The Federal Reserve (Fed) chose to pause on interest rate hikes at their September meeting, leaving the federal funds rates unchanged at 5.25-5.50%. This was not unexpected, but the members did give us a lot of new information. They updated their economic projections, i.e. their views of what the economy, employment, and inflation will do under appropriate monetary policy.

Here are five takeaways.

One: Signs point to no more rate hikes

The Fed keep their terminal rate expectation unchanged at 5.6%, which implies they expect one more rate hike before the end of the year. However, Fed Chair Jerome Powell, was extremely cautious about the path forward. He said they’ve already done a lot, and very fast. And as they get closer to what they think is the appropriate policy rate, the risk of over-tightening increases. Since they moved really fast already, they can afford to pause now, and wait to see the full impact of everything they’ve done.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

That doesn’t sound like someone who wants to raise rates further. Instead, penciling in one more rate hike simply gives them optionality in case inflation surprises higher once again. Right now, that seems unlikely.

Two: They are buying the fact that the economy is strong

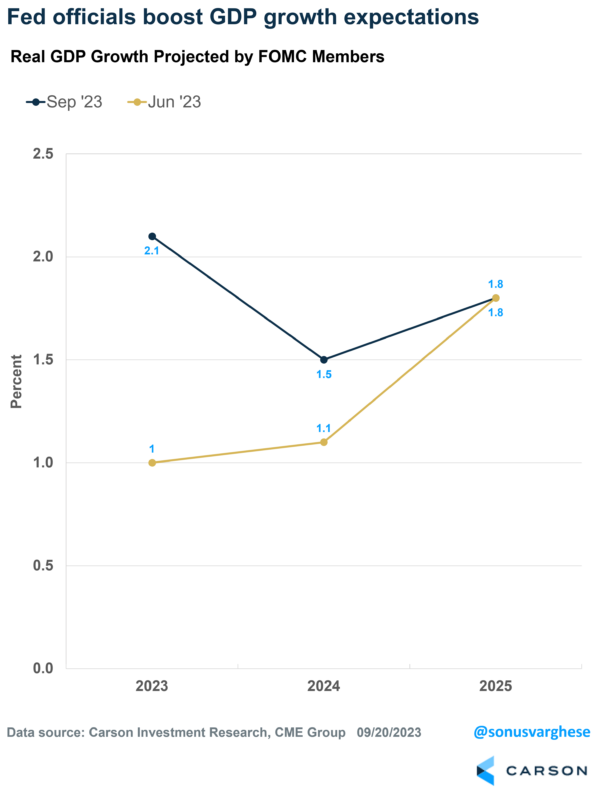

They increased their real GDP growth projection for 2023 from 1% to 2.1%. That is a huge shift and an acknowledgment that the economy is strong. The expectation for GDP growth in 2024 was also increased from 1.1% to 1.5%. Fed Chair, Jerome Powell said that one reason for stronger growth is that household and business balance sheets are much stronger, and so spending has held up. Barry Gilbert, from our team, wrote about this recently.

Powell also speculated that policy rates may not have been restrictive for long enough, and so their full impact is yet to be felt.

Three: A stronger economy raises the bar for rate cuts

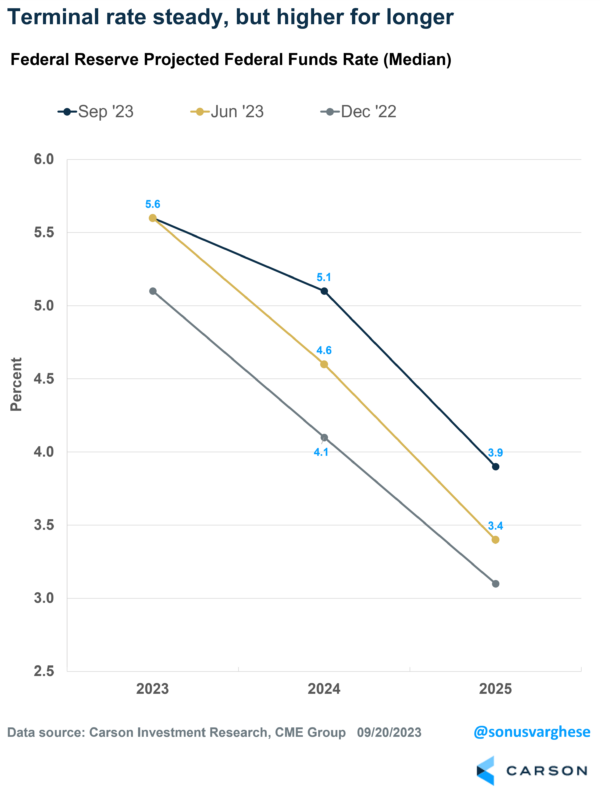

The other side of projecting a stronger economy means they are now projecting fewer rate cuts in 2024. Back in June, they projected the 2024 rate at 4.6%, implying 1 percentage-point worth of cuts. They’re now expecting just 0.50 percentage-points of cuts, taking the 2024 rate to 5.1%.

The big picture here is that a stronger economy has resulted in the Fed moving their rate expectations quite a bit higher over the course of the year. Since last December:

- They’ve moved the 2023 rate up from 5.1% to 5.6%

- The 2024 rate up from 4.1% to 5.1%

- The 2025 rate up from 3.1% to 3.9

Four: They now expect a soft landing

Powell was very reluctant to admit this, but their projections explicitly laid it out.

They lowered core inflation projections for 2023 from 3.9% to 3.7% and expect inflation to fall to 2.6% by 2024. At the same time, they lowered their unemployment rate projection for 2023 from 4.1% to 3.8%. They still expect the unemployment rate to rise to 4.1% by the end of 2024. But that’s not a lot, and it’s a big shift down from the 4.5% they estimated back in June.

In short, the Fed is no longer expecting recession-like conditions that would cause the unemployment rate to jump significantly.

Powell explained that a strong economy by itself is not a problem, as long as it doesn’t threaten higher inflation. In short, we can potentially have a strong economy, low unemployment, and falling inflation – and that is what they expect now.

Irrespective of whether the above scenario actually happens (note: we’re in the camp that it can, and have been saying so since last year), the fact that the Fed buys into this is huge, and a fairly dovish sign. As long as inflation continues to fall, and we believe it will, a strong economy and low unemployment shouldn’t by itself push the Fed to keep policy tight.

Five: The Fed didn’t change their long-run rate expectation

They left their expectation for long-term policy rates at 2.5%, which is where it’s been over the past decade. So, they still believe the same structural forces that kept economic growth relatively low (around 2%) are still in play.

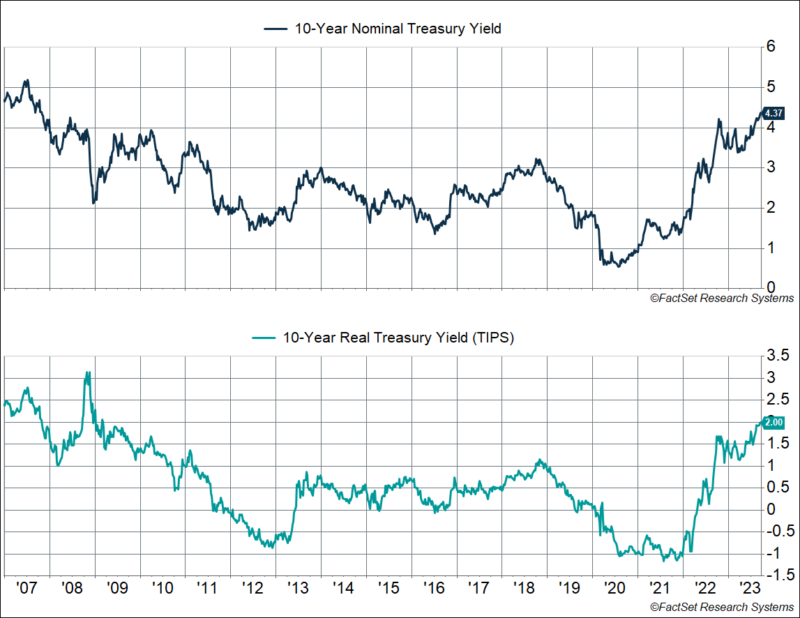

This is a big difference from what investors expect. Market expectations for the implied policy rate in 2027 has increased from 3% to almost 4% over the last 4 months.

This has resulted in a significant increase in long-term Treasury yields over the last few months. Ten-year nominal yields are close to 4.40, the highest we’ve seen since 2007. Even yields on ten-year Treasury-Inflation-Protected securities, i.e. “real yields”, have hit 2%.

Higher long-term yields, especially real yields, are a sign that investors expect stronger growth further out into the future. Powell acknowledged that when asked why he thought long-term yields were rising. He said it wasn’t about inflation expectations, which is why nominal and real yields have risen in tandem keeping the difference between the two, i.e. future inflation expectations, fairly steady. Instead, he said it has more to do with economic growth expectations.

The disconnect between the Fed’s long-run expectations and market expectations will eventually have to be reconciled. Either the Fed moves higher, or market expectations fall. If it’s the former, we can expect long-term borrowing rates (like mortgage rates) to stay relatively higher for much longer. If markets shift expectations down, long-term borrowing costs will fall. In other words, there’s a lot riding on this.

Ryan Detrick and I discussed a lot of these tops on our latest episode of Facts vs Feelings, with Sam Ro, CFA, Founder of TKer.co; Frank Capellari, Founder and President at CappThesis; and Paul Hickey, Co-Founder, Bespoke Investment Group and Bespoke Market Intel. There’s a reason we called it “The Mega-Pod”

1909257-0923-A