Concentration of stocks within the S&P 500 has surged to the highest level since the turn of the century, with the top ten holdings now accounting for over 30% of the index. This phenomenon isn’t unique to the U.S.; a similar trend has emerged globally. In Europe, the largest stocks are referred to by the acronym GRANOLAS and the Japanese Nikkei has recently surpassed highs set 35 years ago, driven by a select group of the top 30 stocks.

The outperformance of the “Magnificent 7” technology-oriented mega-cap stocks has propelled the US market to record heights, raising concerns about its top-heavy nature and susceptibility to toppling. (The Magnificent 7 are Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla.) This trend toward higher concentration has unfolded against a backdrop of rising interest rates and a global economy that hasn’t performed as well as the United States since 2022. Faced with this uncertainty, investors flocked to the highly profitable mega-cap companies, viewing them as the safest bet in a volatile market.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

However, as interest rates are expected to decrease and the benefits of Artificial Intelligence (AI) become more apparent across many sectors, we anticipate a shift. The broader market seems poised to catch up, driven by renewed optimism and a search for additional investment opportunities.

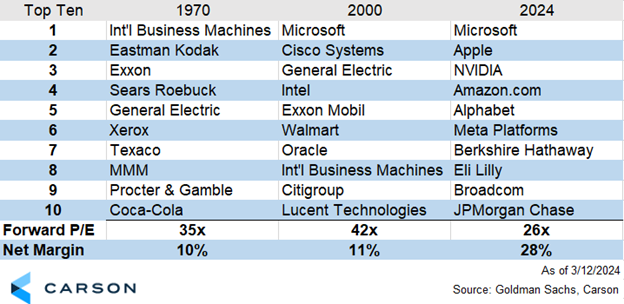

Even outside of potential opportunities elsewhere, fundamentals for the largest stocks in today’s market are strong. Reflecting on historical parallels, the current market dynamics evoke memories of past eras like the Dotcom bubble and the Nifty Fifty. Although concentration levels reached similar heights in the early 1970s and again in 2000, today’s top companies enjoy profit margins that are nearly three times higher than similar prior eras. Moreover, the current stocks are not as expensive as in previous instances, with a blended forward-looking P/E ratio for the top 10 stocks currently hovering around 26x earnings, compared to 42x in 2000 and 35x in 1973.

Market concentration extends beyond individual stocks. The information technology (tech) sector now accounts for 30% of the S&P 500 Index, even after GICS reclassified key components like Meta, Amazon, and Alphabet to other sectors. Without these adjustments, the technology sector would represent more than 40% of the index! While the tech sector is most concentrated in the US, it is increasingly becoming a larger feature of global indices as well. This reflects the evolution of the global economy where technology and tech-enabled businesses now make up a significant portion of global profits. Throughout most of the 1900s, the largest sectors were Energy and Materials, which gradually yielded over the past thirty years.

While concentration itself isn’t necessarily alarming, it’s essential to consider the implications. Today’s top companies delivered explosive growth over the past five years. Even with a sharp pullback in 2022 they’ve outpaced most asset classes. However, as earnings growth for these elite businesses begins to moderate in 2025, diversification may once again become advantageous. Carson’s House Views favor small and mid-caps, anticipating that these asset classes should benefit from the catch-up trade. With a healthy economy and a more favorable outlook for interest rates, we don’t expect a decline in the Magnificent 7. Rather, we anticipate more attractive returns from the rest of the market.

For more content by Jake Bleicher, Portfolio Manager click here.

02161184-0324-A