“If you torture numbers enough they will tell you anything.” -Hall of Fame and Yankee great Yogi Berra

After the best start to a new year over the first seven months for the S&P 500 since 1997, stocks finally fell in August, ending a five-month win streak. In the end the S&P 500 was down only 1.8%, but had fallen close to 5% before a late month rally.

This seasonal weakness wasn’t a surprise to us, as we expected stocks to potentially take a bit of a break after the huge rally as we discussed in Stocks Don’t Like August, Now What? The good news is weakness was normal for this time of year. The bad news is the worst month of the year historically is now upon us.

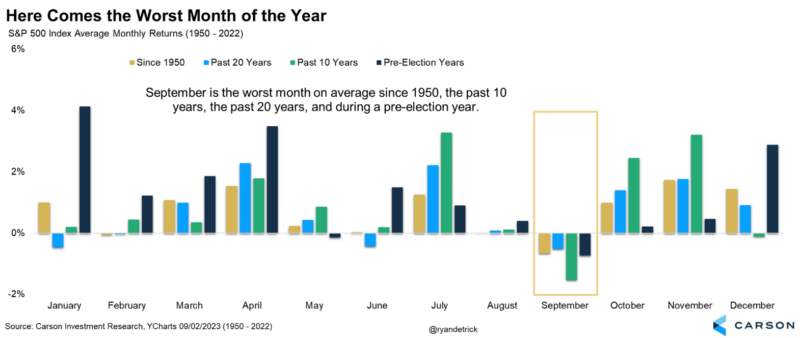

As you might have heard 50,000 times by now, September has historically been the weakest month of them all. Since 1950, it has been down an average of 0.66%. But it doesn’t stop there, as it was also the worst month of the year during a pre-election year, over the past 20 years, and the past 10 years. You can’t ignore this, as we might not be out of the woods just yet, but there are some signs September could be better this year.

Digging into the data a little more closely we found three reasons to think stocks could actually gain in this usually rough month. Of course, as Yogi told us in the quote above, if we torture the data enough it’ll give us what we want to hear. Still, we’d at least say the chances of a huge September drop like last year is quite low.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

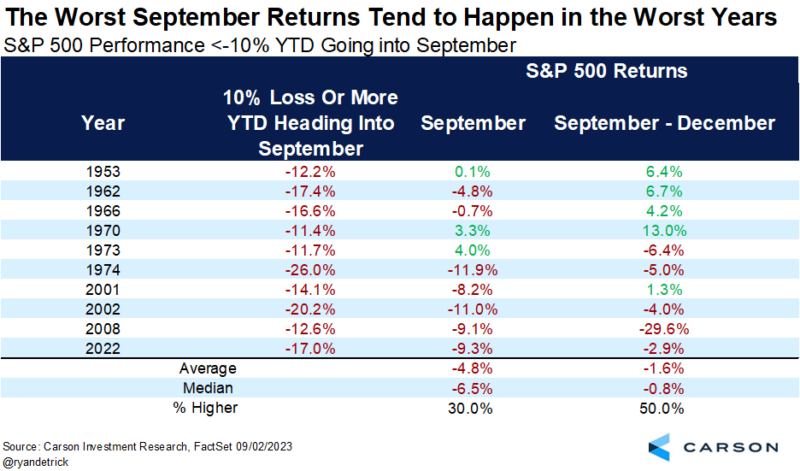

The first thing that stood out to us is that years that were down big heading into September tended to see some of the worst returns. For example, last year’s 9.3% drop in September after stocks were already down 17% for the year through August. In fact, the last five times the S&P 500 was down at least 10% heading into September going back 50 years, the month saw absolutely massive drops.

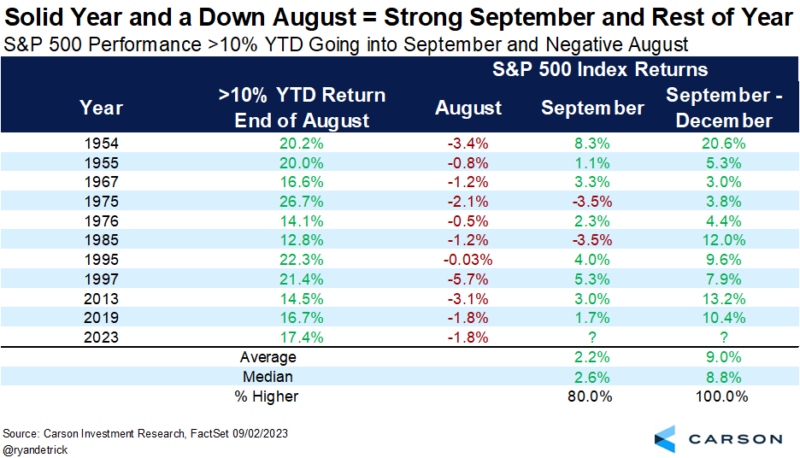

The good news is stocks are on firm footing this year, likely mitigating the risk of a banana peel month for the bulls. In fact, when stocks were up more than 10% heading into September, but on the heels of a red August, September has been higher 8 out of 10 times with some great returns, while the rest of the year has never been lower, up 9.0% on average from September through December.

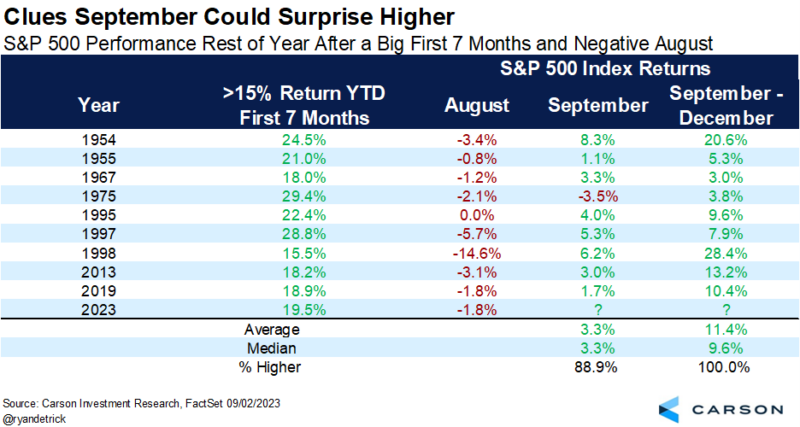

The second reason we think September could be better than expected is we found that when stocks gained more than 15% after the first seven months and then fell in August (like ’23) the chances of a strong September were quite high, with stocks higher eight out of nine times with some very solid returns. Even better news is stocks have never been lower the rest of the year (from September through December) with an average gain of more than 11%. Another 11% from here would put us at new all-time highs for the first time since January 3, 2022, something we think is still quite possible.

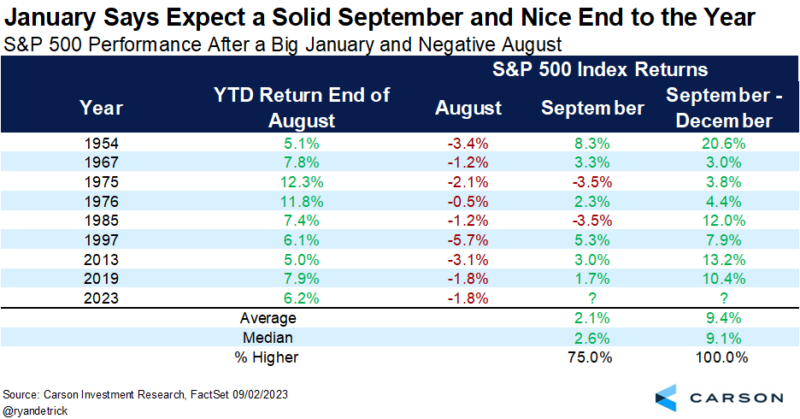

The last reason to think stocks could have a better-than-expected September is looking way back at what happened in January. We noted back then that a strong January usually meant a strong full year, and that has played out quite well so far, but it also could be a clue that September and the rest of the year could be strong. When you have a 5% gain or more for stocks in January, along with an August drop (like ’23) we found September was higher six out of eight times with some nice gains, while the rest of the year was higher all eight times and up 9.4% on average.

Despite a clouded history, the odds of a huge drop in September like we saw last year are quite low. We could still see some seasonal choppiness of course, but the odds favor the potential for some green this September as well.

I discussed this and more with Mike Santoli on CNBC’s Closing Bell on Friday. You can watch the full interview here.