The stocks known as the “Magnificent Seven” – Microsoft, Meta, Amazon, Alphabet, Nvidia, Apple, and Tesla – have buoyed major indices throughout the year, fueled by the growing enthusiasm surrounding Artificial Intelligence (AI). As the third quarter earnings approached, all eyes were fixed on this elite group due to the remarkable performance of their stocks year-to-date. Last week’s show was stolen by the cloud providers, who are responsible for powering AI. The results brought to light Microsoft’s growing dominance in this arena as it continues to gain share from Amazon and Alphabet. Cloud growth overshadowed otherwise solid quarters, where key businesses like digital advertising and e-commerce returned to normalized profitability and growth.

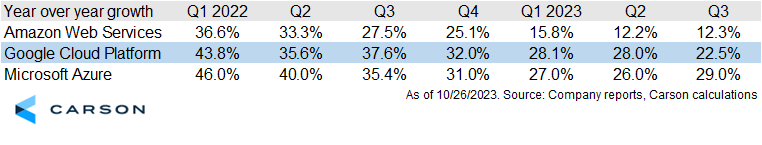

Microsoft – Investors lauded the reacceleration in cloud growth which the company attributed to “higher-than-expected AI consumption.” The company’s Azure cloud infrastructure powers OpenAI and ChatGPT, some of the most heavily used AI products to date. This tangible evidence helps to assuage concerns that AI is not “over-hyped.” Investors balk at its roughly $2.5 trillion, yes T as in Trillion, price tag but it isn’t that unhinged given the company is expected to generate more than $100 billion in operating cash flow this year. Already, its cloud business is approaching half of corporate operating profits and is accelerating the growth of the entire company. By the way, it just recently began offering AI solutions to its cloud customers who seem very eager to adopt them. In November, Microsoft will launch its AI Co-Pilot solution for its suite of Office 365 applications, which should make AI even more accessible to the average user. Across the industry, the cloud is already a $150 billion run-rate business, and it is growing at a 20-30% clip. While the meteoric rise in AI stocks might appear overdone, Microsoft’s fundamentals appear to be keeping pace with the hype.

Cloud Service Growth Rates

Alphabet – The company’s position in cloud is a distant third, and this was accentuated by a continued slowing in growth even as Microsoft accelerated. In short, the company is losing its share. Shares fell precipitously on the news but there were some important positive takeaways from this report. Its advertising business, which had been in a year-long slump, returned to double-digit growth. Other digital advertising peers have confirmed that the market is at least stabilizing, if not improving. I like seeing growth in digital ads because they offer an indirect look at the health of small businesses that often rely on Google and Facebook for marketing. While it would certainly help to see growing adoption of Alphabet’s cloud business and a more convincing toehold in Artificial Intelligence, investor expectations aren’t very demanding. Shares trade at only 21x this year’s earnings, or only 17x if you exclude stock-based compensation. That doesn’t seem like an unfair price for a growing advertising business. I also wouldn’t count Google out of AI given the vast amount of data it has to train its algorithms with.

Amazon – Similar to Alphabet, Amazon’s cloud growth disappointed, even though the rest of the business improved. While Amazon boasts the largest cloud business today, raking in over $90 billion in sales, the rapid pace at which Microsoft is capturing market share suggests a looming shift. If Microsoft’s momentum persists, it may outpace Amazon Web Services (AWS) within a few years. The significance of the cloud to these tech giants lies in its unparalleled profitability. For Amazon, cloud services already contribute over 60% of its profitability. Despite cloud challenges, Amazon experienced a welcome improvement in its e-commerce business. The business had been struggling with costs as it took too long to right-size staff following the pandemic and it invested in regional distribution centers. Profitability appears to be back on track and Amazon’s packages are reaching customers at the fastest rate in the company’s 29-year history. Amazon has been investing for growth across all of its businesses, most notably AWS. As expense growth flattens, the company is poised to flex powerful operating leverage and analysts believe it could generate almost $10 in free cash flow per share by 2026.

Meta (Facebook) – It is remarkable how quickly Meta managed to turn its business around. A year ago the company barely broke even on a free cash flow basis and in the most recent quarter, it generated nearly $14 billion. The company has enhanced its advertising targeting and measurement following the privacy changes from Apple that temporarily crippled the digital advertising industry. Meta’s introduction of Reels, a short-form video feature, has significantly boosted user engagement. The impressive 31% increase in advertising impressions and the fact that over 75% of core Facebook advertisers have embraced Reels underscore its popularity and effectiveness. Moreover, Meta’s incorporation of AI into its advertising products seems to be a game changer, it is more monetizable and more engaging than previously thought.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Amidst lofty expectations, results have been nuanced, especially in the increasingly important cloud market. While Microsoft does appear to be winning round one, Amazon and Google aren’t done fighting. Amazon mentioned it signed “more AWS deals in October than all of Q3.” Aside from cloud, the notable improvements in profitability and the overall stabilization of business operations set a positive tone for 2024. The breakneck pace of growth we witnessed as the world emerged from lockdown was unsustainable. The return to normal is providing businesses with a valuable opportunity to recalibrate and refine their strategies. Looking ahead to 2024, the prospect of healthy but normal mid-single-digit sales growth coupled with a significant uptick in profitability, paints a promising outlook for investors.

01956258-1023-A