“Bulls make money, bears make money, and pigs get slaughtered.” -Old Wall Street saying

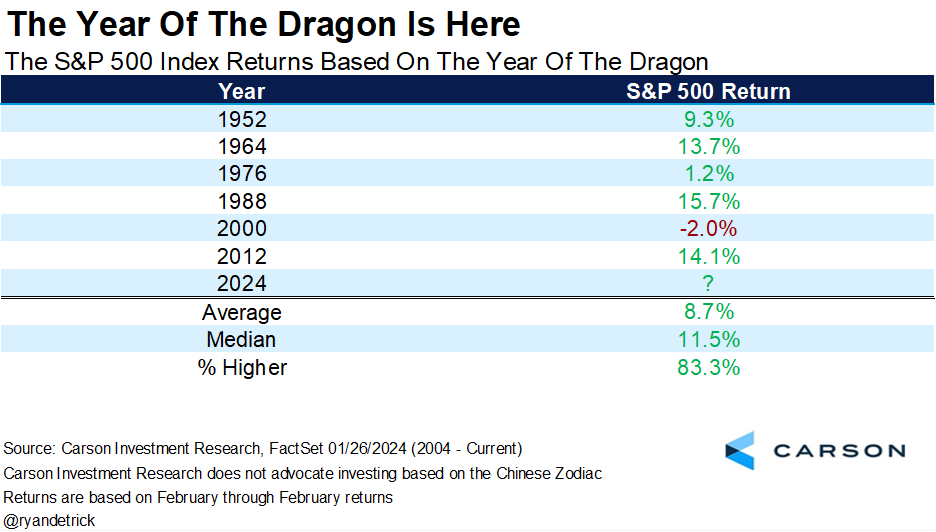

We already had our New Year here in the United States, but the Chinese New Year begins on February 10th and with it the Year of the Dragon. The Dragon is very important in Chinese culture and it will be quite the celebration. Although we would never suggest investing based on the zodiac signs, it is fun to note that the Year of the Dragon has historically been fairly strong for stocks, although stocks really did like the current Year of the Rabbit, which is set to end soon.

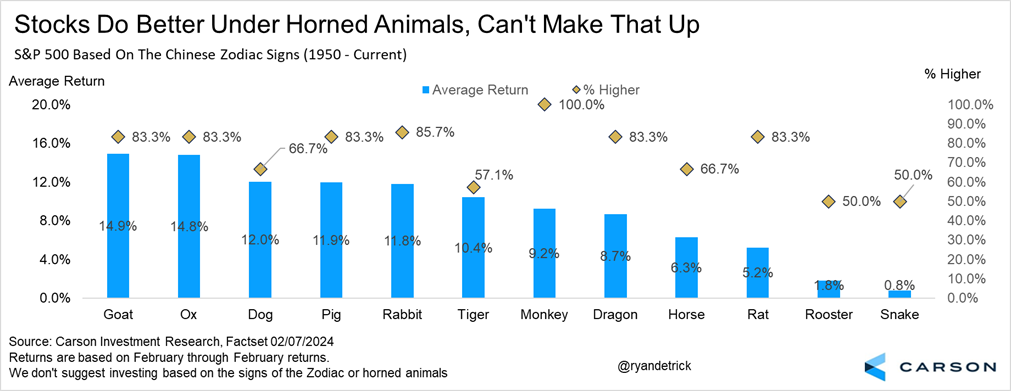

There are 12 Zodiac signs in the following order: Rat, Ox, Tiger, Rabbit, Dragon, Snake, Horse, Goat, Monkey, Rooster, Dog, and Pig. Each sign is named after an animal, and each animal has its own unique characteristics. Someone born during the Year of the Dragon tends to partner well with an Ox or Rooster and tends to be philosophical, organized, intelligent, intuitive, elegant, attentive, and decisive.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Since the Chinese New Year typically starts between late January and mid-February, we looked at the 12-month return of the S&P 500 Index starting at the end of January dating back to 1950. And wouldn’t you know it? The Year of the Dragon has been up five out of six times and up a median of 11.5%. But if you look closer below, you’ll notice that stocks see double digit returns only every other appearance of the Year of the Dragon, which could mean this time it’s due for a breather.

Here’s how all 12 signs have done since 1950. Turns out the Year of the Goat has the strongest returns, but you’ll have to wait till 2027 to see that one again. More bad news—the Year of the Snake is the worst performer and that takes place after the Dragon next year. Lastly, we found it amusing that animals with horns saw some of the best returns, while a slimy reptile like the snake or a dirty little rat saw the worst. Given Dragons have horns, maybe this will be a nice year for the bulls?

Similar to the Super Bowl Indicator, we would NEVER suggest you invest based on things like who wins the Super Bowl, signs of the Zodiac, how many times they show Taylor Swift on Sunday, or whether Travis Kelce proposes to her after the game. Still, it is fun to look at once a year!

Regarding China, we have been underweight emerging markets (EM) for more than a year now, mainly due to our overall concerns about China, which currently makes up about 25% of the MSCI EM Index.

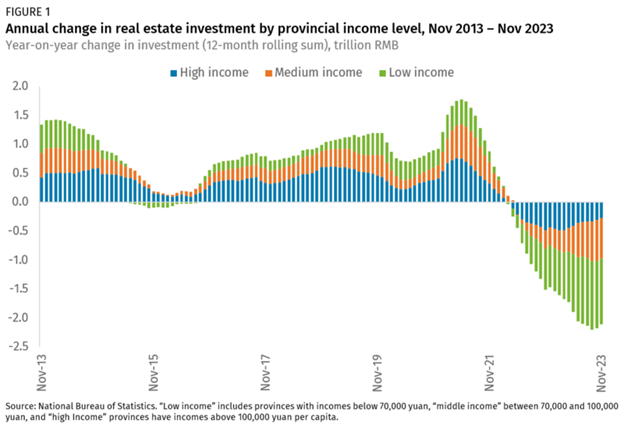

China’s economic growth has been slowing and incredibly, US nominal GDP grew more (5.8%) last year than China’s (5.0%). Virtually no one had that on their bingo card this time a year ago. Much of China’s economy is based on investment spending (43% of GDP) compared with the US, which is mainly consumer based (nearly 70% of GDP is consumer spending). Given much of China’s investment is based on real estate and debt, the ongoing property investment crash in China will continue to hinder any recovery. In fact, property investment was down 10% last year, compared with up 10% in 2018 and 2019 before the pandemic.

Here are some stats from Sonu Varghese, Global Macro Strategist, on China’s real estate issues:

- In March 2021, China was building residential property at a rate of 1.71 billion square meters per year.

- That was cut in half, to ~ 881 million square meters, by December 2022.

- As of October 2023, it’s been cut by another 20%, to 699 million square meters.

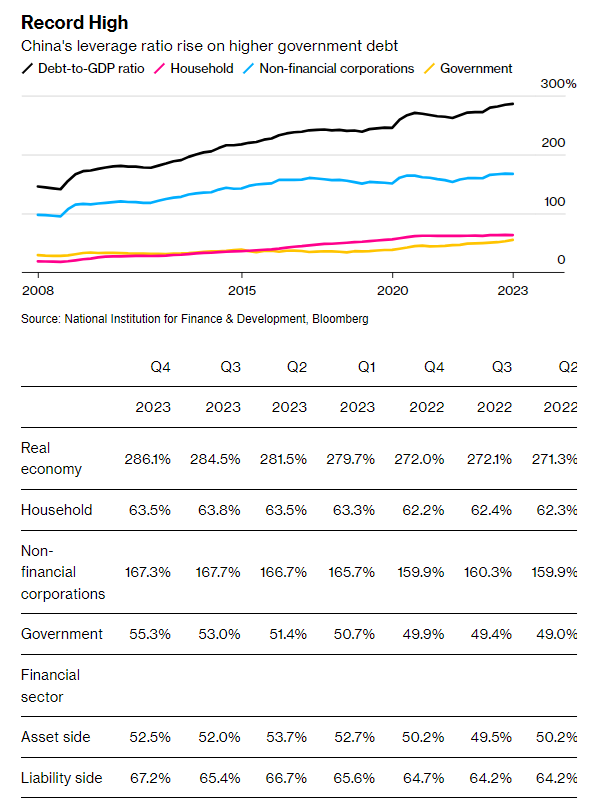

Additionally, China has a lot of debt (so does the US), but most of their debt is private debt, which can be a much bigger issue than public debt (like the $34 trillion our government has racked up).

More from Sonu on this:

- Significant amounts of private debt are actually more detrimental than public debt, and a big risk factor, for an economy.

- Private debt is serviced with revenues from business operations.

- If there’s a slowdown, private sector revenues contract.

- The contraction is even more severe if there is leverage.

- That is what happened in the US in 2008 (high household debt) and in 2001 (high corporate debt).

Thanks for reading. For more of our of latest views on the bull market, economy, Fed, and Super Bowl predictions, please listen to our podcast or watch the latest Facts vs Feelings podcast with Sonu and me below.

02108141-0224-A