It really doesn’t get much simpler: the US economy relies on consumption, and consumption comes from income. Overall income in the economy is dependent on three factors:

- Employment growth

- Hourly wage growth

- Number of hours worked

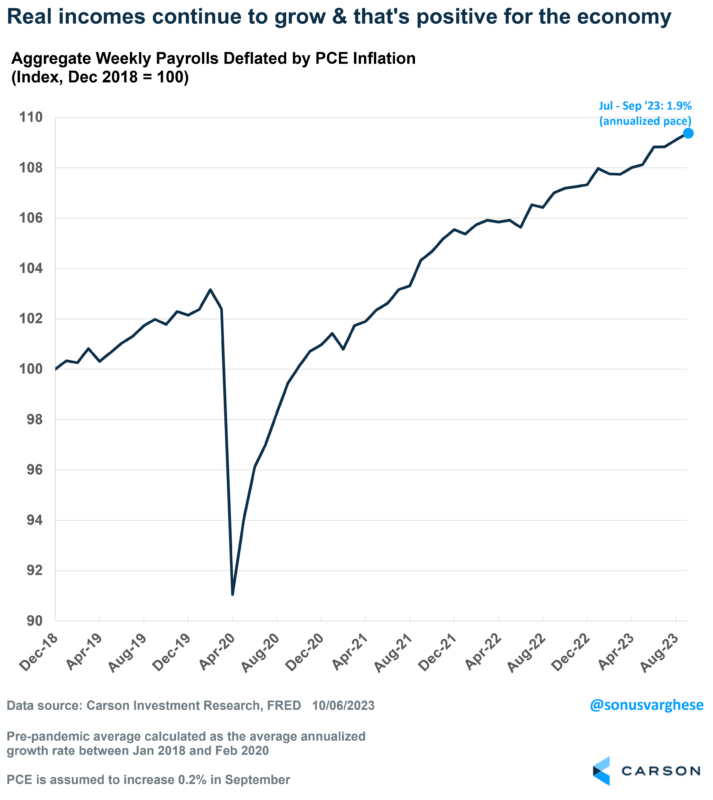

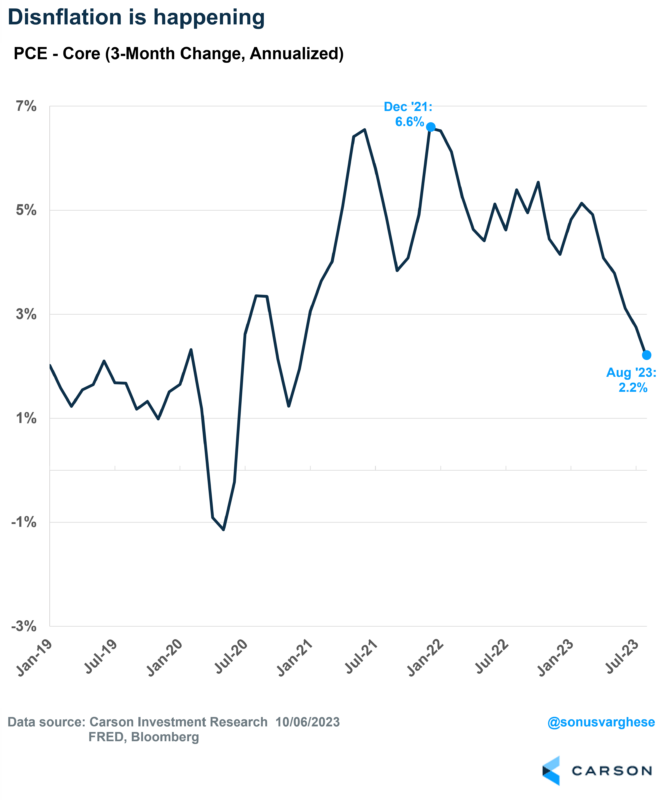

The above three are running strong, and so overall income growth across the economy is strong. That’s powering consumption. In fact, weekly income growth has been running at a 5.2% annual pace over the past three months. By the way, that is higher than what inflation’s running at. The Fed’s favored measure of inflation, which is based on the personal consumption expenditures index, was up at an annual pace of 3.3% over the last 3 months.

No Signs of a Slowdown, Which is Spooking Investors

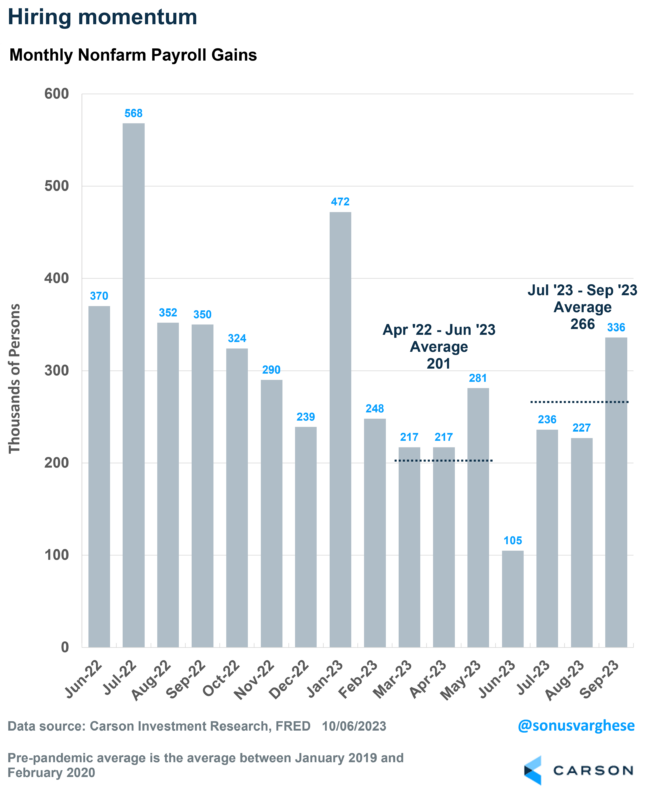

The economy created 336,000 jobs in September, blowing past expectations for a 187,000 increase. Now, a large part of it was government jobs (+73,000) but even the private sector created 263,000 jobs. Also, payroll growth in July and August was revised higher by 119,000. So, over the last three months, payroll growth averaged 266,000 per month. That compares to an average of 201,000 in the second quarter.

In short, the economy has strong momentum going into the fourth quarter, especially amid concerns over myriad issues – all of which Ryan and I have written about (strikes, student loan payment restart, government shutdown). The unemployment rate was steady at 3.8%, but that’s well below historical levels.

On the other hand, a strong economy is spooking investors right now. Investors have pushed bond yields much higher over the last three months. The 10-year treasury yield is now above 4.80, compared to 3.80 at the end of June.

What’s interesting is that short-term interest rates haven’t budged really. The market doesn’t think the Fed will raise rates again, which is why the implied policy rate expectation for 2023 has remained steady at 5.5%. Instead, as you can see on the chart below, it’s the expected policy rate in 2027 that has surged recently, from about 3% in May to 4.35% today. That’s a massive move, and it’s basically happened because investors expect the Fed to keep rates higher well into the future.

Why have long-term rate expectations risen? The simplest answer is that they think the economy is more likely to be stronger. The surge is yields has come as economic data has shown signs of a much stronger and resilient economy over the last three months. Investors are projecting that into the future, but that’s also likely to keep inflationary pressures higher – which means the Fed must keep rates high to counter it. My colleague, Barry Gilbert, wrote about this recently.

In short, a stronger economy is pushing long-term yields higher, and that’s scaring investors into thinking that higher borrowing rates will push the economy into a recession. That’s created volatility in equity markets. If that doesn’t make sense to you, it shouldn’t.

We think good news on the economy is good news for markets. Ultimately, profits come from economic growth, and that’ll eventually play out. Perhaps sooner rather than later, as earnings season kicks off in a couple of weeks.

This Should Ease the Fed’s Concerns

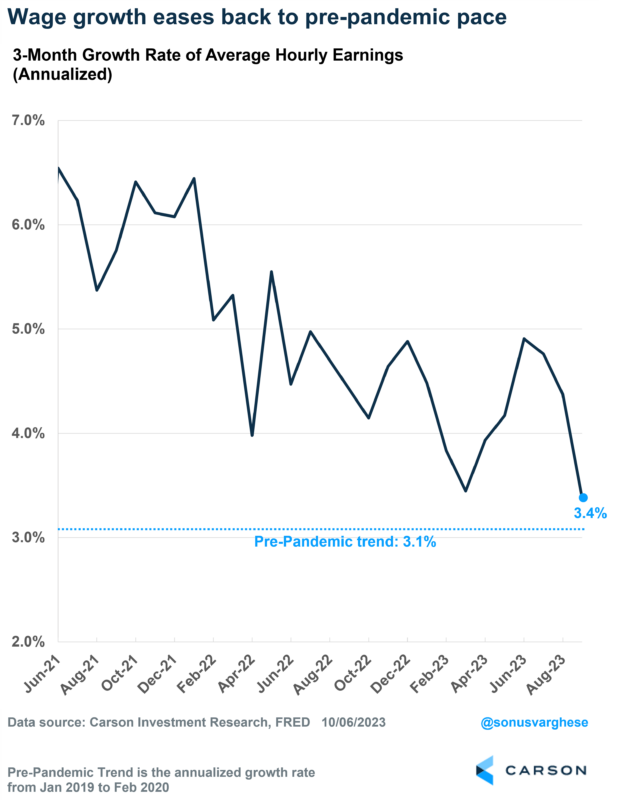

Wage growth, as measured by average weekly earnings, have now eased all the way back to the pre-pandemic pace. Over the last three months, wage growth is running at a 3.4% annual pace, only slightly higher than what we saw pre-pandemic.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Make no mistake, this level of wage growth is still strong. But it does tell us that the labor market, and the economy, is not overheating. That’s important for the Fed, as they can breathe easy about a hot labor market pushing inflation higher. In fact, the proof is in the data. The economy has created 3.2 million jobs over the last year. Meanwhile, core PCE inflation, which is what the Fed focuses on, has slowed all the way to 2.2% over the last three months (through August).

As I said above, all this is good news, even though the market is treating bad news as good news right now. In fact, Ryan wrote about this recently, and how the market could be set up for a fourth quarter rally. We also talked about how a lot of fears investors currently have are probably overblown on the latest Facts vs Feelings episode. Take a listen

1928112-1023-A