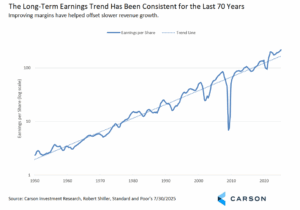

When it comes to stocks, in the long run earnings are everything since the ability to grow earnings gives stocks their fundamental value, and in the long run earnings have followed a fairly steady path, with higher margins really since early 2000 offsetting lower sales due to slower global growth. On the other hand, in the short term, earnings tend to be a lagging indicator of markets because the information comes late (right now we’re getting second quarter earnings). Even forward earnings estimates tend to lag markets, because analysts tend to be slow to update their views relative to markets, which price things in much more quickly. (This is one of the reasons you can view price momentum as partially a fast twitch reflection of earnings growth.) But even with all that, there’s a lot of information embedded in earnings. Today we take a quick look at Q2 2025 earnings so far with a quick look at how this rally remains fundamentally driven.

Q2 2025 Earnings Support the Stock Turnaround

As of Friday, July 25, we are about 1/3 of the way through the Q2 2025 earnings reporting season, with 34% of S&P 500 companies having reported. In a nutshell, corporate America is once again showing its resiliency as earnings continue to surprise to the upside. According to FactSet estimates, 80% of reporting companies have had positive earnings surprises so far, slightly above the five-year average of 78% and the 10-year average of 75%. However, the size of the beats hasn’t been quite as strong versus history (although it’s still early), with reported earnings an average of 6.1% above consensus, below both the five-year average (9.1%) and the 10-year average (6.9%). Possibly more important, margins remain resilient, topping 12% for the fifth consecutive quarter, thanks in part to stronger revenue surprises compared to history.

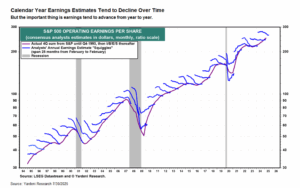

These are good numbers and they confirm the strong rebound we’ve seen in the S&P 500 off those early April lows, but while solid don’t get too excited about them. As seen above, there’s a bit of earnings gamesmanship that needs to be factored out. One-year forward earnings estimates tend to be too high, but earnings estimates at the start of reporting season are almost always too low.

While the below isn’t one year forward estimates, they do show estimates tend to fall for the calendar year over time. But the important thing to focus on is not that the estimate for a particular year tends to fall over time, but that year to year we see overall earnings growth. That’s what matters for market gains.

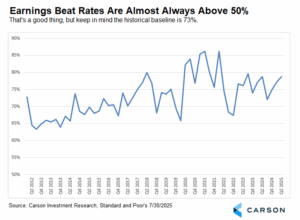

On the other hand, high quarterly beat rates are normal, but that’s ok. S&P provides data on quarterly beat rates (compared to start of quarter expectations) going back to Q2 2012, or 53 quarters (excluding Q2 2025, which are the earnings reports we’re currently getting). Out of 53 quarters, the beat rate was above 50% 53 times! If estimates were well calibrated, on average you would expect that number to average about 50% and be above about half the time and below about half the time. That’s a very large persistent bias, but at least it’s fairly consistent so we can adjust for it. So call earnings season so far solid but not extraordinary, but that’s all stocks need to continue to advance.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Tariff Risk Likely Largely Priced In, or Even Overpriced

Part of the gamesmanship is efforts to lower expectations (the easier to beat!) on the part of businesses. According to FactSet data, of those issuing guidance for next quarter, 52% have been negative (over a small sample), but that’s below the five-year historical average of 57%. This helps give us some sense that lowering expectations is an important part of the earnings game and trying to manage expectations lower is the norm. But businesses have actually been working to lower expectations a little less than usual recently. In part that’s because of more aggressive efforts to adjust expectations earlier this year in the face of the post-Liberation day tariff uncertainty. Another way of saying that is that much of the tariff risk has already been priced in to earnings expectations.

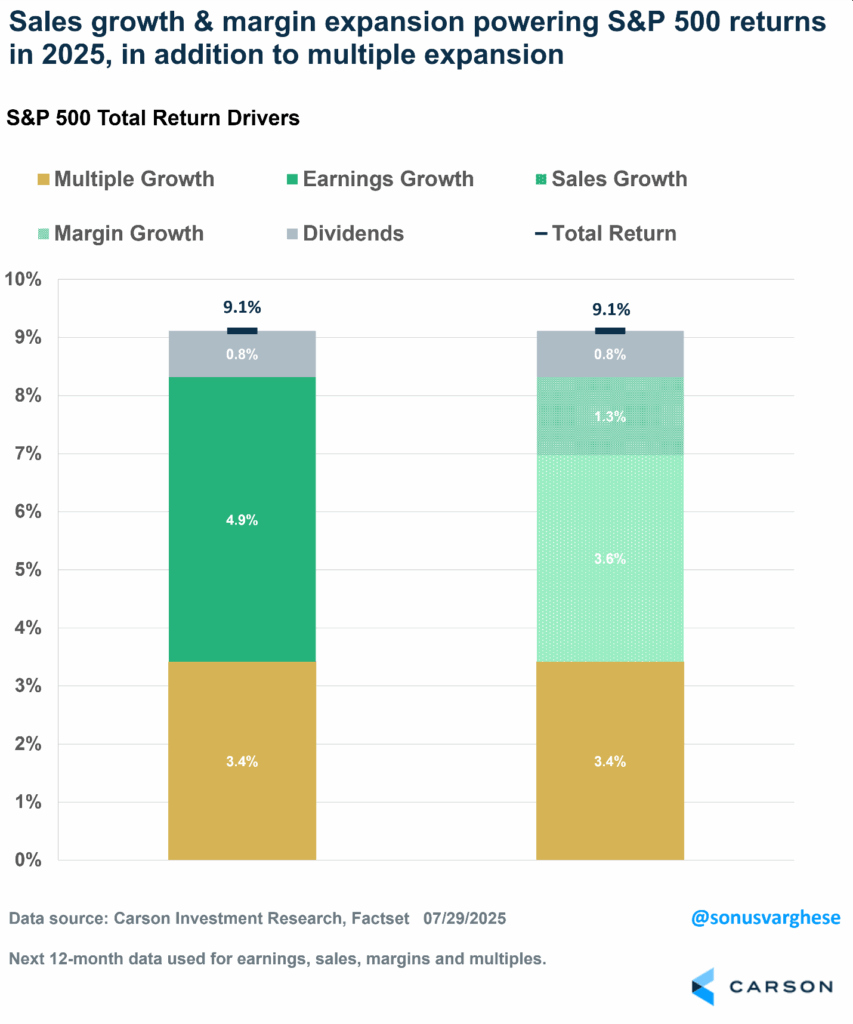

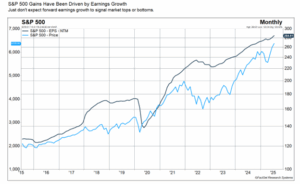

Stock Fundamentals continue To Be the Main Driver of Returns

Getting into the details a little more on returns so far this year, the most important thing to keep in mind is that stock gains have mostly been driven by earnings growth. I break down the numbers below with the help of a favorite chart from Carson’s VP Global Market Strategist Sonu Varghese. The S&P 500 has advanced 9.1% this year. Yes, some of that has been driven by multiples expansion (investors willing to pay more for a dollar of future earnings). That does accounts for 3.4 percentage points of the 9.1%. But a much larger share (4.9 percentage points) can be attributed to earnings growth, which can be broken down into 1.3 percentage points from sales growth and 3.6 percentage points from margin expansion. Add in 0.8 percentage points from dividends and fundamentals have driven 5.7 percentage points of this year’s gain. Similar numbers in the second half (and of course that’s uncertain) would give us an 11.4% advance in the S&P 500 this year from fundamentally driven factors alone! The bigger wild card is multiples, but simply preserve the 3.4 percentage points from valuations so far (that is, nothing contributed in the second half) and you’re up to 14.8% for the year, the higher end of the 12–15% forecast in our Midyear Outlook 2025: Uncharted Waters.

In short, there’s not a lot to worry about in the current earnings, and quite a bit to feel good about. While the impact of tariffs is going to vary quite a lot from business to business, overall businesses may have priced in a much worse case than where we’ve ended up and that’s lowered the bar and may continue to over the rest of the year. Even with that, forward expectations have climbed steadily. That is very different from 2022, for example, when forward-year earnings peaked in June and then fell through February of 2023. (Remember what I said about forward earnings being a lagging indicator—the S&P 500 peaked in January 2022 and bottomed in October, so earnings lagged by about a 3–6 month lag in this case.)

By contrast, the tariff shock has provided only one negative month for forward year expectations (April 2025) and outside of that has advanced 27 of the last 28 months! Just don’t expect forward earnings to tell us when the market is at a peak—watch the market to tell us when earnings are at a peak. But forward earnings still provides important confirmation and also an important reminder that this has been largely a fundamentally-driven rally.

8230047.1.-07.30.25A

For more content by Barry Gilbert, VP, Asset Allocation Strategist click here