“It felt like the world was ending.” -Economist Chris Rupkey on the Crash of 1987.

October is known for many things, with incredible market crashes likely being at the top of the list. The Crashes of 1929 and 1987 stand out for many investors and who could forget the selling and volatility of October 2008?

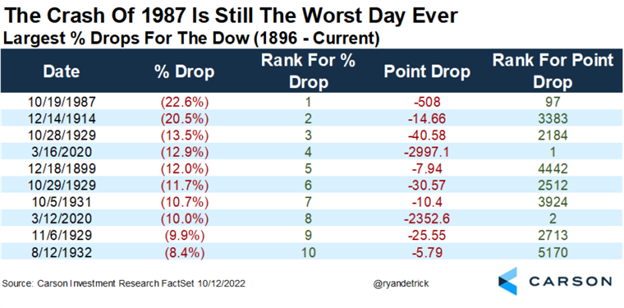

In honor of the anniversary of the largest drop in stock market history, we’ll take a closer look today at the crash of 1987. On Monday, October 19, 1987, the Dow fell 22.6% for the largest one-day drop in its more than 126-year history. To this day it is still the largest percentage drop ever, although it now ranks as only the 97th largest point decline. But it’s the percentage change, not the point change, that matters for investors.

The good news is we don’t see another crash coming anytime soon, as I wrote last week in Four Reasons We Believe Stocks Won’t Crash in October.

So what caused the Crash of 1987? The funny thing is that 35 years later I’m not sure everyone can officially agree. Here are some things to know about the Crash of 1987:

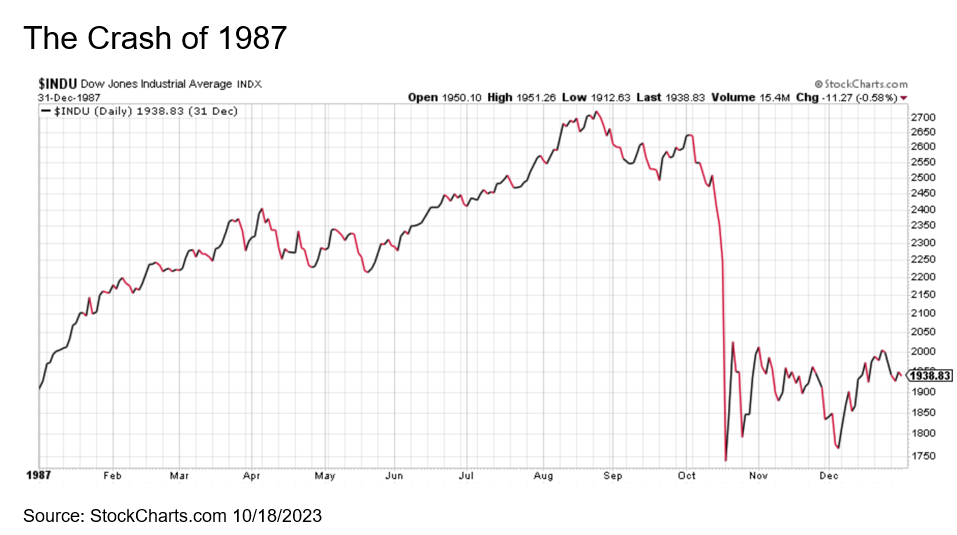

- For starters, stocks were in the midst of a huge run off the August 1982 lows, with the Dow up more than 40% for the year in early August 1987, amounting to one very overstretched rubber band.

- Then consider Alan Greenspan took over the Federal Reserve Bank in August and was hiking rates to cool things off. Talk about a bad time to start a new job. Not to mention during the morning of the crash he was on a plane and no one could get ahold of him, only adding to the stress of the day.

- Over the weekend, Nancy Reagen was rumored to have cancer. She was more than the First Lady; she was the President’s rock.

- Program trading was blamed as well, with Louis Rukeyser pointing out that program trading problems were already coming up the Friday night before the crash. (Simply put, program trades were set to automatically liquidate stocks as certain levels were hit. It worked fine until stocks began to fall more than ever expected, leading to an avalanche of more selling as prices dropped.)

- Currency markets were on edge as well, as the U.S. wanted Germany to weaken their currency due to the latest trade deficit numbers. The back and forth was all over the media as recently as the Sunday before the crash.

- There were other issues getting media and market attention as well: Germany was proposing a change in taxes, adding to worries they would reduce US Treasury purchases. Japan was considering a huge tax on real estate to slow speculation. There were even rumors of U.S. planes in Iran. Put it all together and there were many worries that all added up to one big problem.

- Negative selling momentum was already building before October 19. The three days before the crash the Dow was down 3.8%, 2.4%, and 4.6%, making it safe to say investors were on edge all weekend for how things might open on Monday morning.

- Markets were much less efficient in 1987 and the circuit breakers we have in place today to slow panic selling didn’t exist yet.

In the end, the Dow fell a then record 508 points for a 22.6% one-day decline, topping the previous largest one-day decline of 20.5% in December 1914, when the Dow began trading after being halted for nearly five months due to World War I.

Something most investors might not know is that stocks still finished the year in the green in 1987. Sure, they were well off their highs and the huge volatility was too much for many investors to handle, but if all you saw was the yearly gain of 2% in 1987, you’d think it was a boring year!

We might not know what caused the Crash of 1987, but we also still don’t completely understand what caused the 2010 Flash Crash either. The Flash Crash occurred on May 6 2010, when many stocks and ETFs rapidly plummeted, major indexes losing near 7%, in just fifteen minutes, only to regain the losses by the close for one wild few minutes of trading. The truth is with more and more computers involved, we are due to get big swings periodically. March 2020 saw some of the largest swings of all time, with seven of the 10 largest point declines ever, putting major stress on the system.

Today we do have circuit breakers in place to help calm nerves should we see another major decline in prices, but it’ll take a huge drop for those to kick in. (S&P 500 trading is halted after drops of 7%, 13%, and 20%.)

In the end, volatility is the price of admission for participating in stock markets. Fortunately, stocks are well off their lows from a year ago and aren’t that far away from all-time highs. Should we all have the privilege to invest long enough, there will likely be another day stocks fall significantly. And when they do, just remember that the Dow started trading on May 24, 1896, and it has seen wars, famines, pandemics, inflation, deflation, booms, busts, and more. Yet, it has always eventually come back to new highs and we don’t think this time will be any different.

1941494-1023-A