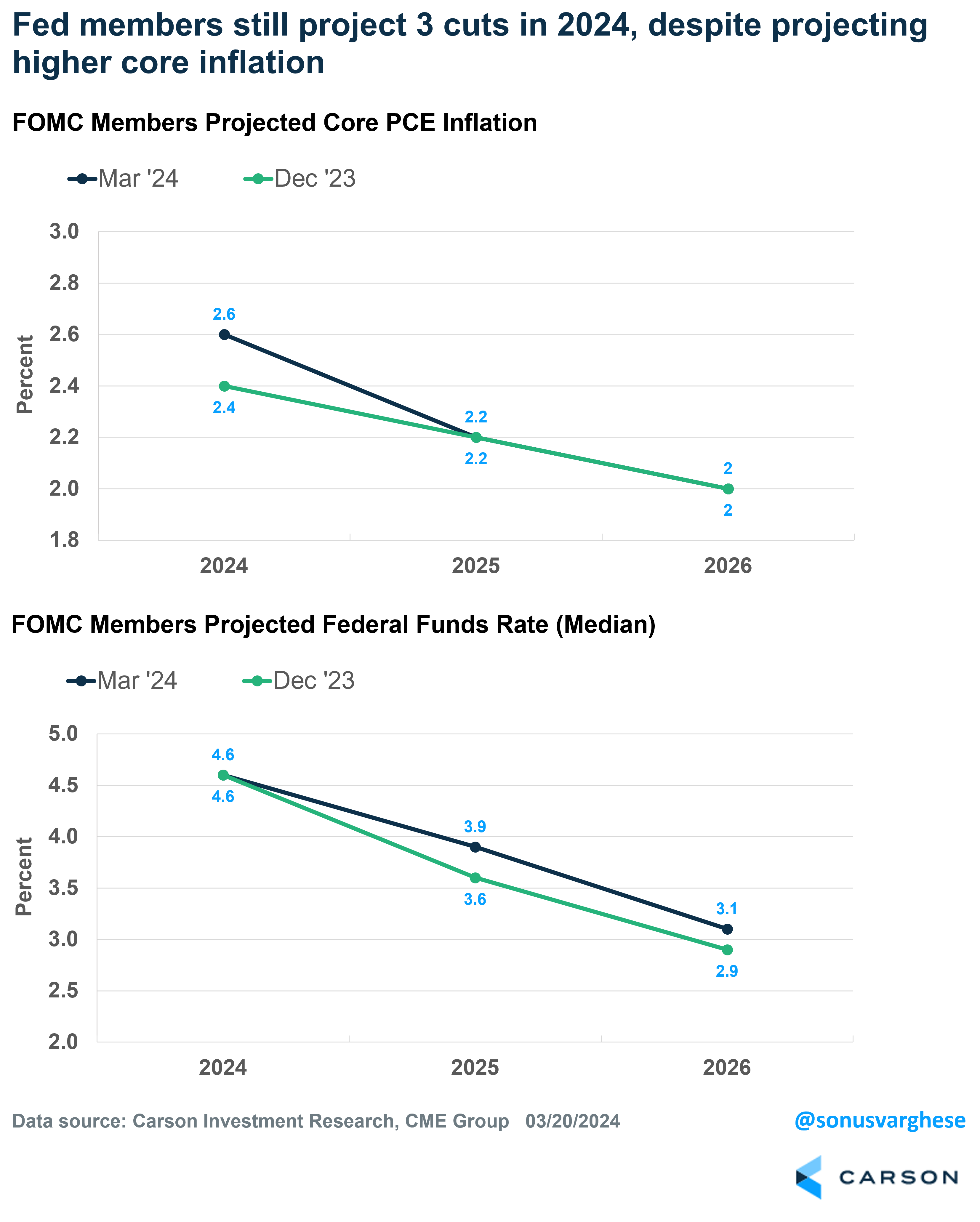

Even more interesting: they increased their core inflation (core PCE) forecast for 2024 from 2.4% to 2.6%.

All this to say, the Fed’s still projecting 3 cuts in 2024 – taking the federal funds rate down from 5.4% to 4.6% by the end of the year – even as they upgraded their view on the economy, and projected core inflation to remain above their target of 2%.

It’s one thing to project rate cuts in the face of a slowing economy and lower inflation. But they did the opposite, and that’s a big deal. In fact, the scenario of strong growth with easing inflation that allows the Fed to ease rates is exactly what we laid out in our 2024 outlook. We’d like to think the Fed read Carson Investment Research Team’s 2024 outlook. 😊

Interest Rate Cuts Will Be a Tailwind for the Economy

Powell did say that the projected interest rate of 4.6% at the end of 2024 would be higher than their long-run estimate of the “neutral rate” of 2.6%, implying that monetary policy would remain restrictive. However, the economy managed to avoid a recession in 2022-2023 despite rates at 5.4%. Even better, the economy grew 3.1% in 2023 (inflation-adjusted), well above the 2010-2019 trend of 2.4%.

The labor market has been the backbone of the economy, with rising employment and strong wage growth coupled with easing inflation boosting consumption. Another positive from the Fed meeting is that Powell said they’re aware of the risks of doing too little, i.e. cutting rates too little and too late, and causing “unnecessary harm” to the labor market. They clearly want to hold on to the strong employment gains we’ve seen over the last two years. Up until last year, they were willing to risk higher unemployment if that’s what it took to quell inflation. That’s no longer the case. With inflation heading the right way (down), the Fed likely has the back of the labor market once again.

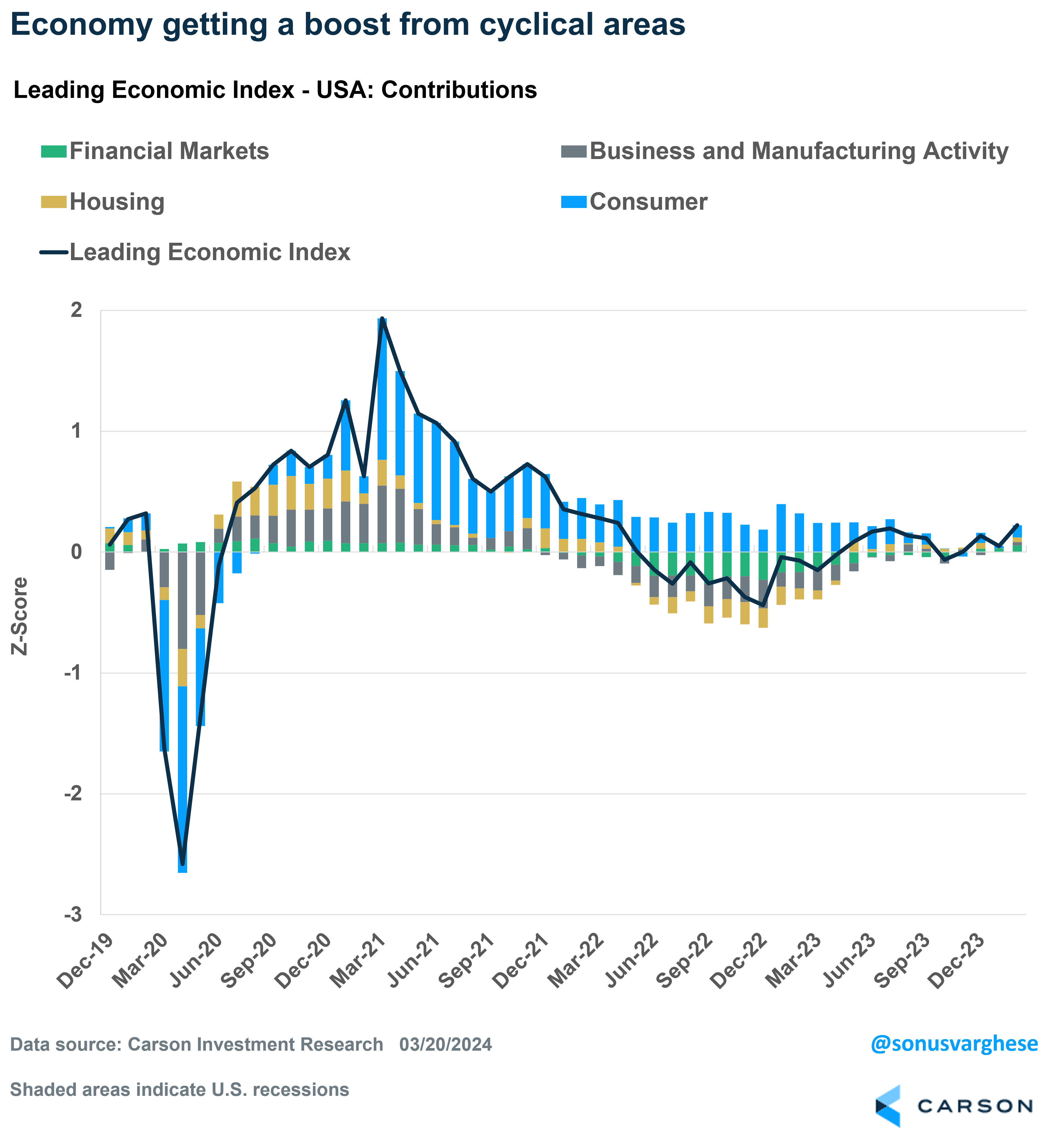

At the same time, interest rate sensitive areas of the economy, notably housing and equipment investing, have been a drag on growth since 2022. You can see this in the chart below, which shows the main components of our proprietary leading economic indicator (LEI) for the US. Consumption more than offset the drag from other areas of the economy and kept the economy humming. Well, there’s reason for optimism as former headwinds turn into tailwinds. Investors, consumers, and businesses sense that interest rates have likely peaked this cycle, and cuts are coming. Or LEI indicates that the economy continues to grow along trend, if not slightly above it (zero implies trend growth in the chart below).

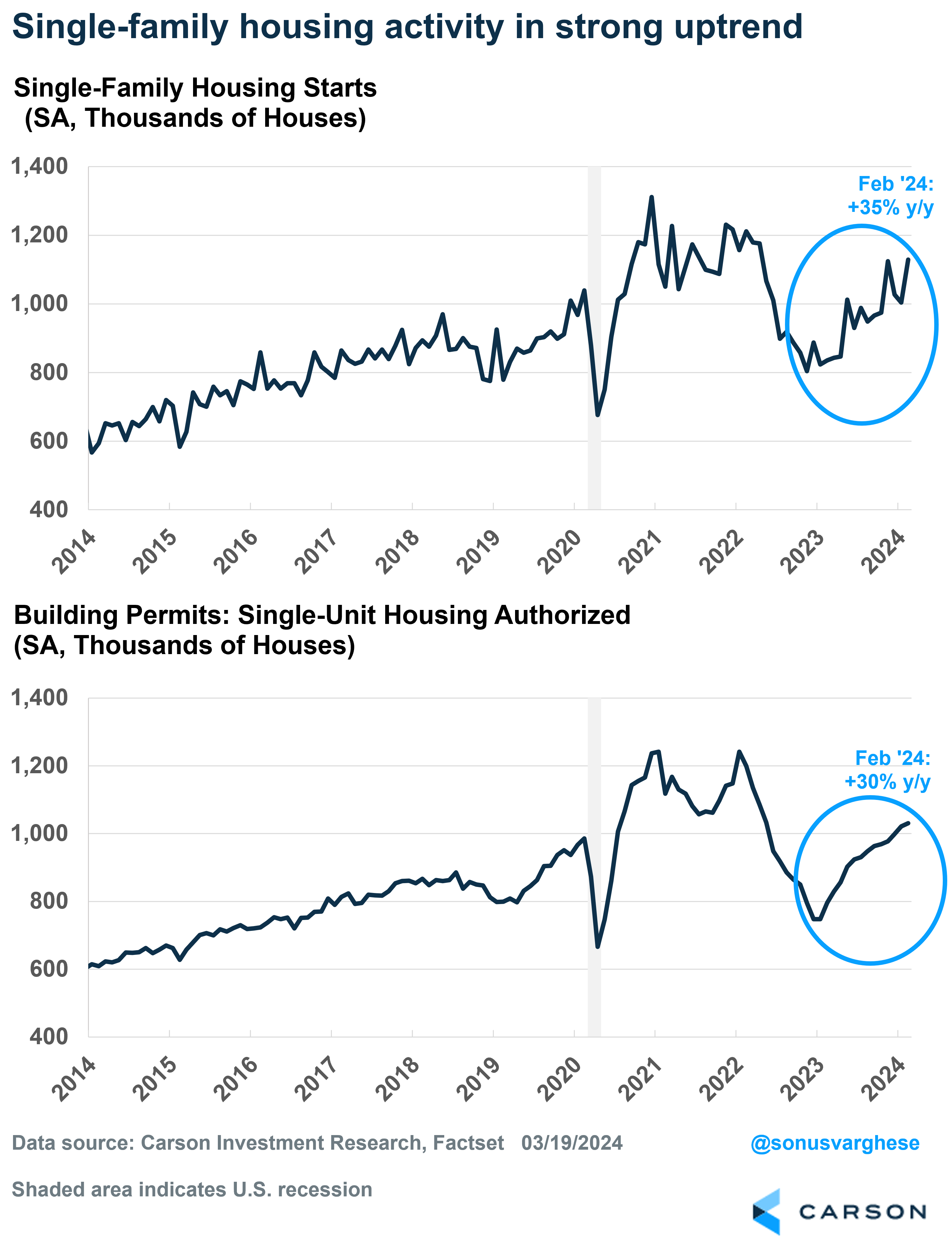

Take housing as an example. Single-family housing activity makes up the bulk of residential investment within GDP, and that crashed in 2022 as the Fed raised rates. Housing dragged on GDP growth for nine straight quarters (through the second quarter of 2023). That shouldn’t be a surprise because housing is perhaps the most interest rate sensitive sector of the economy, and mortgage rates surged from around 4% to 8%. The good news is that single-family activity has been trending higher since late last year, as rates pull back in anticipation of rate cuts by the Fed. As of February, starts are up 35% from the prior year, and are now 27% above the 2019 average. Permits, which are a sign of future supply, are up 30% year over year and 19% higher than the 2019 average. In short, housing is likely to add to GDP growth this year.

Similarly, a pullback in rates will likely boost the manufacturing sector, as businesses start to invest more in equipment and machinery. Parts of the manufacturing sector, especially defense and hi-tech equipment, are already running strong, but it’ll be positive to see broader strength.

Ultimately, what matters for stocks is profits. And if the economy is strong, profits will continue to grow. The icing on the cake is that we could potentially see rate cuts boosting the most cyclical areas of the economy. Ryan Detrick, Chief Market Strategist and I talked about the underlying strength of the economy and why we’re not too worried about recent inflation data in our latest Facts vs Feelings episode.